Why Indonesia Needs a Sugar-Sweetened Beverage Tax: From Societal Costs to Solutions

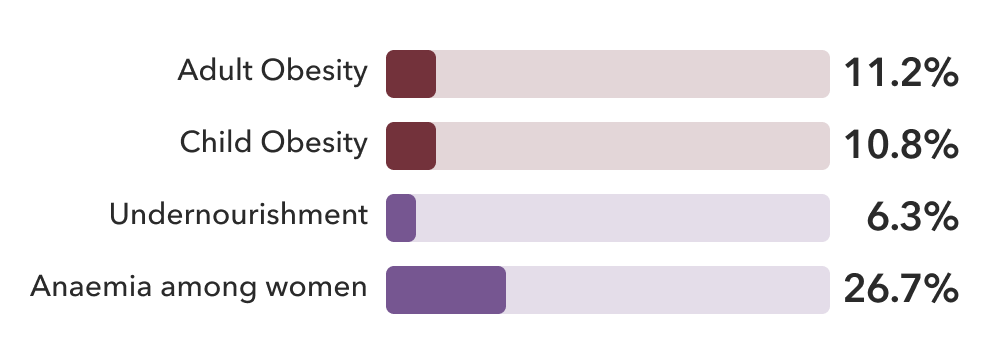

19 January 2026Indonesia faces a complex nutrition challenge: despite some progress in reducing undernutrition, the country is now experiencing a sharp rise in people living with overweight and obesity, alongside persistent issues such as child stunting and micronutrient deficiencies. 1 in 5 children under five remain stunted, and anaemia affects over 27% of women of reproductive age. At the same time, obesity rates are increasing rapidly. Among children and adolescents (5–19 years), obesity rates have more than doubled from 4.5% to 10.8% between 2012 and 2022.

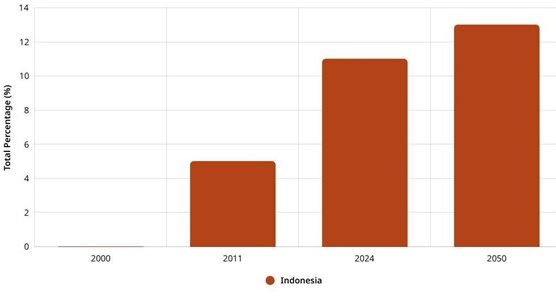

Diet-related non-communicable diseases are also increasing rapidly. For example, diabetes rates have increased four-fold since 2000, now affecting approximately 20.4 million people in Indonesia. The country now has one of the highest numbers of people living with diabetes in the world. One of the key factors driving this increase is a change in dietary patterns, particularly the increased consumption of sugar-sweetened beverages (SSBs).

In addition to diabetes, high sugar consumption—particularly sweetened beverages—is linked to metabolic syndrome and cardiovascular diseases. Indonesia has the third highest consumption of SSBs in Southeast Asia. National survey data shows that nearly half of the population (47.5%) consumes at least one SSB daily, and about three out of five households (68.1%) report spending money on at least one type of SSB each week.

Promotions, marketing and affordability

What is driving this high level of SSB consumption? Consumption is stimulated by marketing, often directed at children. A recent study found that in Indonesia, soft drinks are heavily promoted through social media and the use of branded products. Looking at retailers’ promotion, ATNi’s analysis found that SSBs are among the most promoted products by two of the largest Indonesian retailers, representing 17% and 13% of promoted products by Alfamart and Indomaret, respectively.

Pricing is also a key factor driving consumption of less healthy foods. ATNi’s Retail Pricing Analysis found that in Indonesia, a nutritious retail food basket costs 10.8% more than a less healthy food basket. This gap is especially burdensome for lower-income households, pushing them toward cheaper, less nutritious options. One of the most effective ways to change dietary patterns is through fiscal measures which reduce—or even reverse—this price gap.

How do we shift consumers away from SSBs?

The World Health Organization strongly recommends implementating SSB taxes as part of a package of fiscal policies to realign food prices with public health objectives. Such policies have already been implemented by 114 countries globally in 2024. SSB taxes can decrease consumption by raising prices, increasing public awareness of the negative health impacts of SSBs, encouraging product reformulation and generating revenue for governments.

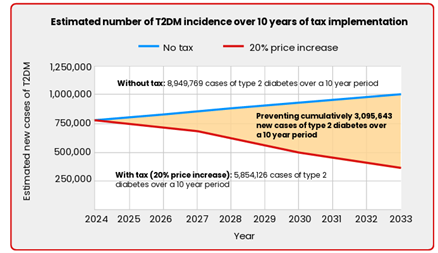

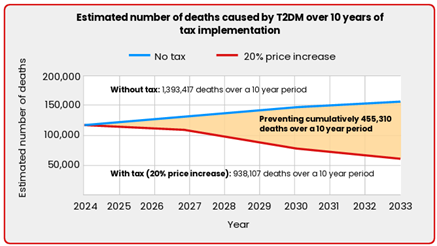

The Centre for Indonesia’s Strategic Development Initiatives (CISDI) has conducted extensive modelling of the health and economic benefits of implementing an SSB tax in Indonesia, specifically exploring the impact on type 2 diabetes. CISDI estimated that a 20% increase in SSB prices would reduce consumption by 17.5%, preventing approximately 3.1 million cases of type 2 diabetes and 455,000 premature deaths over the next decade in Indonesia (Figure 31). The model also predicts savings of about IDR 40.6 trillion (roughly USD 2.5 billion) in treatment costs and lost productivity.

Figure 1 shows the projected reduction in type 2 diabetes incidence (1A) and premature mortality attributable to type 2 diabetes (1B) associated with SSB consumption.

Without intervention, type 2 diabetes incidence is projected to rise over the next decade, reaching a cumulative 8.9 million new cases by 2033. An SSB tax, proxied by a 20% price increase, is estimated to avert 3.1 million cases over this period.

Similarly, cumulative type 2 diabetes-attributable deaths are projected to reach 1.3 million by 2033 in the absence of intervention, with the tax preventing approximately 455,000 deaths.

It is understandable that the Indonesian government remains cautious about implementing an SSB tax. The SSB industry is sizable, employs a significant workforce, and is embedded in complex supply chains that include small retailers and informal street vendors. At the same time, SSB consumption is closely tied to everyday habits of Indonesians, making any policy that raises prices politically sensitive. From this perspective, concerns about potential economic impacts and job losses are not unreasonable.

However, when examined against available evidence, these concerns are not supported by scientific research and credible data. A systematic review and meta analysis of international evidence found that SSB taxes do not lead to net job losses or broader economic harm. While sales of taxed beverages may decline, overall consumer spending does not; instead, it shifts to untaxed goods and services, supporting employment in other sectors. Experiences from countries that have implemented SSB taxes consistently show stable employment levels and no measurable negative effects on economic growth. In this regard, the persistent emphasis on job losses appears to reflect the influence of industry lobbying rather than empirical evidence.

Framing SSB taxation as an economic threat diverts attention from a much larger, well-documented economic burden posed by SSB-related diseases, which continue to place growing strain on Indonesia’s health system and productivity.

Final verdict

Indonesia stands at a critical crossroads. Rising obesity, diabetes, and diet-related diseases are placing an increasing burden on public health, while cost barriers continue to limit access to healthier options. An SSB tax offers a clear and evidence-based opportunity to address both challenges: narrowing the price gap between the less healthy vs. healthier options, while reducing the preventable non-communicable disease burden. The evidence is clear, the policy tools are available, and the global experience is compelling. It’s time for policymakers, industry, and civil society to move beyond hesitation and advance the implementation of SSB taxes, alongside more comprehensive food policies, such as front-of-pack labelling and marketing restrictions. For a healthier population and more equitable access to healthy food in Indonesia, these are some of the most effective and evidence-based actions that can and should be taken now.