Nestlé India Limited

Product categories assessed

Confectionery|Dairy|Sauces, Dips and Condiments|Rice, Pasta and NoodlesPercentage of company India sales covered by Product Profile assessment

60-70%Headquarters

IndiaType of ownership

PublicEuromonitor International Limited [2021]

© All rights reserved

Important

The findings of this Index regarding companies’ performance rely to a large extent on information shared by companies, in addition to information that is available in the public domain. Several factors beyond the companies’ control may impact the availability of information. Therefore, in the case of limited or no engagement by such companies, this Index may not represent the full extent of their efforts.

Scoring Overview

(%) Figure in brackets is the weighting of the category. All category and criteria scores are out of 10.

Product Profile

The Product Profile is an independent assessment of the nutritional quality of companies’ product portfolios. For this purpose, ATNI uses the Health Star Rating (HSR) model, which rates foods from 0.5 to 5.0 based on their nutritional quality. The underlying nutrient profile model assesses nutrients of concern (sodium, total sugar, saturated fat, and overall energy) and positive food components/ nutrients (fruit and vegetable content, protein, fiber, and, in some cases, calcium) to score products on the basis of nutritional composition per 100g or 100mL.

ATNI uses the threshold of 3.5 stars or more to classify products as generally healthier. Product Profile results account for 30% of the total Index score.

Portfolio-level Results

| Total no. products assessed |

Range of total 2021 company sales in India |

Sales-weighted Mean HSR (out of 5 stars) |

Products meeting the ‘healthy’ threshold (HSR of 3.5 stars or more) |

|

|---|---|---|---|---|

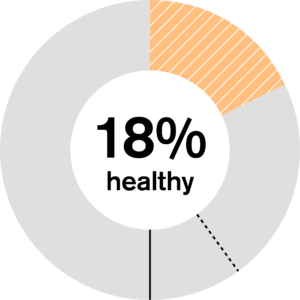

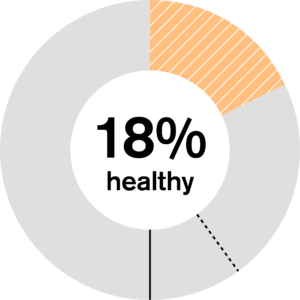

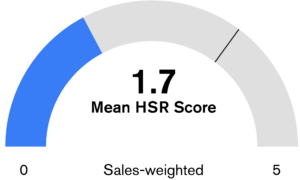

| 159 | 60-70% | 1.7 | % of distinct healthier products |

% sales from healthier products |

| 13 | 18 | |||

• Nestlé India’s average sales-weighted Health Star Rating (HSR) is 1.7 (stars) out of 5 (1.5 unweighted mean HSR).

• A total of 159 products across the company’s four best-selling product categories were assessed using the HSR model.

• 13% of distinct products analyzed for Nestlé India met the ‘healthy’ threshold (3.5 stars or more in the HSR).

• When taking category sales values into account, the company was estimated to derive approximately 18% of its India 2021 sales from healthier products (mostly from Dairy).

• It is important to point out that for Nestlé India, the Product Profile covers 60-70% of the company’s estimated 2021 retail sales, as the HSR system does not apply to packaged baby foods and coffee.

Mean Health Star Rating by category for Nestlé India Limited

companies assessed

in the category

Lowest mean HSR of

companies assessed

in the category Healthy threshold

• Among categories assessed, Nestlé India’s products in Dairy (31 products) had the highest mean HSR (3.0 out of 5.0), of which 68% reached the healthy threshold.

• The company’s lowest scoring category is Confectionery with a mean HSR of 0.9 out of 5, for which 0% of products reached the healthy threshold.

• In total, % of distinct products and % when sales-weighted, was found to be eligible to be marketed to children using the WHO SEAR criteria.

• From the change analysis between this and the last India Index, Nestlé India and one other company showed the greatest improvement in overall sales-weighted mean HSR, increasing 0.6 HSR between 2020 and 2023.

Categories

The Index is divided into seven categories which assess food & beverage companies' policies, practices and transparency related to nutrition in the Indian market.

Governance 10% of overall score

Products 45% of overall score

Accessibility 15% of overall score

Marketing 15% of overall score

Workforce 5% of overall score

Labeling 5% of overall score

Engagement 5% of overall score

Nutrition

• Nestlé India presents its nutrition strategy comprehensively on its website. Its approach involves (re)formulation with a focus on reducing sugar, sodium, and saturated fats and increasing the use of whole grains, vegetables, and fiber, as well as fortification and simplifying ingredient lists. In addition, it involves portion control, marketing healthier choices, nutrition education, and working with retailers to promote healthier food environments. The company also has an affordability strategy for some of its fortified products.

• Through the fortification with iron and affordability of its MAGGI 2-Minute Masala Noodles, the company states that it aims to reach populations at-risk of anemia in India such as mothers-to-be, new mothers, and infants and children in lower-income households in both rural and urban locations, with reference to the National Family Health Survey (NFHS-5), 2019-21.

• While the company reports on each element of its strategy in India, and provides some qualitative examples, there is no specific reference to when these examples were introduced (many examples were found to be more than three years old).

• The company references rapidly changing consumer preferences and consumer demand for more nutrition information as the only nutrition-related risk identified in its India-specific Enterprise Risk Management reporting.

Aspects to improve

• To demonstrate to external stakeholders that it is delivering on its nutrition strategy and/or commitments in India, the company is recommended to report more comprehensively on all elements of its approach in India and against all targets that have been set, showing what has been achieved year-on-year across its portfolio or key product categories, as opposed to mainly qualitative (and potentially old) examples. Reporting should ideally take the form of quantitative metrics, and progress documented systematically.

• To drive progress internally on implementing the strategy, and to ensure the company can be held to account for delivering on it, the company is recommended to develop specific, measurable, and timebound targets encompassing various elements of its strategy in India. The company is also encouraged to set a timebound target to increase sales of products defined as ‘healthy’, relative to overall sales, in India specifically.

• To further improve its nutrition strategy and ensure that it is maximizing its positive impact on public health, the company is strongly recommended to engage with independent experts/stakeholders, such as independent (i.e. not directly affiliated with industry) public health-oriented civil society organizations, academic institutions, (inter-)national organizations. These engagements, including the impact they had on the company’s strategy, should ideally be disclosed on the public domain.

Category B2: Portfolio Development

• In 2018, the company made commitments to the Food Safety and Standards Authority of India (FSSAI) Eat Right Pledge and has since disclosed its achievement in meeting the targets: 10% reduction of sodium in products such as MAGGI Noodles and Masala-ae-Magic; and 13-50% reduction in sugar in products such as Grekyo A+ Yogurt, Milo Powder, MAGGI Tomato Ketchup. Reformulation remains a key part of the company’s nutrition strategy in India; however, no new reformulation targets have been set, nor does the company report quantitatively on its reformulation efforts in India.

• In 2021, as a member of the International Food and Beverage Alliance (IFBA), Nestlé with other members collectively developed and committed to standardized, stepwise voluntary global sodium reduction targets for key categories of products to be achieved incrementally by 2025 and 2030. While the company has since then left the alliance, the company confirms to ATNI that it is still committed to the targets.

• Nestlé India is committed to reducing micronutrient deficiencies across India through fortification. The company currently fortifies cereal products and milk under the FSSAI fortification of foods standards. Examples include a+ Nourish milk with Vitamins A & D and MAGGI Masala noodles with Iron.

• Nestlé has a global fortification policy to guide its practices and confirmed it is applicable to India. The policy entails commitments by the company to refer to latest micronutrient deficiency data from international or national health authorities to target the fortification of its foods and beverages accordingly. The company shared evidence that it commits to not fortify any confectionery products and to only fortify ‘healthier’ varieties of biscuits. Nestle India indicated to ATNI that it does not support fortification of products high in fat, salt, and sugar, although this is not stated in a formal policy document.

Category B3: Nutrient Profiling

• Nestlé India reports that its global ‘Nestlé Nutritional Profiling System’ is used for all products in India for product development and reformulation. It assesses both negative (energy, total fat, saturated fat, trans fat, added sugar, fructose, and sodium) and positive nutrients (calcium, fiber, protein, and whole grains).

• The company states that the NPM refers to international dietary references, based on WHO and other health authorities, which are translated into criteria that are expressed as a percentage of daily reference values per serving or as a percentage of energy. This indicates that the nutrient thresholds are based on ‘per serving’, which does not align with internationally recognized standards that use per 100g calculations. Furthermore, there is a lack of clarity regarding the specific algorithm used for calculating whether a product is ‘healthy’ or not, or how outcomes are reached (i.e., whether it is a dichotomous or continuous score of product healthiness).

• The company’s NPM is available on its global website, but no link is provided to the document on the company’s website for India. The NPM is published in a peer-reviewed journal, which helps stakeholders to better understand and assess it.

• For its entire global portfolio and several markets in Asia (not including India), the company presents, on its global website, the results of its benchmarking exercise against internationally recognized models, such as HSR. However, the company does not report on the performance of their portfolio in India against other external NPMs.

Aspects to improve

Category B2: Portfolio Development

Aspects to improve:

• In order to drive progress on improving the healthiness of its portfolio, the company is encouraged to adopt specific, measurable, and timebound targets to reduce nutrients of concern (sodium, sugar, and saturated fat) and increase positive ingredients (including whole grains and FVNL) across its relevant portfolio, specifically for India. These targets should ideally be aligned with the ICMR/NIN Dietary Guidelines and RDAs for Indians, and/or WHO guidelines, and are recommended to be published on the public domain.

• The company is recommended to report progress against all reformulation targets on an annual basis, in a consistent and easily accessible manner, in order to increase transparency and accountability.

• The company is encouraged to strengthen its fortification procedures by incorporating into its fortification guidelines a policy that it will not fortify unhealthy products, specifically those that have high levels of sugar, sodium, and saturated fats (HFSS). Thereafter, the company is encouraged to consider fortifying more products in its product portfolio in line with FSSAI guidelines in order to contribute to addressing micronutrient deficiencies in India.

Category B3: Nutrient Profiling

Aspects to improve:

• The company is recommended to disclose all details of the NPM it uses in full, including the nutrient thresholds it uses, reference values, and how ‘healthy’ is defined, on the company’s India website.

• Nestlé India is strongly encouraged to apply more stringent thresholds for nutrients of concern that align with international standards, and use per 100g as the reference unit rather than serving size, to ensure greater objectivity and comparability.

• The company is also recommended to repeat the benchmarking of its NPM for the India market specifically, and publicly report the results.

• While not publicly reported, the company shared evidence that the company’s ‘Popularly Positioned Products (PPP) Affordable Nutrition’ strategy, a market-driven initiative introduced globally in 2020, is applied in India.

• Only products in the company’s Dairy, Nutrition, and Ambient Food categories can qualify as ‘Affordable Nutrition’ products, and these are “encouraged” to meet the company’s Nutritional Foundation (NF) criteria, which sets limits for sugar, sodium and saturated fats and thresholds for certain positive nutrients to be considered an “appropriate choice” within a balanced diet by the company. Moreover, they are also intended to be appropriately fortified with vitamin A, zinc, iron, and iodine in particular, which significant micronutrient gaps in India.

• The company showed clear evidence that it has a specific classification for ‘lower-income consumers’ which the strategy aims to reach, both globally and specifically for India, which includes consideration of social grade classifications, lifestyle characteristics, and specified income levels.

• The company also states that its PPP range should be priced with respect to total household disposable income and consumption priorities, and in consideration of the price of other available food products, including competitor products. Other key factors for consideration include the product’s value proposition, small serving sizes/single serves, and local coinage. The company shared evidence of conducting market research to determine these factors for certain products in India.

• The company provides limited details of its affordability strategy in India, including its implementation. The only specific example provided by the company is the MAGGI Masala-ae-Magic, which are fortified with 15% of the recommended daily iron requirements and are available for Rs.5 per pack. However, it is not clear what ‘Affordable Nutrition’ products have been introduced in the last three years in India.

Aspects to improve

• The company is encouraged to adopt stricter nutrient thresholds for defining ‘healthier’ products to be made affordable for lower-income consumers through its Affordable Nutrition / PPP strategy, such that unhealthy products (HFSS) are specifically excluded.

• Nestlé India is encouraged to disclose more information about how its Affordable Nutrition / PPP strategy is specifically applied in India, including how ‘affordability’ and ‘lower-income consumers’ are defined in this specific context.

• Importantly, it would be valuable to disclose how many products it applies to in India, and what new activities the company has undertaken year-on-year. Ideally, the company is recommended to report quantitatively on its progress on implementing the strategy in India, and continually explore new opportunities for delivering ‘affordable nutrition’ in the country.

• The company is recommended to set specific, measurable, and timebound targets (examples of which can be found in the methodology document) for its affordable nutrition strategy to further drive performance and enhance accountability.

• Through its membership to the Advertising Standards Council of India, Nestlé India commits to the Code for Self-Regulations of Advertising Content in India, including the Self-Regulation Guidelines on Advertising of Foods and Beverages. The Guidelines outline commitments related to the representation of products in advertisements directed at a general audience in India.

• Nestlé India adheres to Nestlé’s Marketing Communication to Children Policy, which was updated in 2023 to apply to all children under the age of 16. The policy covers all media channels, including television, radio, print, cinema, outdoor/places where children gather, digital media including social media and video sharing platforms (digisphere), influencers, native online marketing, mobile, games, consumer relationship marketing, viral marketing, apps, e-mail/SMS, Nestlé-owned websites, movie tie-ins, promotions, premiums, contests, product sponsorships, sampling, and point of sale.

• Additionally, the company has signed on to the India Pledge, whereby the company pledges not to advertise products to children below 12 years that do not meet the common nutrition criteria set by the alliance. However, these criteria are not publicly available, and limited information about the Pledge is available on the public domain.

• The company’s policy states that it prohibits direct advertising of confectionery and ice-cream as well as water-based beverages with added sugars to children under the age of 16.

• Nestlé India has a commitment not to use celebrities or influencers and other people with a strong appeal to children in their marketing for products intended for children.

• The company uses the industry best-practice audience threshold of 25% to limit its marketing of products to children across all media channels.

• The company’s Marketing Communication to Children policy states that marketers are required to be trained on the policy as part of their onboarding and take regular refresher training.

Aspects to improve

• The company is encouraged to disclose more information about the ‘India Pledge’ commitments, including the nutrient thresholds used to classify products as suitable to be marketed the children.

• The company is encouraged to strengthen its commitments on responsible marketing to children, including by :

— Adopting WHO-recommended age threshold for marketing to children of 18 years of age, in line with CCPA guidelines;

— Aligning its nutrition criteria for products considered appropriate to be marketed to children with the WHO SEAR nutrient profiling model ;

— Adding additional specific commitments to not use certain materials and techniques to market its products to children, including licensed characters, promotional toys and games, and depicting children on packaging.

• The company is encouraged to commission annual third-party audits of compliance to its Marketing Communication to Children policy in India, and to disclose the results of this audit in its Nestlé Creating Shared Value and Sustainability annual reports.

• Nestlé India has achieved the 5-star "Eat Right Campus" certification by FSSAI for some of its locations.

• Nestlé’s global #HealthyLives training program is also available in India and offers online courses and interactive exercises across four pillars: physical activity, sleep, nutrition, and mental health. Further, Nestlé India also has a program in place to support pregnant women in their workforce with their diets: the program includes access to a dietician and care during 9 months of pregnancy and continues for 3 months after child-birth. No clear targets were shared for these programs.

• The Nestlé “Know your numbers” program includes a health check program focused on assessing overall health profile of employees, combined with tailored advice on focus and attention for eating, nutrition, and exercise.

• The Nestlé Global Parental Support Policy applies to India, which offers secondary caregivers 4 weeks of fully paid leave.

• Each Nestlé facility with more than 50 employees offers a breastfeeding room and refrigerators. Nestlé India offers “pre & post maternity benefits”, such as flexible working arrangements.

Aspects to improve

• The company is recommended to define quantifiable and meaningful expected outcomes and targets for its workforce nutrition program and evaluate it accordingly - for example related to health-related behaviors, health-related outcomes, outcomes related to employee participation, or benefits to the company. Becoming a signatory of the Workforce Nutrition Alliance and utilizing its self-assessment scorecards could be a good first step in this regard.

• Nestlé India is recommended to offer a breastfeeding room and refrigerators for all office workers and production site workers.

• The company is also encouraged to develop a workforce nutrition program for its supply chain workers in India, starting with a needs assessment to identify those groups at highest risk of experiencing malnutrition. It can then engage with its supply chain partners and relevant civil society organizations to help reach these groups, further study the underlying causes of malnutrition in that specific context, and develop a tailored program to address their nutritional needs in a targeted manner. For more guidance, see the ATNI 2021 Action Research report and/or engage with the WNA.

• The company displays numeric information for key nutrients on the front-of-pack (FOP) for part of its relevant portfolio.

• The MyNestle.in website shows clear images of FOP and back-of-pack for most products, and for a considerable number of products also with nutritional information tables showing per 100g, per portion, and % GDA per portion information.

Aspects to improve

• Once it is formally enacted by FSSAI, if the INR FOP labeling system is on a voluntary basis, the company is strongly encouraged to adopt it across their entire portfolio in India.

• The company is recommended to implement features, such as portfolio-wide filter functions, on its website and/or e-commerce site to ensure that healthier varieties can more be easily identified and located by consumers. These should be classified as ‘healthy’ according to a government endorsed and internationally recognized NPM.

• Nestlé India follows the 'Nestlé Policy on Transparent Interactions with Public Authorities', published on its global website, which sets out clearly rules and expectations for individuals engaging with policymakers/government officials on behalf of the company. The policy explicitly applies to third-parties.

• This policy also states that “Nestlé employees must receive approval from their line managers before any [advocacy activities] are conducted for the first time. The appointment of a third party acting on behalf of Nestlé requires the same prior approval… Where applicable, prior consultation should also involve subject matter experts”.

• As part of its Business Responsibility and Sustainability Report (BRSR), the company states that it “works on public health agendas such as foods high in fat, salt and sugar (HFSS) and front of pack labelling (FOPL) with government/regulatory authorities taking into consideration interests of consumers” for the “development of balanced regulations”, disclosing the draft regulation in question of FOP labelling. It publicly states that its Board reviews this activity “as and when required”.

• The company also publicly lists six “[trade] associations and professional bodies that are engaged in policy advocacy” it is a member of in India. However, the company is also listed as a member on the websites of the Public Affairs Forum of India (PAFI) and the Protein Foods and Nutrition Development Association of India (PFNDAI), which are not disclosed by the company.

• On its global website, the company also states that it holds board seats on or are part of the leadership councils for the Federation of Indian Chambers of Commerce & Industry (FICCI) and the Confederation of Indian Industry (CII).

Aspects to improve

• The company is recommended to disclose the 'Nestlé Policy on Transparent Interactions with Public Authorities' policy on the India-specific website, or reference it explicitly in its reporting on the BRSR Principle 7, so it is easier for India-specific stakeholders to access and understand.

• While the company provides some indication of its specific engagements on nutrition-related policy in its BRSR, it is encouraged to be more transparent and specific about its position in relation to these policy developments, and ensure that it discloses comprehensively about its engagements with policymakers in India.

• The company is recommended to disclose the board seats it holds on trade associations in India in the same place as its disclosure about trade associations (i.e., in its BRSR).

• Nestlé India is also recommended to conduct a comprehensive review of its trade association memberships in India to ensure that each one is disclosed.

Sustainability

• The company reports quantitatively on its reductions in its Scope 1 and 2 emissions: between 2021 and 2022, this reduced from 206,379 tCO2e to 192,678 tCO2e, and from 112,879 tCO2e to 1,571 tCO2e respectively. The company also reports a commitment to achieve net zero by 2050, based on a 2018 baseline, and to reduce emissions by 20% by 2025 and 50% by 2030. However, these targets are global in scope.

• Regarding reducing plastic use and transitioning to more sustainable forms of packaging, the company reports a reduction in total waste (in metric tons, MT) from 2309 to 2237 between 2021 and 2022. The company also states that its work includes ”reducing our use of newly made (or virgin) plastic, piloting reuse and refill systems, expanding our use of paper packaging, and helping create well-functioning collection, [and] sorting and recycling schemes”.

Nestlé India’s parent company Nestlé S.A. was also assessed by World Benchmarking Alliance (WBA) in their Food and Agriculture Benchmark 2023, which can be found here: https://www.worldbenchmarkingalliance.org/publication/food-agriculture/rankings/environment/

Aspects to improve

• The company is encouraged to track its GHG emissions across its wider value chain (Scope 3) and set targets to reduce these.

• The company is encouraged to work with its value chain partners to reduce both FLW and plastic use. This should go beyond requirements set out in mandatory waste management regulations.

• The company is encouraged to ensure that its efforts to transition to sustainable forms of packaging in India are evidence-based, and correspond with clear quantitative sustainability outcomes.