Global Index 2024

The fifth edition of the Global Access to Nutrition Index assesses 30 of the world’s largest food and beverage (F&B) manufacturers – 23% of the global F&B market – on their performance to improve access to nutritious foods. The Index presents companies’ relative progress across a range of nutrition-related topics, areas for improvement, and offers a roadmap for change.

Foreword

by Greg S. Garrett, Executive Director at Access to Nutrition initiative (ATNi)

This is the fifth Global Access to Nutrition Index. It assesses how the world’s largest food and beverage (F&B) manufacturers are contributing to addressing malnutrition in all its forms.

- The world faces more challenges than at any point in recent memory. Since 2021, the obesity epidemic has accelerated, with a concurrent slowing of progress in addressing undernutrition.

- The food sector – particularly the modern food retail segment – is growing. This growth is fastest in emerging markets, with processed foods becoming more available.

We will not end all forms of malnutrition by 2030 (Sustainable Development Goal 2) unless we make fundamental food system changes.

The food industry stands at a pivotal crossroad. Embracing nutrition is no longer an option but essential.

“Families around the world are struggling with poor nutrition and the food industry’s role is critical. We support the Access To Nutrition initiative as they help the sector improve the healthiness of its products and make nutritious foods accessible to all.” – UK’s Development Minister, Anneliese Dodds

Read the executive summary here

Read the full report here

Read the foreword here

Key questions we look at include:

- What does ‘good’ look like for a company? What 2030 targets should companies aim for in terms of responsible marketing and portfolio healthiness?

- Is there a difference between the healthiness of food products available in high income markets versus emerging markets?

- Are any companies making healthy foods core to their business strategies?

- What policies are shaping healthier markets, especially in emerging markets?

- How can responsible investors use this Global Index to exert influence in driving better nutrition practices?

- What perverse market incentives need to be addressed through policy?

ATNi invites you to share the Global Access to Nutrition Index 2024 and use it for change.

Overall Ranking

This interactive dashboard displays each company’s performance by category and presents the ranking based on overall scores. Scoring can be recalculated by category. Zoom in using the controls in the bottom right corner.

Product Profile and Responsible Marketing

Key findings for the product profile, assessing the share of company's portfolios from healthy foods, and responsible marketing practices. Click on the button to move between the two.

Key Findings

F&B manufacturers are increasingly recognising their role in shaping consumers’ diets, but bolder action is needed from industry, policymakers, and investors to shift the needle towards the production of healthier foods and the promotion of healthier diets.

Key progress

An increasing number of companies are using government-endorsed nutrient profile models (NPMs) to classify products as ‘healthier’, marketing more responsibly to children, and defining ‘affordable nutrition’. However, the Index reveals all companies must do more, and there are clear opportunities for improvement.

Product Healthiness

Companies derive 34% of their sales from products classified as ‘healthier’. ‘Healthier’ for the index is defined as 3.5 stars and above, out of 5 stars, using health star rating (HSR). Only 30% of companies met ATNi‘s strategic target of at least 50% of sales from healthier products.

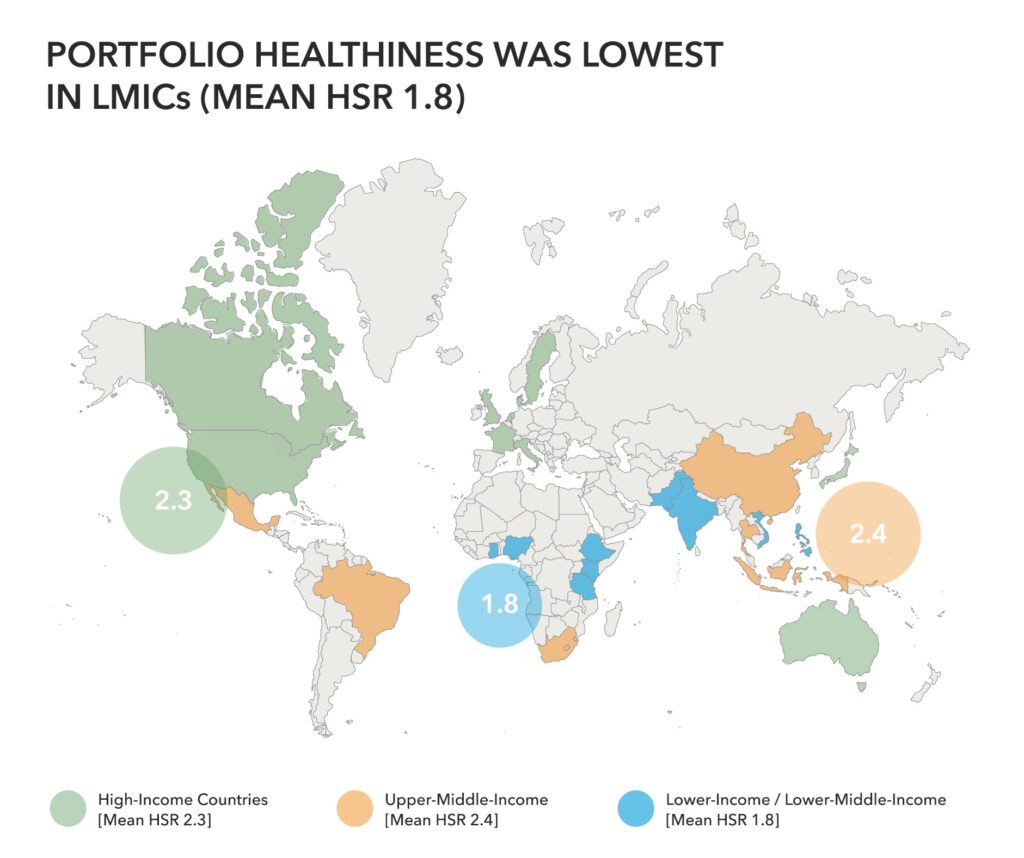

Portfolio healthiness was found to be lowest in low-and-middle-income countries (LMICs). Overall food product healthiness in low- and lower middle-income countries scored much lower (HSR 1.8) than in high-income countries (HSR 2.3).

Companies’ healthier sales targets have considerable scope for improvement. Just one company has set a target to increase the proportion of healthier product sales using a government- endorsed NPM.

Marketing to Children

No company fully prohibits marketing unhealthy foods to children under 18 across all marketing channels and techniques. Five companies have taken positive steps — two are now only marketing ‘healthier’ products defined by a government-endorsed NPM, another five are not marketing any products, and four raising their age thresholds to 16 (plus one already at 18) — none have comprehensive policies that align with all WHO recommendations regarding product restrictions, age thresholds, and comprehensiveness of scope.

Affordable Nutrition

Only 30% of companies have demonstrated a strategy to price part of their ‘healthier’ products affordably for lower-income consumers. Affordability strategies mainly apply to low- and middle-income countries (LMICs) and only two use internationally recognised models to define ‘healthier’ for this purpose. Most strategies apply to a limited range of products and markets, with significant gaps in evidence supporting their implementation.

Key Recommendations

Companies, investors and policymakers have a role to play in transforming the food system to ensure nutritious affordable food is available for all.

Food and Beverage Manufacturers

Evaluate, transform, and disclose.

- Evaluate the suitability of products currently marketed to children, the healthiness of portfolios, and company strategies on affordability.

- Set specific, measurable, and time-bound targets to increase the proportion of sales from healthier products; improve marketing practices, and increase affordability of healthier products.

- Disclose key data on sales of healthier products and compliance with responsible marketing policies.

Policymakers and Governments

Voluntary industry regulations should be supported with mandatory policies and fiscal measures to improve access to nutritious foods.

- Implement a system of taxes and subsidies to incentivise healthier product options. Use revenue generated by taxes in unhealthy products for health-related programmes.

- Adopt mandatory national policies to restrict the marketing of unhealthy foods to children using WHO recommendations, and a mechanism for enforcement.

- Mandate the use of a front-of-pack labelling system based on a government-endorsed NPM, which signposts unhealthy products, and require consistent application across all products.

Investors

Utilise existing nutrition frameworks to assess and promote company performance on nutrition.

- Require that companies disclose information on the healthiness of their product portfolios using a government-endorsed NPM.

- Drive company accountability on nutrition through strategic investment actions such as shareholder resolutions.

- Work actively with governments; environmental, social, and governance (ESG) data providers; and industry bodies to ensure nutrition is embedded within both voluntary and mandatory reporting frameworks.

Report Chapters

Comprehensive report chapters by category are available below, and you can download each one by clicking on the icon.

Download Executive Summary

Download Nutrition Trends

Download Category Report

Download Category Report

Download Category Report

Download Category Report

Download Category Report

Download Category Report

Download Category Report

Download Category Report

Download Full Product Profile Analysis

Download Sustainability Report

Company scorecards

These detailed company scorecards outline the companies' performance across key topics. Each scorecard includes an embedded dashboard for easy reference.

Methodology

This methodology details the approach used to assess and evaluate company performance. This section outlines each step taken to ensure accurate, comprehensive, and transparent results.

The findings of this Index rely, to a large extent ,on information shared by companies, in addition to information that is available in the public domain. Several factors beyond the companies’ control may impact the availability of information including differences in disclosure requirements among countries or capacity constraints within companies. In the case of limited or no engagement by companies, this Index may not represent the full extent of their efforts. Companies who do not engaged are clearly marked.

Read the full methodology hereAcknowledgements & Disclaimers

The Global Access to Nutrition Index (ATNi) 2024 would not have been possible without the generous support of several donors, in particular the Bill & Melinda Gates Foundation and the Foreign,Commonwealth and Development Office.

The Global Access to Nutrition Index (ATNi) 2024 would not have been possible without the generous support of several donors, in particular the Gates Foundation and the Foreign, Commonwealth and Development Office.

The Global Access to Nutrition Index 2024 was produced by many ATNi staff: Aurélie Reynier, Babs Ates, Brenda de Kok, Daniela Hernández Morales, Eaindra Aye, Elena Schmider, Freddie von Kaufmann, Greg Garrett, Gulden Timur, Irene Santoro, Katherine Pittore, Lucy Consenza, Mark Wijne, Nadine Nasser, Patrick de Regt, Sameea Sheikh, Veronica Maxey, Will Sharp; and ATNi consultants: Elizabeth Dunford and Philip Eisenhart.

The ATNi team drew on the expertise and advice of the ATNi Expert Group, whose close engagement throughout the ATNi development process has been a source of invaluable guidance. We would also like to acknowledge The George Institute for Global Health (TGI) for their input on the Product Profile assessment. The views expressed in this report, however, do not necessarily reflect the views of the group’s members or their institutions.

Read the full disclaimer here

Read our press release here

Watch the webinar here