Food fortification

Transforming markets to deliver healthy diets for all

ATNI keeps companies accountable for their contribution to fighting malnutrition. Accountability tools help to hold companies responsible for their nutrition performance, build strong business and nutrition stakeholder networks, and generate information for relevant stakeholders. These insights can be used to influence policies, standards and regulations for regulatory bodies, civil society organizations, and donors.

Till 2022 ATNI has already included food fortification in various of its accountability projects:

- Assessed the largest food and beverage (F&B) companies and tracked their fortification commitments in both its Global and Spotlight indexes (India). Outcomes from the India Spotlight index, for instance, were used to influence regulators on food fortification.

In the Global Indexes of 2018 and 2021, ATNI assessed whether companies followed international guidelines such as the WHO/FAO Guidelines on Food Fortification with Micronutrients and CODEX CAC/GL 9-1987.

- Developed a nutrient profiling model (NPM) which includes micronutrients (NPS+), with support from the BMGF. The NPS+ has been tested on products marketed in India and can be adjusted to other markets. It can also be used to show the micronutrient quality of fortified and non-fortified products.

- Designed a voluntary self-assessment tool for small- and medium-sized enterprises (SMEs). Called the Nutrition Business Monitor (NBM), this was created with the Global Alliance for Improved Nutrition (GAIN), allows for greater attention to fortification.

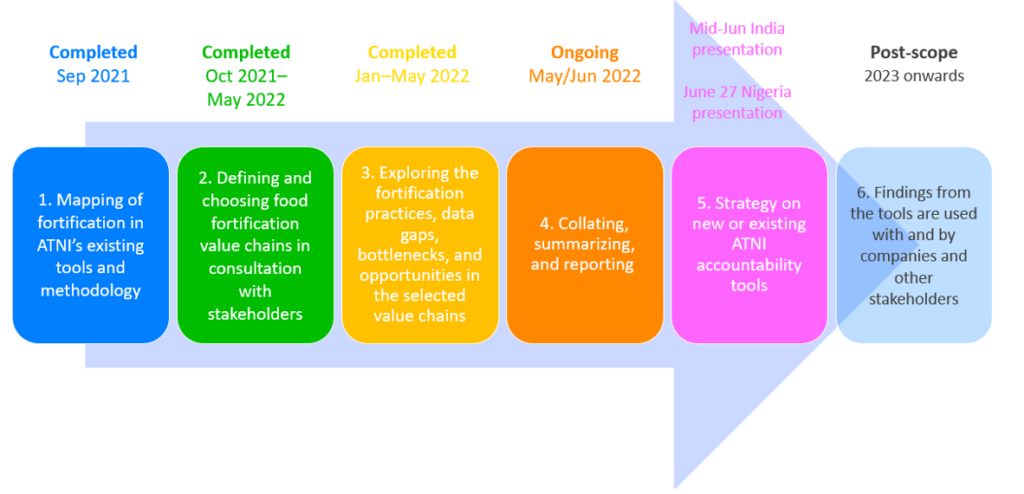

Large Scale Food Fortification Scoping exercise in India and Nigeria (2021-2022)

In 2022, ATNI assessed how it can contribute to fighting micronutrient deficiencies through enhancing its focus on fortification in its existing and future accountability tools and contribute to the Bill & Melinda Gates Foundation’s (BMGF) new large-scale food fortification (LSFF) strategy. A scoping exercise in two emerging markets – India and Nigeria was conducted. The aim was to uncover bottlenecks in existing LSFF value chains and use these findings to influence new ATNI accountability tools that can assess and improve fortification practices.

ATNI’s LSFF team began its scoping work by mapping the fortification indicators currently embedded in existing Indexes (Global and Spotlight), to assess the need for an accountability tool for large F&B manufacturers creating fortified products.

Research was then conducted to map LSFF in the nutrition context of both India and Nigeria, and ongoing practices and in-county programs. Research into relevant fortified staple food value chains of focus included– milk, flour, edible oil, double fortified salt (DFS), and rice in India, and flour, edible oil, DFS, sugar, and rice in Nigeria – was carried out. ATNI also mapped some of the main fortified packaged foods which are widely consumed in Nigeria (Bouillon, tomato paste, and noodles). In-country and online consultations with relevant stakeholders, companies, and government bodies, provided information on fortification practices and bottlenecks in the selected value chains and served as a basis to explore the need for an Index.

Key findings of the scoping exercise

India

Background: India faces the double burden of undernutrition and obesity. Cases of overweight and underweight adults are now almost equal, and the number of micronutrient deficiencies is rising fast. Studies report that more than 35% of Indian children under five are stunted, and at least 50% of women of reproductive age and 40% of children aged 6 to 59 months old are anemic. Major drivers behind these figures include inadequate quality food and a growing consumption of highly processed packaged foods.

Interventions in India, such as mandatory fortification of salt with iodine to combat iodine deficiency disorders, date back decades. However, 40-60% of fortified food production is not reaching, nor being consumed by the most vulnerable groups.[i] Factors such as supply chain bottlenecks, poor distribution channels, and the COVID-19 pandemic, and a lack of regulations and monitoring around food fortification are all issues.

Staple food value chains:

To select an eligible value chain for developing an accountability tool, a set of criteria were determined when investigating the five staple commodities:

- The coverage criteria: ATNI targets food products with high coverage of priority populations in order to have a public health impact

- Main distribution channels and product properties: a) ATNI to focus on widely accessible products available in the commercial market. b)ATNI intends to focus on fortified products that are well-established and food vehicles that have no product quality or acceptability concerns.

- Industry structure and maturity of the market: a)ATNI to focus on mature and structured markets with high penetration in low-income and vulnerable population groups. b)Informal markets (small businesses) are hard to penetrate and address with an accountability tool and will thus not be in focus

Findings: The wheat flour industry is highly fragmented, with only a small percentage of products fortified and distributed through the social safety net program (SSNP). For rice, PATH International India is exploring with some companies in selected states the options of bringing fortified rice products to market. Milk is currently largely produced by the informal sector and around 30% is produced privately, the government is considering mandatory fortification. Double Fortified Salt (DFS) is produced and distributed to SSNP beneficiaries and at present has a limited number of producers. These findings suggest that a tailored accountability tool may not be effective to monitor wheat, rice, milk or DFS at present.

Selected value chain of focus: Companies operating in edible oil are determined to be the most favorable value chain for ATNI to apply a tailored accountability tool. Almost half of all edible oil packaged and two-thirds fortified (the rest is sold loose and not easily traced), reaching 630 million consumers. The industry is structured with 300 large- and medium-sized fortifying companies, whose brands constitute 11% of the edible oil market share.

The main bottlenecks found in the edible oil value chain were:

- Companies do not fortify due to a lack of internal capacity and technical knowledge, high costs of product testing, a lack of awareness about the benefits of fortification, and the belief that consumers won’t pay more for fortified edible oil products.

- Fortification practices are inadequate or not up to standard, often as a result of poor-quality raw materials, high costs, and a lack of capacity, technical knowledge and equipment.

- Sustaining adequate fortification levels seems to be challenging, because of an absence of mandatory laws and regulations, inadequate enforcement, variable consumer demand, and fluctuating costs of raw materials.

Nigeria

Background: Nigeria’s population has the greatest number of stunted children in Africa (32%), and vitamin A, iron, iodine, and zinc deficiencies remain the biggest contributors to undernutrition. Women and girls of child-bearing age are among the most vulnerable, with 58% of women suffering from anemia.[i] The greatest risk factors for undernutrition in Nigeria stem from:

- High levels of poverty

- Limited access to healthcare

- Poor water and sanitation

- Inadequate infant and child feeding practices. [ii]

Staple food value chains: Mandatory fortification of staple foods in Nigeria began in 1993, with the combining of salt with iodine. Currently, almost 95% of salt is iodized and imported from Brazil or Namibia. The fortification of sugar and edible oil with vitamin A has also since been mandated. So, too, has the fortification of wheat, semolina, and maize flour with multiple micronutrients, such as iron and vitamins – A and B12. More than 95% of flour is industrially produced and mostly consumed in the form of bread and cakes made by local bakers.[iii] There is currently no fortified rice product available on the market.

A 2017 GAIN survey demonstrated high household coverage and consumption of all mandated fortified staples. However, compliance with national food fortification standards for fortification of staple foods was inadequate, meaning the dietary contribution of micronutrients from some fortified staples was low.

Existing programs: An accountability tool from TechnoServe – the Micronutrient Fortification Index – is an established mechanism for assessing and improving the fortification practices of companies operating in the studied value chains.

Fortified packaged food: Some packaged processed food (such as bouillon cubes and seasonings, noodles, tomato paste, and bread) are currently fortified voluntarily by the food industry in Nigeria, particularly among large F&B companies. Although there are national and international guidelines and standards for companies to follow at present, there is a lack of harmonization, and adherence is not adequately monitored. As such, discussions and research are being conducted by the government to potentially mandate fortification for additional foods.

The main bottleneck identified include:

- The lack of quality fortification inputs/premixes was cited as a barrier to sustained quality fortification. Issues such as long handling times at import level and the degradation of vitamins due to heat/light, were raised multiple times during ATNI’s visit to Lagos and Abuja. Stakeholders also mentioned the importance of strengthening collaborations with local premix providers.

- Lack of awareness was referred to as a bottleneck, with non-fortifying companies unaware of the added value and long-term benefits of fortification.

- Consumer awareness with regard to the benefits of fortification. The cost factor plays an important role. Low-income consumers will tend to select an unfortified product rather than a fortified one a higher cost.

- Consumption data is challenging to obtain. This can constitute an important bottleneck for understanding consumption patterns and assessing the true impact of fortification programs.

Case studies

Bhawani Silicate, India

Bhawani Silicate, based in Jaipur, Rajasthan,

was established in 1991 as a Partnership Business

Venture. Bhawani Silicate currently fortifies its mustard

oils with vitamins A and D, with the intent to

help reduce micronutrient deficiencies in priority

populations or groups at risk of malnutrition in

India.

Mustard Edible Oil producer, India

Based in Rajasthan, this small mustard oil

manufacturing company was established around

the 1970s. The company fortifies its oil – sold

across India – with vitamin A and D with the aim

to help reduce micronutrient deficiencies in India’s

population.

Soybean and Mustard edible oil producer, India

Based in Rajasthan, this company was established

in the1980s. Their fortification journey began in 2017, when staff were approached by the organizations Global Alliance for Improved Nutrition (GAIN) and the

Indian Institute of Health Management Research

(IIHMR), working in the sphere of oil fortification

(among others)

PZ Wilmar, Nigeria

PZ Wilmar was formed in December 2010 as a

a joint venture between PZ Cussons International

and Wilmar International Ltd. With headquarters in

Singapore, PZ Wilmar is the largest palm oil refinery

in Nigeria (over 41% of Nigeria’s market share in

2021),1 processing and packaging up to 1,000

metric tons of crude palm oil per day.

The company recognizes the importance of

healthy living and acknowledges that food plays a

major role. Mindful that a lack of accessibility and

affordability hinders some of Nigeria’s population

in obtaining healthy foods, PZ Wilmar fortifies

its edible oil with vitamins A and D

Unilever, Nigeria

Published in 2017, Unilever’s position on

fortification outlines its commitment to help tackle

micronutrient deficiencies in developed and

emerging markets, by offering fortified foods at

an affordable price. Its explicit commitment states

that ‘by 2022, we’re aiming to provide more than

200 billion servings with a least one of the five key

micronutrients: vitamin A, D, iodine, iron and zinc.’

Unilever is supportive of

fortification and voluntarily fortifies bouillon with iron.

Unilever’s bouillon cubes reach the most vulnerable

groups in Nigeria and, to support affordability and

consumption, cubes are offered at a competitively low

price. In 2021, Knorr and Royco bouillon had 18.8%

of the market share of bouillon in Nigeria, with sales

reaching up to 100 USD million.

Next Steps for ATNI and Fortification

- ATNI’s experience and findings show that fortification interventions have yet to reach their full potential health impact. The private sector, together with public and civic society, are key stakeholders in the fortification process. To help address barriers including lack of recognition, incentives and investments in fortification, ATNI is developing a new tool that aims to leverage social audit principles, the power of investors and multinational companies. This tool will build on ten years of experience ATNI has built working on private sector accountability frameworks with the world’s largest food companies; designing incentives; and engaging with institutional and impact investors of food companies.

- More immediately, ATNI will implement a third edition of its India Index in 2023. This will include a fortification section and a micronutrient quality assessment of products produced by the country’s largest F&B manufacturers. The Index will look at the accountability of companies throughout their business, in addition to the fortification of processed food.

For more information, please contact Aurélie Reynier at aurelie.reynier@accesstonutrition.org.