India Spotlight Index 2020

Introduction

“ATNI sees food and beverage companies in India showing their commitment to provide healthy food and engaging in a dialogue on how to support India’s Eat Right Movement. Lifestyle changes in India have caused a shift in consumer habits – from the consumption of traditional food, to more urban food habits consisting of packaged and processed foods, high in sugar, fat and salt.”

Inge Kauer, Executive Director, Access to Nutrition Initiative

The Access to Nutrition India Spotlight Index 2020 has been developed by the Access to Nutrition Initiative (ATNI) to drive positive change in the food and beverage industry in India on diet, nutrition and health issues. It is the second iteration of the Index, first published in 2016. It aims to support efforts by all stakeholders, including the government-led Eat Right India movement, to address all forms of malnutrition. It focuses on the contribution being made by the 16 largest food and beverage (F&B) manufacturers in India, by providing comprehensive, independent, comparable and objective information about these companies’ policies, practices and disclosure related to nutrition. As such, the Index serves as a private sector accountability tool, which stakeholders can use to hold the companies to account for delivering on their commitments to tackle these important national challenges.

The second India Spotlight Index covers the same topics and takes the same broad approach to assessing companies, and to scoring and ranking them, as the first iteration. After the successful launch of the 2016 Index, ATNI followed up with stakeholders and companies in India to solicit feedback. This input fed into the development of the India Spotlight Index 2020. In the intervening time, the impact of food and beverage companies on the nutrition and health of Indian consumers has risen and is better understood. Read the full research scope of this Index here.

In February 2021, ATNI published the results and analysis of how the companies deal with nutrition beyond the nutritional quality of products, focusing on the following topics: Governance, Accessibility, Marketing, Employee and Consumer Lifestyles, Labeling and Engagement. The chapters also include an impression of how companies are dealing with the effects of the Covid-19 pandemic. The press release for this publication is available here.

Overall Ranking

Hindustan Unilever and Nestlé India rank joint first with a score of 6.9 out of 10. There has been some progress among the nine previously assessed companies and their average score increased from 3 in 2016 to 4.2 in 2020. Two companies have shown substantial individual progress across most elements of the Index since 2016: Britannia Industries (1.6 to 4.9) and Coca-Cola India (2.4 to 4.4). However, the average Index score is 3.1 out of 10, similar to that of the 2016 iteration.

- A

- Governance

- B

- Products

- C

- Accessibility

- D

- Marketing

- E

- Lifestyles

- F

- Labeling

- G

- Engagement

- *

- Did not provide information to ATNI

Companies

The 16 largest food and beverage manufacturers were selected based on 2018 retail sales, for the India Spotlight Index 2020. Together, they accounted for 31% of India’s packaged food and beverage market share with a combined total retail sales of just over INR 1800 billion.

Findings

The India Spotlight Index 2020 shows some progress on nutrition among the 16 largest food and beverage manufacturers in India. These companies account for nearly a third of the food and beverage market. Most are taking action to fortify their products or have committed to reformulate their products in line with the Government’s initiatives to address India’s nutrition challenges. However, few provide evidence of comprehensively tackling undernutrition, micro-nutrient deficiencies, and overweight and obesity, in all relevant business areas. Current industry efforts are not sufficient to match the scale of the nutrition challenge that India faces.

Current industry efforts are not sufficient to match the scale of the nutrition challenge that India faces.

The overall ‘healthiness’ of Indian food and beverage manufacturers’ product portfolios, as well as their public disclosure of nutrition-focused initiatives and progress, remain low.

Companies must focus their efforts on population groups that are malnourished or are at high risk of malnutrition, by defining objectives adapted to the diverse nutritional needs of the states in which the companies are active.

The food and beverage industry is actively engaging and acting on initiatives and regulatory developments proposed by FSSAI. However, the overall ‘healthiness’ of Indian food and beverage manufacturers’ product portfolios, as well as their public disclosure of nutrition-focused initiatives and progress, remain low.

- Ten of the 13 companies, for which staple food fortification is relevant, voluntarily fortify some or all of their products according to the standards set by FSSAI.

- Hindustan Unilever, Nestlé India and PepsiCo India have developed comprehensive, public, formal commercial strategies to address issues related to the double burden of malnutrition in India. Britannia Industries and ITC are the only India-headquartered companies that have a nutrition policy in place.

- The performance of the companies with the highest scores (Hindustan Unilever, Nestlé India) is comparable to their results in 2016. Both companies have evidenced plans to do more in future. Mother Dairy and Marico lead in Dairy and Edible Oils – their respective industry segments.

- Britannia Industries and Coca-Cola India have improved the most since 2016, with higher scores in at least five of the seven Index categories.

- Five of the companies’ commercial strategies refer, to some extent, to the nutrition and health priorities set out by the Indian Government in the National Nutrition Strategy and POSHAN Abhiyaan. In its business strategy for the Indian market, Nestlé India does this comprehensively, defining how it aims to reach groups experiencing, or at high-risk of experiencing malnutrition.

- Most companies have limited disclosure of their activities and initiatives in India. Hindustan Unilever stands out with the highest score for public disclosure of its policies and practices.

Less than a third (27%) of the estimated 2018 sales of packaged foods and beverages in India of the 16 companies assessed is derived from healthy products. These sales come from 228 products (16% of 1456 assessed). Although the research did not find conclusive evidence of an increase in the percentage of healthy products across companies’ portfolios since 2016, more companies provided data to allow for a more accurate assessment. This led to a modest increase in the estimated sales derived from healthy products.

- For the nine companies assessed in both Indexes, the estimated sales from healthy products increased from 15% in the 2016 India Index to 23% currently. However, the research found no increase in the percentage of healthy products, by number, in the companies’ overall portfolios. The number of companies that provided comprehensive product nutrient content data to ATNI for the product assessments increased from three to seven, improving the quality of this assessment.

- Out of 13 companies that sell staple products covered under FSSAI’s (Fortification of Foods) 2018 Regulation, 10 voluntarily fortify their staple products to help address micronutrient deficiencies in India. Only Mother Dairy and Britannia Industries fortify all products in their portfolios that are covered by the Regulation. The three companies that do not manufacture products covered by FSSAI’s mandate (Coca-Cola India, Mondelez India and PepsiCo India) were found to fortify other products to address micronutrient deficiencies for specific consumer groups in India.

- Having joined FSSAI’s initiatives to support the Eat Right Movement, six of the 16 companies have made public pledges to reformulate their products. Four additional companies make other commitments to make their products healthier.

- Hindustan Unilever, Nestlé India and PepsiCo India stand out as having the most comprehensive reformulation targets. Fewer than half of the companies define targets for reducing salt/sodium, saturated fat and added sugar/calories.

- Of the 16 companies, four have a strategy or target to address affordability and physical accessibility of their healthy products This indicates that most companies are not showing if and how they market their healthier products to Indian consumers whose access to these products is constrained by low-income or by location. For example, targeting consumers living in certain rural or urban areas, or those present in aspirational districts.

- Seven of the 16 companies label sodium content on the back-of-packs, which is three more than in 2016. In terms of front-of-pack (FOP) labeling, five companies have made a public commitment to declare FOP nutrition information. A dialogue on interpretive FOP labeling is ongoing between the Government, industry and other stakeholders in India, but no interpretive FOP labeling has been implemented yet.

Given the high levels of undernutrition and rising obesity levels in children in India, it is important for companies to either selectively market their healthy products to children, or not to market any products to them at all. Presently, six of the companies have a responsible marketing policy that includes commitments about marketing to children. However, none of the companies specifically state that they apply the recently adopted World Health Organization (WHO) South-East Asia Region (SEAR) nutrition criteria or incorporate them into their marketing policies.

- Only 12% (183 products) of the nearly 1,500 products analyzed meet the WHO nutrition criteria for marketing to children, highlighting the need to address responsible marketing in comprehensive policies.

- Coca-Cola India and Mondelez India commit not to market any of their products to children, an approach that is considered equivalent to applying the WHO SEAR nutrition criteria. They apply this commitment to children under the age of 12.

India continues to face a double burden of malnutrition, defined as the simultaneous manifestation of both undernutrition and overweight and obesity. Malnutrition not only directly affects people’s physical growth and health but also their cognitive development and abilities. It has been identified as one of the principal factors limiting India’s economic growth potential. The opportunities are equally enormous; cost-benefit ratio analyses of nutrition interventions to reduce stunting in the first year of life report a monetary return (higher wages) later in life of 18:1 per child, and similar analyses found that a 1 cm increase in adult height due to nutrition interventions was associated with a 4% increase in wages for men, and 6% for women.

In recognition of India’s nutrition challenges, in early 2018, the Government launched the National Nutrition Mission (NNM), also known as POSHAN Abhiyaan, with ambitious targets to reduce various forms of malnutrition and substantial associated budgets. It has also led many initiatives such as the Integrated Child Development Scheme (ICDS), the Mid-Day Meal Scheme, the Maternity Benefit Program and the Public Distribution System (PDS), which all provide food at subsidized rates. The Food Safety and Standards Authority of India (FSSAI) has developed a range of guidelines and standards for food manufacturers, and works with many stakeholders active in the food system.

Aligning with FSSAI’s wide-scale staple foods fortification standards, the Ministry of Women and Child Development has issued new directives to mandatorily use fortified rice, as well as fortified wheat flour and edible oil, in the Mid-Day Meal schemes and public nutrition programs under the ICDS across India since December 2019. To further this agenda, in 2019, the Ministry of Consumer Affairs, Food and Public Distribution has approved a 3-year pilot scheme for the fortification of rice with iron, folic acid and vitamin B-12 under the PDS in 15 districts of India.

The food and beverage sector is the fifth largest manufacturing sector in India. Lifestyle changes in India have caused a shift in consumer habits – with an increased consumption of sugar, fat and salt. India is one of the top 10 consumers of fast food in the world and is set to be the third largest consumer economy by 2025.

Almost two-thirds of the disease burden in India is due to lifestyle diseases. Many of these diseases are diet-related non-communicable diseases that link with changes in diets and eating patterns. Several factors have led to the increased consumption of products from the fast-growing food and beverage segments in India (Breakfast Cereals; Savory Snacks; Seasonings, Dressings and sauces; Naturally Healthy Beverages; Ready Meals; Confectionery; Organic Food; Dairy Food; Bakery).

When considering these factors and segments, combined with the enormous total consumer base of over 1.25 billion, the opportunity is clear for existing as well as new players in the fast growing food and beverages market to develop healthy, affordable and tasty products to improve the diets and health of India consumers.

Full Context Story- Britannia Industries has improved the most since 2016 across all Index categories. The company has formalized its commitments and approach to addressing malnutrition in India in its newly developed Britannia Nutrition Policy.

- Coca-Cola India has achieved the second greatest improvement across all Index categories due to new initiatives that aim to align with the Government’s efforts for achieving Kuposhan Mukt Bharat – free from malnutrition, across the lifecycle. These include improving the distribution of its Minute Made Vitingo product to address iron deficiency in children, the launch of new healthy products within the Dairy product category, and the development of a ‘Compare our Products’ tool for its website so customers can find more nutrition information online.

- Adani Wilmar publicly discloses its support to Government programs and interacts with stakeholders to address undernutrition in India by focusing on food security.

- Mother Dairy has committed to tackling undernutrition and micronutrient deficiencies in India through its strategic focus on food fortification and reformulation. The company voluntarily fortifies all relevant products – its entire range of Milk and Edible Oil products – according to FSSAI’s (Fortification of Foods) Regulation, 2018. In addition, the company has implemented a robust employee health and wellness program called the Safe & Nutritious Initiative @ Mother Dairy. This is in line with FSSAI’s Safe and Nutritious Food at Workplace nationwide campaign (SNF@Workplace), which provides guidance to help people eat safe and healthy diets at work (see the campaign’s key resource The Orange Book).

- Hindustan Unilever has adopted notable nutrition-focused approaches to reformulation, market research and product pricing. Its Unilever Sustainable Living Plan outlines how it intends to reformulate products to reduce salt, sugar and saturated fat content. The company utilizes datasets from the People Data Centre report, and other sources, to gain insight into nutrition and health issues in regions where the company is active, and to identify unmet needs. Its strategy includes specifically defining appropriate price points for healthy products targeted towards consumer groups at high risk of malnutrition in India.

- Mondelez India has a comprehensive approach to responsible marketing to children. It’s the only company to achieve full score with regards to its digital marketing arrangements in order to place age restrictions. Further, it does not conduct any marketing activities in primary or secondary schools. It is also the only company that excludes product or brand-level promotion from its consumer-oriented health and nutrition programs.

- Nestlé India comprehensively engages with internal and external stakeholders to improve its commercial nutrition strategy, and to support the development of public sector strategies aimed at tackling malnutrition in India. It also scores well by way of its strategies to prevent food loss and waste, such as its fresh milk district model for direct procurement in Moga.

- PepsiCo India has developed new healthy products in line with its Performance with Purpose 2025 agenda and its reformulation efforts, which align with FSSAI’s Eat Right Movement.

- Adopt clear and comprehensive commercial strategies to address India’s malnutrition challenges, which include targets for all Index topics/categories, and which contribute to national initiatives, such as the National Nutrition Strategy and POSHAN Abhiyaan, and the Sustainable Development Goals of India.

Focus their efforts on population groups that are malnourished or are at high risk of malnutrition, by defining objectives adapted to the diverse nutritional needs of the states in which the companies are active.

- Adopt and implement policies that are appropriate and specific to India, and that align with various regulatory and stakeholder initiatives to address malnutrition in India.

- Define nutrition criteria for their products, aligned with an internationally recognized NPS, and increase investment in developing and selling products that meet healthy nutrition criteria.

- Manufacture healthier products across all categories and disclose the percentage of products that meet the company’s healthy standard.

- Improve the affordability and physical accessibility of healthy products by defining in commercial strategies specific approaches and well-defined targets that relate to pricing and distribution, and that can be tracked.

- Adopt comprehensive responsible marketing policies, or strengthen existing ones, by explicitly codifying general responsible marketing principles and specific commitments regarding marketing to children – including teenagers. This should involve application of the WHO SEAR criteria and addressing marketing in and near schools.

- Implement an interpretive FOP labeling system as soon as possible, by working with other companies via industry associations, and in partnership with the Government and other relevant stakeholders.

- Be more transparent in reporting on all nutrition commitments, policies and practices as they relate to India and/or specific states, and especially in reporting progress on meeting nutrition-related targets.

- Provide ATNI with relevant information to allow for the best possible, comprehensive assessment of their policies and practices.

The Access to Nutrition India Spotlight Index is a private sector accountability tool. ATNI’s goal in compiling the Index is to enable all stakeholders to use its findings and recommendations in their work to encourage India’s largest food and beverage manufacturers to address the country’s substantial, and mounting, health challenges linked to diet and nutrition. By providing objective, comparable information and data, ATNI hopes to enable the companies themselves, and their stakeholders, to track the progress of these influential manufacturers in improving policies, practices and disclosure, as well as the nutritional quality of their products over time.

After the publication of this second India Spotlight Index, ATNI will follow up with one-to-one meetings with each company to review the findings and recommendations. It will also present and solicit feedback on the results at different fora in India. ATNI will also publish, on a rolling basis, thematic ‘deep dives’ that outline the findings for specific categories of the Index following the publication of the main results.

Category Rankings

The India Spotlight Index assesses companies’ nutrition-related commitments, practices and disclosure and is organized into three sections: nutrition governance and management; formulating and delivering appropriate, affordable and accessible products; and influencing consumer choice and behavior. The sections are further divided into seven thematic categories that are shown below.

Governance

This category assesses the extent to which a company’s corporate strategy includes a specific commitment and focus on health and nutrition in the Indian market. Moreover, it looks at whether the company makes a specific reference to population groups experiencing or at high risk of malnutrition due to a lack of access to a wide variety of healthy foods. Other key facets analyzed include whether the nutrition strategy is thoroughly embedded in its governance and management systems, as well as the quality of its reporting.

Deep-diveFindings

Products

Companies in India can help consumers in making healthier choices by improving the nutritional quality of foods made available to them. In addition to analyzing the healthiness of the company’s product portfolio, i.e. Product Profile results in B1, this category addresses companies' efforts to achieve this goal through research and development (R&D), new product formulation, reformulation of existing products, and tackling undernutrition and micronutrient deficiencies by developing fortified products or using fortified ingredients. It also assesses the quality of the nutrient profiling system that companies use (if any) to guide their product-formulation efforts.

Deep-diveFindings

Accessibility

Producing healthier options is necessary but insufficient on its own to improve consumers’ access to nutritious foods and beverages, and to drive up their consumption. Therefore, companies must offer them at competitive prices and distribute them widely to reach all consumers in need especially those who are vulnerable to malnutrition. This category assesses companies' efforts to make their healthy products more affordable and accessible to Indian consumers through their approaches to pricing and distribution.

Deep-diveFindings

Marketing

This category captures the extent to which companies support all Indian consumers, including children and teenagers, to make healthy choices by adopting responsible marketing practices and by prioritizing the marketing of their healthier products.

Deep-diveFindings

Lifestyles

F&B manufacturers in India can support their staff to eat healthy diets and pursue active lifestyles by providing employee health and wellness programs. In addition to other benefits, these programs can help to facilitate a corporate culture focused on nutrition. Supportive working practices and the provision of appropriate facilities can ensure that companies support breastfeeding mothers in giving their infants the healthiest start to life. Companies can also help consumers to adopt healthy diets and active lifestyles by supporting education programs, especially by those that target groups suffering from various forms of malnutrition. This category assesses the extent to which companies support such efforts.

Deep-diveFindings

Labeling

One important means of promoting healthy diets and addressing malnutrition is to provide consumers with accurate, comprehensive and readily understandable information about the nutritional composition and potential health benefits of what they eat. This can promote better nutrition by helping consumers choose appropriate products to manage their weight and prevent or address diet-related chronic disease, and to raise awareness of products that address micronutrient deficiencies. This category assesses companies' approaches to product labeling and use of health and nutrition claims, across product portfolios and in accordance with local and international standards (Codex Alimentarius).

Deep-diveFindings

Engagement

By responding to requests from policymakers and policymaking bodies, and supporting government activities and positions on nutrition policies, companies can have an impact on Indian consumers’ access to nutrition. In addition, constructive engagement by companies with a wide range of other stakeholders (including international organizations, civil society and academics) can help to strengthen their strategies and policies and provide valuable feedback on their relevance and effectiveness. This category focuses on companies' engagement with stakeholders on nutrition-related issues.

Deep-diveFindings

Governance

Products

Accessibility

Marketing

Lifestyles

Labeling

Engagement

- A1

- Nutrition strategy

- A2

- Nutrition management

- A3

- Reporting quality

- B1

- Product Profile

- B2

- Product formulation

- B3

- Defining healthy products

- C1

- Product pricing

- C2

- Product distribution

- D1

- Marketing policy

- D2

- Marketing to children

- D3

- Auditing and compliance

- E1

- Employee health

- E2

- Breastfeeding support

- E3

- Consumer health

- F1

- Product labeling

- F2

- Claims

- G1

- Influencing policymakers

- G2

- Stakeholder engagement

- *

- Did not provide information to ATNI

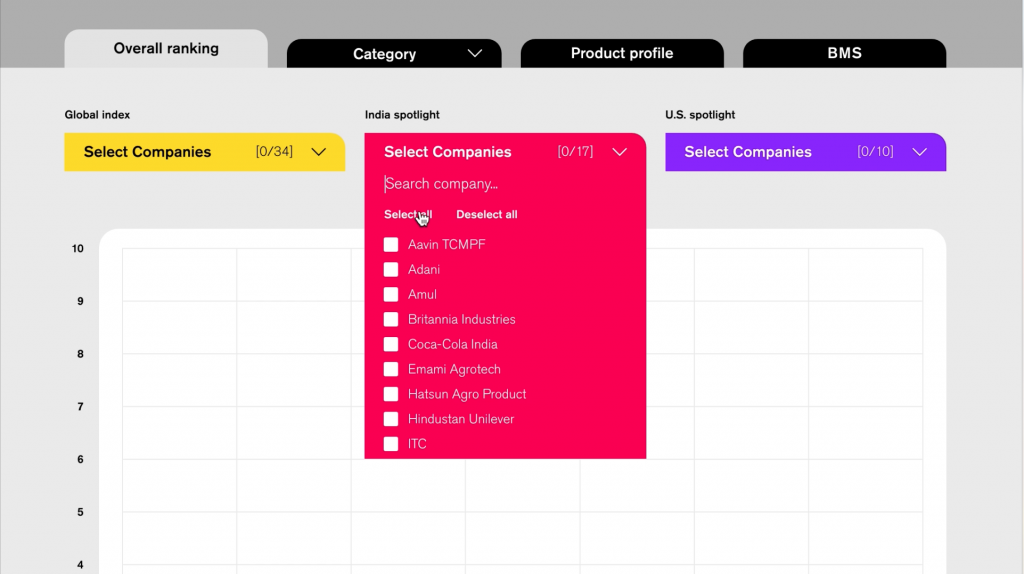

Trends over time

Visualize progress at a glance with ATNI trend-tracking tool.

Embracing the latest progress in data visualization is an important objective for ATNI. With our trend-tracking tool, we intend to provide our stakeholders with a simple interactive interface which allows anyone to select companies, indicators and specific time ranges to compare companies ‘performance across time and within specific categories. To guarantee the overall consistency of our data across different channels of communication, we retrieve data from a single data source, namely our different indexes. Allowing our stakeholders to generate and download their own comparisons also helps us to ensure that ATNI’s findings are actively used and embedded in ongoing nutrition related initiatives.

Amplifying Impact

Improving nutrition for all Indians

End hunger, achieve

food security and

improved nutrition

Ensure healthy

lives and promote

well-being for all

Driving the private sector’s performance on healthy, affordable diets is a crucial factor to reach India’s National Nutrition Mission and the goals of the Eat Right India movement. Reaching these goals for more than 1.25 billion citizens in India is also a prerequisite to reach the 2030 worldwide agenda of Sustainable Development including zero hunger and good health and well-being for all. This ATNI India Index finds food companies in India show their commitment to provide healthy food and discuss how to support the Poshan Abhiyaan mission and the Eat Right India movement. More innovative, healthy and affordable products can and should be introduced to make a real difference.

The second India Spotlight Index was produced by the ATNI India Index project team which consists of Fiona Kirk, Osien Kuumar, Paul Vos and Mark Wijne. For the company research, analysts Julia Llados I Vila, David Jerome and Estefania Marti Malvido complemented the team. ATNI executive director Inge Kauer, senior advisor Rachel Crossley and program intern Sofie van den Berg helped review texts and data.

As noted in the methodology section of the report, the ATNI team drew on the expertise and advice of two advisory groups, a group of expert reviewers in India and the ATNI international Expert Group. Their close engagement throughout the development process for the methodology of the India Spotlight Index 2020 has been a source of invaluable guidance, and this report benefited greatly from their input and advice (group composition and names in the full acknowledgment). The views expressed in this report, however, do not necessarily reflect the views of these two groups’ members or of the institutions they represent.

Create Pdf

Access an overview of the major findings and recommendations of the India Spotlight Index 2020. Obtain quick insights into current best practices and ATNI's recommendations.

Access and download the India Spotlight Index 2020 report in its entirety.

Select only the most relevant content to you via our dynamic interface and generate your customized report.

Select only the most relevant content to you via our dynamic interface and generate your customized report.