Why Access to Nutrition Initiative’s New Strategy Aims to Transform Markets for Healthier Food

1 March 2023Building on ten years of assessing the private sector in nutrition, The Access to Nutrition Initiative (ATNI) is rolling out a new five-year strategy (2023-2027) focused on transforming markets. ATNI’s Executive Director, Greg S Garrett, explains:

After seven months as ATNI’s Executive Director, and working closely with the ATNI team, Board and partners, I’m proud that we can roll out this new strategy and theory of change. Below is the rationale for the strategy, a summary of what’s new and what’s not, and an overview of what’s in store for 2023.

Why the broader focus on markets? Because the food system — and the markets and the financing which are integral parts of the food system — works for large food manufacturers and retailers and their shareholders. But it too often leads to inequitable access, putting profits before health.

According to Forbes Global 2000 the top 25 companies in the food sector generated $1.5 trillion in revenue in the past year, while profits in the sector increased to more than $155 billion. The shareholders of food companies are seeing increased stock valuations and strong financial profits.

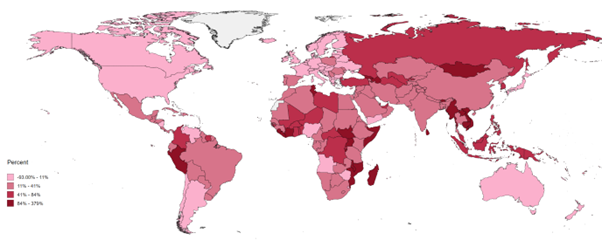

This growth is driving a proliferation of food retail outlets globally with low- and middle-income countries seeing the fastest growth (Figure 1). A surplus of processed foods — products too often laden with high levels of sugar, salt and fat and low in micronutrients – is available to middle- and high-income consumers and increasingly reaching low-income consumers.

On many levels, the food system is not broken. However, it is focused on the wrong outcomes.

When viewed through a 20th century lens and via capital markets, the food system is largely working. However, the food system simultaneously fails most of us, especially the most vulnerable. It ignores externalities, promotes waste, leads to inequitable access and proliferates the market with unhealthy foods driven by profits rather than health.

Although annual global food consumption costs are $9 trillion, the estimated hidden costs are more than twice this at $20 trillion. The costs to human life due to unhealthy diets is $11 trillion followed by environmental costs of $7 trillion. Further, the failures of the food system leave 149 million children under the age of five stunted, 45 million wasted, and hundreds of millions deficient in essential vitamins and minerals. Laslty, more than one billion people worldwide are living with obesity – 650 million adults, 340 million adolescents and 39 million children.

Food markets must be urgently transformed so that equitable access to healthier, affordable products becomes the norm. ATNI aims to help.

ATNI exists for the sole purpose of transforming markets for affordable nutrition. Our vision is a world where markets contribute to providing access to nutritious and affordable diets for all, preventing deaths and illness from diet-related diseases.

The new five-year strategy (2023-2027) aims to position ATNI as a major driver of (formal) market transformation. We want to see at least half of all food & beverage sales derived from healthy products by 2030, contributing to healthy diets for all.

There has been progress over the last ten years of ATNI engagement with the largest 25 food and beverage (F&B) manufacturers. Since ATNI’s first Global Index in 2013, more than half of the companies assessed (14) have adopted criteria or nutrient profiling models to define the healthiness of products. Nine companies have improved the healthiness of their product portfolios. Two of the largest manufacturers agreed in 2022 to benchmark and publish the healthiness of their portfolios using internationally recognized nutrient profile models. Thirteen companies have strengthened their nutrition policies and management systems. Six manufacturers have adopted interpretive labelling schemes.

However, based on ATNI global data on approximately 40,000 products from these manufacturers, 69% do not meet healthy standards when assessed against the Health Star Rating system. What’s more, none of the large manufacturers of baby food are fully compliant with the International Code on the Marketing of Breastmilk Substitutes.

We still have a very long way to go to hold companies to account.

For the development of ATNI’s new strategy, we asked, “What will drive impact”? We looked at what’s worked and what has not, and tried to identify any critical levers which were missing in our approach to date. ATNI (its staff and Board) carefully considered an independent impact review of ATNI published in June 2022. Between July and December 2022, we consulted with over a dozen donors and partners.

What is clear: now is not the time to capitulate. Accountability of the private sector and engagement with the industry is needed more than ever. To build more accountability and drive impact we need to develop and implement multiple levers of change: smarter benchmarking data, more intentional nutrition-sensitive investments and better formulation of policy.

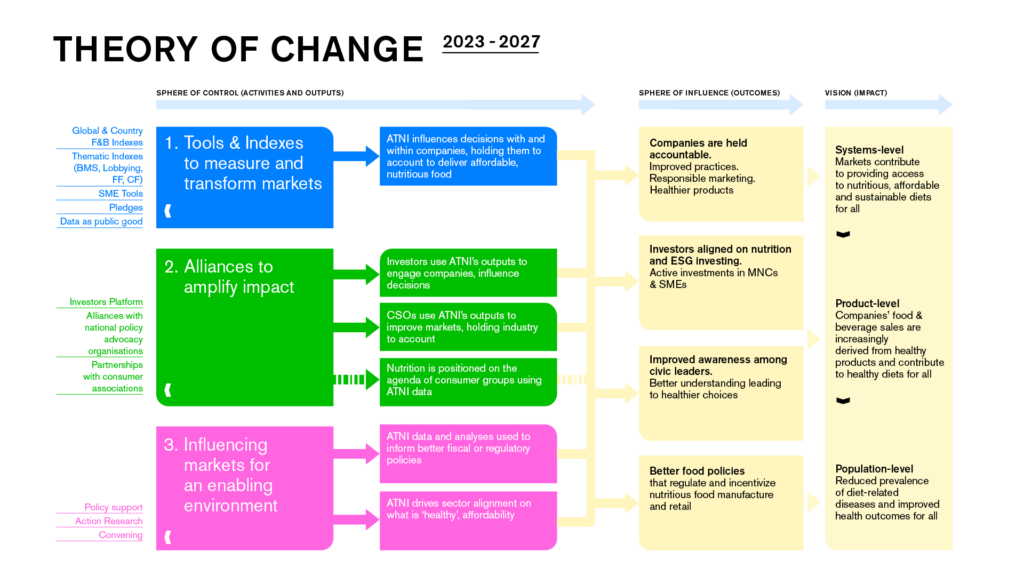

Underpinning these three pillars is the need to increase our strategic partnerships and communications for impact. How these various pillars of work help achieve product-, systems-, and population-level impact is outlined in our new Theory of Change (TOC).

Benchmarking the food industry on nutrition

First, we will build on ten years’ experience assessing the nutrition commitments of the world’s largest food companies and the progress measured during that time. We will rigorously index and rank food companies, engaging them in the process. This remains a pillar of ATNI’s work. We are simplifying our methodology and placing more weight on indicators related to affordability and access, especially among vulnerable populations. ATNI aims to expand its Global Index to up to 100 companies. We will scale up our work in product profiling with partners like The George Institute for Global Health to profile the product portfolios of these companies. We will deploy our Retail Index Methodology to assess the world’s largest food retailers. Working in partnership, we aim to solicit and measure new CEO-level nutrition commitments and track progress towards these. Whenever possible, our index work will include data and analyses on environmental sustainability gathered by partners like the World Benchmarking Alliance.

Investors in Nutrition and Health

Second, ATNI’s Investors in Nutrition and Health has grown to 80 institutional investors representing US$20 trillion in assets under management. Investors are an underutilized group with tremendous potential to stimulate transformational change aimed at the executive level of food companies. We will encourage the systematic use of evidence-based ESG nutrition metrics, reflecting benefits leading to healthier product portfolios. Working with our investor coalition and with partners like ShareAction we aim to provide the data and analyses required for targeted investment strategies, shareholder advocacy and actions. This month, ATNI also joins the Good Food Finance Network to work alongside partners WBSCD, EAT, Food Systems for the Future and UNEP to bring healthy food to the heart of the financing agenda.

- Amundi (FR)

- PIMCO (US)

- Legal and General Investment Management (LGIM) (UK)

- T. Rowe Price (US)

- UBS (CH)

- AXA Investments (FR)

- Schroders (UK)

- Pictet Group (CH)

- Abrdn (UK)

- Columbia Threadneedle Investments (US)

Policy support

Third, evidence-based policy is central to market transformation that drives availability, access and consumption of healthier foods. Informing policies that improve diets and appropriate private sector engagement — as well as tracking lobbying that influences laws and regulations, is now part of ATNI’s approach. New partnerships with national advocacy organizations will be important to enable the ongoing use of ATNI data and recommendations that inform, for example, national fiscal policies that steer the market towards the delivery of more nutritious foods.

Lastly, underpinning our new strategy is the need to make our data more available, form new alliances with those who can amplify our work, and communicate more frequently on key messages via new media initiatives. That is why we recently started placing our data on the World Economic Forum Strategic Intelligence Platform.

ATNI has secured initial funding to start delivering this strategy with the following activities planned in 2023 (dates are indicative):

- Development and launch of a new India Index (Jan-Nov)

- Development and launch of a new Breast-milk Substitute (BMS) and Complementary Foods Marketing Index (Jan-Nov)

- Development and initial research for the fifth Global Index (to be launched in Q2 2024)

- Launching ATNI’s new Policy Platform. We start with a Policy Fix webinar on 22nd March to launch our report on lobbying by the food industry.

- Targeted engagement with ATNI’s Investors in Nutrition and Health and the Good Food Financing Network (Jan-Dec)

- Linking small and medium enterprises in two LMIC to impact investors (Feb-Dec)

- Aligning investors and industry on defining healthy and using nutrient profiling models (March-Dec)

- Development and launch of product profiling for complementary foods (Feb-Dec)

- Launching WHO-ATNI report on the use of trans fat by industry (in May at WHA)

- New communications (e.g. stakeholder panels) and partnership initiatives (Jan-Dec)

- New members joining ATNI’s Board and Expert Group (July)

- Celebrating ATNI’s ten-year anniversary (October)

ATNI thanks its current donors – The UK Foreign, Commonwealth & Development Office, The Bill & Melinda Gates Foundation, The Pictet Foundation, The World Health Organization, and Irish Aid for their ongoing support.

We also express our gratitude to founding donors and partners Wellcome Trust, Directorate-General for International Cooperation of the Netherlands, and the Global Alliance for Improved Nutrition as well as past donors Children Investment Fund Foundation, Guy’s & St Thomas’ Foundation/ShareAction and The Robert Wood Johnson Foundation.

ATNI has already raised 2.5M Euro which it will use to start implementing this strategy. We estimate that a total of 26-29M Euro is required between now and the end of 2027 to enable market transformation and ensure vulnerable populations have better access to healthier products. We are looking for new core and project partners to join us on this exciting journey of market transformation. The value for money is compelling costing just 0.0006% of the estimated sales revenue of the companies we aim to assess over the five-year period.

Join us in driving the market transformation necessary to make healthy foods more accessible for all.