Governance

Corporate strategy, management, and governance

For a food and beverage company to improve all aspects of the business that affect access to nutrition, commitments towards better nutrition should be well embedded in its commercial strategy. This ensures the prioritization of improved nutrition outcomes from the outset: from planning through to implementation and evaluation. It is equally important that companies also support or join governments’ initiatives to prevent and address obesity and/or undernutrition, not only to ensure alignment with public health priorities as identified by the relevant authorities, but because the private sector can and should make a significant contribution to public health targets.

Category A assesses the extent to which a company’s corporate strategy includes a specific commitment to contribute to healthier diets, and whether its approach is embedded within its governance and management systems. The quality of its reporting is also analyzed.

Category A consists of three criteria:

- A1 Corporate nutrition strategy

- A2 Nutrition governance and management systems

- A3 Quality of reporting

To perform well in this category, a company should:

- Have a mission and commercial strategy focused on health and nutrition and are factored into all major business decisions and functions.

- Address the nutritional needs of people experiencing, or at high risk of, any form of malnutrition (priority populations) in line with national nutrition priorities.

- Take action to address the triple burden of malnutrition through its commercial strategy, with a focus on priority populations.

- Assign accountability for implementing its nutrition strategy and/or programs to the CEO, and undertake regular internal audits and management reviews.

- Implement a certified food safety management system and track and prevent food loss and waste across all operations and business units.

- Comprehensively and publicly report on its approach to preventing and tackling all forms of malnutrition in all the markets in which it operates.

Ranking on Governance

- A1

- Nutrition strategy

- A2

- Nutrition management

- A3

- Reporting quality

- *

- Did not provide information to ATNI

Nestlé and FrieslandCampina rank first and second in Category A respectively, with the most comprehensive nutrition strategies, management systems, and reporting among the companies assessed. Since the Global Index 2018, where 22 of the current 25 companies were assessed, Kraft Heinz shows the most significant improvement after adopting global nutrition guidelines in 2020, and increased their score from 0.5 to 3.4. In terms of ranking, Grupo Bimbo shows the biggest improvement in this category, going up seven positions to rank in 5th place and moving from a score of 4.9 (2018) to a score of 6.4 (2021). This is partly due to the way the company includes nutrition challenges in its risk assessments and acquisition decisions, and because Grupo Bimbo’s nutrition strategy is supported by its board and regularly audited.

Category Context

The Global Index 2021 assesses whether companies commit to improving the healthiness of products for the general population, and to addressing the needs of groups experiencing, or at higher risk of, malnutrition than the general population. These groups are referred to in this report as ‘priority populations’. Public authorities’ definition of these risks and the groups affected should guide company commitments in the markets they are present in, and as relevant to their product portfolios and activities.

Global Index 2021 MethodologyTo assess the extent to which companies’ corporate strategies include specific commitments to improving nutrition, ATNI considers that companies should recognize the targets set out in the WHO Global Action Plan (GAP) for the Prevention and Control of Noncommunicable Diseases NCDs 2013-2020. Likewise, they are expected to commit to delivering on the most nutrition-specific Sustainable Development Goals (notably SDGs 2, 3 and 12).

The main focus of this WHO Global Action Plan was on four types of NCDs — cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes — that make the largest contribution to morbidity and mortality due to NCDs, and on four shared behavioral risk factors — tobacco use, unhealthy diet, physical inactivity, and harmful use of alcohol. In 2019, the GAP timeframe was extended to 2030 to prevent and control NCDs and also address mental health and environmental pollution (5×5 agenda, adding air pollution as fifth risk factor).

Box 1. How are nutrition strategy, management systems and reporting relevant to the COVID-19 crisis?

- In light of the COVID-19 crisis, changes in health and mobility have led to a shift in eating habits, which has increased consumer engagement on the benefits of good nutrition for individual health and a move towards home-cooked meals.

- ATNI’s COVID-19 research findings reinforce the need for companies to prioritize nutrition in their strategies and programs — to ensure that appropriate accountability mechanisms are in place and provide sufficient public disclosure regarding their interventions. Together, this guarantees that nutrition-related considerations are sufficiently factored into their efforts to address the COVID-19 crisis, and the positive impact of their interventions are maximized.

- ATNI reported that an explicitly nutrition-sensitive strategic and company-wide response to this crisis was not evident., With the pandemic amplifying the need for healthier diets and better nutrition, companies would benefit from factoring nutrition issues into their acquisitions, disposals, joint ventures, or partnership decisions.

- ATNI also found that donations were a common response to the COVID-19 crisis. However, it is usually unclear whether in-kind donations are of healthy, nutritious products, and the impact of such donations on the recipient communities is also often uncertain, with limited public reporting from companies. ATNI welcomes any form of intervention that can help ameliorate the impact of the COVID-19 crisis on people’s access to nutrition – but companies can have a much greater and more sustained impact by responding to this crisis via their commercial approach. This can be achieved by delivering more healthy foods that are more affordable and accessible, and by aligning their nutrition strategies both with recommendations set out by international authorities (such as the WHO or the FAO) and with plans established by national authorities in the markets in which they operate.

Relevant changes in methodology

In the Global Index 2018, company actions to prevent and address undernutrition among at-risk populations in low-income countries were assessed through a specific set of ‘Undernutrition’ indicators. These were not applied to companies that derived less than five percent of their F&B revenues from non-OECD markets. In the Global Index 2021 methodology, companies’ commitment to specifically address the needs and key nutritional priorities of specific population groups at risk of malnutrition is assessed for low-, middle- and high-income countries alike. As a result, the Global Index 2021 shows if and how a company addresses all forms of malnutrition based on their market presence and the specific nutrition issues in those markets.

The underlying structure of the methodology for the Global Index 2021 has not been changed, but several refinements have been made since the previous iterations of the Global Index to streamline it. These include:

- The number of indicators in Category A has reduced (from 43 to 24), e.g. the removal of non-scored indicators;

- Selected companies’ approaches to undernutrition were previously assessed through a separate section, in this report, the topic is integrated throughout the methodology and for all companies assessed;

- The concept of priority populations has been developed to assess companies’ efforts to address different forms of malnutrition throughout the methodology;

- ATNI has included indicators on food loss and waste (FLW) to strengthen the linkage to the SDGs.

More details about the changes in the methodology can be found in the methodology section of this Index.

Global Index 2021 MethodologyKey Findings

- The average company score on nutrition management and governance (Category A) is 4.6; a slight increase from 4.5 in 2018. Nestlé has a leading position with an average score of 9.7 points. (Note that some changes have been made to ATNI’s methodology since the 2018 iteration – see above.)

- Kraft Heinz showed the largest improvement increasing its score by 2.9 points. The company (which was assessed for the first time as one company in the 2018 Global Index, after the merger of Kraft and Heinz in 2015) published Global Nutrition Guidelines in September 2020, along with a 2020 Environmental Social Governance Report that describes a new, strengthened nutrition strategy.

- Category A remains the highest-scoring category on the Index. Thirteen of the 22 companies assessed in the Global Index 2018 show an improved result, which reflects strengthened nutrition policies and management systems. But 12 out of 25 companies (including three companies new to the Index) show a decline or barely any indication of focusing on better nutrition in their strategies and management.

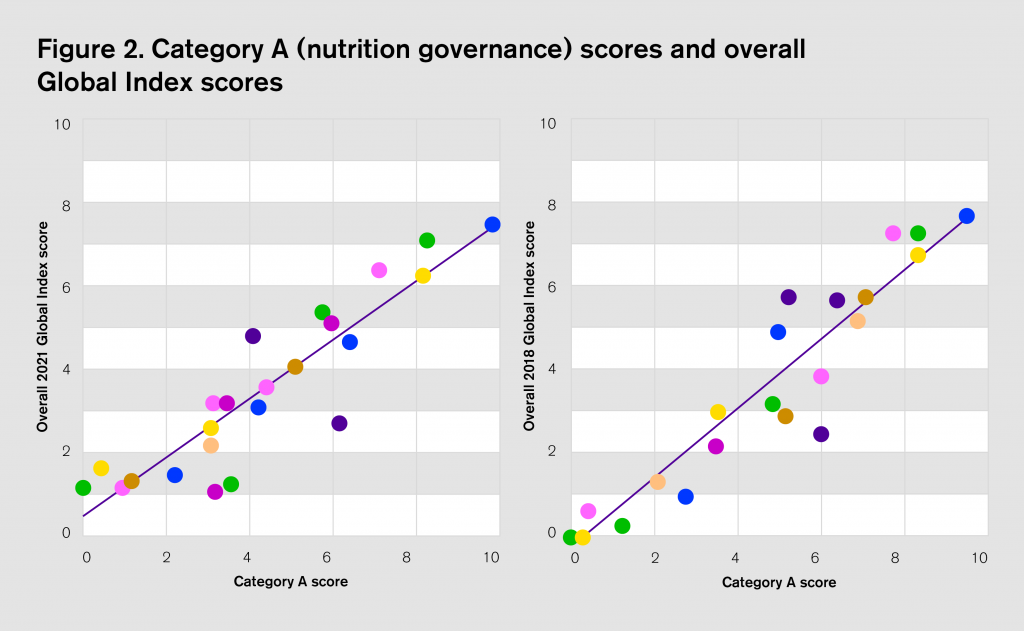

- A particularly important finding is that Category A scores align strongly with overall Global Index scores. This suggests that a company can better sustain and scale up its nutrition activities if commitment starts at the top and is integrated into its core business strategy (see Figure 2 below).

- The Global Index 2021 like the 2018 iteration shows that companies with high overall Category A (nutrition governance) scores tend to have comparably high overall Global Index scores (see Figure 2). These results reflect the association between robust nutrition governance and management systems, more comprehensive commitments and better performance on topics such as responsible marketing, labeling, product formulation, and consumer education.

General Recommendations

For stronger and more accelerated efforts to improve consumers’ nutrition, leading food and beverage manufacturers are encouraged to:

- Continue integrating nutrition considerations in their core business functions.

- Further translate commitments into specific actions.

- Conduct research into commercial opportunities available to them in addressing specific needs of priority populations, including products targeting micronutrient deficiencies.

- To improve and accelerate efforts towards robust nutrition governance and management systems, global food and beverage manufacturers are encouraged to link executive compensation to performance on nutrition objectives, and ensure that nutrition plans and strategies are assessed regularly.

To improve transparency about how they are improving consumers’ access to nutrition, companies are encouraged to:

- Publicly and comprehensively report on their approach to tackling all forms of malnutrition globally and on an annual basis, within the standard corporate reporting cycle.

- Conduct external verification of nutrition data and commentary to improve accountability.

Noteworthy changes and best practice

-

- A

In its Wellbeing Milestones document, published in 2020, Kellogg sets out its approach to address malnutrition and the needs of priority populations (especially women of childbearing age and children in LMICs). The company places a strong emphasis on addressing micronutrient deficiencies via its commercial strategy through targeted reformulation and fortification. An improvement from 2018, the company provided evidence of conducting global, regional, local, and segment-specific assessments of market needs, including using data from public health authorities.

-

- A

Meiji has a significant focus on addressing low levels of protein consumption in Japan, especially among the elderly and women, which is an issue identified in surveys by the Japanese Ministry of Health and Welfare. In 2020 the company launched the Meiji TANPACT product range, which includes beverages, jellies, yogurts, cheese, chocolate, ice cream, frozen foods, soups, and home delivery beverages with added protein and vitamins.

-

- A

FrieslandCampina’s programme, ‘Broadening access to nutrition’, aims to make foods and beneficial nutrients available to more people, especially those with lower incomes. Seanuts II and ANI research projects provide the company with information for products and fortifications needed to help combat undernutrition and micronutrient deficiencies in children up to 12 years old and women of reproductive age in markets in Asia and Africa. The studies’ results are published in the public domain.

-

- A

Coca-Cola established Sustainable Agriculture Guiding Principles(SAGP). In its 2019 Business & Sustainability report, the company states: “We ask our suppliers to demonstrate they are meeting the SAGP criteria by using global sustainable agriculture standards and assurance schemes. The Farm Sustainability Assessment of the Sustainable Agriculture Initiative Platform, the Bonsucro sustainable sugarcane standard and Rainforest Alliance certifications are some of the leading standards we support.” The Principles include harvest and post-harvest handling, such as using correct harvesting techniques to reduce physical damage and loss.

-

- A

The company’s annual Creating Shared Value report is prepared in accordance with Global Reporting Initiative (GRI) standards, and the company discloses its mapping of material GRI indicators against the SDGs. This contributes to better accountability, as stakeholders can easily identify both topics of interest and topics they might miss. Overall, Nestlé’s transparent reporting shows where it has had success in implementing its nutrition-related commitments, and where more progress is needed. The company is expected to release new commitments in 2021.

The Feeding Infants and Toddlers Study (FITS) in the US has explored the eating patterns and nutritional intake of children during their first four years of life. This initiative was expanded in 2014 to include older children (the Kids Nutrition and Health Study, KNHS) and additional countries; and now comprises China, Mexico, Russia, Australia, the US and the Philippines. The studies provide a comprehensive picture of children’s dietary intakes, including nutrients, timing and types of foods consumed at each meal, and feeding practices. In 2019, Nestlé started research projects in Brazil, the United Arab Emirates and Nigeria. Since 2014, FITS and KNHS have resulted in more than 60 papers in collaboration with research partners around the world.

-

- A

Following the completion of the 10 year-long Unilever Sustainable Living Plan (USLP), the company launched its new nutrition strategy ‘Future Foods Initiative’ in 2020 and published the report ‘Transforming the world’s food system for a more nutritious, more sustainable, and fairer future’. This outlines four ways the company attempts to lead change: 1) providing nutritious foods and balanced diets; 2) making plant-based choices available for all; 3) reducing food waste; and 4) producing food that is fair and doesn’t cost the earth.

Unilever states its intention to “continue efforts on removal of regulatory hurdles to fortifying products with key micronutrients to help eradicate deficiencies.” This is a governance best practice, as the company outlines where and how it aims to contribute to nutrition.

PwC is commissioned to verify selected indicators in its USLP. For nutrition, the proportion of company’s products that meet its nutrient profiling model ‘Highest Nutritional Standards’ (HNS) is verified, i.e. “61% of portfolio in 2020.” The company’s Board’s Audit Committee oversees the USLP assurance programme.

A1 Corporate Nutrition Strategy

Since 2018, the quality of companies’ nutrition strategies has increased notably: from 4.4 to 5.2 out of 10. On average, companies demonstrate commitments to greater integration of nutrition factors into core business considerations.

Nestlé maintains its first position in the ranking for A1 from 2018 with a score of 9.7 out of 10, followed by FrieslandCampina (9.1). Both companies make a strategic commitment to grow through a focus on nutrition, and formally set out how they address malnutrition through their commercial strategies. Both companies state they consider nutrition trends when making acquisitions, and that nutrition gets specific attention in their risk assessments. Unilever ranks third with a score of 8.8 and, in 2020, the company launched its new strategy, ‘Future Foods Initiative’, in which it outlines its commitments to produce nutritious and sustainable foods.

Of the 25 Index companies, Meiji (with new commitments to deliver more healthy products and increasing its focus on protein deficiencies in women and the elderly in Japan) and Grupo Bimbo (through stronger focus on nutrition management) improved their scores the most in this Criterion – by more than 3.5 points. However, 13 companies do not show any commitments to address the needs of groups at risk of malnutrition with affordable healthy products.

In general, most companies (23 of the 25) commit to placing a strategic focus on nutrition and health, and to delivering more healthy products – articulated either through their mission statement, a strategic commitment to grow through health and nutrition, or both. In 2018, BRF, Ferrero, Kraft Heinz, Lactalis and Tingyi showed very limited or no evidence of having a relevant nutrition strategy in place, according to ATNI methodology. These companies were encouraged to initiate a process of developing a formal global nutrition strategy, and this 2021 Index shows they all have done so; with BRF, Kraft Heinz and Ferrero making most progress.

The majority of companies (23) state a commitment to deliver more healthy foods – yet only 12 commit to addressing the specific needs of priority populations through providing healthy and affordable products, and only nine commit to doing so on a global basis. Of the 25 companies assessed, 12 identify priority populations in the markets in which they operate, based on priorities defined by relevant health and/or social care authorities.

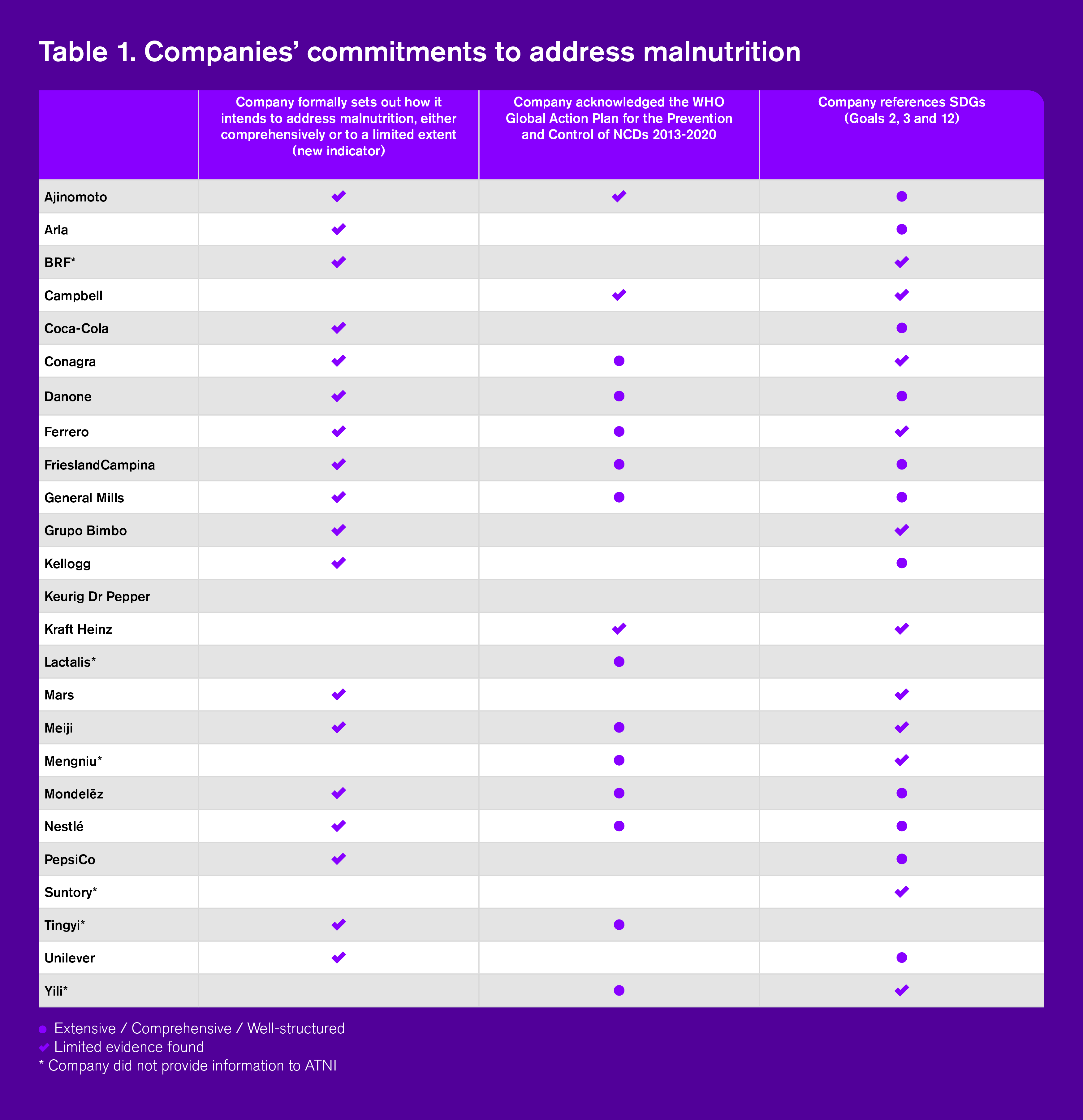

In the Global Index 2018, 17 companies recognized they have a role to play in tackling global nutrition challenges. For the 2021 Index, ATNI raised the bar: Companies were asked how they intended to tackle those issues, as described in their formal commercial strategies. Eighteen companies formally set out how they intend to address malnutrition through their commercial strategy to some extent (see table 1), yet only nine companies do so comprehensively (i.e. covering all forms of malnutrition).

In 2018, 12 of the assessed companies acknowledged their role in tackling nutrition challenges, referring to the WHO Global Action Plan for the Prevention and Control of NCDs. In 2021, Ajinomoto, Campbell and Kraft Heinz also publicly recognized the targets set out in the Global Action Plan. Eleven companies in 2018 also mentioned their role to contributing to nutrition-related Sustainable Development Goals (SDGs) 2 and 3 – and ATNI celebrates that most of the companies assessed (22) in the Global Index 2021 publicly commit to help delivering nutrition-specific SDGs (18 of these 22 companies cover three SDGs with specific nutrition targets: Goal 2: Zero Hunger, Goal 3: Ensure healthy lives and promote well-being for all at all ages, and Goal 12: Ensure sustainable consumption and production patterns).

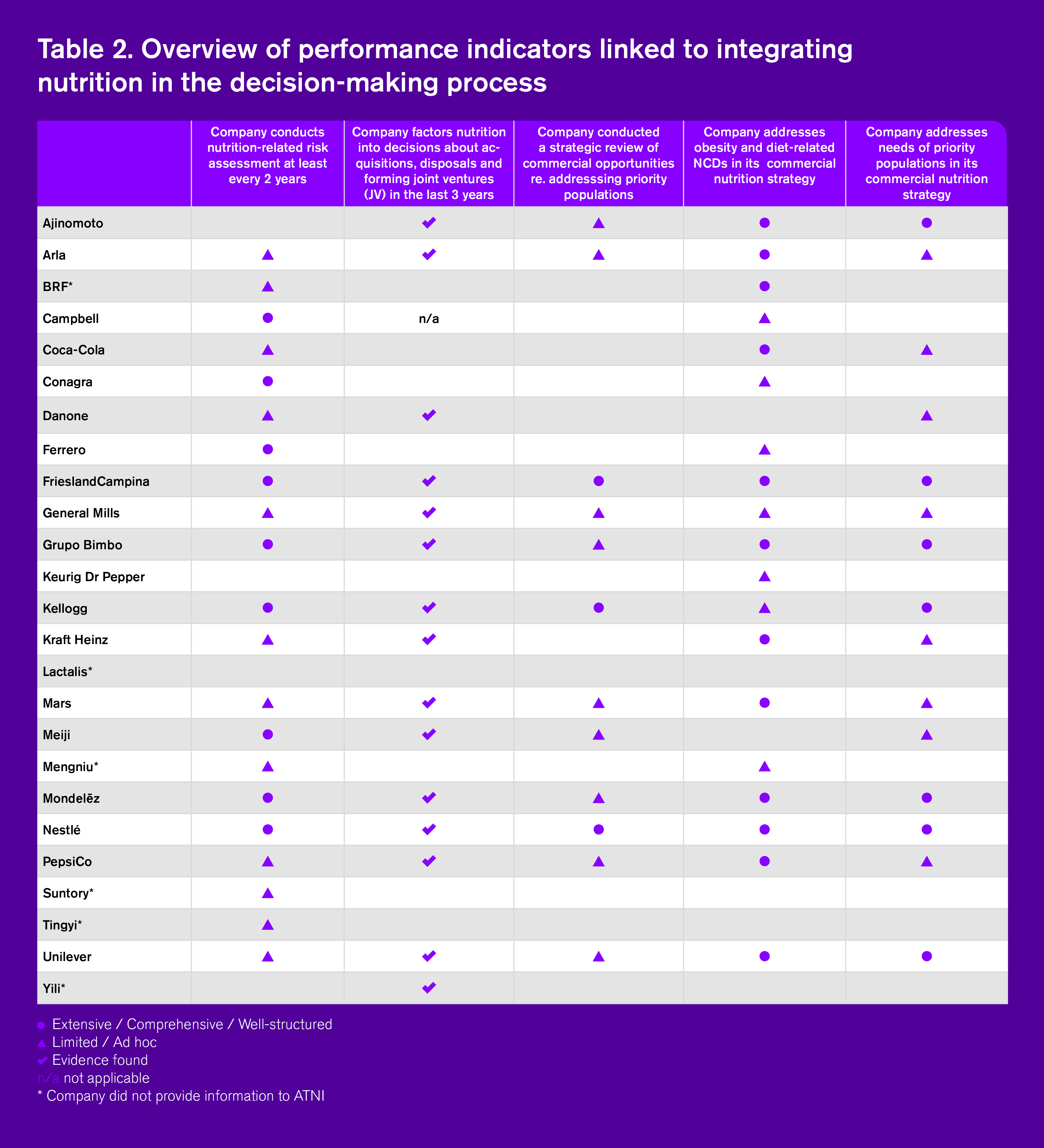

Table 2 highlights important elements of companies’ performance in integrating nutrition in their decision-making processes. 21 of the companies conduct a nutrition-related business risk assessment (e.g., including consumer preference development versus healthy foods, food regulation issues, etc.) at least every two years (although only nine do so in an extensive manner).

Furthermore, 15 companies (a 50 percent increase from 2018) stated that nutrition was a factor in the company’s decisions about acquisitions, disposals and forming joint ventures (JV) or other partnerships in the last three years. This indicates these companies have genuinely embedded a commitment to nutrition into their core business strategy and practices.

In the last three years, 12 companies conducted a strategic review of commercial opportunities available in addressing the specific needs of priority populations (e.g., by reviewing guidance by public health authorities on needs for food fortification with micronutrients). However, only three (Kellogg, Nestlé and FrieslandCampina) did so comprehensively, taking into account company-internal strategies (e.g., portfolio, distribution, innovation strategy) and market research, and had them reviewed at board level. Additionally, 14 companies did market research to assess unmet needs of priority populations.

Twelve companies have a strategic and well-structured commercial approach to making products healthier and addressing obesity and nutrition-related NCD’s. Yet, only eight have an equivalent approach to address unmet nutrition-related needs of priority populations, which includes undernutrition challenges, across the markets in which they are active.

To improve and accelerate efforts to enhance consumers’ nutrition, leading food and beverage manufacturers are encouraged to:

- Continue integrating nutrition considerations in their core business functions: While 2021 results show more companies are committing to a strategic focus on nutrition and health, as articulated in their mission statements and strategic commitments, they can do more in terms of developing specific objectives and activities to improve nutrition and address malnutrition, and to publicly disclose their strategies.

- Conduct research into commercial opportunities available to address specific needs of priority populations, including products that target micronutrient deficiencies. Determining such business opportunities requires careful analysis of the population’s nutritional needs, as defined by public authorities.

A2 Nutrition governance and management systems

Since the 2018 Index, only some companies have demonstrated improvements in their nutrition policy and strengthened governance systems to deliver objectives articulated in their nutrition policies. The average score on Criterion A2 decreased from 4.3 to 3.2 out of 10. Nestlé leads the ranking on A2 with a score of 9.8, followed by FrieslandCampina with a score of 6.5, Kellogg with 6.4, and Unilever with 5.9. All of these companies have a comprehensive nutrition policy with clear objectives and board-level oversight.

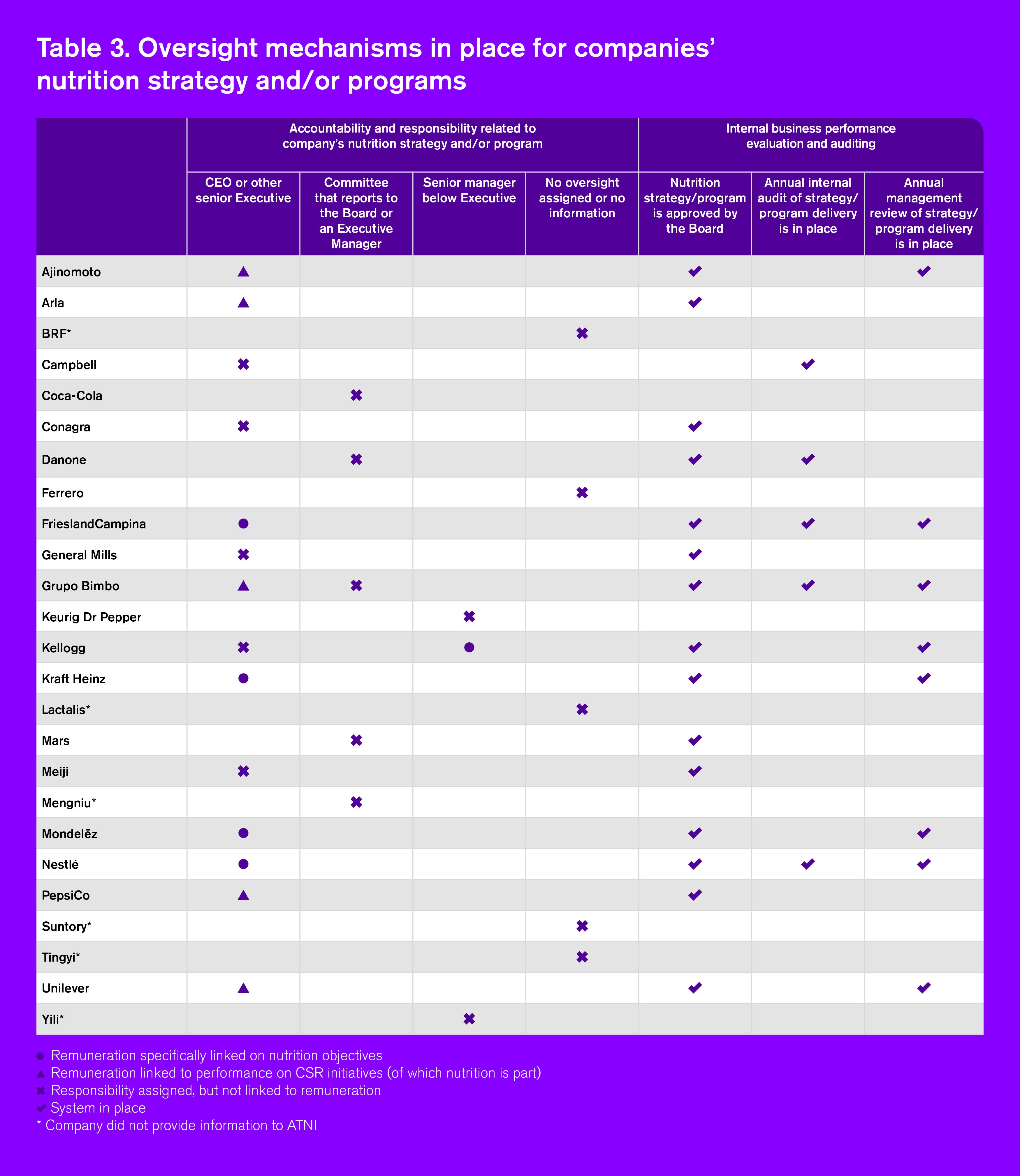

Fifteen of the 25 companies assessed have their nutrition strategy/program approved by the board. Where companies position ultimate accountability for implementing their nutrition strategies is indicative of the priority granted to achieving results. Table 3 shows, 20 companies report they have generally assigned accountability for implementing the company’s nutrition strategy and programs, and 13 companies assign accountability specifically to the CEO or other senior executive.

Only three companies (Mondelez, Nestlé and FrieslandCampina) link CEO remuneration to performance on nutrition objectives specifically. Only three companies (PepsiCo, Kellogg and Nestlé) publicly disclose the compensation arrangements related to implementing the company’s nutrition strategy and/or program.

Only six companies have incorporated their strategy to address undernutrition/micronutrient deficiencies in the accountability arrangement for implementing the company’s nutrition strategy. Some companies are doing this at the executive level (Unilever, Grupo Bimbo, Nestlé and FrieslandCampina) and others at a lower level (Kellogg and Danone). Similarly, only three companies (Grupo Bimbo, Nestlé and FrieslandCampina) incorporate affordability and availability of healthy products in this accountability arrangement, at the executive level.

Six of the assessed companies conduct a standard internal audit and eight companies conduct annual management reviews that cover nutrition issues. Important to highlight in this 2021 Index is that Meiji indicated that the company’s nutrition strategy is subject to an annual internal audit, and Kraft Heinz shared evidence of having an annual management review in place. Grupo Bimbo, Nestlé and FrieslandCampina are the only three companies for whom the implementation of the nutrition strategy is approved at board level, is subject to a standard annual internal audit, and is subject to an annual management review.

A new element of the 2021 Index is consideration of the actions taken by companies to prevent FLW. Apart from the obvious environmental benefits, minimizing FLW substantially contributes to increasing access to food. Eighteen companies include FLW tracking and prevention tools in their management systems and, although all tools show very similar and positive results, value stream mapping appears to be the most popular choice. This entails locating food loss hotspots in key commodities in the upstream supply chain of companies, and then working with farmers to design and implement measures to prevent or curb these.

To improve and accelerate efforts towards robust nutrition governance and management systems, global food and beverage manufacturers are encouraged to:

- Link executive compensation to performance on nutrition objectives.

- Ensure nutrition plans and strategies are assessed regularly by internal audits and/or are subject to an annual management review to monitor progress. ATNI is concerned that the number of companies doing so has barely changed since 2018.

A3 Quality of reporting

In terms of reporting, most companies (24) publish formal, regular reports on their overall approach to tackling nutrition issues. This is an encouraging increase from the 18 that did so in 2018, and shows that companies are aware of the need to be more transparent and accountable on this issue.

Three-quarters of the companies (20) refer to preventing and tackling obesity and diet-related diseases to some extent, although fewer companies (13) report on undernutrition and/or micronutrient deficiencies to some extent. Only 16 companies’ reporting covers global operations, and only 11 of these make specific reference to particular major markets in their reports.

Finally, these reports are subject to independent external review for only 10 companies. In 2018, this was the case for Campbell, Danone, Ferrero, Nestlé and Unilever, and in 2021 Ajinomoto, BRF, Coca-Cola, FrieslandCampina and PepsiCo joined this group.

To improve transparency about how they are improving consumers’ access to nutrition, global food and beverage manufacturers assessed for this Index are encouraged to:

- Publicly and comprehensively report on their approach to tackling all forms of malnutrition issues globally and on an annual basis, within the standard corporate reporting cycle.

- Conduct external verification of nutrition data and commentary. External verification is industry best practice: it enhances accountability and should be adopted more widely. External verification should be carried out by an independent third-party to assure accuracy of reported nutrition-related data (e.g., calculation of sales generated from healthy products). In 2018, 17 companies did not conduct independent external review of their nutrition reports or of the nutrition information contained in other reports or on their websites. In 2021, 15 companies still need to take action on this.