Is the market shifting towards healthier foods?

14 January 2025What we learned in 2024 and ATNi’s 2025 priorities.

Data and trend analyses are invaluable tools, providing the basis for concrete action.

In 2024, we learned much about market trends for healthy foods, and although some of it was negative, getting bad news early is great news. It allowed us to double down on what is important and focus on fundamental food system changes that can result in improved nutrition outcomes.

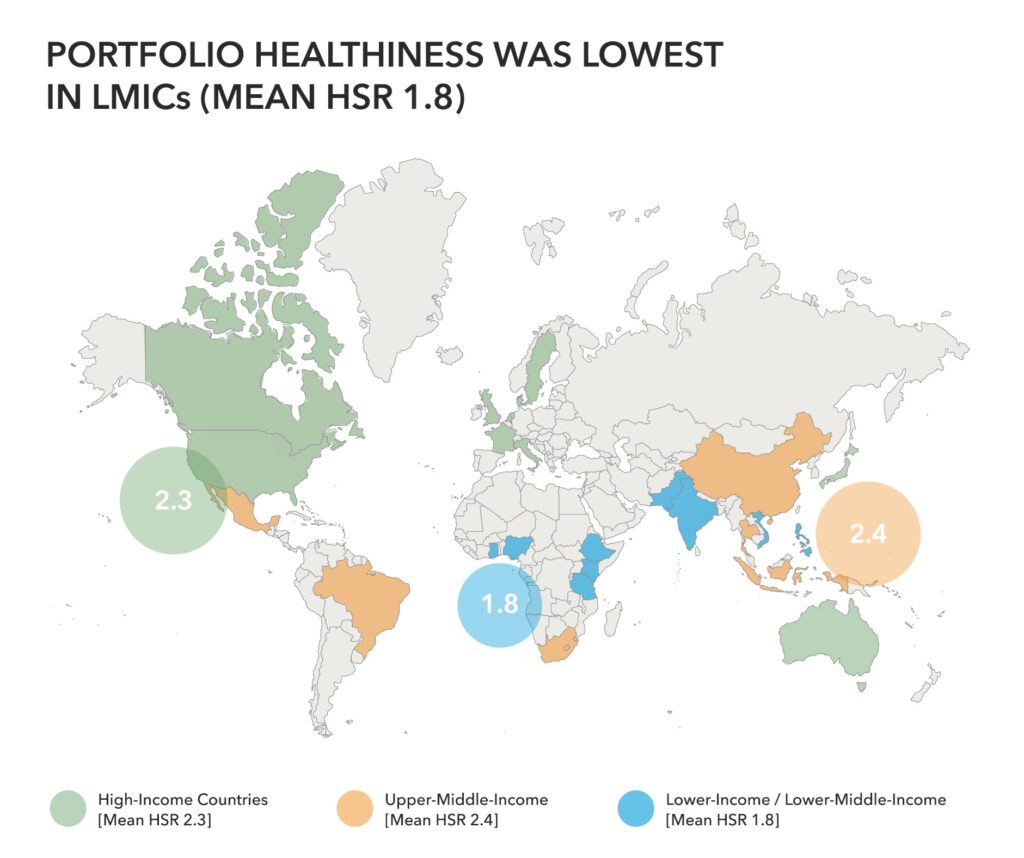

First, what did we learn about the packaged food landscape in 2024? In November, ATNi released its fifth Global Access to Nutrition Index assessing how the world’s largest global food and beverage (F&B) manufacturers are contributing to addressing malnutrition in all its forms. Only 34% of the combined sales of the top 30 companies – representing 23% of the global F&B market – are derived from ‘healthier’ products. What’s more, the least healthy products are being sold in low- and middle-income countries (see Figure below). The silver lining is that this represents a marginal increase from 27% in 2021. If we could assume this pace of growth moving forward we would arrive at around 50% of sales derived from healthier foods at some point in early 2032. But of course this progress is far too slow.

Second, we learned alignment is possible among all actors on measuring the healthiness of foods and food portfolios. We had a breakthrough on measuring and monitoring healthy foods in 2024. ATNi, supported by the Pictet Group Foundation, used a three-round Delphi research process to facilitate stakeholder alignment on nutrient profile models (NPMs) – of which there are dozens and much debate. A total of 86 experts from 14 countries participated, including representatives from investors, academic experts, the food industry and non-governmental organisations. Three NPM’s were found to be appropriate for future monitoring and reporting: Health Star Rating (HSR), Nutri-Score, and the UK NPM. ATNi’s Investors in Nutrition and Health, comprising 88 investors representing $21 trillion in assets under management, calls on all food and beverage manufacturers and retailers to benchmark their product portfolios against at least one of the three recognised benchmarks.

The report uncovered an emerging microeconomic case for nutrition, albeit with caveats. It showed that the major food companies with broad, mixed food portfolios that focus on a healthier range of products achieved a higher average profit (EBIT) margin at 15.2% compared to that of their peers that focus on more unhealthy food product portfolios (13.4%). Focusing on health can actually make business sense, even for Big Food.

However, the Materiality Report also found that the companies with the most narrow, unhealthy, food product portfolios had the highest average EBIT margin, at 16.7%. And therein lies the crux of the problem: unhealthy foods and less healthy food portfolios make great money.

Until markets shift more fundamentally, we will not see the progress required to fix unhealthy diets. So what needs to happen to accelerate market transformation for nutrition?

Fortunately, there are some positive trends. There is a growing appetite among policymakers, consumers, investors and even companies themselves to investigate the adverse effects of unhealthy packaged foods and ultraprocessed foods (UPFs).

This is leading to discussions about what new policies, new products and new corporate practices can be deployed to transform markets for nutrition. During our June launch of the Materiality of Nutrition assessment, Emmanuel Fabernicely summarised the need for regulation and financial institutions to play a bigger role:

Mechanisms like ATNi exist because of ongoing market failures and lack of uniform disclosers….The key messages [of the materiality report] that resonated most with me were: one, regulation will be key to drive the required changes. Two, that consumers will not be the main driver of this change. And three, investors need to play a role, but to date they have been hampered by a lack of disclosure on nutrition…. Financial institutions, from insurers to pension funds and sovereign banks, should factor in the long-term risks of the nutrition challenge, and be more engaged and show leadership.

Recapping 2024

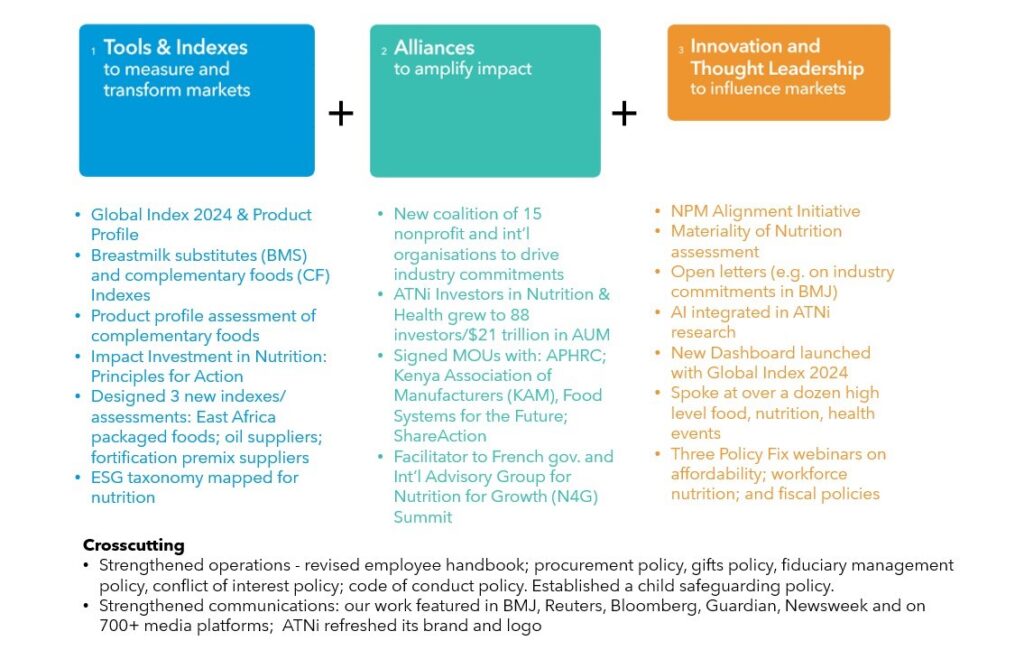

In addition to the three ATNi’s core 2024 outputs summarised above — the 2024 Global Index, the NPM alignment project and the Materiality of Nutrition assessment — ATNi completed over a dozen projects and formed several important alliances for impact in 2024. In the Figure below, these are categorised under each of the three pillars in ATNi’s Theory of Change.

June 2025 is the midpoint in ATNi’s current 2023-2027 Strategy. In addition to taking stock and refining our strategy, we’re excited by the following opportunities which will help accelerate 2024’s progress and improve private sector engagement for nutrition and enable systemic market change for nutrition:

- Leading Nutrition for Growth (N4G) private sector workstream with Global Alliance for Improved Nutrition (GAIN) and Paris Peace Forum (Q1);

- Launching the East Africa Packaged Food Assessment in Kenya and Tanzania (Q2);

- Establishing a Global Product Healthiness Dashboard to provide a user-friendly interface on the healthiness of food product portfolios (Q2);

- Launching a new oil supplier index (Q2);

- Enhancing our Policy Platform (throughout 2025) and hosting an East Africa regional conference on policies to improve food environments (Q2);

- Launching the VitaMin Index (Q3);

- Launching a new global Retail Assessment (Q4);

- Starting complementary foods assessments for local production in Kenya (Q4); and

- Strengthening our Investor Platform and aligning institutional and impact investors on nutrition metrics (throughout 2025).

ATNi aims to maintain our strong Value for Money approach in 2025. In 2024, our expenditure was just over EUR 3,200,000 which represents only 0.00085% of assessed companies’ revenue based on food sales in the 2024 Global Index.

For longer term impact leading up to 2030, ATNi is developing five new initiatives that will help drive market change for healthier foods and build the business case for nutrition:

- Precompetitive platforms that allow for the replication of good practice and positive industry initiatives;

- Benchmarks and monitoring the food industry against SMART targets;

- Driving responsible finance and investments towards healthier food portfolios and companies;

- Mandatory ESG standards and disclosures for nutrition; and

- Supporting national policies including fiscal policies; formulation policies on fortification, sodium reduction and sugar reduction; marketing policies; and labelling policies.

Finally, special thanks to ATNi’s donors, Board and staff and key stakeholders which allow us to undertake this important work. Wishing you all a successful year ahead!