BMS/CF Marketing Index 2021

Breast-Milk Substitutes and Complementary Foods Marketing Index 2021

Introduction

In each of the preceding Global Access to Nutrition Indexes, the assessment of the world’s six largest baby food manufacturers’ marketing of BMS was included as a sub-ranking and chapter within the Global Index report. For the 2021 Index cycle, ATNI took the decision to publish this research as a stand-alone Index in order to place greater emphasis on, and direct greater attention to, the critical importance of the health and nutrition of infants and young children. This new tool is entitled the BMS/CF Marketing Index 2021.

The 2021 BMS/CF Marketing Index expands the assessment of marketing practices relating to not only BMS but also CF, and further covers the assessment of three additional companies, totaling nine BMS/CF manufacturers. It also includes a first-time assessment of companies’ marketing in accordance with WHO’s ‘Guidance on ending the inappropriate promotion of foods for infants and young children’ referenced in WHA resolution 69.9 adopted at the 69th World Health Assembly in 2016.

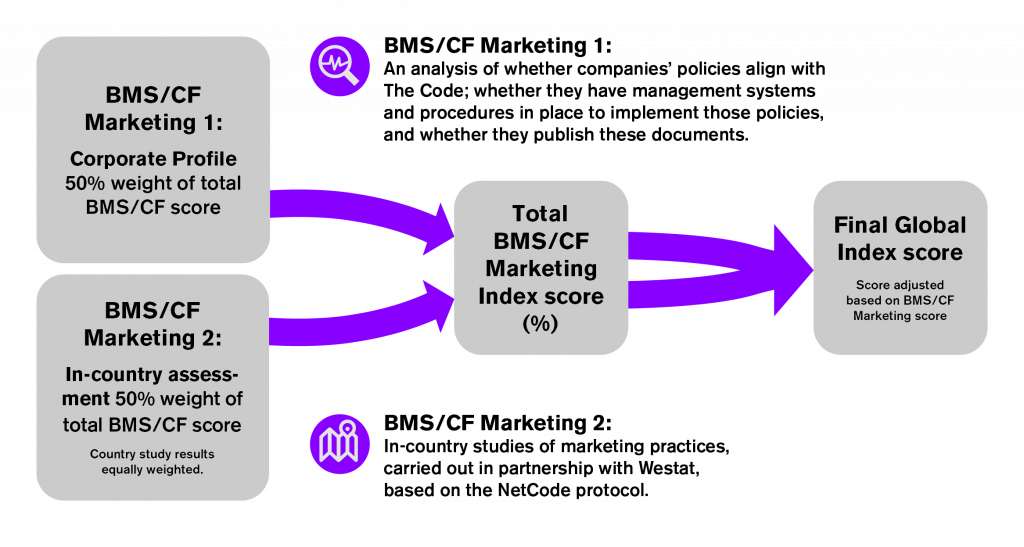

Methodology

A new approach was used for the 2021 BMS/CF Marketing Index by including, for the first time, an assessment of companies’ marketing in accordance with WHO’s ‘Guidance on ending the inappropriate promotion of foods for infants and young children’ referenced in WHA resolution 69.9 adopted at the 69th World Health Assembly in 2016.

Ranking

Compared to the 2018 Index, the assessment in 2021 included not only marketing of BMS products but also that of CF products, where applicable, and incorporated the guidance associated with WHA resolution 69.9 (which was adopted in 2016). Three new leading BMS companies were also added to the assessment – Feihe, Mengniu, and Yili.

Danone retains its leading position with an improved score of 68%, up by 22% from 2018. Nestlé also improves with an overall score of 57% from 45% in 2018 – it continues to rank second. KraftHeinz jumps up from the lowest ranking with a score of 0% to third place in 2021 with a score of 38%. Reckitt also goes up in ranking to fourth place from fifth in 2018 and has shown significant improvement in its level of compliance from 10% in 2018 up to 32% in 2021.

Danone once again ranks first on BMS/CF 1 in 2021, with a score of 53% whereas Nestlé retains its ranking of second with a final score of 48%. Reckitt has made the greatest improvement, ranking third on BMS/CF 1 in 2021 with a score of 47%. In 2021, FrieslandCampina ranks fourth on BMS/CF 1 with a score of 42% while Abbott ranks fifth with a score of 24%. KraftHeinz continues to rank sixth on BMS/CF 1 2021 with an improved score of 11%. Given the limited availability of published information and engagement to allow for the assessment of the three new companies Feihe, Mengniu and Yili, all three scored 0% on BMS/CF 1.

Overall, there remain large variations in companies’ scores across all areas of the Corporate Profile that reflect the content and scope of their policies, where they are applied, the stance they take in relation to complying with local regulations, as well as the strength and geographic application of various elements of their management systems, and their varying degrees of disclosure.

For the BMS and CF marketing in the Philippines report – please click here.

For the BMS and CF marketing in Mexico report – please click here.

Companies

Click on the company's logo to open the Scorecards

Findings

Fully 40 years after the original International Code of Marketing of Breast-milk Substitutes was adopted, this Index provides clear evidence that the marketing practices of the world’s nine largest manufacturers of formula and foods for infants and young children are far from being aligned with its recommendations. Similarly, despite the WHA having passed 18 related resolutions since 1981, including having endorsed in 2016 new guidance on ending the inappropriate promotion of foods for infants and young children, none of the companies assessed yet abides by the recommendations made in, or associated with, all of these resolutions.

Findings of the 2021 BMS/CF Marketing Index reveal some improvements in the companies’ BMS marketing policy commitments, management systems and/or disclosure. Reckitt revised and published an improved and far more comprehensive BMS marketing policy and for the first time, KraftHeinz had shared its BMS Marketing Charter with ATNI.

Other companies such as Danone and Nestlé achieved improved levels of compliance with The Code and national regulations that go beyond The Code in the two in-country studies conducted in 2020 – one in the Philippines and one in Mexico. However, the findings also demonstrate some setbacks compared to the 2018 assessment. Although Abbott now commits to upholding its policy in markets where regulation is absent or weaker than its policy, which is a positive improvement, the wording of the company’s new policy is considerably less well aligned with The Code. FrieslandCampina on the other hand has not changed its policy and continues to uphold it in markets with no relevant regulation.

However, in markets were legal measures are in place, the company continues to defer to them rather than its own policy where it is stricter, which is why a higher penalty was applied in the 2021 BMS/CF Marketing Index to the company’s Corporate Profile score. Overall, none of the six companies that have a BMS marketing policy fully incorporate the wording of The Code; i.e., the 1987 Code and all subsequent relevant WHA resolutions and related guidance and standards, up to and including WHA 69.9.

Since the last iteration, none of the CF manufacturers have published a separate policy or amended their existing policies to address CF marketing to young children aged 6-36 months and although more BMS manufacturers are including infant formulas and follow-on formulas within their scope, still none extend to growing-up milks.

Overall ranking in BMS/CF 1 and BMS/CF 2

Recommendations

Given that the highest Corporate Profile (BMS/CF 1) score is 53%, which reflects the scope and completeness of the companies’ BMS marketing policies, management systems and disclosure, all nine companies need to take steps to bring their marketing of BMS and CF products fully in line with The Code.

First, all companies should adopt a comprehensive BMS/CF marketing policy that fully aligns to The Code (including all WHA resolutions and all related WHO guidance and standards) and that applies to all formula products and complementary foods intended for infants and young children up to 36 months of age, particularly growing-up milks and CF products. The omission of these products is reflected in the findings in both the Philippines and Mexico where the largest number of incidences of non-compliance with The Code were attributed to these two product types. Companies should also ensure that the policy applies globally to all subsidiaries and joint ventures and should further commit to upholding that policy in all markets and going beyond compliance with local regulations where they are absent or weaker than The Code. This is particularly important given that only 31 countries currently have laws and regulations that implement the full breadth of The Code’s recommendations.

While a number of companies do apply their policies globally (i.e. in both higher and lower risk markets), the full global application of the policy tends to be limited to certain product types or provisions of The Code.

The BMS and CF manufacturers should also ensure that their management systems are set to deliver full implementation of the commitments consistently across all countries given the varied findings between the Philippines and Mexico. With the rise of online marketing and promotions, as evident from the findings of the two in-country studies, manufacturers are urged to look for ways to engage with responsible third-parties to ensure that the marketing of their BMS and/or CF products is fully in line with The Code. Most BMS/CF manufacturers have significant scope to improve their disclosure of all relevant policies, audit reports and responses and corrective actions in relation to reports of non-compliance with their policies.

BMS/CF Marketing Index 2021 Full Report