BMS Index 2024

The Access to Nutrition Initiative is pleased to present the BMS Index 2024, assessing the world's largest 18 companies estimated to cover 76% of the global sales of BMS products.

Introduction

The BMS Marketing Index assesses company standards on the marketing of breast-milk substitutes, hereinafter referred to as BMS products. These include any milks (or products that could be used to replace milk, such as fortified soya milk alternatives), in either liquid or powdered form, that are specifically marketed for feeding older infants and young children up to the age of three years. The 18 companies assessed on ATNI’s BMS Marketing Index 2024 represent 76% of the global BMS market.

A person’s first 1,000 days, or the period from conception until age two, are the most crucial for the development of their brain, body, metabolism, and immune system. Breastfeeding provides unparalleled brain-building benefits and gives infants the healthiest start to life. The World Health Organization (WHO) recommends exclusive breastfeeding up to six months of age, with continued breastfeeding along with appropriate complementary foods (CF) up to two years of age or beyond.

Read the full Index report

Inappropriate promotion of breast-milk substitutes (BMS) remains a threat to the protection and support of breastfeeding worldwide undermining informed choice among parents and caregivers and leading to suboptimal breastfeeding practice in high-income and low-income settings alike. Improving breastfeeding practices could save the lives of nearly 420,000 children and 90,000 mothers and prevent more than 4.6 million cases of childhood obesity globally each year. The 2023 Lancet series on breastfeeding estimated that USD 341.3 billion per year is lost globally from unrealized benefits to health and human development due to inadequate investment in protecting, promoting, and supporting breastfeeding.

For over a decade, ATNI has assessed how BMS companies comply with the 1981 International Code of Marketing of Breast-milk Substitutes (‘the Code’), which provides guidelines for the responsible marketing of BMS, including CF for infants and young children. ATNI’s research and Indexes do not assess compliance with local regulations or laws, but rather assess private sector performance against international standards and guidance.

In this iteration, ATNI has expanded the coverage to include the 20 largest companies in the global baby food segment – 11 additional companies compared to the last assessment in 2021.

Combined, the 20 companies hold an estimated share of at least 70% of the global baby food (BMS and CF) market. Eighteen of these companies that sell BMS products, contributing to at least 5% of their global baby food sales, are included in this BMS Index – and, together, these companies are estimated to cover 76% of the global sales of BMS products. This BMS Marketing Index 2024 assesses the quality of companies’ BMS marketing policies and management systems, their level of transparency, and their marketing practices in five global markets – China, Germany, Indonesia, Viet Nam, and the US.

Read the Executive Summary

Context

The BMS Index 2024 assesses companies' quality of BMS marketing policies and management systems, their level of transparency, and their marketing practices for the world's largest 18 manufacturers.

Companies are assessed on two main components:

– The Country Studies, which measure companies’ marketing practices in selected countries. For this Index, five countries were selected representing the companies’ primary baby food markets: China, Germany, Indonesia, Viet Nam and the US.

– The Corporate Profile assessment, which examines global corporate policies and procedures and level of disclosure.

The Corporate Profile and Country Studies evaluate the extent to which company policies and practices align with the various provisions of the Code. While the Corporate Profile assesses company policies and commitments on all aspects of the Code, the Country Studies assess marketing practices against specific provisions of the Code.

The product scope for this research includes:

– IF: infant formula (intended for infants younger than six months of age)

– FUF: follow-up formula (intended for older infants between six months up to one year of age)

– GUM: growing-up milks or toddler milks (intended for young children between one to three years of age)

Results

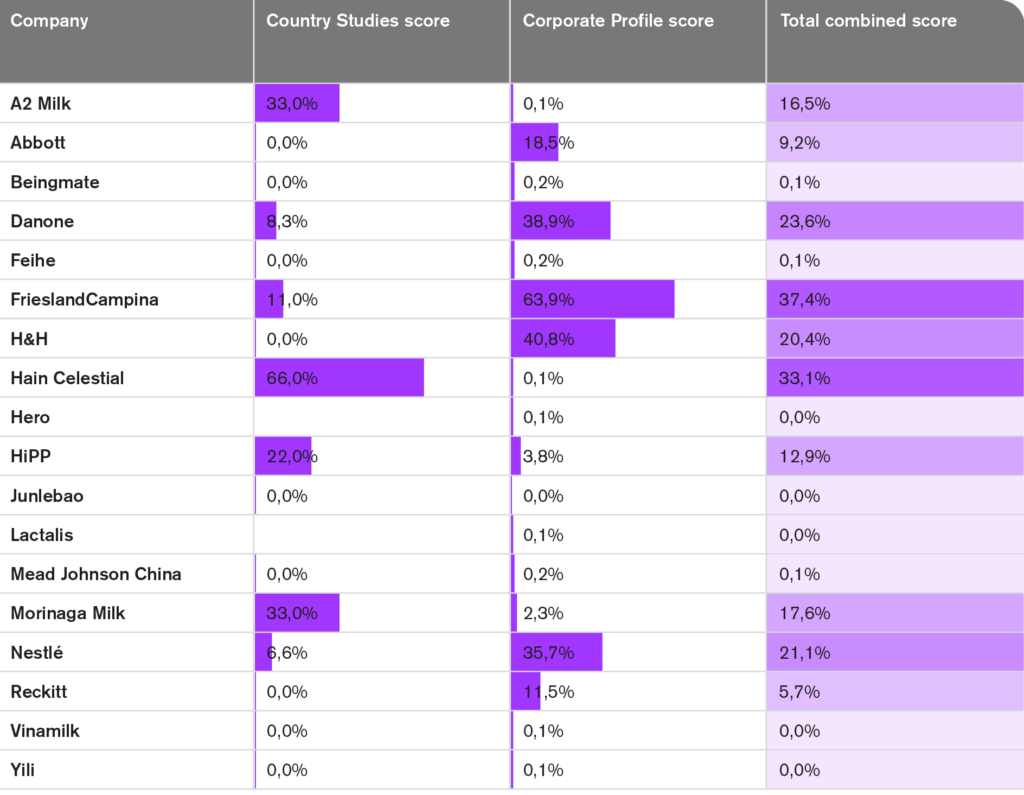

Below you can see the results of all assessed companies. None of the 18 companies assessed fully align with the Code.

Key Findings

BMS companies have a significant opportunity to improve their marketing policies and practices globally.

Since 2021, some improvements were measured related to updated policies and enhanced practices. However, not one of the 18 companies assessed fully align with the Code. In addition, digital platforms have now emerged as the major driver for BMS marketing representing 61% of the incidences of non-compliance.

Not one of the 18 companies assessed in the BMS Index 2024 scores 100% compliance with the Code for their policies and practices.

- The highest total score is 37% for FrieslandCampina followed by four companies between 20% and 33% (Danone, Hain Celestial, H&H, and Nestlé).

- Three companies scored between 13% and 18% (A2 Milk, HiPP, and Morinaga Milk).

- Two companies scored below 10% (Abbott and Reckitt).

- Eight companies (Beingmate, Feihe, Hero, Junlebao, Lactalis, Mead Johnson China, Vinamilk, and Yili) scored 0%.

A total of 1,614 incidences of inappropriate marketing of formula, not-compliant, with the Code were identified across all companies in the five markets assessed. Of these, 61% occurred in online media and online retailers/points-of-sale (980 out of 1,614), while around 9% were observed on traditional media, mostly TV (138 out of 1,614). Approximately 31% of the incidences of non-compliance were identified on product labels (496 out of 1,614).

A total of 290 incidences of non-compliance with the Code concerned BMS products sold by Danone, 219 incidences concerned Nestlé BMS products, and, in descending order, 142 incidences were observed for Abbott, 135 for Reckitt, 120 for Morinaga Milk, 105 for FrieslandCampina, 104 for Feihe (all in China), 102 for Mead Johnson China (all in China), 87 for Junlebao (all in China), 81 for Yili (all in China), 65 for HiPP, 63 for H&H (all in China), 44 for Vinamilk (all in Viet Nam), 38 for Beingmate (all in China), 14 for A2 Milk (all in China), and five for Hain Celestial (in the US).

Nearly all product labels assessed (98%) were found to contain one or more incidences of non-compliance with the Code, like the inclusion of claims and the absence of a statement on the importance of exclusive breastfeeding in the first six months of life and continued breastfeeding for up to two years or beyond.

Most observed incidences of non-compliance concerned growing-up milks (GUM, 893 out of 1,614). This suggests positive effects of more stringent regulations limiting the advertising and promotion of infant formula (IF) and follow-up formula (FUF) through traditional and online media channels.

The Corporate Profile assessment of company policies and management systems showed eight out of 18 companies had a BMS marketing policy. Abbott, Danone, Feihe, FrieslandCampina, Nestlé, Reckitt, and Yili were previously assessed in the BMS/CF Index 2021, and it was noted that Abbott, FrieslandCampina, and Nestlé have revised their policies since 2021.

Recommendations

To better support our research, below are some recommendations for key stakeholders; focusing on improving the current situation.

Recommendations to BMS companies:

Companies should prioritize efforts to enhance and harmonize compliance with the Code across all countries they operate in, to protect optimal nutrition for infants and young children globally.

- Companies must fully align their policies and practices with the Code, including all subsequent relevant WHA resolutions up to WHA Resolution 71.9. Companies are especially urged to follow the guidance on ending the inappropriate promotion of foods for infants and young children, supported by WHA Resolution 69.9, to strengthen responsible BMS marketing practices in line with the Code.

- Based on ATNI’s findings, companies are encouraged to have explicit commitments and guidelines on responsibly marketing their BMS products in digital environments, in line with the latest guidance by WHO on restricting digital marketing of foods for infants and young children.

- Based on the results of the country studies, companies are urged to strengthen their policies and practices to address the inclusion of nutritional, health, and marketing claims on product labels in line with the Code.

- ATNI urges companies to uphold their BMS marketing commitments for all BMS products (including special purpose foods/ FSMPs) globally, and extend responsible marketing practices to GUMs, which constitute around 40% of global BMS sales.

- Companies that do not yet have a dedicated BMS marketing policy should develop and/or publish such policies that fully align with the Code. All companies are encouraged to refer to ATNI’s model company BMS marketing policy to see how they can comply with the Code in policy and practice.

- Companies should bolster their management systems to deliver consistent compliance with their stated commitments, once brought into full alignment with the Code.

- Companies should promptly take corrective actions upon receiving reports of incidences of non-compliance with the Code.

- ATNI urges companies selling products within the scope of the Code to take responsibility for monitoring their marketing practices beyond local regulations, according to the principles and the aim of the Code and subsequent relevant resolutions.

- Companies should publish more information on their BMS marketing policies and practices to increase transparency, and make key documents easily accessible to stakeholders.

Recommendations to investors

As shareholders, investors play a significant role in shaping food companies’ governance, strategy, and disclosure practices.

- Investors should make use of existing models, such as ATNI’s model company BMS marketing policy, to integrate Code compliance into responsible investment strategies.

- Investors can use the findings of this Index to drive companies’ progress on responsible BMS marketing practices through various investment strategies, calling for transparency and compliance to the Code.

- Investors can use the data from this report to develop materials to support engagement with companies.

- Investors are urged to employ their influence to encourage companies to take steps towards full Code compliance.

Recommendations to policy makers

Regulatory authorities should align local regulations more closely with the provisions of the Code, to address existing gaps and strengthen enforcement mechanisms.

- Digital marketing is challenging the ways in which national legislation is enforced and monitored. There is an urgent need to enforce regulations on digital marketing and introduce stronger legislation to monitor responsible BMS sale strategies. Ministries of information and communications and ministries of health should test new artificial intelligence applications for tracking Code violations online (e.g. such as VIVID, short for Virtual Violations Detector).

- We suggest that particular focus be placed on restricting parallel imports to countries and recommend the consideration of stricter rules to prevent the entry and marketing of parallel import products that do not comply with national regulations. The authorities could, perhaps, look at how the importation of these products might be more strictly controlled.

- The scope of national legislation should be expanded to encompass formulas intended for older infants and young children up to 36 months of age.

Recommendations to civil society and non-governmental organizations (NGOs)

- Educational campaigns targeting consumers should be conducted to raise awareness on the importance of breastfeeding and the potential risks associated with inappropriate marketing of BMS products.

- NGOs, professional groups, institutions, and individuals can contribute by proactively reporting incidences of non-compliance with the Code to companies or distributors through available channels.

- NGOs, civil society, and academia can contribute to addressing current public health concerns by developing tools and means that support overall Code monitoring, enforcement, research, and adoption.

Companies Assessed

Click on the tiles below for a detailed overview of individual companies' performance and key recommendations.

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Methodology

This index includes a Corporate Profile and Country Assessments, which together assess companies' nutrition policies and practices, globally and in the selected markets.

The increased number of selected companies and countries assessed for the BMS and CF Marketing Indexes 2024, as well as separate assessments of BMS and CF marketing, warranted several adjustments to the methodology. ATNI undertook an extensive consultation process in which these changes were discussed.

The methodology for the BMS and CF Marketing Indexes 2024 includes additional information about the companies selected and the respective Index(es) they are assessed in, as well as the basis and nature of the assessments for each component and how they feed into the overall Indexes.

Read the full methodology here

Acknowledgements and Disclosures

This report is being supported by the Bill & Melinda Gates Foundation. The writing of this report, the underlying methodology development and the research were conducted by the Access to Nutrition Initiative Infant and Young Child Nutrition project team, which consists of Efi Chatzinikolaou, Lucy Cosenza, Daniela Hernández Morales, Ludovica Ibba, Nadine Nasser, Marina Plyta, Irene Santoro, and Mark Wijne. We would also like to thank colleagues for their support in various steps of the process: Babs Ates, Freddie von Kaufmann, Eaindra Aye, Aurélie Reynier, Omari Palmer, Vrinda Poojari, and Philip Eisenhart as well as Juliana Constantino, who supported the research as part of her internship at ATNI.

The ATNI team drew on the expertise and advice of the ATNI BMS expert group members Elizabeth Zehner, Laurence Grummer-Strawn

(observer), Linda Meyers, Shelly Sundberg, and Shiriki Kumanyika and would like to thank them for their valuable input throughout thisresearch and the underlying methodology. The views expressed in this report, however, do not necessarily reflect the views of the group’s members or their institution.

Underlying data for the country studies has been sourced from Digimind, Innova Market Insights, and Nielsen Ad Intel International under license.

ATNI would like to thank Kummer & Herman and Studio September for design, Wren Media for editing and proofreading, 73Bit for setting up the data platform and M&C Saatchi for communications.