Hindustan Unilever Limited

Product categories assessed

Ice Cream|Sauces, Dips and Condiments|Soup|Sweet Spreads|Other Hot drinksPercentage of company India sales covered by Product Profile assessment

50-60%Headquarters

IndiaType of ownership

PublicEuromonitor International Limited [2021]

© All rights reserved

Important

The findings of this Index regarding companies’ performance rely to a large extent on information shared by companies, in addition to information that is available in the public domain. Several factors beyond the companies’ control may impact the availability of information. Therefore, in the case of limited or no engagement by such companies, this Index may not represent the full extent of their efforts.

Scoring Overview

(%) Figure in brackets is the weighting of the category. All category and criteria scores are out of 10.

Product Profile

The Product Profile is an independent assessment of the nutritional quality of companies’ product portfolios. For this purpose, ATNI uses the Health Star Rating (HSR) model, which rates foods from 0.5 to 5.0 based on their nutritional quality. The underlying nutrient profile model assesses nutrients of concern (sodium, total sugar, saturated fat, and overall energy) and positive food components/ nutrients (fruit and vegetable content, protein, fiber, and, in some cases, calcium) to score products on the basis of nutritional composition per 100g or 100mL.

ATNI uses the threshold of 3.5 stars or more to classify products as generally healthier. Product Profile results account for 30% of the total Index score.

Portfolio-level Results

| Total no. products assessed |

Range of total 2021 company sales in India |

Sales-weighted Mean HSR (out of 5 stars) |

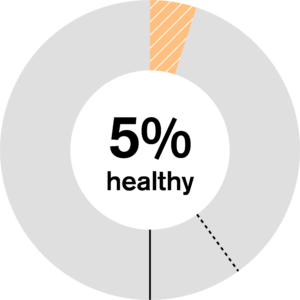

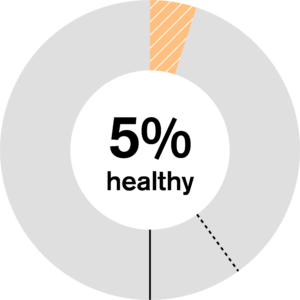

Products meeting the ‘healthy’ threshold (HSR of 3.5 stars or more) |

|

|---|---|---|---|---|

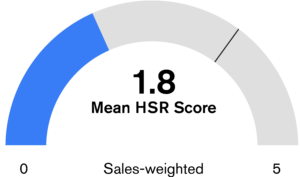

| 210 | 50-60% | 1.8 | % of distinct healthier products |

% sales from healthier products |

| 8 | 5 | |||

• For Hindustan Unilever, Other Hot Drinks; Ice Cream; Sauces, Dips and Condiments; Soup; and Sweet Spreads are covered in this Product Profile assessment, which together account for approximately 50-60% of the company’s sales.

• Hindustan Unilever (HUL)’s average sales-weighted Health Star Rating is 1.8 (stars) out of 5 (2.1 unweighted mean HSR).

• A total of 210 products across the company’s five best-selling product categories were assessed using the HSR model.

• 8% of distinct products analyzed for HUL met the ‘healthy’ threshold (3.5 stars or more in the HSR).

• When taking category sales values into account, the company was estimated to derive approximately 5% of its India 2021 sales from ‘healthier’ products (mostly from Soup).

• It is important to point out that for HUL, 50-60% of the company’s 2021 retail sales in India is covered in the Product Profile; the company derived a significant proportion of its sales from products excluded from the assessment, for example, packaged tea and coffee products.

Mean Health Star Rating by category for Hindustan Unilever Limited

companies assessed

in the category

Lowest mean HSR of

companies assessed

in the category Healthy threshold

• HUL’s product portfolio changed substantially since the 2020 ATNI India Index, because of the acquisition of products in the Other Hot Drinks category (brands like Horlicks and Boost). Based on EMI sales estimates, this category now constitutes the largest product category for HUL, whereas in 2020 this category was not in the top-5 selection.

• The estimated largest category assessed is Other Hot Drinks, with a mean HSR of 1.7 out of 5. As per HSR guidance, ATNI/ TGI has classified specific products in the Other Hot Drinks group (malt-based) as under the HSR Category 2 “foods”, and accordingly applied HSR scores to the products “as sold”. The company informed ATNI it uses “as prepared” values, which might cause or could explain part of large discrepancy between HSR scores reported by the company and ATNI/ TGI’s findings for this specific product line.

• Among categories assessed, HUL’s products in Soup (19 products) had the highest mean HSR (3.1 out of 5.0), of which 42% reached the ‘healthy’ threshold.

• The company’s lowest scoring category is Sauces, Dips, and Condiments with a mean HSR of 1.3 out of 5, for which 8% of products reached the ‘healthy’ threshold.

• In total, 8% of distinct products and 5% when sales-weighted, was found to be eligible to be marketed to children using the WHO South-East Asia Region (SEAR) criteria.

• From the change analysis between this and the last India Index, HUL and one other company showed the greatest improvement in overall sales-weighted mean HSR, increasing 0.6 HSR between 2020 and 2023 (without Other Hot Drinks in the analysis).

Categories

The Index is divided into seven categories which assess food & beverage companies' policies, practices and transparency related to nutrition in the Indian market.

Governance 10% of overall score

Products 45% of overall score

Accessibility 15% of overall score

Marketing 15% of overall score

Workforce 5% of overall score

Labeling 5% of overall score

Engagement 5% of overall score

Nutrition

• Hindustan Unilever (HUL) presents its nutrition strategy cohesively on its ‘Positive nutrition’ webpage. It involves reformulation (cutting salt, sugar, and calories); offering affordable and healthier foods and beverages; encouraging consumers to cook with healthier recipes; offering foods that carry positive nutrition like fruits, vegetables and essential fatty acids; and fortification.

• HUL shared evidence that it had identified priority populations in India based on government and national survey data sources and consumer studies, had sought to understand their dietary perceptions and intakes, and developed products, access, and communication strategies to reach them.

• The company has several targets in place to drive progress on this strategy. In 2022, HUL set the target “85% of our servings to meet our new Unilever Science-based Nutrition Criteria (USNC) [by 2028]”, which relates to limiting nutrients of concern in its products. While set at the global level, the company indicated to ATNI that HUL is working towards the same target. Since the company confirms that “servings” means “servings sold”, this is a target to increase sales of ‘healthier’ products relative to overall sales, is specific, measurable, and timebound.

• In 2020, HUL set the target “Double the number of products sold that deliver positive nutrition [i.e. meeting its Positive Nutrition Standards] by 2025” (from an undisclosed 2019 baseline level); the company indicated that HUL is working towards the same target. While the target states the “number of products sold”, the company shared evidence that refers to the proportion of products sold, based on servings (i.e. relating to overall sales).

• HUL reports against the Positive Nutrition target for India, stating that currently 43% of its “portfolio” meet its Positive Nutrition Standards (and 48% at the global-level), although it is not clear whether this refers to sales or the number of products it offers, nor whether this is on track to meet the goal of “doubling by 2025” or not. There was no reporting on the USNC target at the time of research, because the target was less than a year old.

• The company shared evidence that nutrition-related risks are regularly identified and reviewed at various levels in the organization, although these are not reported explicitly in the public Enterprise Risk Assessment report of the company’s Annual Report.

• The nutrition strategy is reviewed at Board-level by the ESG Committee as part of its wider ESG portfolio. Meanwhile the Executive Director of Foods & Refreshment for HUL is a member of the Global Nutrition & Ice Cream Leadership Team, which is responsible for the development and implementation of Unilever’s global nutrition strategy and is accountable for the success of HUL’s Positive Nutrition target.

• HUL has a remuneration system (the ‘Performance Share Plan’) for all managers globally which links to progress on eight company-wide sustainability-related KPIs, one of which broadly relates to nutrition (but is not related to the company’s aforementioned commercial strategy or targets).

• Confidential evidence was provided by HUL on mapping nutrition and health experts/influencers in India and engaging them on the topics of product development, consumer behavior, priority populations, communication, and external engagement, among others.

Aspects to improve

• The company is recommended to frame its targets for healthy sales - and its reporting against these - with clearer terms that are used consistently, so that external stakeholders can more easily understand whether they refer to ‘sales’ and/or are relative to overall sales or not.

• While the company clearly publishes Unilever’s global targets on its India domain, it could also be made clearer that HUL is expected to meet the exact same target, as opposed to only contributing to an aggregated global target.

• Similarly, for targets that involve relative increases from a baseline (e.g. “doubling”, or a percentage increase), HUL is recommended to ensure that the baseline level, at the time of the baseline year, is disclosed on the public domain, including for India specifically, without which it is not possible for external stakeholders to hold the company to account.

• The company is encouraged to more clearly and specifically outline the nutrition-related risks that have been identified in its public Enterprise Risk Assessment reporting.

• The company is encouraged to link remuneration of HUL’s Executive Director of Foods & Refreshment directly success on the company’s nutrition-specific targets in India.

• The company is encouraged to be more transparent about its stakeholder engagement activities in India related to nutrition; identifying more specifically who it engaged with, what was discussed, and how the discussions impacted the company’s nutrition strategy or approach.

Category B2: Portfolio Development

• HUL states that its reformulation approach “follows international as well as Dietary Guidelines for Indians including RDA-Recommended Dietary Allowances for relevant age group and gender by National Institute of Nutrition (NIN-ICMR) and this applies to our whole portfolio – covering every brand and product”.

• In 2022, HUL set the target “85% of our servings to meet our new Unilever Science-based Nutrition Criteria (USNC) [by 2028]”, which relates to limiting sodium, sugar, and saturated fats in its products. The company indicated to ATNI that HUL is committed to meeting the same target. Since the target is in terms of sales, then it should be noted that it can also be achieved, for example, through mergers & acquisitions, marketing and distribution strategies and increasing sales volume of healthy products, in addition to reformulation.

• HUL has previously set a target for “85% of our Foods portfolio to help consumers reduce their salt intake to no more than 5g per day by 2022.” The company reports that by 2022, 50% of its Foods portfolio met this target.

• The company had also set a target that 95% of its packaged ice cream would contain no more than 22g of sugar and 250kcal per serving by 2025. It reports that, by the end of 2022, 100% of its packaged ice creams and frozen desserts in India have a serving size that meets this target.

• HUL has guiding principles in place for its fortification practices (see Unilever's position on Fortification) which are based on WHO and FAO (CODEX) guidance. The guidance includes principles for serving size, vehicle selection, and consumption. The company further outlines that Unilever's Highest Nutritional Standards (HNS) (now replaced by the USNC) have strict principles for nutrients to limit, and are applicable when selecting products to fortify.

Category B3: Nutrient Profiling

• HUL employs two discrete sets of nutrition standards, the ‘Highest Nutrition Standards’ (HNS; which have been replaced by the USNC as of January 2023) and the ‘Positive Nutrition Standards’ (PNS). The HNS sets thresholds for nutrients of concern (calories, sugar, salt, and saturated fat) only; and the ‘Positive Nutrition Standards’ (PNS), which sets a range of minimum thresholds for various positive ingredients (fruits and vegetables, whole grain, and diary only for children’s products) and nutrients (protein, fiber, omega-3 fatty acids, vitamins, and minerals), for which a product must meet at least one to qualify.

• These standards are applied to products in its global portfolio, including India, to guide product formulation, fortification, and marketing to children, as well as target-setting. The company does not use a model that assesses the overall healthiness of its products, factoring in both negative and positive nutrients.

• HUL publishes information for both its nutrition standards on the company’s website for India and published details of its NPM, including product criteria and nutrient thresholds, in a peer-reviewed journal.

• HUL has benchmarked the percentage of its Global Nutrition and Ice Cream portfolio, including the India market, meeting the HNS, against six internationally recognized NPMs (including HSR). The results are published in the public domain. It should be noted, however, that there is a significant discrepancy between HSR findings in the India Index Product Profile for HUL and those reported by Unilever. The company has indicated that it assessed the totality of its portfolio, including plain coffee, tea, wheat flour, and salt (product categories which collectively represent 40 to 50% of the company’s 2022 sales in India), product categories the HSR system does not consider as 'intended foods'.

Aspects to improve

Category B2: Portfolio Development

• While the company’s targets for USNC and Positive Nutrition compliance effectively translate into general reformulation targets, the company is encouraged to measure and report on its reformulation progress specifically per negative nutrient (i.e. sugar, saturated fats, and sodium) and positive ingredient group (whole grains and fruit, vegetable, nut and legume (FVNL)) across its portfolio.

• The company is encouraged to strengthen its fortification procedures by incorporating into its fortification guidelines a policy that it will not fortify unhealthy products, specifically those that have high levels of high in fat, sugar or salt (HFSS).

Category B3: Nutrient Profiling

• The company is advised to apply a single NPM for defining products as ‘healthier’ rather than using two independent sets of standards in place, for a more comprehensive approach and to enable foods to be ranked on their overall healthiness. For example, the company could report on the number of products that meet both the USNC and Positive Nutrition criteria simultaneously.

• ATNI welcomes the company’s intention to upload the USNC criteria directly on the HUL website, as indicated during the engagement process, together with the reporting on progress against USNC.

• HUL’s benchmarking exercise against six external NPMs shows a concrete effort to improve transparency, although ATNI strongly recommends adhering strictly to the NPM guidelines when applying the external NPMs. The company is encouraged to repeat the exercise with its USNC to demonstrate the degree of alignment between these new criteria and internationally recognized NPMs.

• HUL demonstrated that it has a formalized approach to offering affordable nutrition across its portfolio in India. For products meeting its USNC (which places maximum thresholds on ‘negative nutrients’), including products addressing specific micronutrient deficiencies in India’s population, the company provided evidence of a clear process for determining/ calculating ‘affordability’ for the affordable nutrition strategy, including with formal definitions of ‘low-income consumers’ using the Living Standard Measure (LSM).

• To ensure affordability, the company has identified ‘magic price points’ of INR 2, 5, 10 & 20, varying SKU sizes across the price point spectrum, and analyzing market penetration among low-income consumers. It also states that it is able to reduce costs for its USNC products through volume sourcing and manufacturing, logistics, and automation.

• The company also continues to run 'Project Shakti', whereby the company enlists micro-entrepreneurs to distribute its products throughout rural areas, the majority of which meet its HNS.

• HUL demonstrates evidence of monitoring the penetration of its ‘healthier’ products in different LSM groups, thereby providing insight on whether these are affordable and accessible to these groups, and the effectiveness of its affordable nutrition strategy.

Aspects to improve

• HUL is encouraged to disclose more information about its strategy and approach for ensuring that at least part of its ‘healthier’ product portfolio is priced affordably for lower-income consumers in India, including the specific definitions used, the approaches taken to ensure affordability, and the progress made in implementation in India, at both an output- and outcome-level.

• The company is encouraged to adopt stricter nutrient thresholds for defining ‘healthier’ products to be made affordable for lower-income consumers, such that HFSS products are specifically excluded.

• The company is recommended to set specific, measurable, and timebound targets (examples of which can be found in the methodology document) to further drive performance and enhance accountability.

• Through its membership to the Advertising Standards Council of India, HUL commits to the Code for Self-Regulations of Advertising Content in India, including the Self-Regulation Guidelines on Advertising of Foods and Beverages. The Guidelines outline commitments related to the representation of products in advertisements directed at a general audience in India.

• HUL adheres to the company’s global Principles on Responsible Food & Beverage Marketing to Children, which covers all media channels and children under the age of 16.

• The company commits not to use certain materials and techniques to market its products to children, including celebrities, licensed characters, and promotional toys and games.

• The company has adopted the industry best-practice audience threshold of 25% to limit its marketing of all products to children across all media.

• As a member of the International Food & Beverage Alliance (IFBA), HUL provided evidence that compliance with its responsible marketing to children policy is audited by a third party. As Unilever has since left the IFBA, HUL has indicated to ATNI that it is committed to continuing the audit process.

Aspects to improve

• The company is strongly encouraged to strengthen its commitments on responsible marketing to children, including by aligning its nutrition criteria for products considered appropriate to be marketed to children with the WHO SEAR nutrient profiling model

• The company is also recommended to adopt the WHO-recommended age threshold for marketing to children of 18 years of age, in line with Central Consumer Protection Authority (CCPA) guidelines in India.

• The company is encouraged to include in its policy additional specific commitments not to use certain materials and techniques to market their products to children, including sponsorship of activities and materials popular with children, and depicting children on packaging.

• HUL has a clearly defined workforce nutrition program in place for all its employees called ‘Healthier U’ which includes targets. This program includes all four workforce nutrition pillars 1) Healthy food at work, 2) Nutrition Education, 3) Nutrition focused Health Checks, and 4) Breastfeeding Support. For example, healthy meals and snacks are offered at subsidized rates at all sites. The company also offers nutritional information for food items. Further, regular nutrition education sessions are given for all employees and personalized nutrition counselling is available.

• HUL is the only company to show evidence of having measured impact of its workforce nutrition program at outcome-level. HUL is also using the Workforce Nutrition Alliance self-assessment scorecard to inform on its ‘Healthier U’ program, applied at all 35 different sites in India.

• HUL offers three weeks of paid paternity leave, which can be availed twice in the employees’ career.

• HUL has a ‘Maternity Transition Policy’, which ensures a transition to and from maternity, including attention to role and performance, flexible working options, offering on-site daycare facilities for children between 6 months and 6 years old (only in offices in Mumbai and Bangalore), as well as a travel policy for new parents. Further, HUL indicated that most of its sites have breastfeeding rooms and refrigerators for storage of breastmilk.

• ‘Healthy Diets for Tea Communities’ is a coalition led by the Global Alliance for Improved Nutrition (GAIN) and the Ethical Tea Partnership (ETP), with funding from leading tea companies in India, including HUL. It aims to address malnutrition in tea supply chains with sourcing estates in Assam. The program focuses on improving dietary diversification and improving nutrition through nutrition education, increasing access to nutritious food, and improving the enabling environment for healthy diets.

Aspects to improve

• The company is encouraged to strengthen current workforce nutrition efforts by defining quantifiable and meaningful expected outcomes for nutrition-focused health checks and evaluate accordingly.

• HUL is also encouraged to publish the results of its Workforce Nutrition Alliance self-assessment scorecard and third-party assessments of their 'Healthier U' program.

• The company is encouraged to offer maternity or primary caregiver leave and paternity leave regardless of the number of children born.

• HUL displays numeric information for key nutrients on the front-of-pack (FOP) for the majority of its relevant portfolio.

• The company publishes documents on its website that comprehensively list nutritional information per product in the public domain. However, these are not obviously located for external stakeholders to locate.

Aspects to improve

• Once it is formally enacted by FSSAI, if the Indian Nutrition Rating (INR) FOP labeling system is on a voluntary basis, the company is strongly encouraged to adopt it across their entire portfolios in India.

• The company is recommended to ensure that comprehensive nutritional information is clearly located on product-specific pages, in addition to the portfolio-wide tables already shown on the company’s website. This should ideally include FOP and BOP images, nutritional information tables, and ingredient lists.

• The company follows Unilever’s Code of Business Principles (CoBP), which stipulates that “any contact by the Company or its business associates with Government, legislators, regulators or NGOs must be done with honesty, integrity, openness”. This also applies to third-parties.

• The company also states that “Prior internal approval is required for initiating any contact between the Company, its representatives and officials, aimed at proactively addressing changes/suggestions to regulation or legislation”.

• The company indicated to ATNI that HUL’s Executive Director for Legal & Corporate Affairs is responsible for political engagement in India, although this is not clearly reported on the public domain.

• As part of its 2022-23 Business Responsibility and Sustainability Report (BRSR), under Principle 7, the company does not indicate that it has engaged on any nutrition-related topics with government bodies in India.

• HUL also provides links on its website to Unilever’s global position statements on FOP labelling, dietary guidelines, salt reduction, and fortification, all of which include clear positions on regulatory measures.

• The company lists twelve trade associations it is a member of in India, while also indicating in its bio for the Managing Director of HUL that they are a director of the Federation of Indian Chambers of Commerce & Industry (FICCI). In addition, the company is also listed on the ‘All India Food Processors' Association (AIFPA)’s website as a member, and the company’s Head of Government & Corporate Affairs is on the Managing Committee of the Public Affairs Forum of India (PAFI); neither are reported by the company.

• The company should comprehensively disclose details of all engagements with policymakers with regards to influencing nutrition-related policy in India, including participation in policy-related multistakeholder meetings, responding to public consultations, and any other interactions with policymakers.

Aspects to improve

• The company is recommended to enhance its Responsible Advocacy Policy to require that the evidence presented shall be as independent and representative as possible and to always consider the wider public health interest in its efforts. It should also clearly define what it defines as advocacy interactions (for example, whether this includes participation in policy-related multistakeholder meetings, responding to public consultations, and any other interactions with policymakers).

• The company is recommended to publish clearer details about the governance of its policy engagement and advocacy in India, including roles and responsibilities within the organization.

• The company should comprehensively disclose details of all engagements with policymakers with regards to influencing nutrition-related policy in India, including participation in policy-related multistakeholder meetings, responding to public consultations, and any other interactions with policymakers.

• While the company provides links to its global positions on certain policy measures, it is encouraged to publish positions specific to the India context, i.e. in relation to specific policy measures under consideration by FSSAI or other relevant bodies.

• The company could also improve the disclosure of its Board seats on trade associations by publishing this information in the same place as its wider trade associations disclosure or political engagement reporting, in line with other companies, since it is not obvious for stakeholders to check the specific bios of its leadership team.

• In addition, it is recommended to conduct a comprehensive review of its trade association memberships in India to ensure that each one is disclosed.

Sustainability

• The company has two targets at the global level o reduce its emissions which are aligned with the 1.5°C trajectory, which it also reports against:

– Net zero emissions for all products from sourcing to the point of sale by 2039.

– Zero emissions in operations by 2030.

• Emissions data from the company indicates a decrease from 2020-1 to 2022-3 for scope 1 emissions 32.056 to 20.165 MT CO2, and a longer term decrease since 2019-20 (69.004). For Scope 2 emissions, the company shows an increase from 219.650 to 219.650 MT CO2 between 2022-22 and 2022-3, and a longer term increase since 2019-20 (178.877 MT CO2).

• The company demonstrates that it is measuring food loss and waste across its own operations, and has a target to halve food waste in their operations by 2025. The company shared evidence of a range of activities to measure and reduce waste, including collaboration with value chain partners, manufacturing improvements, finding reuse opportunities, and product innovation to increase shelf life of their products.

• The company provides evidence of reducing plastic use and is transitioning to more sustainable forms of packaging, having targets and reporting progress, and working with value chain partners to reduce plastic use and transition to sustainable forms of packaging. This includes targets to use 100% reusable, recyclable, or compostable plastic packaging by 2025 and using 15% recycled plastic by 2025. The company shows evidence of collecting and processing more plastic than it uses in packaging for calendar years 2021 and 2022.

HUL’s parent company Unilever was also assessed by the World Benchmarking Alliance (WBA) in their Food and Agriculture Benchmark 2023, which can be found here: https://www.worldbenchmarkingalliance.org/publication/food-agriculture/rankings/environment/

Aspects to Improve

• The company is encouraged to track its Greenhouse Gas (GHG) emissions across its wider value chain (Scope 3) and set targets to reduce these.

• The company is recommended to publicly disclose details on the impact of its activities to prevent FLW in India, ideally including quantitative evidence of outcomes for reducing FLW.

• The company is encouraged to ensure that its efforts to transition to sustainable forms of packaging in India are evidence-based, and correspond with clear quantitative sustainability outcomes.