BMS/CF Chapter Global Index 2021

The BMS/CF Marketing Index assesses the extent to which the world’s nine largest manufacturers of breast-milk substitutes (BMS) and complementary foods (CF) market their products in line with WHO guidance.

The BMS/CF Marketing Index assesses the extent to which the world’s nine largest manufacturers of breast-milk substitutes (BMS) and complementary foods (CF) market their products in line with WHO guidance, as set out in the 1981 International Code of Marketing of Breast-milk Substitutes (BMS) and 18 subsequent relevant World Health Assembly (WHA) resolutions (collectively referred to as The Code). For the studies ATNI commissioned to assess the companies’ marketing in the Philippines and Mexico, the scope extends to any national legal measures that go beyond The Code.

This Index is the only one of its kind. A score of 100% would indicate that a company’s marketing policies, practices and disclosure are fully aligned with international recommendations.

Similar prior assessments were presented as a sub-ranking of ATNI’s 2016 and 2018 Global Indexes. Now, to place greater emphasis on, and direct greater attention to the critical importance of the health and nutrition of infants and young children, ATNI published a stand-alone Index.

The results of the BMS/CF Marketing Index will again feed into the Global Index 2021, as in previous iterations and in the same way, for any company in the Global Index that generates more than 5% of its total global revenues from sales of formula and foods for infants and young children. Therefore, the scores of six of the nine companies assessed on the BMS/CF Marketing Index will be used to calculate a proportionate adjustment to these companies’ Global Index scores. The six companies are Danone, FrieslandCampina, KraftHeinz, Nestlé, Mengniu and Yili.

The importance of nutrition in early life

The critical importance of good nutrition and healthy diets has been underlined by the COVID-19 pandemic. Baby food companies can play a critical role in improving the health and life prospects of infants and young children by protecting and supporting breastfeeding. By following the recommendations of The Code, they can contribute to the realisation of several WHO 2025 nutrition targets and the Sustainable Development Goals. Specifically, to SDG 2 – by preventing child mortality and various forms of undernutrition – and SDG 3 – by decreasing children’s risks of developing NCDs later in life.

Until such time as all countries have passed laws and regulations to give effect to The Code, baby food companies can contribute to health and nutrition by voluntarily marketing their products in line with WHO recommendations.

To date, only 31 countries have a Code-aligned legal framework to control the marketing of BMS and CF. While many factors have contributed in recent years to falling breastfeeding rates in many countries, and the concomitant increasing use of BMS, a principal driver has been the increasing and widespread marketing of these products. Breastfeeding has long been proven to provide myriad significant health benefits compared to BMS. These benefits are unique to breastfeeding and help both mother and infant. Positive long-term benefits for infants include protection against becoming overweight or obese, as well as against certain non-communicable diseases such as diabetes mellitus. Further, in areas of the world where hygiene is poor and the availability of, and access to, food is sub-optimal, breastfeeding is key to lowering infants’ risk of undernutrition and infectious diseases.

Methodology

The full methodology is available here. In short, the Index scores and ranks companies based on two types of assessment that are given equal weight. The first – BMS/CF 1 – determines the extent to which the companies’ own policies – adopted voluntarily – and their associated management systems and disclosure align fully to the recommendations of The Code. One section also assesses the stance companies take on lobbying governments in relation to adoption of legal measures to implement The Code. The companies’ scores are based both on information in the public domain and – if they wish – unpublished internal documentation which they submit under a non-disclosure agreement to ATNI’s online research platform. For those companies included in the Global Index 2021, the total possible adjustment made based on the Corporate Profile or BMS/CF 1 score is -0.75, 50% of the maximum possible adjustment of -1.5.

The second – BMS/CF 2 – aims to assess the extent to which companies market their products in line with The Code within two low or middle-income countries (called higher-risk countries). As for previous assessments, ATNI selected two countries in which to undertake research for this Index: the Philippines and Mexico. ATNI’s summary reports, and those of Westat, the company which ATNI commissioned to undertake them, are available here. For those companies included in the Global Index 2021, the total possible adjustment made based on the in-country assessment or BMS/CF 2 score is -0.75, 50% of the maximum possible adjustment of -1.5.

Numerous factors relating to the companies’ own policies and practices, their market share, length of time in the market and the alignment of national legal measures with The Code, and others, influences how companies perform on the second element of the assessment. For the first time, ATNI provided data from this element of the research to FTSE Russell to use in its decisions about the suitability of Danone, Nestlé and Reckitt to continue to be constituents of its FTSE4Good Index Series.

Given that the final combined BMS/CF score represents the level of compliance with the ATNI methodology, for companies included in the Global Index 2021, the adjustment is based on the level of non-compliance. Therefore, the calculation for the adjustment is: -1.5 x (100% – final combined score). The maximum adjustment however for Mengniu and Yili is -0.75 given that they were only assessed on BMS/CF 1 as they have no market presence in the Philippines and Mexico; the calculation for the adjustment is: -0.75 x (100% – final corporate profile score).

One principal change to the previous methodology is the inclusion of an assessment, for the first time, of companies’ marketing in accordance with 2016 WHO ‘Guidance on ending the inappropriate promotion of foods for infants and young children’, referenced in WHA Resolution 69.9 adopted at the 69th World Health Assembly. Another notable change is the inclusion of the next three largest companies in the baby food segment, which are all based in China. ATNI was unable to establish contact with these companies and therefore they did not engage in the research process. Their assessments therefore had to be based only on information in the public domain, as has been the case for other companies in the past.

BMS/CF Marketing Index 2021 Ranking

Key finding

Fully 40 years after the original International Code of Marketing of Breast-milk Substitutes was adopted, this Index provides clear evidence that the marketing practices of the world’s nine largest manufacturers of formula and foods for infants and young children are far from being aligned with its recommendations. Similarly, despite the WHA having passed 18 related resolutions since 1981, including and having endorsed in 2016 new guidance on ending the inappropriate promotion of foods for infants and young children, none of the companies assessed yet abides by the recommendations made in, or associated with, all of these resolutions.

All BMS companies were addressed by a BMS Call to Action issued in June 2020 by WHO, UNICEF and several non-governmental organizations which urged them to publicly acknowledge The Code and to commit to delivering full Code compliance by 2030 at the latest. While 17 companies responded – including seven included in this Index, most did not make the requested commitments or action. The signatories to the Call to Action, in their response to industry, stated that they were ‘profoundly disappointed that no other company, including the largest global companies, took this crucial opportunity to commit to achieving compliance with internationally agreed health policy.’

The UN Food Systems Summit, being held in September this year, and the Nutrition4Growth Summit being hosted by the Government of Japan in December, provide all baby food companies with the ideal opportunity to make the commitments necessary to honor The Code. We call on their investors and other stakeholders to encourage them to take this vital step. Those governments that have not yet adopted legal measures to fully implement The Code could also take this opportunity to do so. With less than a decade to go to realize the SDGs, now is the time for the companies ATNI has assessed – and all others in the sector, to commit to delivering on their responsibilities.

Results by company

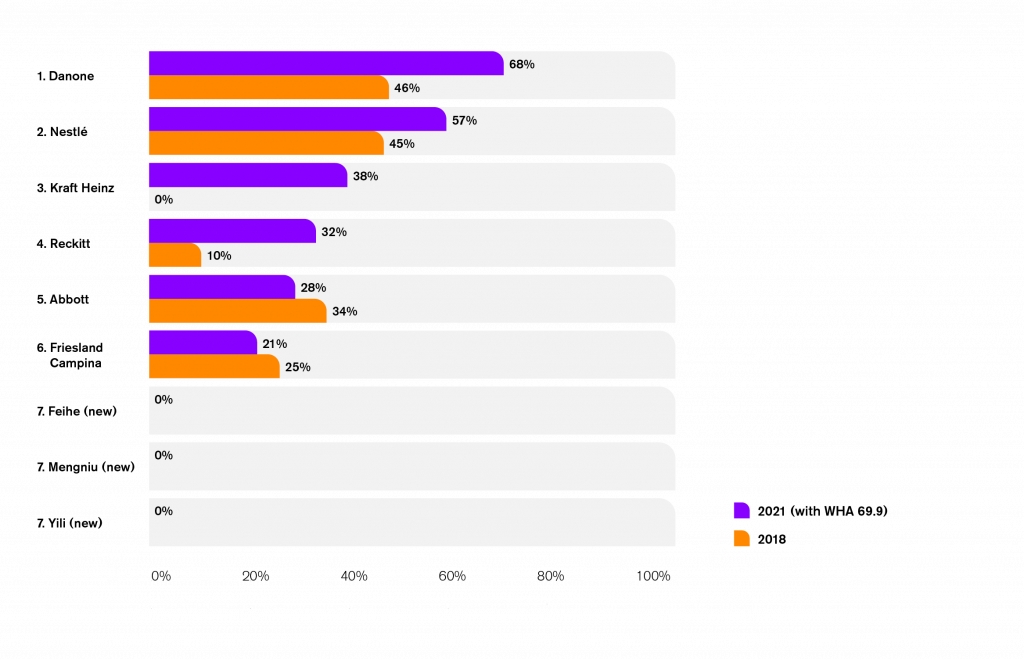

The table below shows the component scores on each element – BMS/CF 1 and BMS/CF 2 – and the impact on relevant companies’ Global Index 2021 scores.

1. Danone retained first place, with a score of 68%, up substantially from its score of 46% in 2018 – the Global Index adjustment is therefore -0.48. It had the second highest sales in this segment in 2019 of US$ 8.5 billion Its higher score in 2021 was driven principally by higher levels of compliance with The Code and local regulations that go beyond The Code in the Philippines and Mexico compared to the levels of compliance found in previous studies carried out in in Nigeria and Thailand for the 2018 Index. It therefore achieved a higher score on BMS/CF 2 than in 2018. Though it has not revised its policy since the last assessment, the company’s overall score fell in relation to its policy, management systems and disclosure, i.e., on BMS/CF 1. While it provided evidence of slightly stronger management systems in some areas and scored slightly better on the lobbying section of the methodology, the deterioration in its BMS/CF 1 score overall was due to the company having not adopted any of the recommendations in the guidance associated with WHA 69.9 and as a result there being no related disclosure.

2. Nestlé is the market leader with sales of just over US$15 billion from this segment in 2019. It retained its second place, with a score of 57%, up substantially from its score of 45% in 2018 – the Global Index adjustment is therefore -0.64. This increase was principally a result of the higher level of compliance with The Code and local regulations that go beyond The Code in the studies carried out in the Philippines and Mexico, compared to the results from the studies carried out in in Nigeria and Thailand for the 2018 Index. It therefore achieved a higher score on BMS/CF 2 than in 2018. Nestlé’s score fell in relation to its policy, management systems and disclosure as measured by BMS/CF 1, principally because the company has not adopted any new commitments to give effect to the guidance associated with WHA 69.9, nor any related management systems. As a result, it could not score on the relevant disclosure indicators.

3. KraftHeinz increased its ranking to third, with a score of 38%, up from a score of zero in 2018 – the Global Index adjustment is therefore -0.93. This company is substantially different to the other nine assessed, as it is both the smallest, with global sales in 2019 of US$ 512 million. It generated most of those sales from complementary foods, whereas all of the other companies generated most of their sales from BMS. The improvement in its score was driven by two factors. The company provided to ATNI for the first time its BMS Marketing Charter for assessment, and participated in the research process, which increased its BMS/CF 1 score. It also achieved a better result in the 2020 Mexico study compared to the one carried out in Nigeria in 2017. As a result, its BMS/CF 2 score also increased.

4. Reckitt (previously called RB until it rebranded in March 2021, which owns the former Mead Johnson Nutrition brands), was the fourth largest company in this segment in 2019 with sales of US$ 3.8 billion – Reckitt is not included in the Global Index 2021 as it is not classified as a food and beverage company. It increased its ranking to fourth, with a score of 32%, up from a score of 10% in 2018. This improvement is due to the company having developed and published a new BMS marketing policy, and having adopted associated management systems, as well as disclosing more. The company also engaged fully with ATNI’s research process for the first time. These factors all contributed to its higher BMS/CF 1 score. Compared to the findings of the in-country studies carried out for the 2018 Index, Reckitt achieved higher levels of compliance with The Code and local regulations that go beyond The Code in one of the two countries, i.e., in Mexico, but not in the Philippines. Its BMS/CF 2 score therefore also improved.

5. Abbott’s ranking fell to fifth, with a score of 28%, down from 34% in 2018. It is the third largest company in the segment, with sales of just over US$4 billion in 2019 – Abbott is not included in the Global Index 2021 as it is not classified as a food and beverage company. The company revised its BMS marketing policy since the 2018 assessment. While it now commits to uphold its policy in markets where regulation is absent or less stringent than its policy, which is a positive development, the wording of the new policy is considerably less well aligned with The Code than the previous iteration. As a result, its score fell on BMS/CF 1. The company’s levels of compliance found in the in-country studies did not change between 2018 and 2021. It had a high level of compliance with The Code and local regulations that go beyond The Code in the Philippines (as it did in Nigeria in 2018), and a low level of compliance with The Code in Mexico (as it did in Thailand in 2017). Its BMS/CF 2 score therefore did not change.

6. Friesland Campina is the sixth largest company in this segment, with 2019 global sales of close to US$1.5 billion. Its ranking fell to sixth, with a score of 21%, down from 25% in 2018 – the Global Index adjustment is therefore -1.18. The company has not changed its policy since the previous assessment; the wording is relatively well aligned to The Code. However, although the company commits to uphold its policy in markets with no relevant regulation, in markets where legal measures are in place, it defers to them, both in terms of the products within their scope and the provisions relating to marketing and labelling. The company has improved its management systems a little and improved its disclosure since 2018. Its lower score and ranking in this Index are principally due to a higher penalty being applied to its BMS/CF 1 score than previously, due to its stance in relation to local regulations, which is explained further in the report. The company’s level of compliance in the one in-country study in which it was included – Mexico – was low, as it was in Nigeria in 2018, and therefore its BMS/CF 2 score did not change.

=7. Feihe, a new entrant to the Index, ranks equal seventh, with no score. The company does not appear to publish a BMS marketing policy or any other relevant documents. As it does not market its products in either Mexico or the Philippines, its score does not include any results from the in-country studies. Feihe is not included in the Global Index 2021 as it is not part of the 25 largest food and beverage companies.

=7. Mengniu, a new entrant to the Index, ranks equal seventh, with no score – the Global Index adjustment is therefore -0.75. The company does not appear publish a BMS marketing policy or any other relevant documents. As it does not market its products in either Mexico or the Philippines, its score does not include any results from the in-country studies.

=7. Yili, a new entrant to the Index, ranks equal seventh, with no score – the Global Index adjustment is therefore -0.75. The company does not appear to publish a BMS marketing policy or any other relevant documents. As it does not market its products in either Mexico or the Philippines, its score does not include any results from the in-country studies.

Ten key findings and recommendations

- Reckitt revised and published a comprehensive BMS marketing policy following the acquisition of Mead Johnson Nutrition in 2017. The policy however applies only to infant formula and follow-on formula (and excludes most of its formulas for special medical purposes, FSMPs).

- For the first time, KraftHeinz shared its BMS Marketing Charter with ATNI though it has substantial gaps compared to The Code and does not cover CF, which make up most of its sales.

ATNI welcomes these improvements.

- Danone demonstrated complete compliance in the Philippines. It also achieved a high relative level of compliance in Mexico.

- Nestlé was found to have a high relative level of compliance in both Mexico and the Philippines during the study period. It is the market leader by sales value in both countries.

- KraftHeinz also achieved a high level of compliance in Mexico in relation to its CF products.

ATNI commends these results but encourages the companies to take action to eliminate all incidences of non-compliance as soon as possible.

- This is illustrated in their initial BMS/CF 1 scores falling well short of 100%.

All six companies are urged to update their existing policies to align their wording fully to The Code.

ATNI strongly encourages these companies to publish BMS marketing policies in which they commit both to uphold national regulation in China (and any other countries in which they currently do business or may do business in future) and to implement The Code in full in all markets.

- This is the most significant, common weakness in the companies’ policies. While more include infant formulas and follow-on formulas within their scope, none extend to growing-up milks. Further, many companies state that some or all of their FSMP products (formulas for special medical purposes) are excluded from their policies and/or they follow national regulatory definitions of these products. Although not yet factored into ATNI’s methodology nor the companies’ scores, of particular concern is the exclusion from the scope of company policies some or all of their FSMPs. These products are BMS and have always been included in the definition of BMS products in the scope of The Code and should be included within the scope of companies’ BMS marketing policies.

All companies must extend the scope of their policies to include all types of formulas, including growing-up milks and all FSMPs, to fully align them to The Code.

- Despite this resolution and the associated guidance being adopted by the WHA five years ago, in May 2016, which inter alia made new and specific recommendations about marketing CF, none of the companies that make these foods have published a separate policy or amended their existing policy provisions to implement the recommendations in full.

All companies must revise their policies to incorporate commitments to implement in full the recommendations in the guidance associated with WHA Resolution 69.9 in relation to CF for children 6-36 months of age.

- The Code is intended to be applied consistently in all markets. The Code does not make a distinction between ‘higher-risk’ and ‘lower-risk’ countries. This distinction was introduced by FTSE Russell’s FTSE4Good Index Series in 2010.

All companies are urged to restate the geographic scope of their policies to be global, in respect of all product types and all provisions of The Code.

- While all companies commit to uphold national laws, regulations and standards, and most pledge to uphold their policies in full where such legal measures are absent or less extensive than their own policies, not all companies do so.

ATNI calls on all companies that do not yet do so to commit not only to comply with local laws and regulations, but to go further and uphold their policies in full – adhering to the scope they establish for their policies in terms of products and types of marketing, and to do so in all countries where legal measures are weaker than The Code, or where they are absent altogether.

- The critical importance of both strong national laws and regulations and of companies adopting global policies that align fully to The Code was made clear by the results of the studies in the Philippines and Mexico. While neither country’s laws nor regulations fully implement The Code, those of the Philippines are much more closely aligned to it than those in Mexico. As a result, ATNI found far fewer incidences of non-compliance with The Code and the one aspect of local regulations relating to labelling in the Philippines (152) than in Mexico (325).

- Moreover, the compliance of the companies included in this Index was better in relation to product types covered by their policies (typically infant formulas and follow-on formulas) and worse in relation growing-up milks and CF (though these products are also less well covered by the national legal measures). This illustrates that when companies adopt policies aligned to The Code and put in place effective management systems to implement those policies, less inappropriate marketing occurs.

ATNI calls on all countries that have not yet done so to emulate the 31 countries that have to date adopted laws and regulations substantially or fully aligned with The Code. By doing so they will create a level-playing field for ALL companies.

However, given that it is likely to take many years for countries to pass such measures, in the meantime it is imperative that companies adopt marketing policies that fully align to the Code, in all dimensions, as already noted.

- It is vital that all countries adopt national laws, regulations and standards that fully align to The Code. ATNI assessed the extent to which companies pledge to support such efforts by assessing the relevant commitments, management systems and disclosure, using a small number of indicators. However, a related report published in June 2021 entitled Spotlight on Lobbying – provides a more comprehensive picture.

Companies that make BMS and CF must make clear and unequivocal commitments to support – and not to undermine – the efforts of governments and international bodies to adopt Code-aligned legal frameworks. This will both provide the necessary protections to breastfeeding while also creating a level-playing field on which all companies can compete fairly. Without such measures, most companies are reluctant to make voluntary commitments due to the considerable impact such steps would have on their revenues and profits.

ATNI calls on all companies to implement the Responsible Lobbying Framework in full and to put in place rigorous systems to ensure that their interactions with policymakers and governments in all markets are governed by their public commitments. Much greater transparency about their lobbying positions and activity must also be provided. Investors are urged to use their influence with companies to encourage them to take these steps.

Future Indexes

ATNI hopes that this Index will aid the work of all organizations and individuals committed to improving the health of infants and young children, particularly through increasing breastfeeding everywhere. ATNI encourages all stakeholders to use the Index and to provide feedback about how they have used it and how it could be improved in future.

From the autumn of 2021, ATNI will hold a series of consultations with a wide range of stakeholders to collate this input and inform the evolution of the methodology for the next Index.

The next BMS/CF Marketing Index – planned for 2023 – will be expanded to the world’s 20 largest baby food manufacturers.