Governance

Corporate nutrition strategy, governance, and accountability

Category A assesses the extent to which a company’s commercial strategy includes a specific commitment to contribute to improved nutrition, and whether this approach is embedded within its governance and accountability mechanisms.

Category A consists of two equally weighted criteria:

- A1 Corporate nutrition strategy

- A2 Nutrition governance and accountability

To perform well in this category, a company should:

- Have a mission statement and commercial strategy that focuses on health and nutrition to show that they are factored into all major business decisions and functions.

- Address the nutritional needs of people experiencing, or at high risk of, any form of malnutrition (priority populations).

- Use multiple approaches, e.g., product (re)formulation, marketing to address obesity, and diet-related chronic diseases in the US.

- Comprehensively and publicly show progress on its nutrition strategy in the US.

- Assign accountability for implementing its nutrition strategy and/or programs to the CEO or Senior Executive, and undertake regular internal audits and management reviews.

- Link accountable person’s remuneration to performance on nutrition-related objectives.

Ranking

- A1

- Nutrition strategy

- A2

- Nutrition management

Nestlé and Unilever demonstrate the most comprehensive nutrition strategies, management systems, and reporting among the companies assessed. Overall, companies perform well on incorporating nutrition in their corporate strategies, but there are only a few improvements observed on nutrition governance and accountability mechanisms.

Category Context

The private sector has an important and prominent role to play in addressing key nutrition challenges in the US, such as obesity, food, and nutrition insecurity. For a food and beverage company to improve all aspects of the business that affect access to nutrition, commitments towards better nutrition should be well embedded in its commercial strategy. This ensures the prioritization of improved nutrition outcomes from the outset: From planning through to implementation and evaluation. It is also important that nutrition-related commitments are owned by the top management of the company. This ensures cohesive integration of such commitments in the company’s core business strategy and defines how a company conducts business. In doing so, companies are also able to prioritize nutrition efforts, make them better, and scale them up over time.

Obesity is a critical and costly health concern that affects nearly 41.9% of adults and 15.5% of children between the ages of 10 and 17 in the US. Obesity prevalence has increased by 11% since 1999. During the same time, the prevalence of severe obesity increased from 4.7% to 9.2%, with half of US adults projected to have obesity by 2030.

The latest Dietary Guidelines for Americans 2020-2025 emphasize the fact that obesity puts people at risk for many serious chronic diseases, such as Type 2 diabetes, high blood pressure, heart disease, certain types of cancer, and stroke, among others – and recommends Americans to limit foods and beverages higher in added sugars, saturated fat, and sodium. It is therefore more important than ever that companies’ nutrition commitments include a specific focus on addressing obesity and diet-related diseases.

Obesity does not affect all groups equally. Recent research suggests stark and deep disparities, with higher rates of obesity among children of color and kids from low-income families. These disparities have been further highlighted by the COVID-19 epidemic. According to the Centers for Disease Control and Prevention, obesity increases the risk of severe illness from COVID-19 among people of any age, including children.

In addition, healthcare costs are especially higher for people who are overweight or living with obesity. Therefore, food and beverage manufacturers have an important role to play in making nutrition commitments that support and promote a healthy weight and prevent extreme weight gain.

When we think about the reasons why obesity impacts certain racial, ethnic, and income groups harder than others, it has a lot to do with opportunities to make healthy choices. With the economic devastation from the pandemic in recent years, food security is now more difficult to achieve. In 2020, an estimated one in eight Americans were food insecure, equating to over 38 million individuals, including almost 12 million children. While food security implies access to enough food for an active, healthy life, it is also important to consider how the quality of our diets can help reduce diet-related diseases. This is captured in the United States Department of Agriculture’s (USDA) commitment to enhancing (food and) nutrition security. It defines nutrition security as all Americans having consistent access to the safe, healthy, affordable foods essential to optimal health and wellbeing. It also emphasizes equity and the need to tackle long-standing health disparities.

ATNI encourages companies to specifically address the needs of priority populations in their nutrition strategies. ATNI defines priority populations as groups (at risk of or) experiencing malnutrition or obesity at a higher rate than the general population, due to factors outside of their direct control. In the US, this applies primarily to those disproportionally experiencing obesity and/or food and nutrition insecurity in association with multiple complex (and often overlapping) contributing factors, such as: low incomes; geographic factors (e.g., grocery stores far away or communities in which stores only have a limited range of healthy products); and other social determinants of health (e.g., how race/ethnicity influence marketing – all aspects beyond advertising – of foods of different nutritional quality).

There are several ways in which companies can contribute to better nutrition, including product (re)formulation, prioritizing marketing of healthier products, and labeling and responsible lobbying. However, the premise for these efforts is reflected in the company’s broader commitment to addressing these issues in its core commercial strategy. For this strategy to translate into effective implementation, it is also important that proper governance and accountability measures are in place and that progress against these objectives is shown comprehensively and regularly in the companies’ reporting.

Relevant changes in the methodology

Overall, the 2022 methodology reduces the attention on companies’ non-commercial nutrition-related activities, and instead favors the development and continuation of healthy food and better nutrition policies, and practices embedded in companies’ commercial strategies. For Category A, while the weight remained the same (12.5%), the methodology revision resulted in 18 fewer indicators.

Summary of changes:

-

Greater focus on the quality of the strategy to address obesity and diet-related chronic disease in the US, including for priority populations.

-

Several indicators considered not relevant to the US context – such as risk assessments and reporting formats, given that these are regulated – have been removed.

- As such, criterion A3 on quality of reporting has been removed, also considering that reporting is assessed throughout the Index via disclosure indicators.

Key Findings

- All 11 companies include a commitment to focus on nutrition or health in their commercial growth strategies. In 2018, seven out of 10 companies did so. Out of these 11 companies, three (Kellogg, KDP, and Unilever) show that these commitments are part of their mission statement in addition to their commercial strategies.

- Four companies make an explicit reference to addressing the needs of priority populations in their nutrition strategy. In 2018, only one company (Kellogg) did so. Within this commitment, Kellogg focuses on food-insecure households, and the other three (KDP, PepsiCo, and Coca-Cola) focus on calorie reduction efforts in communities where health disparities have led to higher obesity rates than the national average.

- All companies show that they are addressing obesity and/or diet related diseases through their nutrition commitments; however, the approaches taken differ between them.

- Five companies have adopted comprehensive approaches to deliver on their nutrition strategies, such as product (re)formulation and responsible marketing. These companies also define nutrition-relation objectives rooted in national/international guidelines (like the Dietary Guidelines for Americans), including time-bound targets with baselines. In 2018, only two companies did so.

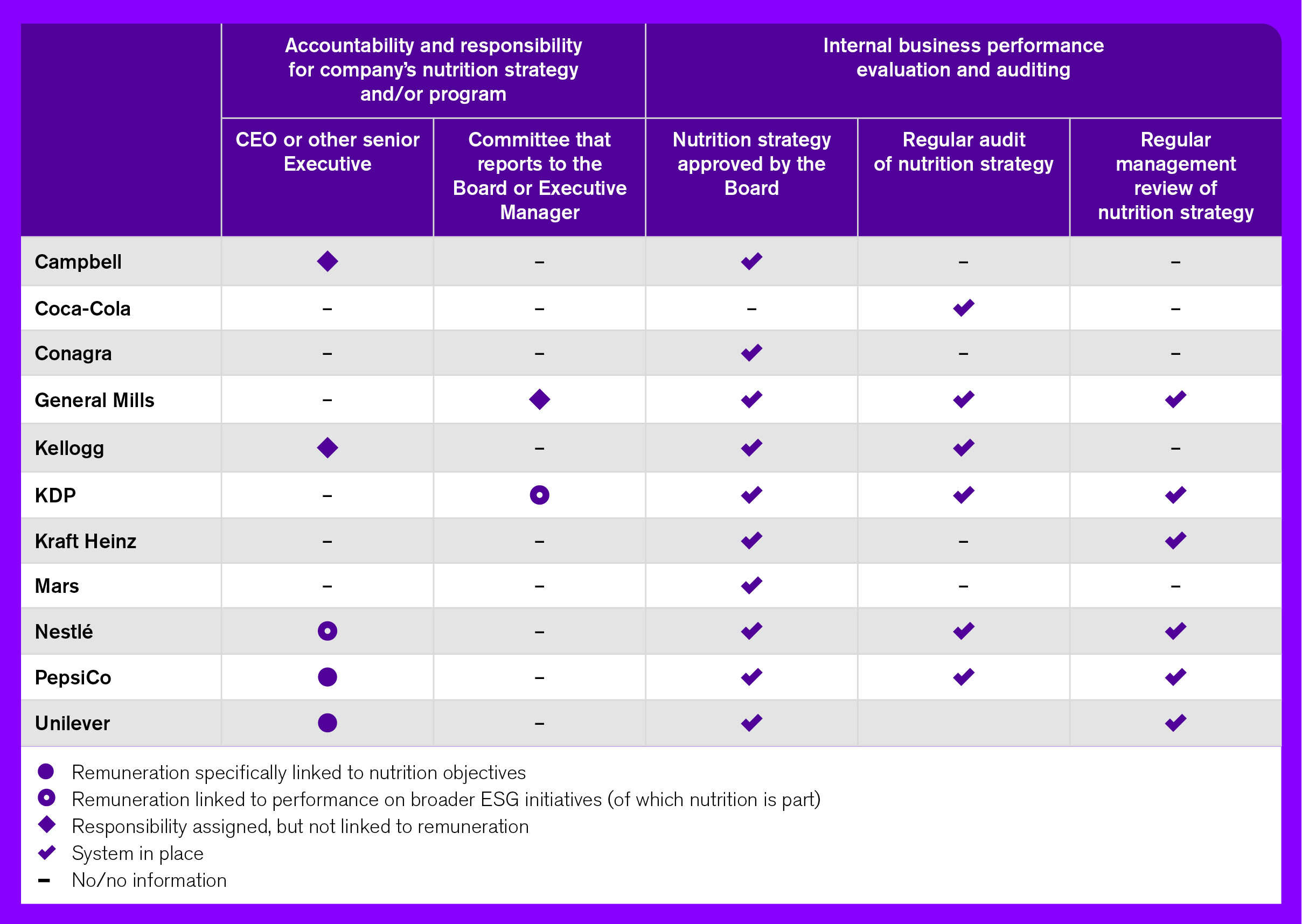

- All companies have defined explicit accountability arrangements for their nutrition strategy. Five companies show that the CEO or another senior executive is responsible for the company’s nutrition strategy, and for three companies, accountability lies with a committee that reports to the board. All companies disclose these arrangements except one. This is a great improvement since 2018, when this was lacking across the board.

- Only four companies link remuneration of the person accountable for their nutrition strategy to nutrition-related objectives.

- In 2018, ATNI found that formal and regular reporting on companies’ nutrition strategy in the US was quite limited, with only three companies doing so. In this iteration, seven companies show either substantial US reporting – in the form of a separate report or section on their website or US-specific section in Global Reporting – by detailing progress or providing US-focused examples.

Notable Examples

-

- A

Unilever is one of three companies that make nutrition and health part of their mission statement and part of their core commercial strategies. In 2020, Unilever launched its new strategy – The Unilever Compass – which builds upon the Unilever Sustainable Living Plan (USLP) 2010-2020. The company’s purpose is to ‘make sustainable living common place’. Under the ‘Improve people’s health, confidence and wellbeing’ pillar, the company has set six goals on Positive Nutrition, including to “Double the number of products sold that deliver positive nutrition by 2025” and for “70% of our portfolio to meet World Health Organization (WHO)-aligned nutritional standards by 2022.” These goals are part of the company’s ‘Future Foods’ strategy. Further, in July 2020, the company published a plan titled ‘Transforming the world’s food system for a more nutritious, more sustainable, and fairer future’, in which it outlines four ways the company is leading change. These include: 1) Nutritious foods and balanced diets; 2) Making plant-based choices available for all; 3) Less food waste; and 4) Food that is fair and doesn’t cost the earth. On its US website, the company states: “As one of the biggest consumer goods companies in the world, with a large Foods & Refreshment portfolio, we’re mindful of the huge impact we can make through our scale and reach. We aim to produce tasty, accessible, affordable, and nutritious products, and encourage people to make nutritious choices through transparent labeling and balanced portions.” On its US website, Unilever has a dedicated section to report progress on its nutrition efforts, including US-specific progress on nutrition targets. In addition, on its global website ‘Sustainability performance data’, Unilever publishes progress by country.

-

General Mills commits to conducting regular management reviews and internal audits of their nutrition strategies. The company’s ‘Bell Institute of Health and Nutrition’ reports directly to the Chief Innovation, Technology and Quality Officer, who approves the overall health and wellness strategy and updates the Public Responsibility Committee of the Board of Directors. On an annual basis, this committee reviews the company’s actions in furtherance of its corporate social responsibility and sustainability strategies, plans, and objectives. These include matters concerning nutrition, marketing, and advertising. In addition, the company’s nutrition plan is reviewed and audited yearly by the Chief Innovation, Technology and Quality Officer.

A1. Corporate Nutrition Strategy

All 11 companies include a commitment to focus on nutrition or health in their commercial growth strategies. However, four companies also make this part of their mission statement, which shows how nutrition and health drive their purpose. For example, Kellogg’s vision includes a focus on nutrition and health and is integrated into the company’s ‘Deploy for growth’ business strategy. One of its tenets is ‘Nourish with our foods’ while another is ‘Feed people in need’. The company commits to crafting foods that include nutrients of need, address hidden hunger or malnutrition, and support a healthy gut microbiome.

Companies use different approaches to integrate nutrition into their commercial strategies. Some have incorporated nutrition as part of a broader Environmental, Social, and Governance (ESG) framework, where they consider other sustainability dimensions such as packaging and environmental impact. Campbell, for instance, takes a holistic ESG approach of which ‘Trusted Food’ is one of four pillars. Campbell defines this as ‘delicious, wholesome, accessible, food made with trusted ingredients.’ According to the company, trusted food is nutrition-focused, accessible, and lower in negative nutrients. Conagra’s nutrition strategy is centered on the idea of nourishing consumers with good food that provides them choices, while simultaneously meeting high quality and food safety standards. Unilever also includes in its commitments a focus on making plant-based foods accessible and reduce environmental impact.

Others define their nutrition strategy in the context of positive nutrients and nutrients of concern, often referencing their own nutritional profiling model (NPM). General Mills commits to producing more ‘Nutrition-Forward’ foods, which is the framework of nutrition metrics defined by the company. ‘Nutrition-forward’ foods provide at least half a serving of wholegrains, fruit, vegetables, low or non-fat dairy, or nuts/seeds per labeled serving, or meet United States Food and Drug Administration (FDA) ‘Healthy’ criteria per serving. The company’s ‘Accelerate business’ strategy calls for growing sales across key categories, many of which are ‘Nutrition-Forward’ foods. Nestlé commits to launching more nutritious foods and beverages, simplifying ingredient lists, and removing artificial colors, while adding micronutrients where they are deficient in the local population and further reducing sodium.

Four companies – Nestlé, Unilever, Mars, and KDP – integrate nutrition within a health and wellbeing component of their strategies. Mars includes in its commercial strategy a ‘Nourishing Wellbeing’ pillar, which applies to the US and includes commitments to delivering products and services that are trusted and enjoyed. This also involves providing high-quality and transparent information across its entire food portfolio to enable consumers to make informed choices, and continuously improving the nutritional content of its products. The commitment further includes “supporting the wellbeing of people across the global food supply chain by enabling best practice to produce safe, nutritious, and enjoyable food.”

Notable example: In 2020, Unilever launched its new strategy – The Unilever Compass – which builds upon the Unilever Sustainable Living Plan (USLP) 2010-2020. The company’s purpose is to ‘make sustainable living common place’. Under the ‘Improve people’s health, confidence and wellbeing’ pillar, the company has set six goals on Positive Nutrition, including to “Double the number of products sold that deliver positive nutrition by 2025” and for “70% of our portfolio to meet WHO-aligned nutritional standards by 2022.” These goals are part of the company’s ‘Future Foods’ strategy. Further, in July 2020, the company published a plan titled ‘Transforming the world’s food system for a more nutritious, more sustainable, and fairer future’, in which it outlines four ways the company is leading change. These include: 1) Nutritious foods and balanced diets; 2) making plant-based choices available for all; 3) less food waste; and 4) food that is fair and doesn’t cost the earth. On its US website, the company states: “As one of the biggest consumer goods companies in the world, with a large Foods & Refreshment portfolio, we’re mindful of the huge impact we can make through our scale and reach. We aim to produce tasty, accessible, affordable, and nutritious products, and encourage people to make nutritious choices through transparent labeling and balanced portions.”

All companies explicitly make references to addressing obesity and/or diet related diseases through their nutrition commitments; however, the approaches taken differ across them. Six of these companies also include an explicit focus on addressing the needs of priority populations.

The three beverage companies included in the Index – Coca Cola, PepsiCo, and KDP – commit to reducing beverage calories through their association with the Balance Calories Initiative (BCI). With this, they commit to providing more choices with less sugar, putting calorie information up front, removing full-calorie soft drinks from schools, and/or setting responsible marketing guidelines and general awareness-raising campaigns.

Through their association with the BCI, these companies also commit to addressing the needs of priority populations by tracking calorie reduction efforts in five communities in the US – in which health disparities have led to higher obesity rates compared to the national average, and where reducing beverage calories is expected to be most challenging. The most recent evaluation of this work concluded that beverage calories per person fell in all five selected communities and that low- and no-calorie beverages have grown in these communities. Meanwhile, consumption of full calorie beverages have declined, driving an eight to 13% reduction in calories per 8oz serving from the baseline.

With childhood obesity being a major public health concern and its associated increased risk of diet-related diseases, three companies include an explicit focus on tackling childhood obesity in their nutrition strategies. For instance, Kellogg, through its ‘Childhood Wellbeing Promise’, commits to addressing childhood obesity cohesively through multiple approaches – encompassing access to healthy foods, consumer education, strengthening marketing to children standards, reformulation, and portion control. Unilever also launched new principles on marketing and advertising foods and beverages to children. The company made a new commitment not to market their products to children and, in April 2022, also announced that it is raising the age threshold of this commitment to all under 16s – being the first US Index company to use this age limit and the closest to the International Child Rights Convention’s definition of a ‘child’ (18 years).

Five companies adopt comprehensive approaches to deliver on their nutrition strategies, such as product (re)formulation and responsible marketing. These companies also define nutrition-relation objectives rooted in national/international guidelines, including time-bound targets with baselines, and present them in a cohesive report. The remaining companies include at least two of these four features in their strategies.

Notable example: Nestlé adopts a comprehensive approach to deliver on its nutrition strategy and help tackle obesity. The company’s commitments cover: Reformulation (decreasing sugars, sodium, and saturated fat, and increasing vegetables, fiber-rich grains, pulses, nuts, and seeds in their foods and beverages); marketing (leveraging marketing efforts to promote healthy cooking, eating, and lifestyles); and portion control (offering guidance on portions for its products). These commitments are accompanied by several time-bound targets in the company’s ‘Creating Shared Value’ report. Nestlé also publicly commits to support US Dietary Guidelines. As a ‘National Strategic Partner’ with the USDA Nutrition Communicator’s Network, several Nestlé USA brands will develop a series of innovative communications efforts to promote the Dietary Guidelines Consumer Messages, encouraging consumers to make healthier food choices and exercise more.

In 2018, ATNI found that formal and regular reporting on companies’ nutrition strategy in the US was quite limited. Only three companies were doing so. In this iteration, seven companies show either substantial US reporting – in the form of a separate report or section on their website or US-specific section in Global Reporting – by detailing their progress or providing US-focused examples. Nestlé, for instance, does not publish a specific report for the US, but includes some reporting into the global report that spotlights specific market data, including US information. In addition, the company has a US-specific website that reports on its commitments.

Notable example: On its US website, Unilever has a dedicated section to report progress on its nutrition efforts, including US-specific progress on nutrition targets. In addition, on its global website ‘Sustainability performance data’, Unilever publishes progress by country.

To improve and accelerate efforts to enhance consumers’ nutrition, leading food and beverage manufacturers are encouraged to:

- Continue integrating nutrition considerations in their core business functions

. The2022 results show more companies are committing to a strategic focus on nutrition and health, as articulated in their mission statements and strategic commitments. However, they can do more in terms of developing specific objectives and activities to improve nutrition and address malnutrition, and to publicly disclose progress against these.

- Conduct research into commercial opportunities available to address specific needs of priority populations, including products and marketing that helps address obesity. Determining such business opportunities requires careful analysis of the population’s nutritional needs, as defined by USDA, the 2020-2025 Dietary Guidelines for Americans, and other relevant public authorities.

A2. Nutrition governance and accountability

All companies have defined explicit accountability arrangements for their nutrition strategy. Five companies show that the CEO or another senior executive is responsible for the company’s nutrition strategy. Kellogg, for instance, includes in its strategy that its approach to nutrition and philanthropy is led by its Senior Vice President, Global Research and Development (who reports to the company’s Chief Growth Officer), and its Senior Vice President, Global Corporate Affairs (who reports to the company’s CEO).

For the remaining companies, accountability lies with a committee that reports to the Board. For Coca-Cola, the Board’s ESG and Public Policy Committee assists in overseeing the company’s policies and programs and related risks to the company that concern, among others, progress against the company’s ESG goals.

All companies disclose these arrangements except Mars. This is a great improvement since 2018 when disclosure was lacking across the board.

Only two companies link remuneration of the person accountable for their nutrition strategy to nutrition-related objectives, and two companies link remuneration to broader ESG-related objectives, which include nutrition. PepsiCo discloses that the accountable person’s renumeration is tied to “continued investment in Pepsi Zero Sugar, which has grown in retail sales compared to prior fiscal year.”

Table 1. Oversight mechanisms in place for companies’ nutrition strategy and/or programs

Five companies commit to conducting regular management reviews and internal audits of their nutrition strategies. For the three beverage companies that are part of the BCI (KDP, Coca-Cola, and PepsiCo), progress is audited by a third party. General Mills’ ‘Bell Institute of Health and Nutrition’ reports directly to the Chief Innovation, Technology, and Quality Officer, who approves the overall health and wellness strategy and updates the Public Responsibility Committee of the Board of Directors. On an annual basis, this committee reviews the company’s actions in furtherance of its corporate social responsibility and sustainability strategies, plans, and objectives. These include matters concerning nutrition, marketing, and advertising. In addition, the company’s nutrition plan is reviewed and audited yearly by the Chief Innovation, Technology, and Quality Officer.

To improve and accelerate efforts towards robust nutrition governance and management systems, global food and beverage manufacturers are encouraged to:

-

Link executive compensation to performance on nutrition objectives and ensure that nutrition plans and strategies are assessed regularly.

- Ensure nutrition plans and strategies are assessed regularly by internal audits and/or are subject to a regular management review to monitor progress.