ATNI Covid-19 Project

The Access to Nutrition Initiative (ATNI) is committed to improving the food industry’s contribution to addressing the world’s nutrition challenges, leveraging its power to provide accessible and affordable healthy food to all. This accountability is essential during the Covid-19 pandemic, as food systems and families struggle to adapt to unprecedented circumstances – and it is also the start of a unique and urgent opportunity to reorient the food system to a more healthy, equitable and sustainable future: a chance for the world to build back better.

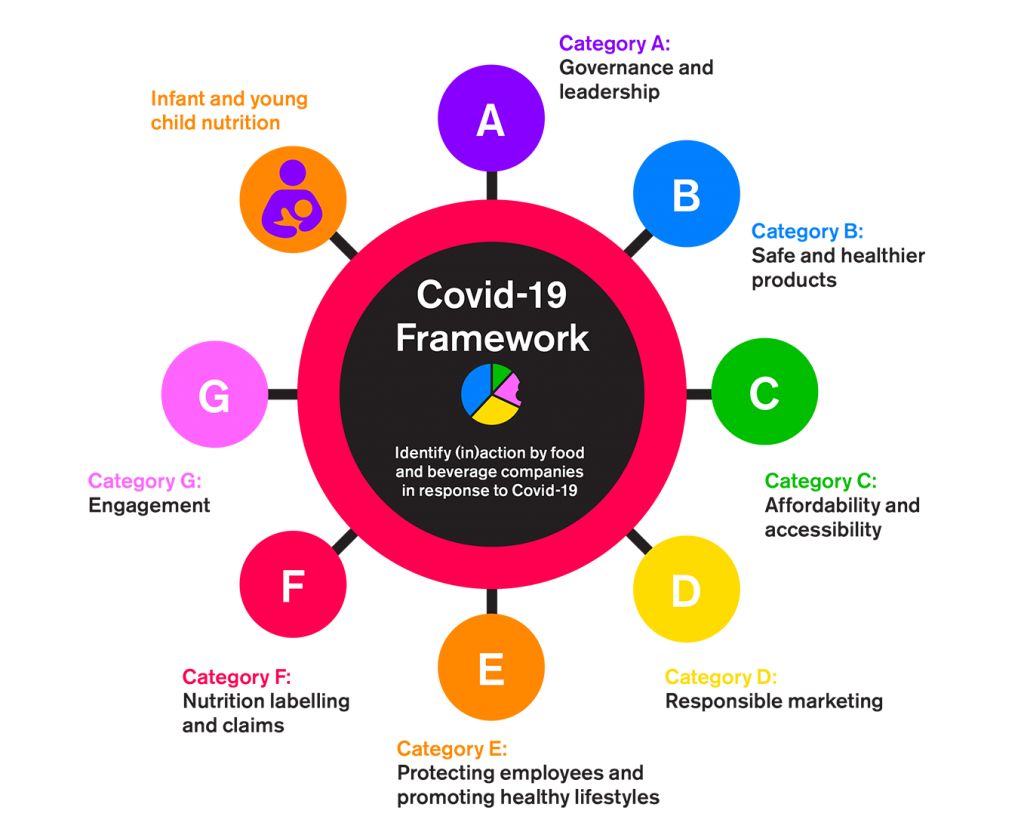

ATNI has developed a Framework to identify action (and inaction) by food and beverage manufacturers in response to the crisis, adding an explicit Covid-19 lens to ATNI’s existing assessment of companies.

In July 2020, ATNI published the first in the ATNI Covid-19 report series: the research Framework and it’s aims.

Download the first quarterly report

On World Food Day 2020, ATNI published the second report, an assessment of 39 companies globally.

Download the second quarterly report here

In February 2021, ATNI released the third report, an analysis of Covid-19 impacts in India, Mexico, and Nigeria.

Download the third quarterly report here

In July 2021, ATNI published the fourth and last report, including a comprehensive list of recommendations.

Before the Covid-19 pandemic, the world was already facing a triple burden of malnutrition – 820 million people in the world living without sufficient food, 2 billion suffering micronutrient deficiencies and 2 billion estimated to have overweight or obesity – which is now being exacerbated by Covid-19. The pandemic is further undermining nutrition security, particularly among vulnerable groups and in the poorest countries of the world, and exposes the fragility of local and global food systems. Every percentage drop in global GDP is expected to result in an additional 700,000 stunted children, and the World Food Program estimates that a further 130 million people will be pushed into acute hunger in 2020. Ensuring access to safe, nutritious food and promoting breastfeeding should be core to food and beverage companies’ responses to the pandemic – and beyond.

Analysis done as part of this project will enable stakeholders – including companies, investors, policymakers, NGOs, citizens, nutrition professionals and public health experts – to understand the actions of major food and beverage manufacturers worldwide and act as a best-practice guide.

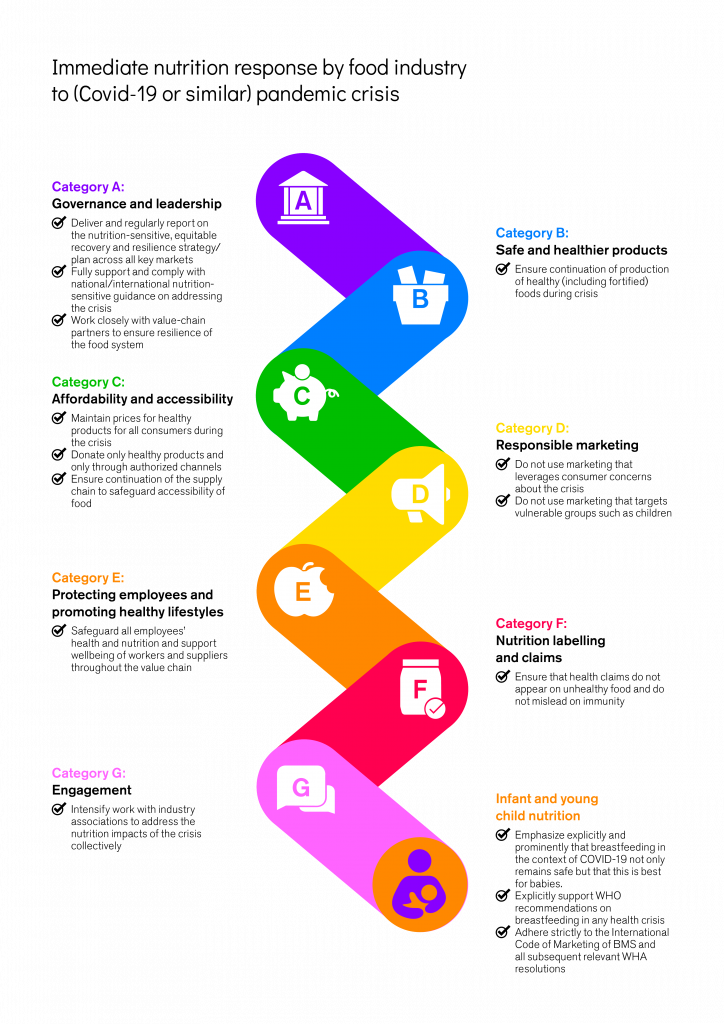

It enables a systematic assessment of all companies’ strategic commitments, product formulation and marketing, accessibility and affordability of products, support for employees and supply chain partners, and whether, during the crisis, baby-food manufacturers are marketing the products in line with the International Code of Marketing of Breast-milk Substitutes (BMS).

The Framework provides the basis for ATNI’s analysis of the food and drink manufacturing sector throughout the Covid-19 crisis. ATNI reports findings in quarterly reports, with each report focusing on a specific aspect of the response, for example in a regional snapshot.

In addition, the structure established by the Framework will contribute an important extra layer to all of ATNI’s products (including the Global Index and country Spotlights), for as long as Covid-19 and its repercussions continue: this is not a short-term addition to ATNI’s work, but a longer term pivot towards the new normal, whatever form that takes.

As the crisis develops and new information emerges, ATNI is maintaining open and ongoing communication with relevant stakeholders, including the food and beverage manufacturers, to consider their main concerns and recommendations.

The aim is for the outputs of this project to be used as an accountability tool:

- to examine and better understand the role of the private sector in light of the Covid-19 crisis and the global malnutrition context;

- to inform existing monitoring/ accountability mechanisms to measure companies’ contribution to food systems in crisis contexts such as Covid-19, and;

- as a source of best-practice on which food and beverage companies and other nutrition stakeholders can draw.

In contrast to ATNI’s other work, the project will not lead to a benchmark or Index nor will it provide a comprehensive overview of everything companies did or are doing in response to Covid-19. Instead, it is an instrument that will give ATNI and other stakeholders insights into the reactions of the food industry, identifying areas to scale up and flagging areas of concern.

ATNI Covid-19 Framework

The Framework comprises indicators spanning eight categories, which have been adapted from the existing methodology for ATNI’s Global Index, and draws on the international guidance that has rapidly emerged since the start of the Covid-19 pandemic. It takes a ‘nutrition-sensitive’ approach, to focus primarily on activities that address the immediate and underlying factors affecting nutrition outcomes, while going beyond in some categories to consider broader actions that influence the health and wellbeing of food systems and people everywhere.

This includes mitigating supply-chain disruptions, supporting small and medium-enterprises and donating or distributing personal protective equipment. As food and beverage companies continue to develop their responses to the crisis, this approach will enable ATNI and others to follow the ways in which activities and programmes inform companies’ longer-term strategies and action.

The primary focus of the Framework will be the food and beverage companies that ATNI’s Global and Spotlight Indexes have assessed: the world’s 25 largest food and beverage manufacturers, and the 11 largest manufacturers in the United States and 16 in India. ATNI will also collate the actions by baby-food manufacturers, focusing on the 10 companies included in the forthcoming ATNI Global Index. Each of the total of 39 companies’ websites will be monitored by ATNI’s analysts using the indicators within the Covid-19 Framework and the companies will be encouraged to provide to ATNI further information on their Covid-19 response.

In addition, where resources permit and/or when selected third-party sources might point to strong cases by companies beyond the 39 manufacturers, action by other companies or country subsidiaries will be included, including an anticipated focus on key developing markets. ATNI has, since April 2020, been undertaking research into the impacts of Covid-19 to achieve this broader understanding of the actions of other food companies. This is more light touch, delving regularly into a wide variety of third-party sources.

Full ATNI Covid-19 Framework

ATNI published the second report in the Covid-19 Report series on World Food Day 2020 (16th October). The report presents unique and distinct findings that depict if and how food manufacturing companies’ nutrition strategies and approaches have been adapted to the fast-changing Covid-19 realities over the first six months of the pandemic (to the end of August 2020).

The research highlights that companies have quickly responded to shocks along their supply chains and have adapted to rapidly changing consumer behaviours – for instance by expanding e-commerce platforms and setting up direct-to-consumer channels. Most Covid-19 responses by food and beverage companies, however, still appear as short-term, ad-hoc measures rather than long-term, targeted actions.

Consumer trends and the financial bottom line: There has been a dramatic shift in eating habits, particularly during lockdown, with a decline in eating out and takeaway and a move away from ready meals towards homecooked food, which played out in financial results of many companies. There is also increased consumer engagement on the benefits of good nutrition for individual health – for example, the perceived impact of certain product types (such as the dairy sector in Asia) in relation to immunity and Covid-19.

Strategic response: The companies’ financial reporting demonstrates a rapid reaction to the Covid-19 crisis, but an explicitly nutrition-sensitive strategic response has been much less evident. Few of the companies analyzed by ATNI have seized the opportunity to convert their initial responses on issues such as employee health and donations – typical of the early stages of the pandemic – into longer-term, targeted actions. Most reporting is limited to short sections on websites and financial reports, but ATNI acknowledges that companies’ interventions might have gone above and beyond the actions that have so far been publicly disclosed.

Health of the workforce: The food and beverage manufacturers in scope for this project employ over 2 million people worldwide. Employee safety is one of the most reported areas of corporate action in response to Covid-19, with about a third of the companies analyzed following good practice in publicly reporting on complying with national/international guidance in relationship to Covid-19 and the workplace. However, only a few companies were found to reiterate or enhance existing commitments to support parents and breastfeeding mothers in the workplace. Overall, it is not yet clear how long-lasting support for employees will be, particularly for frontline workers – for example, whether it will lead to improved pay and other standards over time.

Resilience in the value chain: Covid-19 has put the value chains of the food manufacturers under very significant strain, but the impact for food systems has not fallen equally worldwide and in some regions supply chains have regained their resilience. Companies have published a range of initiatives to support small and medium-sized (SME) suppliers and smallholders, who need particular support during the crisis and beyond. Were all the major food manufacturers to roll these out globally, this would be likely to make a very significant difference to the ability of the value chain to withstand future shocks. However, there has sometimes been a lack of update on these schemes, and often with no indication of their duration.

Donations: Donations – both financial and in-kind – stood out as being a frequent (and frequently reported) aspect of companies’ response. Where donations are of products, it is often not clear whether these are of nutritious products. It is also often unclear how much has been donated (and amounts vary widely), whether donations have been topped up over time, or what has been the impact of the donations on the recipient communities. ATNI would welcome a structured approach to reporting on donations, which places sustainable and healthy diets at its heart.

E-commerce: There has been a rapid shift towards e-commerce that has pushed food and beverage manufacturers to respond in innovative ways, but these do not seem to place particular focus on using e-commerce specifically to improve access to nutritious or healthy foods (for example, by prioritizing healthy products through the new direct-to-consumer delivery channels that have been established for some brands).

Responsible marketing: Lockdown may have served to accelerate the already significant shift from traditional forms of advertising to online marketing – the impacts of which on children are much more challenging to understand, trace and regulate. Only one company has explicitly reiterated its commitment to responsible marketing to children during the pandemic.

Fortification, immunity and the product mix: Asia, in particular, has seen a big surge of interest in products that are alleged to improve resilience, for instance dairy products and curcumin. Caution is strongly urged about any health claims made relating to Covid-19, as these can easily be deceptive.

Engagement: There are examples of food companies influencing governments in keeping their operations and supply chains moving during lockdown, but it is less clear whether, overall, companies’ approach to engagement with governments had an impact on nutrition-related policy; companies must commit to lobby on nutrition issues only in support of public health. Some companies have implemented their own Covid-19 education and public awareness programs and established new partnerships with government authorities, local and international NGOs, but it is not yet clear how this engagement will play out in the longer term.

Infant and young child nutrition (including breast-milk substitutes): ATNI’s research found that none of the companies’ websites include an explicit statement of continued commitment to the International Code of Marketing of Breast-Milk Substitutes within the context of the Covid-19 crisis – although the need for compliance is as important as ever, as breastfeeding support services have been disrupted. Some companies state that their products are safe, and that breastfeeding remains safe if precautions are taken to avoid infection, but most do not emphasize that breastfeeding remains best despite the pandemic.

ATNI welcomes suggestions from readers of the current report as to which aspects of the food industry’s response to Covid-19 would benefit from further analysis. Please contact Fiona Kirk (fiona.kirk@accesstonutrition.org) with any feedback, or if you require any communications support around this publication.

On February 10th 2021, ATNI published the results of its most recent research on impacts of, and responses to, Covid-19 on nutrition in India, Mexico, and Nigeria. By analysing in-country responses – which differed widely due to the countries’ socio-economic contexts, magnitude of Covid-19 impacts, and underlying nutrition challenges – the report helps to draw a much more nuanced picture of governmental and industry responses to the pandemic.

India registered the third-highest country total of Covid-19 deaths after the United States and Brazil.

The pandemic threatens to derail the government’s program to improve nutritional outcomes for children, pregnant women and nursing mothers, POSHAN Abhiyaan (National Nutrition Mission) – with UNICEF reporting disruption to nutritional programs for children.

Between March and November 2020 the Indian Government released five economic relief packages, the first of which included a significant food component: 5kg of either rice or wheat and 1kg of pulses per month free, initially for three months, in addition to a pre-existing entitlement of 5kg of low-cost wheat/rice per person per month. This was offered to two-thirds of the population and helped to cushion the blow of the pandemic on malnutrition.

To ensure the well-being of migrant workers, which make up a significant proportion of India’s large informal economy, changes have been made by the government to ration cards, which are now no longer state-specific, meaning that if a worker moves to another part of their country then they can still receive subsidized food through these.

The Food Safety and Standards Authority of India has taken several steps since the start of the pandemic, which include the launch in June 2020 of Eat-Right during COVID-19 (a range of hygiene tips and dietary/lifestyle guidance, including eating a balanced diet) and bolstering labeling requirements for the food-service industry. The FSSAI has also stepped up its efforts in encouraging the fortification of food products (for example, the addition of vitamins, iron and folic acid), beginning to address the fortification of staples such as rice and wheat and announcing that fortification of edible oil and milk with vitamins will be mandatory by the end of 2020.

This report looked at the 16 largest food manufacturers in India – the same as ATNI’s India Spotlight Index – finding no indication of a clear, strategic response to the developing crisis. No company, for example, made commitments to keep prices low nor commitments to responsible marketing to children during the pandemic.

Many of the companies published information on ways in which they were supporting their workforce, such as screening of employees upon arrival. Multiple companies also reported their efforts to support their value chain partners, including distribution partners, street vendors, farmers and tea-plantation workers, through the provision of hygiene products or Covid-19 insurance. Food as well as monetary donations to vulnerable populations, key workers, communities local to company sites were also noted. The impact of these initiatives is not clear due to lack of regular reporting, and the lack of transparency gives rise to concerns about the healthiness of donations.

Specific to the India context are claims, supported by the AYUSH Ministry, that certain Ayurvedic foods such as turmeric can boost immunity – these are being responded to by companies. Several have rebranded or relaunched existing products, marketing them as (or implying that they are) protective against Covid-19.

Concerns have been voiced that, in India as elsewhere, unfounded concerns about Covid-19 have interrupted appropriate breastfeeding. The Breastfeeding Promotion Network of India is an NGO that officially assists in monitoring the implementation of the Infant Milk Substitutes Act 1992 (which goes beyond the International Code of Marketing of Breast-Milk Substitutes in some areas) – a number of apparent breaches of the law have been identified by BPNI.

Similarly to India, Mexico has suffered a particularly high direct health burden of Covid-19, with the fourth-highest death toll in the world.

The impact of Covid-19 on the economy has been stark, with estimates of an 8% reduction in GDP for the year and the high levels of economic inequality likely to intensify this impact. Food insecurity rose from 35% to 42% in 2020 and could lead to a resurgence of more than 177,000 cases of moderate or severe wasting, in this country that had largely eradicated it. Drawing together the economic effects and impact of Covid-19 on nutrition, studies by the Universidad Iberoamericana suggested that around one in three Mexican households declared a 50% loss in income.

The urgency of the nutrition situation led in June to a partnership between UNICEF, the National System for the Integral Development of the Family and the private sector in the ‘Healthy food for every child’ campaign, aimed at expanding the food assistance program for people in emergency situations in the context of Covid-19. The first phase of this aimed to benefit 80,000 children.

The responses of the Mexican government that have received most international attention is the ongoing commitment to clear front-of-pack labelling of products high in fat, salt and sugar and moves by some states in the country to restrict sales of such products to children. These have been galvanized by concerns about the link between obesity and worse Covid-19 outcomes but have received industry pushback.

Consumers’ eating habits have changed, particularly under lockdown. There was an immediate increase in the purchase of staples such as rice and beans (increasing 400% in the first two weeks of March) and there was a shift towards packaged products. However, at the same time there is some evidence that health concerns have led to an uptick in both ‘health and wellness products’ and in the purchase of fresh food – the growth in sales of which Euromonitor data suggests outweighed the growth in packaged food

Among the 10 largest food manufacturers in Mexico researched for this report – only one was found to have implemented a price promise not to increase product prices during Covid-19.

Several examples of employee support schemes were found in Mexico – notable among the Mexican companies (not seen in the India or Nigeria research) is that two have a specific focus on mental health support for employees.

Support for the value chain was also evident. An example of an industry-level initiative was highlighted in the second report in this series, supporting the small retailers that account for 40% of grocery sales in Latin America and provide income for 2.9 million Mexican families.

In response to frequent donations, FAO expressed concerns about ‘promotion and advertising opportunism of foods’ in Latin America during the pandemic, including by food manufacturers themselves. These concerns include inappropriate donations (including to health workers – which was an action by several companies) and free home deliveries of unhealthy products (particularly by food-service companies rather than manufacturers)

Concerns about BMS Code violations were found in Mexico as well which are covered in section 4.3 of the report.

At a first glance, the direct health burden in terms of cases and mortality of Covid-19 on Nigeria appear to have been on a much smaller scale than in Mexico or India. This may be due to the very young population (half of all Nigerians are under the age of 18), and its largely rural population, and also to low rates of testing, which may mask a higher actual rate.

The statistics suggesting a relatively low direct health impact disguise the very serious economic consequences of the Covid-19 crisis, which led to Nigeria being described in July 2020 by the FAO and WFP as an ‘acute food insecurity hotspot’. According to this report, these consequences include rising unemployment, disruptions to food supply chains, falling government revenues, and continuing political instability in the north-east of the country.

Poverty inevitably rose in a country where 60% already lived on less than $1.90 a day – one estimate is that poverty rates will increase by 15%, equivalent to 30 million more people being below this poverty line. 90% of the population depend on daily wages, and these informal workers were reported in October to have lost up to 80% of their earnings. Millions of internally displaced people in the north-east were already vulnerable before the Covid-induced crisis – the number of people in need of food assistance in the region rose from 2.9 million to 4.3 million.

Food prices rose dramatically, with most people in Nigeria experiencing increased prices and the FAO noting that in some cases prices doubled. The initial nutrition-specific response of the government was to produce The Nigeria Food and Nutrition Response Plan for the Covid-19 Pandemic, to ensure the integration of nutrition into the national Covid-19 response plan. The plan had six specific objectives, including developing strategies to continue critical nutrition interventions and mitigation measures to limit the impact on vulnerable populations, and to develop guidance for actions to ensure safe, resilient markets and food supply chains. However, despite this plan, the response in practice of the government has been slow.

There is not much in the public domain about the Covid-19 response of the largest food and beverage companies in Nigeria, all of which are headquartered outside the country. Seven of the companies report some form of action – whether on the country website, a regional West-Africa website or on the main global website. The issue where the majority of companies have specifically responded to Covid-19 is through donations (‘palliatives’), including financial donations, PPE or food. The main industry-level channel for donations is CACOVID, a network of companies that have come together to provide food donations to be distributed by government – but, while donations have been received, there have been public concerns about delays in the distribution phase.

Research for this report found that food security and nutrition outcomes in the three countries are deteriorating, with especially worrying consequences for maternal and child health. In all countries, a shift towards foods with lower nutritional value and longer shelf-life was uncovered. Reporting by food industry on in-country efforts is less detailed than at the global level. Some companies had no mention of Covid-19 on their website and even for relatively more reported-on actions – which, similarly to findings of the previous report, were efforts to support employee wellbeing and donations – information was scarce.

ATNI thus encourages companies in India, Mexico, and Nigeria to formally and regularly report on their strategic response to Covid-19, including on their efforts to support workforce nutrition and value chain partners. ATNI urges companies to increase transparency of donations by committing to only donating healthy foods through authorized channels. Finally, companies must ensure full compliance with the International Code of Marketing of Breast-milk Substitutes at all times, including during global health crises such as the one created by the Covid-19 pandemic.

After publication, ATNI will organize in-country webinars to discuss the findings of each study. Details will be available on ATNI’s events page.

The fourth and last report in this series is anticipated to publish in April 2021. It will include examples of industry best practice with the aim of providing helpful guidance on positive and nutritious way forward for the new normal.

On July 27, 2021 – on the occurrence of the second day of the UN Food Systems Summit pre-Summit event – ATNI published the fourth report in its COVID-19 Project. Just over a year since ATNI first published the COVID-19 Framework on July 17, 2020, this last report in the FCDO-commissioned series provides a comprehensive list of recommendations to the food industry.

This report looks at the impact of the first 18 months of the COVID-19 pandemic on global nutrition and updates the second report, returning to the 39 food and beverage companies first assessed between July and October 2020, to see the development of their response beyond the immediate crisis of the first few months. The report thus uses the eight Categories of the Framework to structure the findings, and provides a set of recommendations which, taken together, form a coherent and comprehensive package of measures to ensure an effective nutrition-sensitive response and recovery from COVID-19. These recommendations are threaded throughout the report and are based on learnings from all four reports in the series as well as from consultation with expert stakeholders. The report also highlights new trends such as increasing concerns around equity in the food system and issues such as vaccination priority.

- Governance and leadership: COVID-19 continues to impact the bottom line of companies but 2020 annual reports suggest that companies have largely pivoted successfully around the challenges posed by the pandemic, including a shift towards online purchasing. However, there is little evidence of strategic and sustainable changes that place nutrition at the heart of the response. In particular, reporting across all categories is often inadequate and outdated, and is often focused primarily on home markets, rendering it challenging for stakeholders to understand the development of companies’ COVID-19 responses over time and across different geographies and populations, particularly those most at risk of malnutrition in all its forms. Developing a strategy and plan that includes creating a healthier food environment and that supports the whole value chain in all key markets will both hasten a healthy recovery and improve pandemic preparedness and resilience into the future.

- Healthier products, labeling and claims: There was a rapid increase in interest among consumers for comfort food and also for products that claim to maintain a healthy immune system and this has continued, with many new products coming to markets. Companies should ensure that all health claims are firmly evidence-based and do not appear on unhealthy foods. Fortification to address malnutrition is as important as ever, but there is little evidence of companies committing to scaling up resources for fortification to ensure that the most vulnerable receive good nutrition during the pandemic, and this would be welcomed.

- Affordability and accessibility: Few commitments were found by companies to ensuring widescale affordability or accessibility of healthy food during the crisis, other than through donations. In-kind and financial donations were evident from the earliest days of the pandemic and continue to the time of writing, with a recent shift towards funding for vaccinations. It is not clear which organizations will continue to be supported by donations and in what form – and, in particular, whether donations of food are healthy or not, with some evidence of unhealthy foods being donated. But companies should consider going beyond donations to commit to ongoing affordability and accessibility of healthy products for the whole population.

- Responsible marketing: It was immediately evident that marketing campaigns were shifting to the new reality of life in lockdown, focusing on online campaigns and with some evidence that advertising leveraged consumer concerns about the pandemic. Responsible marketing should be more, not less, of a priority during a crisis – particularly for vulnerable groups and for children, who spend so much more time online during lockdown.

- Protecting employees and promoting healthy lifestyles: All the companies reacted swiftly to the many health threats to the workforce. Initially focusing on provision of protective equipment and on basic (but temporary) financial protection, there has in recent months been a greater focus on mental health and on employee vaccination. Action taken by companies should be country-specific, with regular reporting on longer-term efforts made to support health and nutrition in the workplace. This support for health and nutrition should be provided more widely across the value chain, particularly to SMEs that are such a crucial part of the resilience of the supply chain.

- Engagement: Research found several examples of individual company and industry association lobbying of government on COVID-19-related issues, such as vaccination prioritization for the food sector. Industry associations are also active in sharing best practice (including on the response to COVID-19) and the pandemic has led to some trade associations emphasizing the importance of nutrition and public health. Any lobbying on nutrition and food issues should only be in support of measures that are beneficial for wider public health.

- Infant and young child nutrition: In the early days of the pandemic, there was initial uncertainty – rapidly quelled – about the safety of breastfeeding, but many companies have not clearly and explicitly restated that breastfeeding remains best for babies in the current context. Additionally, concerns were almost immediately raised by NGOs that the International Code of Marketing of Breast-milk Substitutions was being violated: all the reports in this series note examples of this, including from ATNI’s own research in Mexico and the Philippines. All companies should reiterate commitment to The Code and follow this up with action.

Overall, the research found many more examples of company responses taken in home markets, many of which are based in Europe and the United States, rather than in other countries. As a result, there are more examples from these countries in this report. ATNI calls on companies to provide more detailed reporting in their annual reports, CSR reports and websites on action beyond the home market.

ATNI calls on all the world’s major food and beverage companies to step further along this path, taking consistent steps towards a future in which the food system is more resilient to COVID-19 and its economic and nutrition aftershocks, and also to any crises in the future. COVID-19 has been a moment of reckoning and it must be a moment of change. For this reason, ATNI will share and discuss the findings from the COVID-19 project series with its stakeholders and where suitable incorporate them in its future research and work on corporate accountability.