Category B: Products

Formulating appropriate products (35% of overall score)

Category B consists of three criteria:

-

B1

Product Profile (20% of overall score)

-

B2

Product formulation (7.5% of overall score)

-

B3

Defining healthy and appropriate products (7.5% of overall score)

To perform well in this category, companies should:

B1 Product Profile

- Have a healthy product portfolio overall, measured objectively in the Product Profile using the Health Star Rating (HSR) Nutrient Profiling System (NPS)

- Have healthier products than other companies within the same product category

B2 Product formulation

- Commit to improving the nutritional quality of their products in India and have public reformulation targets in place to reduce nutrients of concern

- Introduce new healthy products and products to address undernutrition or specific micronutrient deficiencies

- Have a clear and robust approach to micronutrient fortification

B3 Defining healthy and appropriate products

- Adopt a robust and publicly disclosed NPS and apply it to all products in the Indian market

Indian context

The Government of India, and in particular the FSSAI, has made great progress in developing initiatives to tackle the double burden of malnutrition in India. The FSSAI’s initiatives address and involve the food and beverage industry, with a focus both on reformulating products to make them healthier and on staple product fortification to address micronutrient deficiencies.

The Eat Right Movement, launched in 2018 and led by FSSAI, is a collective effort, which incorporates both demand- and supply-side interventions, to promote the consumption of more healthy and safe foods. As part of the Eat Right Movement, companies have been encouraged to publish pledges that include commitments to reformulate their products by cutting down on salt, sugar, and trans-fats. Reducing these nutrients is critical to stem the growing challenges of overweight, obesity and diet-related chronic diseases in India.

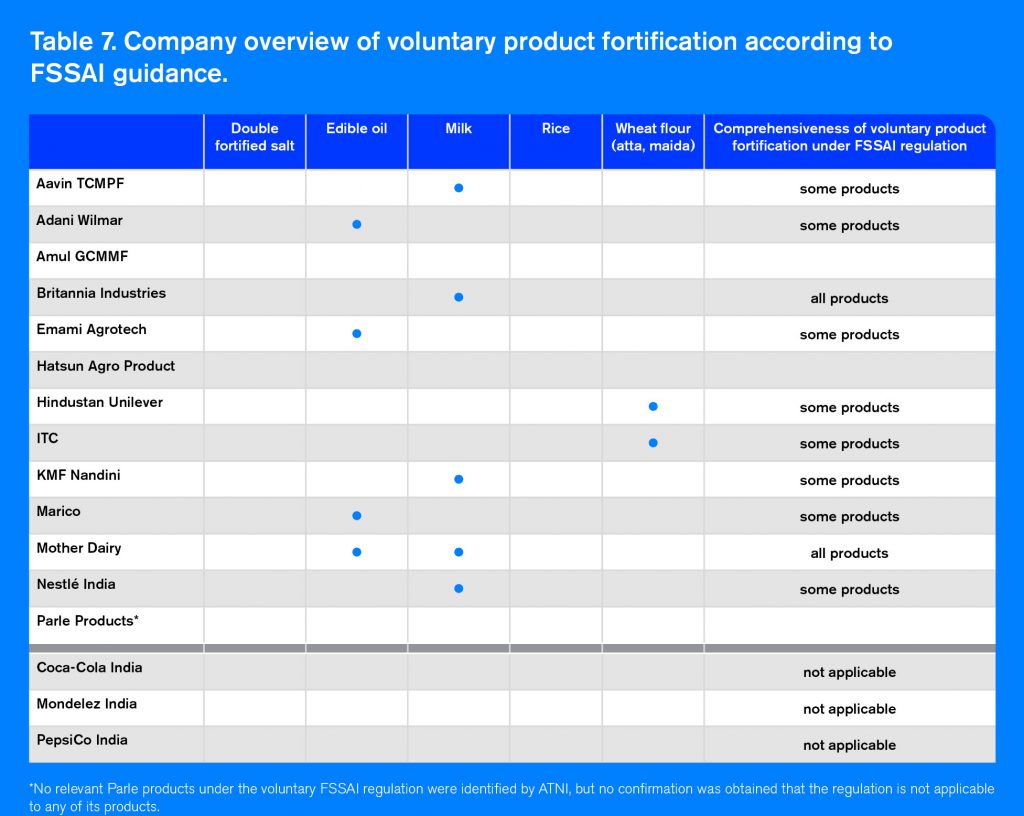

In October 2016, FSSAI drafted fortification standards for staple foods which came into force in August 2018 as the Food Safety and Standards (Fortification of Foods) Regulations, 2018. These standards are applicable to all food manufacturers that voluntarily fortify the following staple food products: wheat flour and rice (with iron, vitamin B12 and folic acid), milk and edible oil (with vitamins A and D) and double-fortified salt (with iodine and iron). Although fortification of these staple foods is voluntary, if companies decide to fortify staple food products, they have to comply with the minimum and maximum fortification levels and other aspects of the FSSAI regulation. When they do, the ‘+F’ logo has to be shown on the product package. The FSSAI guidance only covers staple foods and therefore does not address other types of products that may be fortified or micronutrient-rich. The fortification of other products is allowed under some conditions in India, but these cannot carry the ‘+F’ logo.

Why is formulating appropriate products even more crucial during the COVID-19 crisis?

- As highlighted in ATNI’s report on the impact of Covid-19 in India, India is the country with the third-highest mortality rate due to Covid-19 in the world. Even though more than 30% of India’s population is under 18 and thus likely to escape most of the virus’ direct health consequences, the economic impacts of the pandemic will surely take a toll on the whole population. Nutrition will be severely impacted as a consequence, amongst other basic needs.

- In this regard, companies must intensify their efforts to deliver healthier products and ensure rapid response to Government recommendations during these times. Further, it is fundamental that companies offer continued support and adherence to government programs such as POSHAN Abhiyaan (aimed at improving nutritional outcomes for children, pregnant women and nursing mothers), as the pandemic has threatened their success. Special attention should be placed on women nutritional needs, as they are disproportionally impacted by the economic consequences of the pandemic. Stunting and micronutrient deficiency is expected to increase also in the upcoming years, for which companies should intensify their efforts towards product fortification, as recommended by the FSSAI.

The India Spotlight Index 2020 research did not include indicators to score and rank companies’ responses to the COVID-19. But ATNI did talk to companies about their initial coping strategies and responses to the pandemic between March and June 2020 and ATNI has been tracking publicly available information on industry’s response globally to the COVID-19 crisis, including in India, and reported on trends, best practices and areas of concern in separate reports. Read more about how companies can positively contribute to addressing the global nutrition challenges in ATNI’s COVID-19 Project.

ATNI Covid-19 Project

Main Messages

- Nestlé India leads Category B with a score of 6.9 out of 10, followed by Hindustan Unilever (6.4), and PepsiCo India (5.4). Aside from their respective Product Profile results, these companies show better disclosure practices than most peers, have adopted an NPS and demonstrate evidence on their reformulation and innovation strategies, as well as fortification efforts, in alignment with national nutrition initiatives. The performance of these companies in this category contributes significantly to their overall performance in the Index.

- Of the 1,456 Indian food and beverage products assessed in the Product Profile across all companies, 16% achieve a HSR of 3.5 stars or more out of 5 and thus meet the ‘healthy’ threshold. An estimated 27% of the companies’ combined 2018 packaged foods and beverages retail sales value was derived from these healthy products. This is a modest increase on 2016, which may be partially attributed to improved data quality and the higher number of products assessed. A particularly positive development was that seven companies provided up-to-date product nutrition information to ATNI, four more than in 2016, contributing towards a more accurate assessment of the healthiness of packaged food and beverage products on the Indian market.

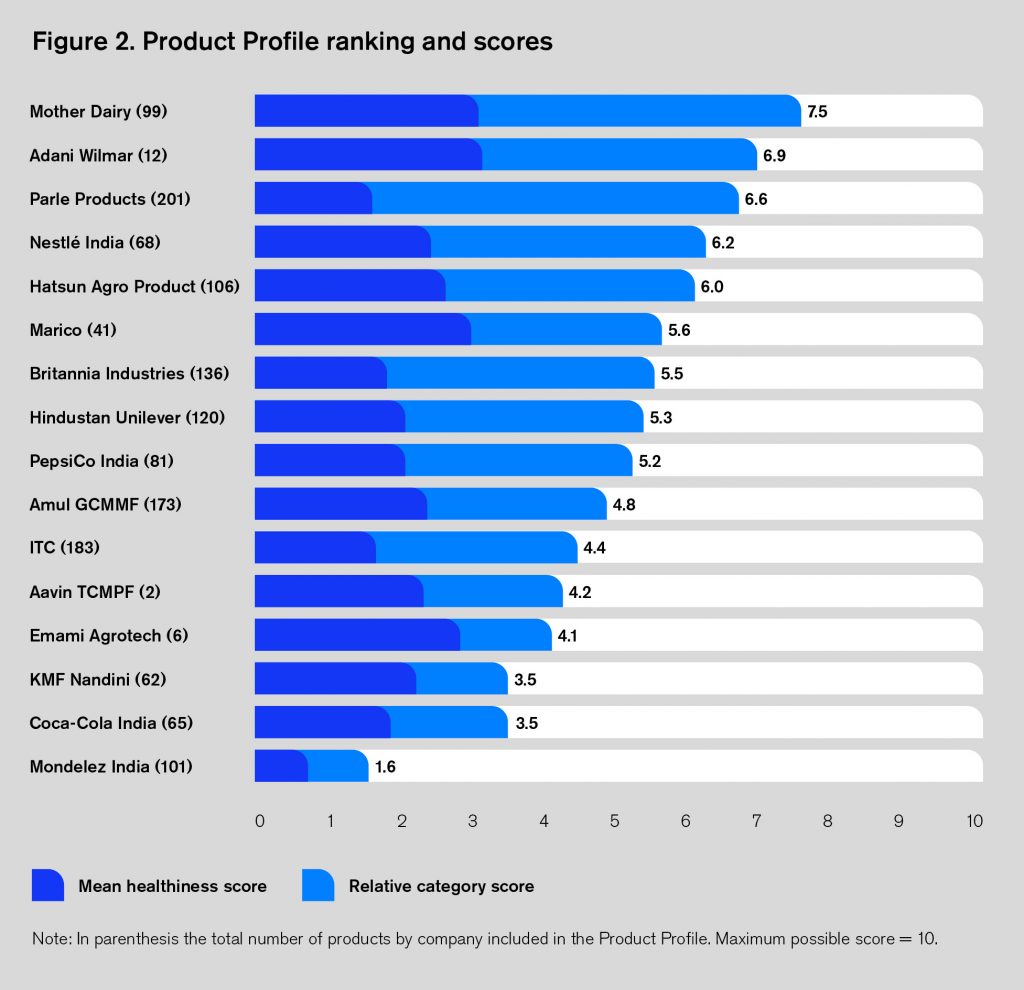

- Mother Dairy ranks first in the Product Profile with a score of 7.5 out of 10. Adani Wilmar performs best on the ‘mean healthiness’ score, achieving the highest sales-weighted HSR across its portfolio of Edible Oil products. Parle Products performs best in the ‘relative category’ score as it ranks better than its peers across three product categories: Savoury Snacks; Confectionary; and Sweet Biscuits, Snack Bars and Fruit Snacks.

- Companies have responded well to Government initiatives run by the Food Safety and Standards Authority of India (FSSAI) which focus on making products healthier and promote micronutrient fortification of staple products. In total, 10 out of 16 companies make relevant commitments to investing in or developing healthier products and six of those 10 companies have made a public pledge to the FSSAI on product (re)formulation. Ten out of 13 companies, for which staple food fortification is relevant, voluntarily fortify staple products according to FSSAI regulation to help address micronutrient deficiencies. Mother Dairy and Britannia Industries are the only two companies that voluntarily fortify all relevant staple foods in their portfolios.

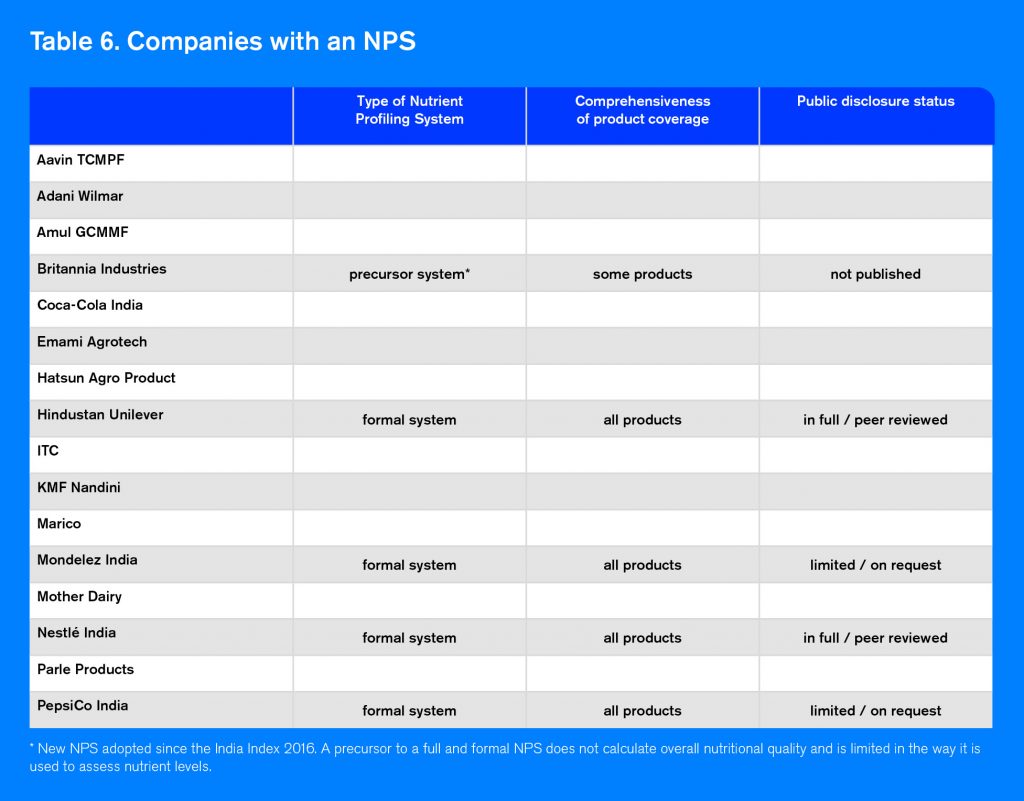

- In their efforts to develop a healthier product portfolio, companies are encouraged to adopt clear, time-bound product reformulation targets, define nutrition criteria for healthy products and report regularly and comprehensively on their progress. Currently, seven of the 16 companies have defined one or more reformulation targets to reduce nutrients of concern, and five have adopted an NPS to guide their activities. Britannia Industries has adopted and implemented a new NPS since the India Index 2016. None of the five companies benchmark their NPS against an internationally recognized NPS, such as the HSR and the healthy threshold of 3.5 stars or more.

Novelties and best practices

Hindustan Unilever’s approach to product reformulation, innovation and annual public reporting on progress in India

As part of its Unilever Sustainable Living Plan and focus on nutrition, Hindustan Unilever has defined and published its Highest Nutritional Standards (HNS) to define category-specific criteria for its healthy products. In addition, the company has published a pledge to FSSAI with reformulation targets to reduce sodium and calories in its products. Hindustan Unilever is the only Index-assessed company that annually reports on the percentage of Indian sales that are generated by products meeting its nutrition criteria (reported as sales volume), and thereby highlighting progress against its target to reach 60% HNS products by 2020.

The company also actively supports the aims of FSSAI. In June 2019, Hindustan Unilever received the Eat Right Award as recognition for its efforts to adopt healthy food choices whilst focusing on the delivery of safe and nutritious food. Further, it was recognized by FSSAI for reducing the levels of salt, sugar and saturated fat in its products.

Mother Dairy fortifies all milk and edible oil products according to FSSAI guidance

Mother Dairy has committed to tackling undernutrition and micronutrient deficiencies in India by placing a strategic focus on food fortification and reformulation. Currently, the company voluntarily fortifies its entire range of milk and edible oil products according to FSSAI’s Fortification of Foods standard. This makes it one of only two companies to voluntarily fortify all products covered by FSSAI guidance in their portfolio. These products are sold under brand names Mother Dairy and Dhara. In addition, Mother Dairy focuses on improving nutrition by selling healthy fruit and vegetable products and having introduced low-sugar variants of its Mishti Doi Lite and Dietz beverages.

Britannia Industries’ new NPS

Britannia Industries’ nutrition guidelines are incorporated in the ‘Britannia Health and Wellness Nutrition Profiling System,’ newly developed since the India Index 2016. The guidelines are part of Britannia Industries’ overall nutrition strategy to define guidelines for its product development and reformulation, as described in the Britannia Nutrition Policy. The NPS takes into account levels of sugar, fat, saturated fat, trans fats and sodium, along with positive nutrients like dietary fiber, whole grains and micronutrients.

India Index 2020 Product Profile

The Product Profile is an objective assessment of the nutritional quality of the packaged foods and beverage market in India. The Product Profile analyses the ‘healthiness’ of food manufacturers’ products using the HSR system, which is determined by the levels of energy, saturated fat, salt and sugar, the content of fruit, vegetables, nuts, legumes and the quantities of other components like protein and fiber. New to the 2020 iteration of the Product Profile is the relative performance analysis which compares companies that market products in the same categories.

The internationally recognized HSR system, in use and endorsed by governments in Australia and New Zealand, is used to analyze all products to assign a score between 0.5 and 5 stars.

The healthy threshold (having an HSR of 3.5 stars of more) categorizes products into those that are considered healthy and those that do not meet the threshold. ATNI commissioned an independent organization – The George Institute for Global Health (TGI) – to execute the nutrient profiling element of the Product Profile. More details on the methods, results, and limitations of the study are available in TGI´s report here. An analysis of the products found to be suitable to be marketed to children according to the World Health Organization (WHO) South-East Asia Region (SEAR) criteria will be described in Chapter D.

The score is made up of two scored elements; each with an equal weight in the final score:

- Mean healthiness score: a representation of the nutritional quality of each company’s overall product portfolios (the sales-weighted mean HSR).

- Relative category score: a representation of the companies’ product categories’ performance against peers that sell products in the same category (based on the ranking within product categories).

Nutrition information for a total 1,495 packaged foods and beverages products sold by the 16 companies of the Index were initially selected to be included in the Product Profile. These products represented an estimated retail sales value of more than INR 1,800 billion in 2018, which accounted for a little over 30% of all Indian food and beverage sales.

The Product Profile captures the majority of the 2018 estimated retail sales for most companies. It is important to point out that for Hindustan Unilever, between 30 and 40% of the company’s 2018 retail sales in India is covered in the Product Profile; the company derived a significant proportion of its sales from products excluded from the assessment, for example, packaged tea, coffee and wheat flour products. Similarly, for Nestlé India, the Product Profile covers 60-70% of the company’s estimated 2018 retail sales, as the HSR system does not apply to packaged baby foods and coffee .

Therefore, the Product Profile only assesses the healthiness of a part of the overall product portfolios for both companies. The percentage of each company´s 2018 sales covered in the Product Profile, the categories selected, and the total number of products assessed for each company are shown in Table 1.

The total number of products assessed for each company ranged from two for Aavin TCMPF to 202 for Parle Products. Only two products could be assessed for Aavin TCMPF because the nutrition information necessary to conduct the analysis for the remaining products was insufficient. In total, of the 1,495 products initially selected, sufficient information was available for 1,456 products across all companies for assessment using the HSR system.

What percentage of the companies’ products sold in India are healthy?

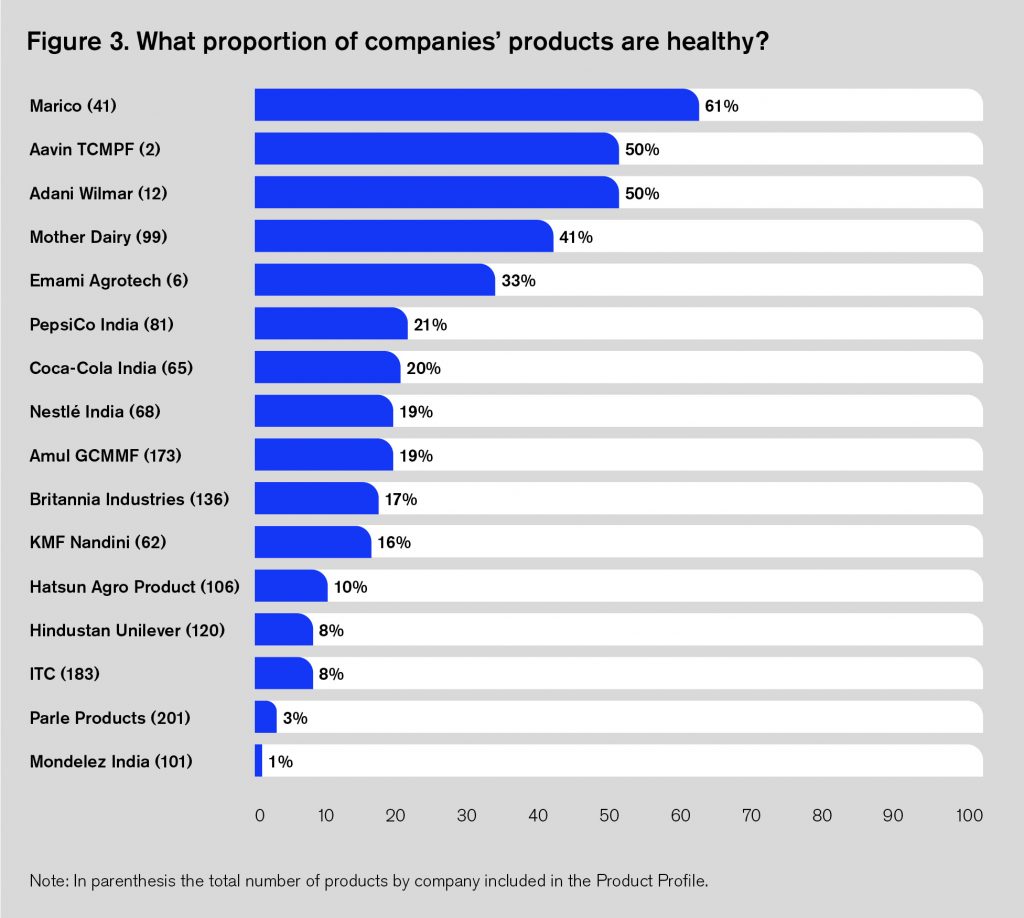

The Product Profile found that out of all products analyzed, 16% met the healthy threshold, (having a HSR of 3.5 or more). The average HSR for all companies’ products combined was low (1.9 out of 5). These results illustrate the need for much greater commitments to product formulation and innovation to improve the nutritional quality of packed foods and non-alcoholic beverages in India.

Although it is not a scored element of the Product Profile, Figure 3 provides an overview of the percentage of products, by number, that meet the healthy threshold for each company. The results of this assessment may be influenced by the number of products in the analysis, especially if the number of products for which sufficient nutrition information is limited. For most companies (9 out of 16) between 10% and 49% of their product portfolios meet the healthy threshold.

The company with the overall highest proportion of healthy products is Marico, with 25 out of 41 products meeting the healthy threshold (61%), followed by Aavin TCMPF, with one out of two products meeting the healthy threshold (50%) and Adani Wilmar, with 6 out of 12 products meeting the healthy threshold (50%). It should be noted that for Aavin TCMPF, insufficient nutrition information was available for 16 products, rendering the analysis inconclusive regarding the healthiness of their full portfolio. Nutrition information was insufficient for only one product of Adani Wilmar and for none of Marico’s products.

With sales-weighting incorporated into the analysis, an estimated 27% of total 2018 sales are attributed to products that meet the HSR ‘healthy’ threshold. Mother Dairy is estimated to have derived the largest proportion (53%) of its 2018 retail sales from healthy products. Nevertheless, for most companies, the estimated healthy product-derived sales are low, with four estimated to have derived less than 10% of their 2018 retail sales in India from healthy products.

Product Profile company findings

- Mother Dairy leads the Product Profile with a score of 7.5 out of 10, before Adani Wilmar (6.8) and Parle Products (6.7). Mother Dairy is active in product categories that score relatively well overall (Dairy, Edible Oils, Processed Fruits and Vegetables). The company ranks second for both the mean healthiness score (6.1 out of 10) and relative category (8.8 out of 10) score of the Product Profile. Mother Dairy is estimated to have generated 53% of its 2018 sales from products meeting the healthy threshold – the highest proportion among companies assessed.

- Among companies from the edible oil industry segment, Adani Wilmar ranks first in the Product Profile with a score of 6.8 out of 10, followed by Marico (6.5) and Emami Agrotech (4.1). Of all companies assessed in this Index, Adani Wilmar achieves the highest sales-weighted mean HSR of 3.1, resulting in a mean healthiness score of 6.2 out of 10. When compared to the other four companies that sell edible oils in India (as part of their top-selling categories), Adani Wilmar achieves the second highest mean HSR of 3.1 out of 5 in the category and the highest among companies from the edible oil industry segment.

- Among companies from the dairy industry segment, Mother Dairy is the top performer (7.5 out of 10), followed by Hatsun Agro Product (6.0), and Amul GCMMF (4.8). Mother Dairy’s products in the Dairy category achieve a higher mean HSR (3.0) than the other companies within the dairy industry segment. Furthermore, its non-dairy sales are mostly derived from two relatively healthy categories, Edible Oils and Processed Fruit and Vegetables, and to a lesser extent from the less healthy Ice Cream and Frozen Desserts category.

- Among companies with a mixed product portfolio, Parle Products leads the Product Profile with a score of 6.6 out of 10, followed by Nestlé India (6.2) and Britannia Industries (5.5).

- Parle Products performs relatively well in the Product Profile thanks to ranking first in the relative category score. The company’s products in all three categories selected for assessment (Confectionery; Savoury Snacks; and Sweet Biscuits, Snack Bars and Fruit Snacks) achieved a higher mean healthiness score than its peers. Although the variation in HSR scores across companies was limited in these categories, Parle Products’ Confectionery and Savoury Snacks products scored best in relation to the respective category averages. Parle Products’ Confectionery products have low levels of saturated fat compared to products from other companies.

How healthy are companies’ product portfolios?

One of the scored elements in the Product Profile is an assessment of the companies’ overall product portfolio ‘healthiness.’ A score of 7 or more for this element would indicate that a company’s portfolio consists of ‘healthy’ products on average..

Companies such as those in the dairy or edible oil industry segments that manufacture products within healthier categories are expected to perform better. That is why this Index also measures the relative category scores (explained in the next section).

- Overall, the average HSR was low at 1.9 stars out of 5.0 for all companies combined. Before sales-weighting, there is substantial variation in the average HSR among companies, ranging from 0.6 for Mondelez India to 3.5 for Marico. After sales-weighting, the average HSR ranges from 0.5 for Mondelez India to 3.1 for Adani Wilmar.

- Companies in the edible oil industry segment perform relatively well in the mean healthiness assessment as they derive most of their estimated sales from this category alone. Adani Wilmar shows the highest sales-weighted mean healthiness score (6.2 out of 10); the analysis was based on 12 Edible Oil products, which achieved a mean HSR of 3.1 out of 5.

- Mother Dairy (6.1 out of 10) is the second-best performing company in the mean healthiness assessment. Although Mother Dairy’s overall HSR is higher than Adani Wilmar’s for its Edible Oil products (3.8 out of 5), the company is estimated to have derived much less (between 10-20%) of its 2018 retail sales from this category. Mother Dairy also markets products in less healthy categories including Ice Cream and Frozen Desserts. Therefore, after applying sales-weighting, Adani Wilmar is the top-performer in the mean healthiness assessment with a score of 6.2 out of 10.

- Mondelez India shows the lowest mean healthiness score (1.1 out of 10) as its portfolio of 101 products (73%) comprises predominantly of confectionery items.

How healthy are companies’ products within a category compared to those of their peers?

The second scored element of the Product Profile is an assessment of the companies’ relative category performance against their peers within the same category. Category subsets where there are significant differences in the mean HSR of company products indicate big opportunities for companies’ to improve their relative performance.

- Parle Products is the top performer in this element of the Product Profile, ranking first in all three product categories in which it competes with one or more peers (Confectionery; Savoury Snacks; and Sweet Biscuits, Snack Bars and Fruit Snacks). Parle Products therefore achieves the maximum relative category score of 10. The next best performing company in this scored element is Mother Dairy, which ranks first among its peers in the Edible Oils category, joint second in the Dairy category and third for Ice Cream and Frozen Desserts.

- For the relative category score, the best performing company in the dairy industry segment is Mother Dairy (8.8 out of 10), followed by Hatsun Agro Product (6.8 out of 10). For the companies in the edible oil industry segment, Adani Wilmar performs best (7.5 out of 10), followed by Marico (5.2 out of 10) and Emami Agrotech (2.5 out of 10).

- There is considerable variation in the mean HSR values between different companies within the same product categories (e.g. ranging from 2.2 to 3.5 in the Dairy category, from 2.8 to 3.8 in the Edible Oils category, and from 1.4 to 2.2 for Ice Cream and Frozen Desserts). These results demonstrate that relatively low-scoring companies have an opportunity to improve the healthiness of their products marketed in India.

Companies with a lower average ‘healthiness’ score in a given category are encouraged to step up their efforts to reformulate these products and to develop new healthy products. Detailed results can be accessed in Table 2.

In the previous India Index completed in 2016, the Product Profile analyzed 918 packaged food and beverages sold by 11 large manufacturers in India. The mean healthiness score was found to be low overall at 1.9 out of 5. Although five new companies (Aavin TCMPF, Adani Wilmar, Emami Agrotech, Hatsun Agro Product and Marico) and more products (1,456) were assessed for this Product Profile, the mean healthiness score remained the same.

In 2016, approximately 16% of the products were found to meet the healthy threshold which, again, is the same proportion as the 2020 Product Profile. Among the companies that were assessed for both Indexes, the estimated sales from healthy products increased from 15% in 2016 to 23% in 2020. However, no increase was found in the percentage of healthy products within the companies’ portfolios.

Changes in the companies’ weighted and unweighted mean HSR between the 2016 and 2020 Product Profile results are compared in Table 3.

For most companies, the number of products selected for the 2020 Product Profile is significantly higher than in 2016. PepsiCo India is one of the exceptions, with fewer products analyzed in the 2020 Product Profile. Despite this, the company shows the largest improvement in the sales-weighted mean HSR score, improving from 1.2 to 2.1 out of 5.

TGI’s detailed report on the 2016 and 2020 Product Profile results can be found here. Access the 2016 Product Profile results here.

Product Profile findings show that food and beverage manufacturers in India can and must do much more to improve the overall nutritional quality of their product portfolios, and offer Indian consumers more healthy options. Companies are encouraged to:

- Provide more nutrition information on their labels beyond that required by local regulations. The presentation of this information should align with Codex Alimentarius standards and guidelines to allow for more comprehensive and accurate Product Profile analysis. Companies are encouraged to engage with ATNI to further improve the accuracy and comprehensiveness of the Product Profile.

- Adapt and publicly disclose a stringent NPS to guide new product development, product reformulation and innovation.

- Accelerate reformulation efforts to improve the nutritional quality of products and increase the proportion of marketing efforts dedicated to healthier categories to amplify public health impact.

- Adopt and define India-specific SMART targets (Specific, Measurable, Achievable, Relevant and Time-bound) for key nutrients critical to public health – e.g. reductions in sodium – and improve accountability through better reporting.

Product Profile results from the analysis of the products found suitable to be marketed to children, according to the WHO SEAR criteria, can be found in Category D.

B2 Product formulation and B3 Defining healthy and appropriate products

- In response to FSSAI’s calls as part of the Eat Right India Movement, six of the assessed companies have made a public pledge that is published on FSSAI’s website. These pledges all contain one or more product reformulation target to make products healthier (according to their own criteria or definitions). Some companies have made other commitments as well, e.g. regarding responsible marketing to children or influencing consumers to lead healthier lifestyles.

- Four other companies have made similar commitments regarding product reformulation and developing new healthy products in general, or related to products suitable to address micronutrient deficiencies and undernutrition. Therefore, in total, 10 of the 16 assessed companies make relevant commitments regarding healthy products. An overview of companies that have published a pledge or commitment is shown in Table 4.

- In addition to forward-looking commitments, it is important to assess what evidence companies provide of having delivered healthy products through reformulation or new product development. Only one of the companies reports annually on the percentage of healthy products (as the percentage of sales volume) that are sold in India: Hindustan Unilever reports on the percentage of products that meet its HNS criteria.

- On a positive note, 11 companies report having introduced new healthy products in the last 3 years, showing that the majority of the companies assessed are focusing on improving the healthiness of their product portfolio in this way. An overview of this information is shown in Table 4. Although this development is not yet positively reflected in improved Product Profile outcomes, companies should maintain their focus in this area and increase the sales of their (new) healthy products.

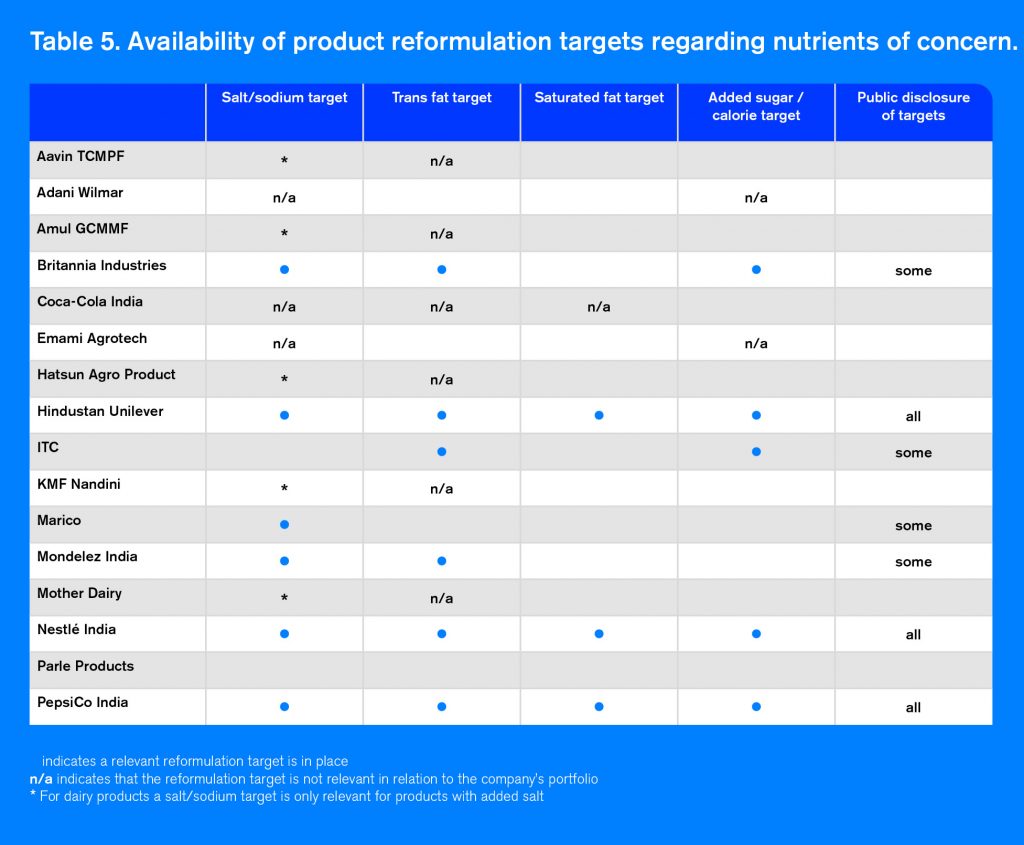

- In line with FSSAI’s focus on reducing salt, fat and added sugars, ATNI assesses whether companies have product reformulation targets in place to reduce these nutrients, distinguishing two fat-related targets – to eliminate industrially-produced trans fat and to reduce saturated fat. An overview of nutrient reduction targets currently in place for 7 out of 16 companies is shown in Table 5. Hindustan Unilever, Nestlé India and PepsiCo India stand out in this overview, as they have all four relevant targets (to reduce salt, added sugar, trans fat and saturated fat) in place and disclose them publicly. Britannia Industries has developed new product reformulation targets since the 2016 India Index, whilst ITC and Marico also have relevant targets in place (none of which were assessed in 2016). All companies could further improve transparency by making their targets fully externally verifiable.

- Depending on the companies’ product portfolios, not all reformulation targets are relevant for all companies. For example, although there are some naturally occurring trans fats in dairy and meat products, a trans fat reduction target is only relevant with regard to industrially produced trans fat. A total of 6 out of 10 companies, for which this is relevant, have a trans fat target, and 6 out of 13 have a salt reduction target. However, the number of targets related to reducing added sugar and saturated fat is much lower. Overall, the 16 companies have defined 20 targets out of a possible total of 49.

- Of the five companies with an NPS, Nestlé India, Hindustan Unilever, PepsiCo India and Mondelez India have explicit nutrition criteria to define healthy products; these criteria are applied to all of their products. However, none of these companies benchmark their definition of healthy products against the HSR system or equivalent systems.

- When making commitments to introduce healthy products, it is important that companies clearly define what a healthy product is using objective nutrition criteria. Five of the assessed companies have adopted an NPS to do so. An overview of the main characteristics of these companies’ systems is shown in Table 6.

- Hindustan Unilever, Mondelez India, Nestlé India and PepsiCo India have adopted a formal NPS that covers all of their products on the Indian market. Hindustan Unilever and Nestlé India perform best by publishing their full NPS on their own websites as well as in peer-reviewed journals.

- Britannia Industries is the only India-headquartered company that has adopted an NPS, which they introduced following the India Index 2016. Currently, the company refers to general aspects of its NPS in its nutrition policy, but details have not been disclosed publicly.

- Although companies could adopt the HSR system or another internationally recognized NPS that is endorsed by governments or relevant authorities, ATNI recognizes that there are reasons why companies develop or adopt other systems that may be tailored to their specific product ranges, featuring more specific or detailed product reformulation-related parameters. To ensure the appropriateness and comparability of the companies’ systems, ATNI assessed whether the companies benchmark their NPS and/or nutrition criteria against the HSR (using the healthy threshold of 3.5 stars or more) used in the Product Profile. None of the companies were found to benchmark their NPS against the HSR system or any other internationally recognized NPS.

- There has been a strong industry response to the Food Safety and Standards (Fortification of Foods) Regulations which were operationalized in October 2016. Ten of the companies assessed voluntarily fortify at least some of their staple products that are covered by the regulation. Two companies, namely Britannia Industries and Mother Dairy, fortify all of the relevant products within their portfolio. Three companies (Coca-Cola India, Mondelez India and PepsiCo India) confirmed that they do not sell any staple products covered by the regulation, rendering this point not applicable to them.

- Amul GCMMF, Hatsun Agro Product and Parle Products are the only three companies not showing evidence of voluntary fortification according to FSSAI guidance. Parle Products might not have relevant staple products in its portfolio, but ATNI was unable to verify this.

- The most commonly sold voluntarily fortified staple products are milk and edible oils with added vitamin A and D; five Index assessed companies were found to fortify their milk, and four their edible oils. Two companies fortify wheat flour, but no evidence was found of companies selling double-fortified salt or fortified rice. It is not clear which of the assessed companies sell these products, if any at all. An overview of companies and their voluntary fortification of staple products according to FSSAI guidance is shown in Table 7.

- Many of the products that companies sell are not covered by the FSSAI regulation, but it is important that all product fortification is done according to sound scientific principles. The following seven companies committed to using international guidance on fortification (i.e. CODEX CAC/GL 09-1987 or equivalent): Britannia Industries, Coca-Cola India, Hindustan Unilever, Mondelez India, Mother Dairy, Nestlé India and PepsiCo India.

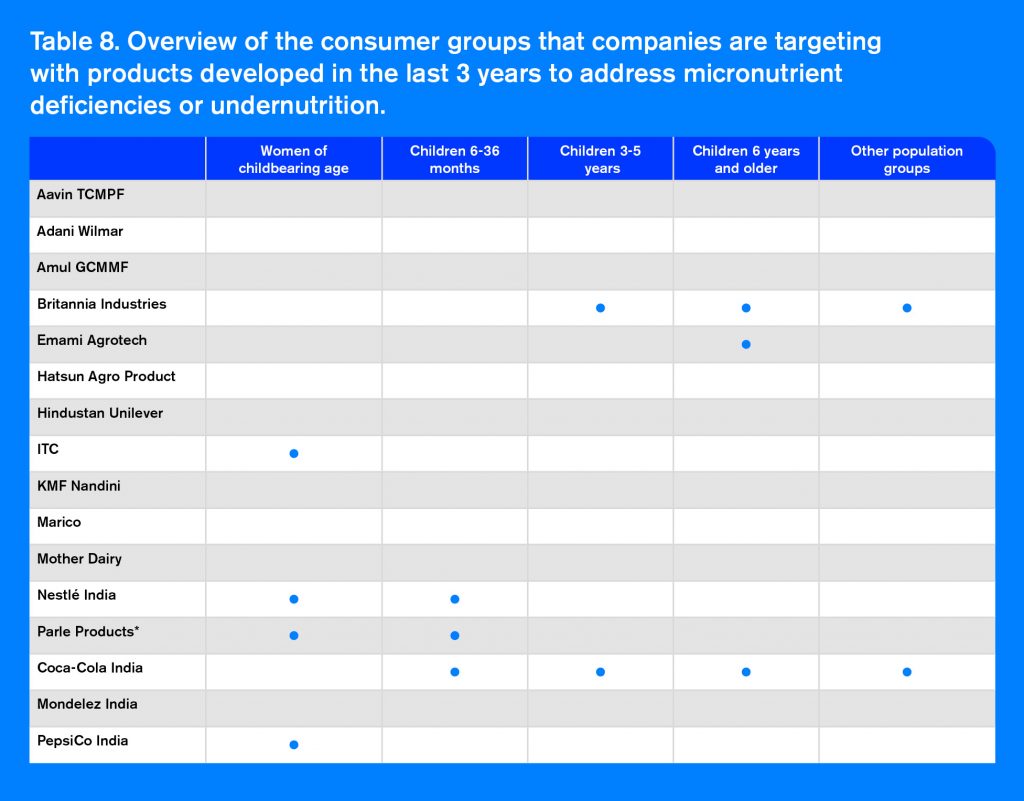

- The same seven companies have introduced new fortified products, or other products that specifically address undernutrition or micronutrient deficiencies, in the last 3 years. Table 8 provides an overview of population groups that the new products are targeted towards to help address the nutritional issues they face. On aggregate, women of childbearing age and children between 6 and 36 months are the most commonly targeted groups, with the strongest focus on reducing iron deficiency in relation to anaemia among women of childbearing age.

To improve and accelerate their healthy product formulation efforts, food and beverage manufacturers in India are encouraged to:

- Make a public pledge with FSSAI, showing their explicit support for this important Government initiative in India and their assistance to FSSAI’s efforts to inform and educate the public.

- Define a set of product reformulation targets that cover all products and all nutrients of concern relevant to their product portfolio, as Hindustan Unilever, Nestlé India and PepsiCo India have done. It is important that product formulation and reformulation are addressed comprehensively at the portfolio level to ensure that all company products becomes healthier over time, rather than improving the healthiness of selected products or product categories only.

- Publicly disclose the percentage of their product portfolio that meets their criteria for healthy products in India, as Hindustan Unilever does, to improve transparency about progress towards increased product healthiness. Similarly, companies could highlight their efforts to innovate in this regard by publishing comprehensive lists of newly introduced healthy products.

- Adopt an NPS to define which products are considered healthy using objective nutrition criteria. To ensure the appropriateness and comparability of companies’ definitions of healthy products, all companies should consider benchmarking their NPS and/or nutrition criteria against the HSR (using the healthy threshold of 3.5 stars or more) or another internationally recognized NPS.

- Fortify all staple products within their portfolio that are covered under FSSAI guidance (with their first priority being to ensure good alignment with local priorities and the Government’s work). For other fortified foods and beverages, companies should always ensure compliance with relevant Codex Alimentarius (General Principles for the Addition of Essential Nutrients to Foods) and WHO/Food and Agriculture Organization of the United Nations (Guidelines on Food Fortification with Micronutrients) guidance.