Mondelez India Foods Private Limited

Product categories assessed

Confectionery|Sweet Biscuits, Snack Bars and Fruit Snacks|Concentrates|Other hot drinksPercentage of company India sales covered by Product Profile assessment

90-100 %Headquarters

IndiaType of ownership

PrivateEuromonitor International Limited [2021]

© All rights reserved

Important

The findings of this Index regarding companies’ performance rely to a large extent on information shared by companies, in addition to information that is available in the public domain. Several factors beyond the companies’ control may impact the availability of information. Therefore, in the case of limited or no engagement by such companies, this Index may not represent the full extent of their efforts.

Scoring Overview

(%) Figure in brackets is the weighting of the category. All category and criteria scores are out of 10.

Product Profile

The Product Profile is an independent assessment of the nutritional quality of companies’ product portfolios. For this purpose, ATNI uses the Health Star Rating (HSR) model, which rates foods from 0.5 to 5.0 based on their nutritional quality. The underlying nutrient profile model assesses nutrients of concern (sodium, total sugar, saturated fat, and overall energy) and positive food components/ nutrients (fruit and vegetable content, protein, fiber, and, in some cases, calcium) to score products on the basis of nutritional composition per 100g or 100mL.

ATNI uses the threshold of 3.5 stars or more to classify products as generally healthier. Product Profile results account for 30% of the total Index score.

Portfolio-level Results

| Total no. products assessed |

Range of total 2021 company sales in India |

Sales-weighted Mean HSR (out of 5 stars) |

Products meeting the ‘healthy’ threshold (HSR of 3.5 stars or more) |

|

|---|---|---|---|---|

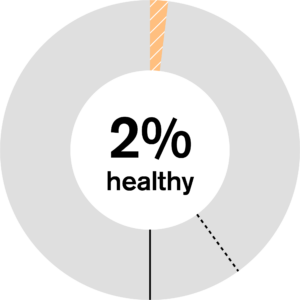

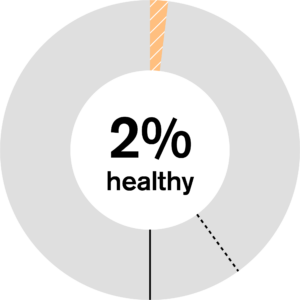

| 63 | 90-100 % | 0.9 | % of distinct healthier products |

% sales from healthier products |

| 3 | 4 | |||

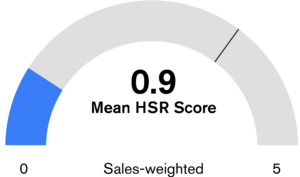

• Mondelēz India’s average sales-weighted Health Star Rating (HSR) is 0.9 (stars) out of 5 (0.8 unweighted mean HSR).

• A total of 63 products across the company’s four best-selling product categories were assessed using the HSR model.

• 3% of distinct products analyzed for Mondelēz India met the ‘healthy’ threshold (3.5 stars or more in the HSR).

• When taking category sales values into account, the company was estimated to derive approximately 4% of its India 2021 sales from healthier products (mostly from Other Hot Drinks).

Mean Health Star Rating by category for Mondelez India Foods Private Limited

companies assessed

in the category

Lowest mean HSR of

companies assessed

in the category Healthy threshold

• Among categories assessed, Mondelēz India’s products in Other Hot Drinks (6 products) had the highest mean HSR (2.3 out of 5.0), of which 33% reached the healthy threshold. As per HSR guidance, ATNI/ TGI has classified specific products in the Other Hot Drinks group (malt-based) as under the HSR Category 2 “foods”, and accordingly applied HSR scores to the products “as sold”.

• The company’s lowest scoring category is Concentrates with a mean HSR of 0.5 out of 5, for which none of the products reached the healthy threshold.

• In total, 0% of distinct products and 0% when sales-weighted, was found to be eligible to be marketed to children using the WHO South-East Asia Region (SEAR) criteria.

Categories

The Index is divided into seven categories which assess food & beverage companies' policies, practices and transparency related to nutrition in the Indian market.

Governance 10% of overall score

Products 45% of overall score

Accessibility 15% of overall score

Marketing 15% of overall score

Workforce 5% of overall score

Labeling 5% of overall score

Engagement 5% of overall score

Nutrition

• The company follows Mondelēz International’s ‘Snacking Made Right’ well-being strategy, which was introduced in 2020. This involves offering ‘Better For You’ options (for example, with reduced sugar or with healthier ingredients), the increased use of whole ingredients, fortification of key products, and emphasizing portion control for indulgent snacks. It also emphasizes its ongoing commitment to (re)formulate products with reduced sodium, saturated fat, and sugar; and increased use of whole grains.

• The company also has a target, set at the global level, that by 2025, to “100% of our net revenue [delivered] through Mindful Portion Snacks”, meaning that all snacks will be either individually-wrapped in <200kcal servings, or provide “portion label/information” on pack.

• Mondelēz India does not report on its nutrition progress separately from the company’s global reporting. In its global ‘Snacking Made Right’ report, the company reports several specific examples of ‘healthier’ products introduced in India, such as the BournVita Crunchy wholegrain biscuit (2020) and Cadbury Fuse fit bar with protein (2021); however, public reporting on its nutrition approach in India is not systematic.

• The company conducts a risk assessment at India market-level, which then feeds into the company’s global Enterprise Risk Management methodology, identifying the risk of damage to reputation and brand image of being associated with being unhealthy, changes in consumer preferences, and potential changes in nutrition-related regulations.

• The company states that its ‘Snacking Made Right’ strategy is reviewed by its Board at the global level.

Aspects to improve

• In addition to improving the healthiness of its portfolio through reformulation and the development of ‘mindful snacking’, Mondelēz India is encouraged to also integrate in its nutrition strategy how its ‘Better For You’ (or otherwise ‘healthier’) products reach consumers relative to its less healthy products, for example through via relative pricing strategies and/or increasing investments in marketing of the former. Ideally, this should also include specific attention to addressing the unmet needs of priority populations (based on government priorities).

• The company is encouraged to set a timebound target to increase sales of its ‘Better For You’ (or otherwise ‘healthier’) relative to overall sales, both at the India- and global-level.

• To demonstrate to external stakeholders that it is delivering on its nutrition strategy and/or commitments, Mondelēz India is recommended to report more comprehensively on all elements of its approach in India, showing what has been achieved year-on-year across its portfolio or key product categories. Reporting should ideally take the form of quantitative metrics, and progress documented systematically.

• The company is recommended to assign formal responsibility for the success of its nutrition strategy to the highest levels of seniority within the company in India, who shall take ownership of any targets and/or KPIs by which success or failure can be measured. Ideally, to make this more concrete and further incentivize progress, this should be linked to remuneration arrangements or other incentives for the responsible person and/or other key senior personnel.

• To further improve its nutrition strategy and ensure that it is maximizing its positive impact on public health, the company is strongly recommended to engage with independent experts/stakeholders, such as independent (i.e. not directly affiliated with industry) public health-oriented civil society organizations, academic institutions, (inter-)national organizations focused on public health.

Category B2: Portfolio Development

• In 2021, as a member of International Food & Beverage Alliance (IFBA), Mondelēz International collectively with other members developed and committed to standardized, stepwise voluntary global sodium reduction targets for key categories of products to be achieved incrementally by 2025 and 2030. The company confirms that Mondelēz India must also work towards these targets.

• In 2018, the company made commitments to the Food Safety and Standards Authority of India (FSSAI) 'Eat Right Pledge'. The company continues to work towards its target to reduce sugar levels by 10% in its biscuits portfolio by 2025; the saturated fats target was met in 2020 and no new reduction target has been set.

• Mondelēz India continues to enhance the nutritional quality of its fortified bakery products sold under the brand BournVita by fortifying with calcium and iron. Meanwhile it has expanded its fortified 'functional foods' innovation pillar, which focuses on fortified products, include other snacks, beverages, protein bars, and spreads.

Category B3: Nutrient Profiling

• Mondelēz India uses the ‘Mondelēz Nutrient Profiling Model’, a model developed by the company, which sets category-based baseline criteria for almost all products for negative nutrients only (energy, saturated fat, total sugar, and sodium) to guard new product formulations and reformulations, and more stringent criteria for relevant brands. However, details of this model are not available on the public domain.

Aspects to improve

Category B2: Portfolio Development

• In order to drive progress on improving the healthiness of its portfolio, the company is encouraged to adopt specific, measurable, and timebound targets to reduce nutrients of concern (sodium, sugar, and saturated fat) and increase positive ingredients (including whole grains and fruit, vegetable, nut and legume (FVNL)) across its relevant portfolio. These targets should ideally be aligned with the ICMR/National Institute of Nutrition (NIN) Dietary Guidelines and Recommended Dietary Allowances (RDAs) for Indians, and/or WHO guidelines, and are recommended to be published on the public domain.

• The company is recommended to report progress against all reformulation targets on an annual basis, in a consistent and easily accessible manner, in order to increase transparency and accountability.

• The company is strongly encouraged to develop an internal policy to prevent the fortification or enrichment of unhealthy products (i.e. with high levels of fat, sugar, and/or sodium), for example, according to nutrition criteria defined by an (internationally recognized) NPM. Thereafter, it is encouraged to produce more fortified products to address specific micronutrient deficiencies in India according to government priorities, while ensuring that these are ‘healthier’.

Category B3: Nutrient Profiling

• The company is recommended to disclose all details of the NPM it uses in full, including the nutrient thresholds per category, reference values, and how ‘healthier’ is defined, on the company’s website and, ideally, in a scientific journal that is peer-reviewed and indexed.

• The company is additionally encouraged to publish its system in a peer-reviewed journal, so that stakeholders can better understand and assess it.

• The company is also recommended to benchmark the proportion of products defined as ‘healthier’ according to this model against internationally recognized (and/or government-endorsed, when applicable) NPMs, strictly adhering to the guidelines of these models, and annually disclose the percentage of its India portfolio ‘healthier’ sales in the public domain.

• The company did not show evidence of having an affordability strategy or approach specifically for products that meet ‘healthier’ criteria in India.

Aspects to improve

• To ensure that products that are considered by the company to be ‘healthier’ are being priced affordably for lower-income consumers, the company is recommended to:

- ensure that such products are defined as ‘healthy’ through the use of an NPM (or other clear nutrition criteria) - such that products high in fat, salt or sugar (HFSS) are specifically excluded;

- have a clear approach to determining whether a product is ‘affordably priced’; and

- use a formal classification of ‘lower-income consumers’ that it is trying to reach.

• With these definitions and processes in place, the company is encouraged to develop and implement a strategy or approach for ensuring that at least part of its ‘healthier’ (and, ideally, fortified or micronutrient-rich) product portfolio is priced affordably for lower-income consumers, and continually explore new opportunities for delivering ‘affordable nutrition’. Examples of approaches can be found in the methodology and chapter for Category C.

• The company is recommended to publicly disclose information about its affordable nutrition strategies/approaches, including specific definitions, the approaches taken to ensure affordability, and the progress made on implementation, to enable stakeholder scrutiny.

• Through its membership to the Advertising Standards Council of India, Mondelēz India commits to the Code for Self-Regulations of Advertising Content in India, including the Self-Regulation Guidelines on Advertising of Foods and Beverages. The Guidelines outline commitments related to the representation of products in advertisements directed at a general audience in India, and do not include specific commitments on the marketing of foods and beverages to children.

• Mondelēz India adheres to the company’s global Responsible Marketing policy, which states that it will not directly market any products to children under the age of 13 across all media.

• The company uses an audience threshold of 30% to limit its marketing to children across all media channels.

• As a member of the International Food & Beverage Association (IFBA), Mondelēz International discloses on its website that compliance with its responsible marketing to children policy is audited regionally by an industry association-appointed third party, and clearly provides link to the IFBA website. In 2022, IFBA specifically audited compliance with members’ responsible marketing commitments in India.

Aspects to improve

• The company is encouraged to strengthen its commitments on responsible marketing to children, including by adopting:

- WHO-recommended age threshold for marketing to children of 18 years of age;

- aligning its nutrition criteria for products considered appropriate to be marketed to children with the WHO SEAR nutrient profiling model;

- audience threshold of 25% for limiting children’s exposure to advertisements on all media;

- specific commitments not to use certain materials and techniques to market their products to children, including sponsorship of activities and materials popular with children, celebrities, licensed characters, promotional toys and games, and depicting children on packaging.

• The company is encouraged to commission additional annual third-party audits of compliance to its responsible marketing policy in India, and to disclose the results of this audit, as well as the response mechanism it has in place to address instances of non-compliance.

• It is not clear whether there is a workforce nutrition program in place that includes healthy food at work (and if yes to whom this is available) in India. The company indicated to ATNI that its headquarters in India will be opting for 'Eat Right Campus' certification by FSSAI in the coming year.

• Under its ‘Mondelēz Wellness Benefits Program’, the company offers nutrition education to its employees through an app, including customized diet plans and consultations with nutritionists. It is not clear if there are targets in place for the use of this app or other nutrition education initiatives.

• The company offers annual health check-ups, including keeping track of trends and changes year on year for cholesterol, HbA1C, vitamin B12, and vitamin D, amongst others.

• The company offers secondary caregivers 28 days of paid leave, for up to two children.

• Mondelēz India offers flexible working arrangements and creche facilities to breastfeeding mothers.

Aspects to improve

• The company is recommended to define quantifiable and meaningful expected outcomes for its workforce nutrition program and evaluate it accordingly - for example related to health-related behaviors, health-related outcomes, outcomes related to employee participation, or benefits to the company. Becoming a signatory of the 'Workforce Nutrition Alliance' and utilizing its self-assessment scorecards could be a good first step in this regard.

• The company is encouraged to develop a clear policy on support extended to breastfeeding mothers at work in order to aid their maternal health; and this should apply equally to all office and production site employees. Support should, at a minimum, include i) Private, hygienic, safe rooms for expressing breastmilk; and ii) Refrigerators in place to store milk. Furthermore, it is important to foster a workplace culture that is supportive of breastfeeding, for example through awareness campaigns.

• The company is also encouraged to develop a workforce nutrition program for its supply chain workers in India, starting with a needs assessment to identify those groups at highest risk of experiencing malnutrition. It can then engage with its supply chain partners and relevant civil society organizations to help reach these groups, further study the underlying causes of malnutrition in that specific context, and develop a tailored program to address their nutritional needs in a targeted manner. For more guidance, see the ATNI 2021 Action Research report and/or engage with the Workforce Nutrition Alliance (WNA).

• The company displays numeric information for key nutrients on the front-of-pack (FOP) for the majority of its relevant portfolio.

• The company does not provide nutritional information for its products on its India-specific website; while this can be found for specific products on other Mondelēz sites, it is not certain whether the product formulations are the same across different markets.

Aspects to improve

• Once it is formally enacted by FSSAI, if the Indian Nutrition Rating (INR) FOP labeling system is on a voluntary basis, the company is strongly encouraged to adopt it across their entire portfolios in India.

• While the company includes some product nutritional information on their Mondelēz SnackWorks website, this is not India-specific, and not easily readable for consumers. The company is recommended to ensure this information is available on its India website, ideally showing images of FOP and BOP packaging, plus nutritional information tables.

• The company indicated it will introduce “Mindful portion label” in India this year.

• The company follows Mondelēz International’s 'Interacting With Government Officials' policy, which stipulates that anyone engaging with policymakers, including third-parties, must “Deal honestly” and “Use common sense and good judgment, and act with the highest level of integrity ... considering how those outside the Company would view your conduct." Staff are required to train third-parties in the policy.

• The company’s global policy states that its Corporate Affairs employees have general authority to lobby on the company’s behalf without pre-approval; all other staff must be pre-approved to do so. The company also has a policy for appointing intermediaries for engaging with government in India.

• The company confirmed to ATNI that it is a member of several trade associations in India and holds Board or Committee seats on several; however, these are not disclosed on the company’s public domain.

Aspects to improve

• The company is encouraged to disclose the Mondelēz International 'Interacting With Government Officials' policy on its India-specific website, so it is easier for India-specific stakeholders to access and understand.

• This should also be expanded to include requirements that the evidence presented shall be as independent and representative as possible, and to always consider the wider public health interest in its efforts. It should also clearly define what it defines as advocacy interactions. In addition, clearly definitions of ‘lobbying’ and/or ‘advocacy’.

• The company is recommended to publish details about the governance of its policy engagement and advocacy in India, including roles and responsibilities within the organization, approval procedures, and tracking mechanisms. If these are not already in place, they should be developed.

• The company is encouraged to keep track of all engagements with policymakers with regards to nutrition-related policy and publish these on the public domain.

• In order to enhance transparency, accountability, and the consistency of its political advocacy, the company is strongly encouraged to disclose its policy positions on key nutrition-related policy measures that are under debate or development in India that would likely affect the company (for example, FSSAI’s new FOP labelling system), even if the company is not engaging directly. These disclosures should be either on its website or in its reporting, ensuring that they are as specific and unambiguous as possible. These policy positions should consider the wider public health interest and long-term material implications of rising levels of malnutrition in India.

• The company is encouraged to disclose comprehensive lists of its trade association memberships in India and clearly indicate which it holds leadership positions on, such as on their Boards, management committees, or thematic working groups or sub-committees, in order to signify to stakeholders which ones the company has greater stakes in.

Sustainability

• The company provides evidence at the global level of reducing plastic use, including data on: total weight of packaging (MT), packaging material eliminated (vs. 2013) (MT), Plastic designed to be recyclable (%), Recycled plastic content (%), reduction in overall virgin plastic (vs. 2020) (%), and reduction in rigid virgin plastic (vs. 2020) (%).

• The company also provides global-level information that 96% of their packaging is designed to be recyclable (2022), and global targets to make “100% packaging designed to be recyclable by 2025”, “Reduce virgin plastic in rigid plastic packaging by at least 25% and in all plastic packaging by 5% by 2025”, and “Have 5% recycled content in our plastic packaging by 2025”.

• The company publishes case studies for reducing plastic waste in India specifically, such as eliminating single-use plastic including the overwrap film on Cadbury Celebrations Gift packs, recycle-ready packs, and introducing post-consumer recycled PET for Cadbury Rich Dry Fruit Collection Celebration packs and Cadbury Lickables spoons. The company is said to have surpassed Extended Producer Responsibility norms in 2021-22, achieving 100% plastic waste neutrality.

Mondelez India’s parent company Mondelez was also assessed by the World Benchmarking Alliance (WBA) in their Food and Agriculture Benchmark 2023, which can be found here: https://www.worldbenchmarkingalliance.org/publication/food-agriculture/rankings/environment/

Aspects to Improve

• The company is strongly encouraged to track its Greenhouse Gas (GHG) emissions in India, not only in Scopes 1 and 2, but also across its wider value chain (Scope 3).

• The company is recommended to set clear targets to reduce GHG emissions across Scopes 1 and 2 that are aligned with the Paris Agreement’s 1.5°C trajectory, and report quantitatively on progress. These targets (and reporting) should be for absolute reductions against a baseline, rather than relative emissions (i.e. ‘emissions intensity’).

• The company is encouraged to work with its value chain partners to reduce both Food Loss and Waste (FLW) and plastic use. This should go beyond requirements set out in mandatory waste management regulations.