ITC Limited

Product categories assessed

Confectionery|Sweet Biscuits, Snack Bars and Fruit Snacks|Rice, Pasta and Noodles|Savoury Snacks|FlourPercentage of company India sales covered by Product Profile assessment

90-100 %Headquarters

IndiaType of ownership

PublicEuromonitor International Limited [2021]

© All rights reserved

Important

The findings of this Index regarding companies’ performance rely to a large extent on information shared by companies, in addition to information that is available in the public domain. Several factors beyond the companies’ control may impact the availability of information. Therefore, in the case of limited or no engagement by such companies, this Index may not represent the full extent of their efforts.

Scoring Overview

(%) Figure in brackets is the weighting of the category. All category and criteria scores are out of 10.

Product Profile

The Product Profile is an independent assessment of the nutritional quality of companies’ product portfolios. For this purpose, ATNI uses the Health Star Rating (HSR) model, which rates foods from 0.5 to 5.0 based on their nutritional quality. The underlying nutrient profile model assesses nutrients of concern (sodium, total sugar, saturated fat, and overall energy) and positive food components/ nutrients (fruit and vegetable content, protein, fiber, and, in some cases, calcium) to score products on the basis of nutritional composition per 100g or 100mL.

ATNI uses the threshold of 3.5 stars or more to classify products as generally healthier. Product Profile results account for 30% of the total Index score.

Portfolio-level Results

| Total no. products assessed |

Range of total 2021 company sales in India |

Sales-weighted Mean HSR (out of 5 stars) |

Products meeting the ‘healthy’ threshold (HSR of 3.5 stars or more) |

|

|---|---|---|---|---|

| 233 | 90-100 % | 2.4 | % of distinct healthier products |

% sales from healthier products |

| 9 | 40 | |||

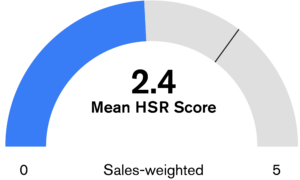

• ITC’s average sales-weighted HSR is 2.4 (stars) out of 5 (1.2 unweighted mean HSR).

• A total of 233 products across the company’s five best-selling product categories were assessed using the HSR model.

• 9% of distinct products analyzed for ITC met the ‘healthy’ threshold (3.5 stars or more in the HSR).

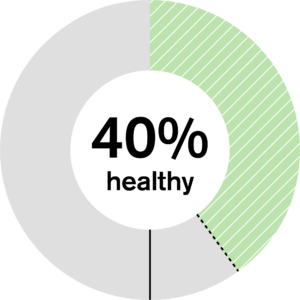

• When taking category sales values into account, the company was estimated to derive approximately 40% of its India 2021 sales from healthier products (mostly from Flour).

Mean Health Star Rating by category for ITC Limited

companies assessed

in the category

Lowest mean HSR of

companies assessed

in the category Healthy threshold

• Among categories assessed, ITC’s products in Flour (15 products) had the highest mean HSR (4.8 out of 5.0), of which 100% reached the healthy threshold.

• The company’s lowest scoring category is Confectionery with a mean HSR of 0.7 out of 5, for which 0% of products reached the healthy threshold.

• In total, 2% of distinct products and 4% when sales-weighted, was found to be eligible to be marketed to children using the WHO SEAR criteria.

Categories

The Index is divided into seven categories which assess food & beverage companies' policies, practices and transparency related to nutrition in the Indian market.

Governance 10% of overall score

Products 45% of overall score

Accessibility 15% of overall score

Marketing 15% of overall score

Workforce 5% of overall score

Labeling 5% of overall score

Engagement 5% of overall score

Nutrition

• ITC publishes extensive information about its nutrition strategy on its ‘Help India Eat Better’ webpage. The strategy encompasses increasing the use of positive nutrients/ingredients across its portfolio and reducing nutrients of concern; fortification; an affordability strategy specifically for healthier products; portion control; and on-pack communication regarding healthy diets, among others, through its 4-pillar model.

• To drive progress on this strategy, ITC has developed a range of targets for almost each of these elements, as well as an overarching target “to achieve 90% of its sales (relative to overall sales) from healthier products basis ITC’s Food Division Nutrition Profiling System by 2025”. The baseline level in 2023 when this target was set was 88%.

• The company reports against each element of its nutrition strategy. On its ‘Help India Eat Better’ webpage, it reports clearly against each of its targets, including the percentage of sales derived from products meeting the company's ‘healthy’ definition, while also publishing a range of other metrics about the nutrient content of its portfolio. Meanwhile it has also published a dedicated report, named ‘ITC Foods Division Product Portfolio’, which provides both quantitative and qualitative examples of each element of its nutrition strategy in action.

• ITC highlights its efforts to support the government’s ‘Anaemia Mukt Bharat’ initiative to address anemia in India through products containing or fortified with “goodness of iron” (defined according to FSSAI guidelines of both +F fortification of staples and advertising and claims regulations). In addition, the company reports that it sells and uses iodized salt to help combat iodine deficiency in India, as well as products fortified/enriched with micronutrients such as Zinc, Calcium, Vitamin A, B vitamins, Magnesium, and Vitamin D. It also has a clear affordable nutrition strategy to ensure that such products are accessible to lower-income at-risk populations.

• The company showed evidence of identifying a range of nutrition-related risks to ITC Foods’ business, and these are published on its ‘Help India Eat Better’ webpage.

• The company states that the ‘Help India Eat Better’ strategy is approved by the Board, and formal accountability for its implementation and success is assigned to Chief Operating Officer (a member of the Foods Division’s Divisional Management Committee) and Head of Nutrition. Since ITC Foods is part of a conglomerate, the divisional management is taken to be the equivalent of C-Suite Executive. The company reports that progress on the nutrition strategy is part of their annual appraisals and remuneration.

• The company shared evidence of engaging with a nutrition expert to solicit feedback on its ‘Help India Eat Better’ strategy, as well as commissioning a consumer study to gather insights into how the strategy is perceived and how it should be communicated externally.

Aspects to improve

• While it is commendable that ITC has set a specific and timebound target to increase sales of healthier products relative to overall sales, the company is encouraged to make this more ambitious by making its definition of ‘healthier’ stricter and more closely aligned with internationally recognized and (when available) government-endorsed classifications.

• To further improve its nutrition strategy and ensure that it is maximizing its positive impact on public health, ITC is recommended to more systematically engage with a wide range of independent experts/stakeholders, including public health-oriented civil society organizations, academic institutions, and (inter-)national organizations. Ideally, the groups should be independent of industry funding and affiliation, in order to minimize the risk of conflict of interest. These engagements, including the impact they had on the company’s strategy, should ideally be disclosed on the public domain.

• The AccountAbility AA1000 Stakeholder Engagement Standard offers a best practice framework for assessing, designing, implementing stakeholder engagement activities, as well as how to communicate this to the wider stakeholder community.

Category B2: Portfolio Development

• Through its ‘Enhanced Nutrition Commitments’, ITC has set specific targets to reduce the quantities of fat, salt, and sugar in some of its relevant product categories. The company indicates on its website whether the targets have been achieved or if work is still in progress.

• ITC is also one of only two companies found to have targets in place to increase levels of beneficial nutrients such as wholegrains and fruits, vegetables, nuts, and legumes (FVNL), applicable across its relevant portfolio, which is “to increase product portfolio with goodness of whole grains, nuts, legumes, fruits & vegetable by 50% from the baseline of FY 2021-22”. “[G]oodness of…” is based on reference values provided in the ITC Foods Division's Nutrition Profiling System. The company publishes a document ‘Results of Enhanced Nutrition Commitments’ which appears to report against this target, although at the time of research it was not clear how the numbers in the table relate to the target in question.

• ITC continues to support the Food Safety and Standards Authority of India (FSSAI)’s agenda to tackle micronutrient deficiencies in the Indian population by voluntarily fortifying 100% of its milk (with Vitamins A and D) and a variant of packaged wheat flour (with Iron, Vitamin B12 & Folic Acid) since 2019, as per the (Fortification of Foods) Regulation.

• The company also indicated to ATNI that it enriches its fruit beverages with Vitamin C.

• The company recently launched millet-based products (under ITC’s ‘Mission Millet’ initiative) which have been formulated using ingredients high in naturally-occurring micronutrients such as Iron, Calcium, and B- vitamins.

Category B3: Nutrient Profiling

• ITC has developed its own nutrient profiling model (NPM), the ‘ITC Nutrition Profiling System’, which is applied to its entire range of products for both portfolio development as well as marketing purposes. This is a new development since the 2020 India Index.

• The company’s NPM includes both negative (energy, added sugars, saturated fat, trans fat, and sodium) and positive nutrients (protein, fiber, vitamins, minerals, MUFA, PUFA, DHA, clinically proven ingredients, probiotics, prebiotics, whole grain, multigrain, dairy, nuts, seeds, cereals (millets, oats, suji etc), legumes/pulses, fruit, and vegetables). The company refers to integrating dietary recommendations issued by the ICMR-NIN, FAO, WHO, FSSAI, and other international organizations into their internal standards. However, the reference unit for the nutrient thresholds is expressed as “% reference value per serve”. This indicates that the nutrient thresholds are set according to serving sizes that are determined by the company for each product, whereas internationally recognized standards use ‘per 100g’ in order to increase objectivity and comparability.

• ITC to meet its ‘healthier’ definition, the company clearly states that “products should be within threshold for all nutrients of concern & have at least one positive nutrient &/or ingredient -except in treats”. Since a number of thresholds are based on serving sizes (determined by the company), this information is required for external parties to use the NPM. The company’s internal guidance document titled ‘Serve Size Principles and Guidance Document’ is not available in the public domain, although serve sizes can be found for most products on the company’s e-commerce website.

• The company's NPM is accessible through its website and is also published in a peer-reviewed Indian nutrition journal. It is important to note that this particular journal is not indexed in major scientific databases like Scopus, PubMed, or Web of Science, and could not be accessed by ATNI.

• ITC shared a performance benchmark for its definition of ‘healthy’ according to its NPM, disclosing the proportion of its sales volume meeting this definition compared to three internationally recognized NPMs (NutriScore, Health Star Rating (HSR), and Healthier Choice Symbol). The results of the benchmark assessment are not available in the public domain.

Aspects to improve

Category B2: Portfolio Development

• ITC could improve the specificity of its reformulation targets, which all involve percentage increases or decreases, by ensuring that the baseline level is reported as an absolute amount, rather than a percentage (which is relative level), as this is difficult for stakeholders to interpret and independently verify.

• The company is encouraged to strengthen its fortification approach by adopting and disclosing a policy or process document outlining its position on the fortification of High in saturated Fat, Salt and Sugar (HFSS) food products and commitment to comply with national standards and regulations regarding food fortification. This should cover how it voluntarily aligns with the FSSAI Fortification of Foods Regulation.

• The company is advised to apply stricter measures regarding application of its NPM when selecting products to fortify e.g., the company currently voluntarily fortifies a variety of products such as fruit beverages, milkshakes and health supplement jelly bears for children which are not covered under the FSSAI voluntary fortification of processed food regulation, however, could have high amounts of fat, salt or sugar.

Category B3: Nutrient Profiling

• While adopting an internal NPM to define what is considered ‘healthier’ is a notable development, ITC is strongly encouraged to apply more stringent thresholds for nutrients of concern that align with international standards and use per 100g as the reference unit.

• The company is advised to ensure that all information regarding the NPM algorithm which is needed to determine whether a product meets the company's 'healthy' definition, such as standardized serving sizes per product category, is publicly accessible.

• ITC’s benchmarking exercise of its ‘healthy’ definition against three external NPMs is a promising first step to measure its degree of alignment with internationally recognized standards, although ATNI strongly recommends adhering strictly to the NPM guidelines when applying the external NPMs to its products. The company is also encouraged to disclose the results of its benchmarking exercise on its website.

• ITC publishes its ‘Strategy for Affordable & Accessible Products’ on the ‘Help India Eat Better’ page of its website. Here, the company explains its approach for making products that meet its definition of ‘healthy’, including those that address specific micronutrient deficiencies, affordable for lower-income consumers. It uses a formal definition for lower-income consumers using the New Consumer Classification System (NCCS): those in the socio-economic classification (SEC) C, D, E & F categories.

• The company explains how it conceptualizes ‘affordability’ in its ‘Strategy for Affordable & Accessible Products’. Moreover, the company provided evidence of using Kantar Worldpanel data to find that lower SEC consumers consume a higher proportion of Rs.10 and below SKUs relative to higher income groups.

• The company’s affordability approach encompasses multiple strategies, including 'Innovation & Renovation strategies', 'Mapping of specific price points', 'Operational capabilities', and 'Local & wide spread distribution system', with added detail for each, such as 'using locally available nutritious ingredients, fortification of healthier portfolio at affordable pricing'.

• To illustrate the strategy in action, the company publishes a dedicated document entitled ‘Case study and Examples for Affordability & Accessibility’ on its website which provides a wide range of specific examples of products and affordability approaches, including for products addressing micronutrient deficiencies.

• The company has a clear target to “increase the affordable healthier product portfolio by 20% by 2025”, from a 2022-23 baseline of 20% of healthier product portfolio is affordable (Rs 10 and below).

Aspects to improve

• The company is strongly recommended to apply more stringent nutrient thresholds to define ‘healthier’ products that are part of its ‘affordable nutrition’ strategy, such that products that could be considered unhealthy (HFSS), and risk contributing to obesity, are specifically excluded.

• ITC is also recommended to assess and report on the impact of its affordable nutrition strategy and specific affordability approaches, such as the degree of market penetration into lower-income segments, for example.

• ITC has published its Food Division Marketing and Communication Policy, which outlines in full its responsible marketing policy, which covers all audiences, and is applied across all media.

• Through its membership to the Advertising Standards Council of India, ITC commits to the Code for Self-Regulations of Advertising Content in India, including the Self-Regulation Guidelines on Advertising of Foods and Beverages. The Guidelines outline commitments related to the representation of products in advertisements directed at a general audience in India. Many of the commitments in the Guidelines are also explicitly disclosed in ITC’s own responsible marketing policy.

• ITC’s responsible marketing policy includes specific commitments on marketing to children, with ITC being the only company in this Index found to define children as ‘under the age of 18’.

• The policy states that it will only market products intended for children that comply with ITC's internal Nutritional Profiling System (NPM).

• The company commissions annual internal and independent third-party audits of compliance with its responsible marketing policy, including commitments on marketing to children.

Aspects to improve

• The company is encouraged to strengthen its commitments for responsible marketing to children, including by:

- aligning its nutrition criteria for products considered appropriate to be marketed to children with the WHO SEAR nutrient profiling model (NPM) ;

- applying the audience threshold of 25% to all advertisements across all relevant media platforms;

- adopting and disclosing specific commitments not to use certain materials and techniques to market their products to children, including celebrities, licensed characters, promotional toys and games, and depicting children on packaging.

• The company is encouraged to publish the results of the annual audit of compliance with its responsible marketing policy, including commitments on marketing to children, in the public domain.

• The company is advised to adopt and disclose a more robust response mechanism to address instances of non-compliance with its responsible marketing policy.

• ITC states that it offers healthy food at work to their employees by offering nutritious fresh meals at subsidized rates. At the headquarter office there is a ‘Give me 5 Healthy Bar’ that provides multiple options such as fresh cut fruits to fresh fruit juices, smoothies, fresh salads. Further, all manufacturing units are certified by FSSAI as Eat Right Campuses. ITC has published a target on their website: “100% workforce to have access to affordable & healthier food options at work”. However, it is not clear what is the baseline and timeline and to how much of the workforce affordable & healthier food options at work are currently available.

• The company offers nutrition education (modules, blogs, and infographics) to employees through their intranet site- ITC Nutrition Portal for all ITC employees. A target has been set: “100% of the employees to be trained towards nutrition, health and wellness to encourage them to adopt healthy diets & active lifestyle." It is not clear what is the baseline and timeline.

• The company offers nutrition-focused health checks, including weight, blood pressure, BMI. Further, periodic nutrition related health camps such as Body Composition Analysis is organized along with nutrition counselling. ITC was the only company to share a broad target in place for nutrition-focused health checks: “100% workforce to be provided free health checks including (not limited to) nutrition focused indicators such as weight, BMI, BCA, Blood pressure etc." & "100% of workforce to have access to healthcare experts and nutritionist (24*7) via a dedicated and free app." It is not clear what is the current baseline and timeline.

• ITC shares in its ‘Food Division Workforce Wellness Program’ document that employee feedback is sought through a biennial employee survey “iEngage”, and refers to employee perception on how well wellness needs are being addressed, the number of employees using the “Doctor 24/7 application”, and the likelihood of recommending the “Body Composition Analysis camp” to family & friends.

• ITC offers 10 days of paid paternity leave, for up to 2 children per employee.

• The company commits to offer breastfeeding rooms and creche facilities at HQ as well as manufacturing units.

• ITC states on their website “Workforce including direct employees and extended workforce (procurement, supply chain partners, vendors etc.,) are one of the most important assets of any organization and supporting them in leading a healthy balanced life is essential for sustainable growth of the organization” – and the company showed some evidence of organizing webinars and health checks for its value chain partners. However, it is not clear how well attended these were, whether those who attended were at greater risk of experiencing malnutrition, nor whether this is part of a structured program.

Aspects to improve

• The company is recommended to define quantifiable and meaningful expected outcomes for its workforce nutrition program and evaluate it accordingly - for example related to health-related behaviors, health-related outcomes, outcomes related to employee participation, or benefits to the company. Becoming a signatory of the Workforce Nutrition Alliance and utilizing its self-assessment scorecards could be a good first step in this regard.

• The company is encouraged to develop a clear policy on support extended to breastfeeding mothers at work in order to aid their maternal health; and this should apply equally to all office and production site employees. Support should, at a minimum, include i) Private, hygienic, safe rooms for expressing breastmilk; ii) Refrigerators in place to store milk; and iii) Other flexible working arrangements to support breastfeeding mothers, such as flexible working hours or on-site creche facilities. Furthermore, it is important to foster a workplace culture that is supportive of breastfeeding, for example through awareness campaigns.

• The company is recommended to offer maternity and paternity or second caregiver leave, extending parental leave policies to go beyond current national regulations, and remove limitations based on the number of children born.

• The company is also encouraged to develop a workforce nutrition program for its supply chain workers, starting with a needs assessment to identify those groups at highest risk of experiencing malnutrition. It can then engage with its supply chain partners and relevant civil society organizations to help reach these groups, further study the underlying causes of malnutrition in that specific context, and develop a tailored program to address their nutritional needs in a targeted manner. For more guidance, see the ATNI 2021 Action Research report and/or engage with the Workforce Nutrition Alliance (WNA).

• ITC displays numeric information for key nutrients on the front-of-pack (FOP) for part of its relevant portfolio.

• ITC’s online retail site shows images of the FOP and back-of-pack (BOP) for most products, as well as nutritional information tables showing nutritional information per 100g, per serve, %RDA per serve.

Aspects to improve • Once it is formally enacted by FSSAI, if the INR FOP labeling system is on a voluntary basis, the company is strongly encouraged to adopt it across their entire portfolio in India.

• In 2023, ITC Foods published the 'ITC Foods Divisions Nutrition and Public Health Engagement Policy' on the 'Our Policies' webpage, which sets out the company's responsible advocacy policy specifically in relation to nutrition. The policy explicitly applies to third-parties.

• Of interest, the company states that it does not “encourage political engagements by employees and designated 3rd parties”, preferring that it is conducted by relevant industry bodies if necessary. Any staff and third-parties must gain pre-approval to do so on behalf of the company.

• The company is the only one found in this Index to address the hiring of any former government officials/policymakers to positions in which they might influence incumbent policymakers, stating that it will map “internal potential conflict of interest” and identify “specific responsibilities for the individual amongst other critical requirements would also be undertaken, before engaging and hiring such employees”.

• ITC publishes a document titled ‘ITC Food Divisions Position on Public Health Engagement Topics’, in which the company states that it “support restrictions on marketing initiatives on products that are unhealthy (as defined in the current regulations) as long as they are based on the laws laid down by the regulator and aligned with applicable nutritional profiling systems based on India’s dietary patterns and are towards consumer advantage”, as well as regulations for health/nutrition claims and mandatory fortification of salt with iodine. The document does not, however, address mandatory FOP labelling systems nor fiscal measures to address obesity.

• The company publishes a document on its website listing the 20 trade associations ITC Foods specifically belongs to “on matters of nutrition and public health". This includes a comprehensive list of managers holding positions on executive committees / management committees / governing body members of these trade associations.

Aspects to improve

• The company is recommended to enhance its Nutrition and Public Health Engagement Policy to require that the evidence presented shall be as independent and representative as possible and to always consider the wider public health interest in its efforts. It should also clearly define what it defines as ‘political engagement’ and the types of interactions this involves; this definition should be as comprehensive as possible.

• To improve its control over and accountability for its advocacy activities, the company is recommended to ensure that these interactions are tracked and disclosed on the public domain.

• In addition, the company is encouraged to publicly disclose information about its engagement activities and position on FSSAI’s development of a proposed FOP labelling system, as well as what the company’s position is with regards to potential fiscal measures to address obesity.

Sustainability

• The company demonstrates evidence of targets in place to reduce its Scope 1 and 2 emissions. These targets are: to achieve a 50% reduction in specific GHG emissions from 2018-19 baseline by 2030, and achieve 100% purchased grid electricity requirements from renewable sources by 2030. The company publicly reports on its progress against these.

• The company discloses categories of its Scope 3 GHG emissions, with levels of emissions for each (tons of CO2e).

• ITC indicates that it measures its food loss and waste (FLW) across its own operations and supply chain and reports quantitatively on progress it has made in reducing it. The company has set a target which is aligned with SDG 12.3 goal of reducing FLW by 50% by 2030. ITC’s Sustainability Integrated Report 2022 mentions activities to reduce food loss and waste, such as improving crop productivity throughout key value chains like wheat, spices, and potato; improving efficiency; partnering with suppliers; and reducing wastage at the distribution end. It also emphasizes its efforts to reduce FLW through appropriate labelling and consumer education on portion sizes.

• Regarding reducing its plastic use and transitioning to sustainable forms of packaging in India, the company states that it has “gone beyond plastic neutrality in the current year by collecting and sustainably managing more than 60,000 tonnes of plastic waste across 35 States/Union Territories”. Moreover, it has set a target that “over the next decade for 100% of packaging to be reusable, recyclable or compostable/biodegradable”, stating that it is currently at 99.9%, with less than 0.1% of its packaging being “Non-Recyclable or Hard to Recycle”.

Aspects to Improve

• The company is recommended to submit its GHG emission reduction targets to the Science-based Targets Initiative (SBTi) for validation of their alignment with the 1.5 °C trajectory, such that ITC can be listed on SBTi’s website.