Category C: Accessibility

Delivering affordable, accessible products

Producing healthier options is necessary, but an insufficient measure on its own to improve consumers’ access to nutritious foods and beverages and drive up their consumption. Therefore, companies must offer them at competitive prices and distribute them widely to reach all consumers in need, especially those who are experiencing and/or are vulnerable to malnutrition. This category assesses companies’ efforts to make their healthy products more affordable and accessible to all consumers (including priority populations), globally, through their approaches to pricing and distribution.

Category C consists of two criteria:

- C1 Product Pricing

- C2 Product Distribution

To perform well in this category, a company should:

- Make clear, formalized public commitments that extend into an action plan to promote accessibility and affordability of healthy products over less healthy products, including those healthy products that are specifically designed to address micronutrient deficiencies in groups experiencing or at high-risk of malnutrition (priority populations). Specifically, adopt and publish formal policies and strategies incorporating these elements and demonstrate a clear focus on low-income consumers and consumers that lack regular access due to geographical factors (e.g., living in rural areas, poor urban locations, etc.).

- Set objective, measurable targets to improve the affordability and physical accessibility of all healthy products in all markets, and publicly disclose them. For example, define targets on price points on healthy products for low-income consumers, or target number of consumers to reach with healthy products through improved distribution in remote locations.

- Provide evidence of doing pricing and distribution analysis to appropriately price and distribute healthy products, in all their active markets.

- Take actions to improve the affordability and physical accessibility of healthy products including those specifically designed for priority populations, by providing examples of initiatives that have improved pricing and distribution of healthy products to all consumers, especially those with low-income and constrained by geographical factors.

Ranking on Accessibility

- C1

- Product pricing

- C2

- Product distribution

- *

- Did not provide information to ATNI

FrieslandCampina and Nestlé rank first and second in Category C respectively, with the most comprehensive pricing and distribution approach for their ‘healthy’ products, including those products that are designed to address micronutrient deficiencies in groups experiencing and at high-risk of malnutrition. They are followed by Danone (third) and Unilever (fourth). Companies that show improvement in their scores are FrieslandCampina, Coca-Cola, Meiji, Mars, and Unilever. FrieslandCampina shows the greatest improvement in score (5.2 to 7.7), followed by Meiji (0.6 to 1.7).

Category Context

In this Category, ATNI assesses the food and beverage manufactures on their commitments, practices, and transparency to improve their pricing and distribution efforts and increase access to nutritious food.

Access to affordable, nutritious food is especially important in the context of the Covid-19 pandemic. 150 million more people will fall below the extreme poverty line due to Covid-19, with drastic impacts on food security and access to nutrient-rich foods. Worldwide, food insecurity has increased as global food prices rose almost 20% between January 2020 and 2021. Many countries, especially low- and middle-income countries, have experienced high food price inflation at retail-level and face constant supply-chain disruptions due to the pandemic. In the middle of the Covid19 crisis in 2020, the Food and Agriculture Organization of the United Nations (FAO) estimated that more than three billion people could not afford a healthy diet. Their research also highlighted that higher cost and unaffordability of healthy diets is associated with increased food insecurity and different forms of malnutrition, including child stunting and adult obesity. Due to the Covid-19 epidemic, this problem is likely to exacerbate.

Access to healthy food is further hindered by inequities that affect everyday food environments, and Covid-19 has disproportionately affected poorer and marginalized populations globally. Reducing food costs and successfully making context interventions that transform food purchase and supply are therefore essential to improve the livelihoods of many, in all markets – including higher-income, as well as medium- and lower- income countries.

Relevant changes in methodology

Some adjustments have been made since the previous iteration of the Global Index. For Category C, these include:

- In 2018, Category C had a weight of 20% of the overall Index score. It now accounts for 15% of the Index score. This adjustment is partially because of the integration of the Product Profile scores in the current Global Index ranking algorithm.

- In addition to nutrition indicators, the previous Global Index iteration included a set of undernutrition indicators. These assessed company commitments and actions to prevent and address undernutrition and micronutrient deficiencies among at-risk populations in low-income countries. In the current methodology, the commitment of companies to specifically address the needs and key nutritional priorities of specific population groups at risk of malnutrition is assessed for low-, middle-, and high-income countries alike. As a result, all companies are assessed on their efforts to reach these priority populations.

- For this Index, the assessment of physical accessibility of healthy products encompasses companies’ actions to address lack of geographical access to healthy products (e.g., rural groups, living in ‘food deserts‘).

- ATNI credits companies according to the quality and strength of their commitments. The 2021 iteration makes this more stringent by crediting only those commitments that are publicly disclosed.

- In addition to assessing companies’ pricing and distribution efforts for products that are considered ‘healthy’, this Category now also assesses healthy products that are specifically designed to address undernutrition and micronutrient deficiencies in priority populations (e.g., fortified products that meet company’s-own/externally defined healthy nutrition criteria).

- The 2021 Index gives less credit to companies’ philanthropic efforts to improve accessibility, for example, product donation programs. This Index encourages companies to improve access with their commercial strategies. For example, offering discounts and price promotions on healthy products aimed at low-income groups, and examples of arrangements for prominent shelf positions for healthier, affordable products in retail outlets catering to groups at risk.

More details about the changes in the methodology can be found in the methodology section of this Index.

Global Index 2021 MethodologyKey findings

- The average Category C score decreased by 0.6 points from 2.5 to 1.9 since the 2018 Global Index. So, the score for this category remains low, with companies performing better in accessibility (accounting for geographical access and distribution of healthy products) than affordability (accounting for healthy products’ pricing).

- FrieslandCampina ranks first moving up from the fifth rank in 2018. This improvement can be attributed to the company’s updated ‘Broadening Access to Nutrition’ program that includes formal commitments, a concrete strategy, and measurable targets to improve the affordability and physical accessibility of its healthy products. In addition, these commitments and actions extend to products that aim to address micronutrient deficiencies in groups experiencing, or at high-risk of, malnutrition (priority populations).

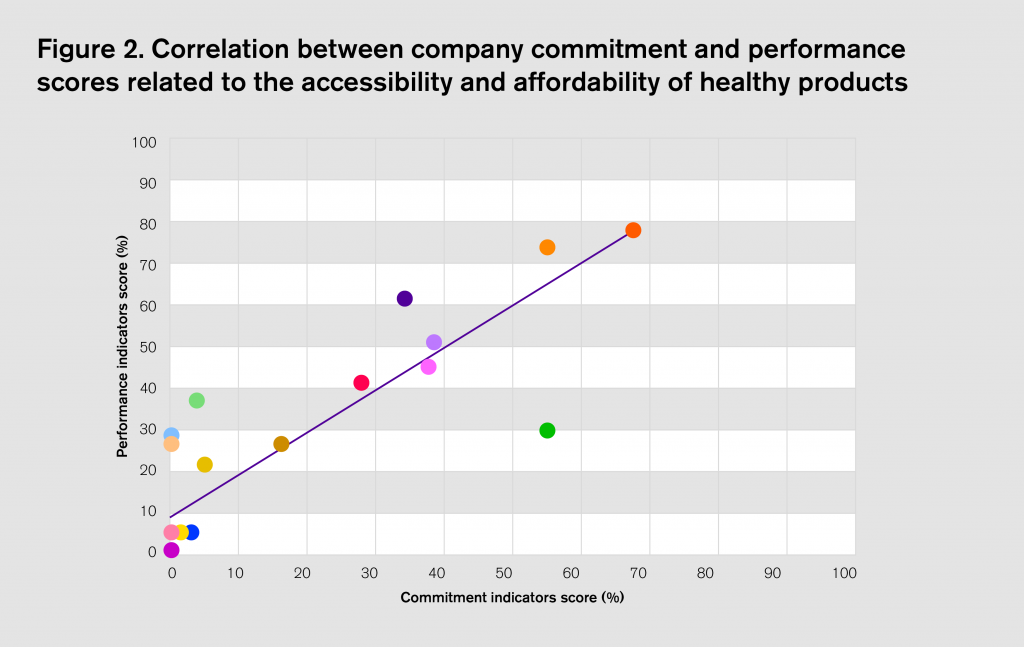

- Overall, there is limited evidence of commitments, actions and disclosure from most companies linked to accessibility and affordability. Twelve out of 25 companies do not show any high-level public commitments on affordability and accessibility, compared to 10 out of 22 in the 2018 Global Index. Most low-scoring companies assessed in this Index made broad and stand-alone commitments that are not part of a comprehensive policy. At times, these companies demonstrate ad-hoc actions in some markets and/or for some products only. This trend is similar to the one observed in 2018, where companies performed poorly in the absence of robust commitments on affordability and accessibility. Thus, a stronger, company-wide commitment is necessary to increase impact at the performance-level (see Figure 2).

- Only seven companies were found to have clear strategies for improving the affordability of healthy products specifically designed to combat micronutrient deficiencies in priority populations, while eight were found to have the same for improving accessibility. Although more companies have provided examples of improving accessibility and affordability of such products, these efforts are limited to some low- and middle-income countries, and not across all markets the companies are active in.

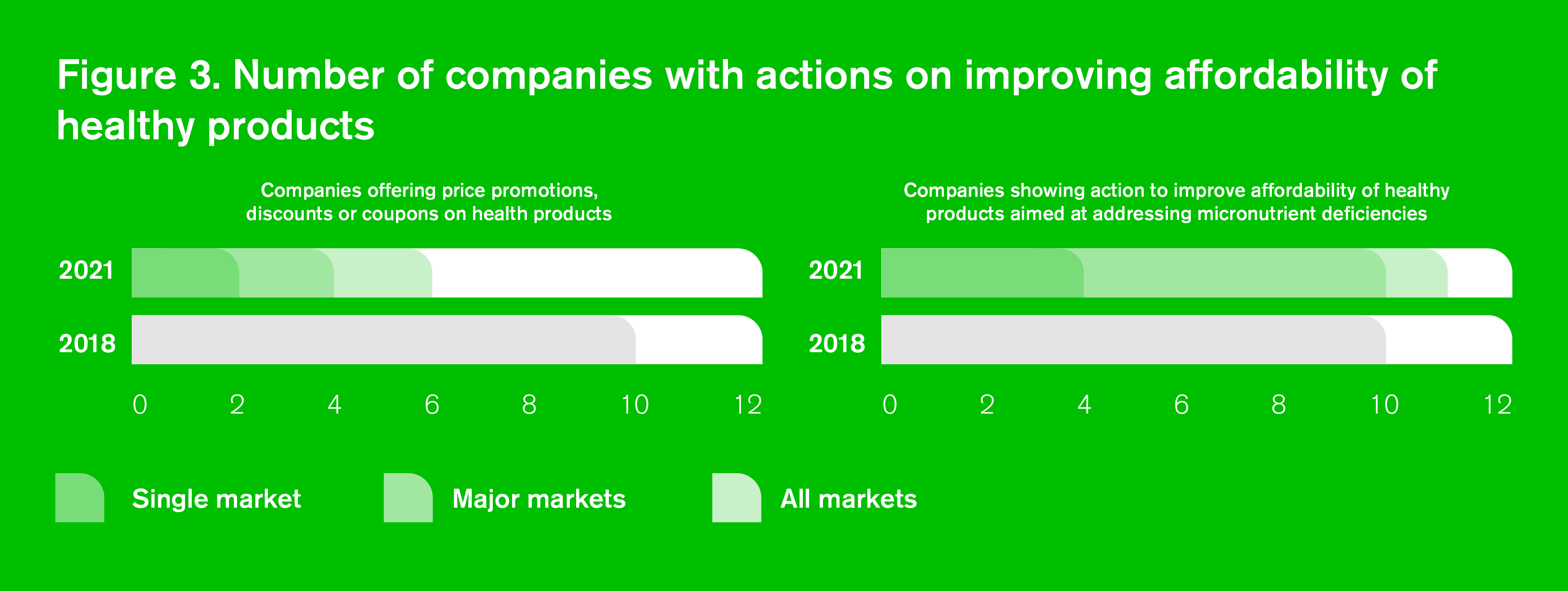

- Despite the need for more action to improve the affordability and accessibility of healthy products, especially as the COVID-19 pandemic has further threatened access to nutritious foods, companies’ practices show limited progress in this area. Six companies have shared examples of improving the accessibility of their healthy products with better distribution practices (four more than in 2018). And only six companies have provided examples of improving affordability of their healthier options by offering promotions and discounts on their healthy products (four less than in 2018).

General recommendations

To improve commitments, strategies, and actions on affordability and accessibility, ATNI encourages food and beverage manufacturers to:

- Clearly define their healthy products based on objective nutrition criteria that align with national and international standards.

- Develop a policy with strong, company-wide, public commitments that translate into clear action plans to address affordability and accessibility of healthy products, including products specifically designed to address micronutrient deficiencies. The policy should specifically address the needs of priority populations at risk of malnutrition and consumers with low-income and/or those that lack physical access to nutritious food across all markets.

- Set concrete, SMART pricing and distribution targets to reach consumers with healthy products across all markets it is active in to encourage more purchases of healthier products rather than less healthy products over time.

- Conduct periodic/regular country-level pricing and distribution analysis to identify and address the unmet needs of consumers with low incomes and based in remote, inaccessible locations.

- Provide and disclose evidence of actions undertaken to improve the pricing and distribution of healthy products, as well as products designed to address micronutrient deficiencies, and report on progress made.

Noteworthy changes and best practices

-

- C

FrieslandCampina has enhanced its commitments, strategies, and practices by effectively adopting a policy on affordability and accessibility called ‘Broadening Access to Nutrition’. Its concrete, measurable targets linked to this program stand out. One of its objectives is to increase the share of affordable nutrition products in its lower-income markets (Nigeria, Pakistan, Ivory Coast, Indonesia, Vietnam, and the Philippines) to at least 15 % of sold volume in 2025. Additionally, it aims to increase the percentage of affordable nutrition products that complies with its own nutrition criteria, Affordable Nutritional Standards, in these markets to at least 50 % in 2025. In its efforts to improve the accessibility of its affordable healthy products, the company has conducted robust pricing and distribution analysis, and shares examples of arrangements made with distributors regarding how healthy products are made accessible in several low- and middle-income countries.

-

- C

Nestlé has developed and updated its commercial strategy, known as Popularly Positioned Products (PPP), to address the affordability of products meeting its own nutrition criteria, including those aimed at addressing micronutrient deficiencies across all its market operations. To appropriately price healthy products whilst considering the needs of low-income consumers, the company has an Integrated Commercial Planning process in place. This aims to review pricing of Nestlé’s healthy products falling within the scope of its Popularly Positioned Products strategy, globally. The company also demonstrated examples of its application in various markets. In terms of distribution, the company shares evidence from Bangladesh through which it reaches “deep rural marginal outlets” to ensure the availability and accessibility of healthy Nestlé products to rural consumers. Its focus on priority populations is substantiated with examples of various products designed to address micronutrient deficiencies (e.g., the Bear Brand in South-East Asia).

-

- C

Unilever discloses commitments that consider the needs of low-income consumers and those with limited geographical access and tries to reach priority populations in low- and middle-income countries with healthy products specifically designed for them. Since the 2018 Index, the company has expanded its accessibility strategy in rural areas by introducing its renowned Shakti Project model in 10 more countries, including Ethiopia, Sri Lanks, Pakistan, Colombia, and Egypt. The company has adopted a strategy to improve the price points of its products.

-

- C

Since 2018, Meiji has expanded its free Home Delivery Service in Japan that offers a range of dairy products, vitamin-rich fruit and vegetable juices, and other products with healthy ingredients. The service is used by 2.5 million households in Japan via 3,000 local distributors and is now also offered by its subsidiary in Thailand.

C1 Product Pricing

Companies assessed on this Index achieve an average score of 1.8 in the area of affordability. FrieslandCampina achieves the highest score of 8.2 in this Criterion, an improvement from 5.4 in the previous iteration, by integrating accessible and affordable nutrition as a key driver of its revised ‘Broadening Access to Nutrition’ program; a significant component of the company’s business strategy (see Best Practices). Nestlé (7.6) and Danone (5.4) follow in second and third place, respectively.

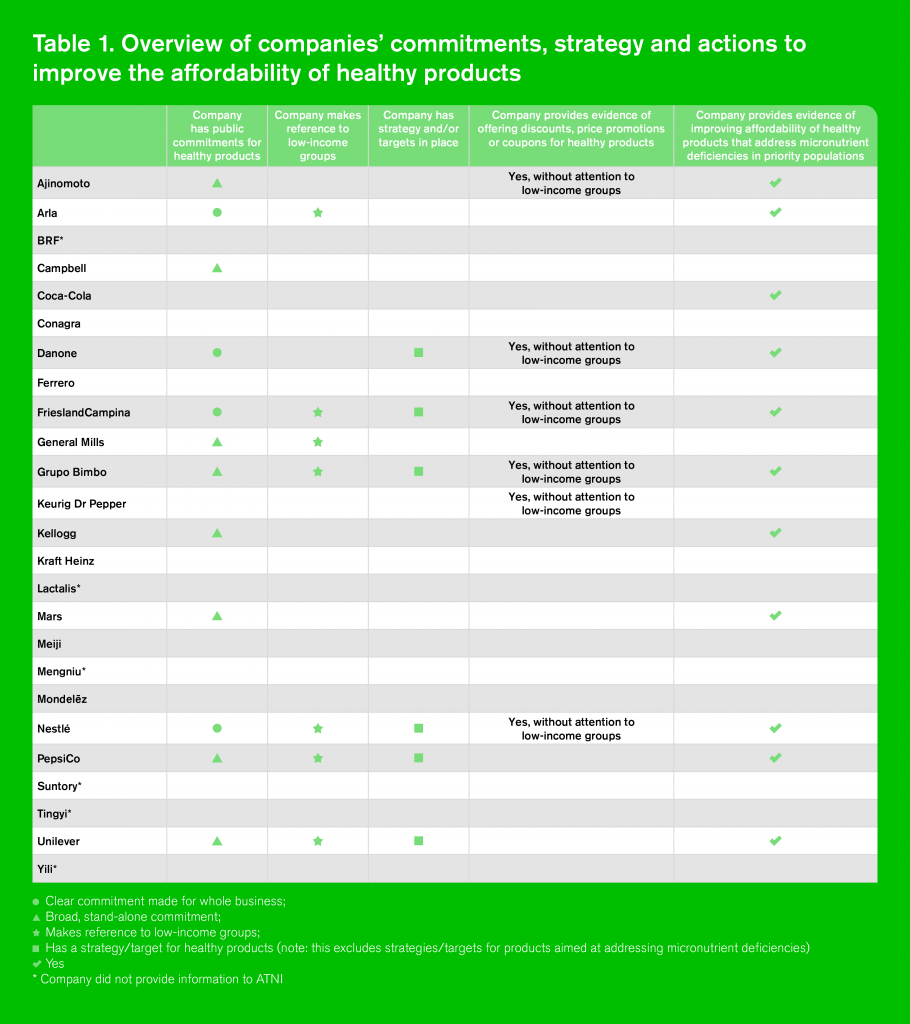

Table 1 (below) shows that 12 out of 25 companies make public commitments to improve the affordability of their healthy products. Among them, eight extend their commitments to all their business operations. Mars has shown improvement by committing to offer affordable, nutritious products with its Mars Edge segment in India. Arla, FrieslandCampina and Nestlé make clear, company-wide commitments explaining how they will ensure affordability of their healthy products, whilst referring to the needs of low-income groups in all the markets they operate in. Danone also makes such a commitment, but without explicitly referring to low-income groups in its public statement. General Mills, Grupo Bimbo, PepsiCo, and Unilever refer to low-income groups, although in commitments that have not been formalized or lack explicit focus on healthy products.

Five companies – Arla, FrieslandCampina, Grupo Bimbo, Nestlé, and Unilever – express concrete commitments to improve the affordability of healthy products designed to address micronutrient deficiencies in priority populations. Especially noteworthy are commitments made by Arla and FrieslandCampina.

Danone, FrieslandCampina, Grupo Bimbo, Nestlé, PepsiCo, and Unilever strengthened their commitments with strategies that aim to improve the affordability of healthy products as shown in Table 1. FrieslandCampina stood out as the only company with objective, measurable targets linked to its ‘Broadening Access to Nutrition’ program for improving pricing and distribution of its healthy products (see Best Practices). Danone monitors in its Danone Way reporting the reach of lower-income groups with its healthy products. Besides, Danone is defining concrete targets for 2030. Nestlé has ‘PPP-Affordable Nutrition Guidelines’ which formally set out its new strategy and is particularly focused on improving affordability in emerging markets.

Arla, FrieslandCampina, Grupo Bimbo, Kellogg’s, Nestlé, PepsiCo, and Unilever draw specific attention to priority populations in their commercial affordability strategies for healthy products addressing micronutrient deficiencies. Nestlé includes fortification of its healthy products in its ‘PPP’ strategy to help address micronutrient deficiencies. To accelerate efforts in this area, the company’s R&D Center in Abidjan, Cote d’Ivoire, has been assigned to lead innovations, develop solutions for specific product categories, identify nutritious raw materials, and support agronomy research. The company states that 87 percent of its popularly positioned products for lower-income consumers were fortified with at least one micronutrient.

For Nigeria and Bangladesh, Arla had aimed to “increase market penetration by 2% in 2020, reaching 71.4 million lower income consumers.” Arla’s approach in Bangladesh is focused on increasing market penetration of fortified ‘filled-milk powder’ supplied under its Pushti Ambassadors program. The program employs rural women as female micro-entrepreneurs also known as ‘Pushti workers’, who supply fortified milk powder at affordable prices to low-income families in remote regions of Bangladesh, who have children at high-risk of undernutrition.

Pricing analysis refers to research focused on determining what low-income consumers are willing and able to pay for healthy products. This type of analysis is conducted to appropriately price healthy products compared to other products that do not meet healthy standards.

In this Index, ATNI found fewer companies providing evidence of conducting comprehensive pricing analysis for their healthy products. Among the seven companies that do so, Nestlé has conducted the most comprehensive analysis as part of its Integrated Commercial Planning process, for all markets it is active in and with specific attention to low-income groups (see Best Practice). FrieslandCampina indicated that it has conducted pricing analysis to assess the extent to which their product offering is aimed at lower-income groups, and whether those products meet the company’s Affordable Nutrition Standards (AFS), its nutrition criteria to determine healthiness of products aimed at groups at high-risk of undernutrition. Grupo Bimbo conducts pricing research as part of its Revenue Growth Management methodology, which includes a price management mechanism for Sanissimo brand in the U.S. but does not specifically refer to low-income groups.

Coca-Cola demonstrated conducting appropriate research with which it determined price points for its Minute Maid Vitingo product in India, a specially formulated product to address micronutrient deficiency and malnutrition in the country. The product is fortified with iron, vitamin A, vitamin C, zinc, folic Acid, vitamin B2 and vitamin B12, and offered in dilutable sachets of 18gm priced at INR 5, which is considered to be within the budget of consumers that fall below the poverty line in India.

Companies have shown limited progress in terms of providing examples of price reductions for healthy products and products designed to meet the nutritional needs of priority populations. Six companies specifically offer discounts, price promotions, or coupons on their healthy products, four less than in 2018. As shown in figure 2, only two companies (FrieslandCampina and Danone) provided examples for all the markets in which they operate. Danone shared evidence of offering discounts up to 25 percent on its healthier products aimed at low-income groups. Nestlé, Grupo Bimbo, Ajinomoto, and Keurig Dr Pepper provide similar examples, but only for their selected markets without specifically targeting low-income groups. Nestlé specifically refers to the needs of low-income groups in Nigeria and Philippines in its pricing-related promotional activities.

For healthy products aimed at addressing micronutrient deficiencies in priority populations, 11 companies provide relevant examples – one more than in 2018. Coca-Cola and Mars show improvement by providing examples of reaching priority populations with affordable products in India. Nestlé provides the greatest number of examples from all markets in which it is active. The company highlights its micronutrient fortification strategy in Asia, Oceania, and Sub-Saharan Africa, comprising 64 countries. FrieslandCampina shares various examples of healthy products and brands aimed at addressing micronutrient deficiencies for which it has improved affordability based on its pricing analysis in countries like Nigeria, Philippines, Indonesia, Vietnam, Ivory Coast and Pakistan.

ATNI recommends that companies:

- Develop and publish formal commitments, in a policy or similar document, to improve the affordability of healthy products and make specific reference to products designed to address micronutrient deficiencies in priority populations and refer to low-income groups.

- Formulate a clear strategy with objective, SMART targets , taking into account how healthy products reach low-income consumers in all markets where the company operates.

- Design tailored affordability strategies and objectives for healthy products aimed at addressing micronutrient deficiencies in priority populations and disclose examples of actions taken.

- Conduct regular pricing analysis to assess and address the unmet needs of low-income consumers and use this insight to appropriately price all healthy products.

- Provide and disclose examples of offering discounts, price promotions, or coupons on its healthy products by explicitly focusing on products that meet the company’s healthy standard, or by addressing affordability of healthy products relative to products not meeting healthy standards.

C2 Product distribution

Companies assessed on this Index achieve an average score of 2.1 in the thematic area of accessibility (accounting for physical access to healthy products). FrieslandCampina achieves the highest score of 7.2, improving from a score of 5 in the 2018 Global Index. Specifically in this area, the company has improved its distribution channels in several low- and middle-income countries by reaching consumers that live in remote, rural areas (see Best practices). Nestlé (5.1) ranks second, followed by Kellogg (5) and Danone (5) sharing third place.

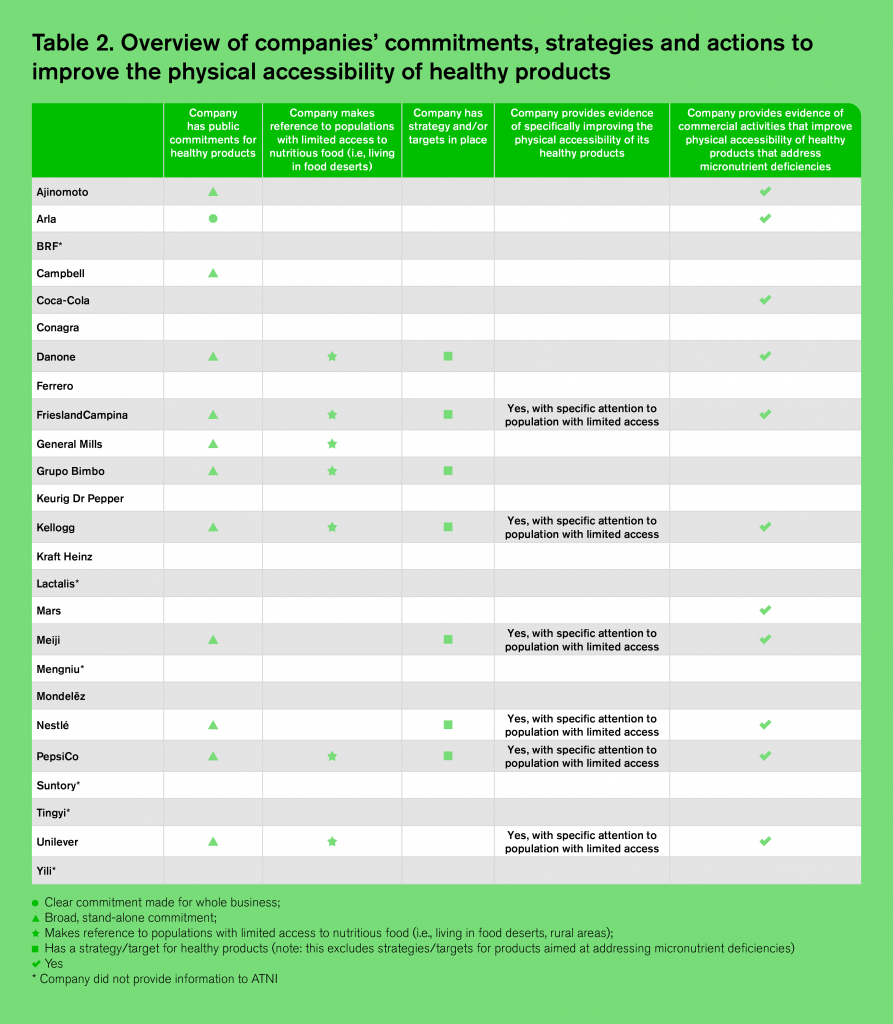

Twelve out of 25 companies have publicly committed to improving the physical accessibility of their healthy products (in 2018 only 10 companies did this). Danone and Meiji have shown improvement by increasing transparency on their commitments. As shown in Table 2, Danone, FrieslandCampina, General Mills, Grupo Bimbo, Kellogg, PepsiCo, and Unilever make commitments with a focus on groups lacking access due to geographical factors. Arla’s commitment on this topic is clear and embedded in its Global Health Strategy, but without reference to groups with limited physical access to nutritious food.

Seven companies expressed commitments for improving the accessibility of healthy products specifically designed to address micronutrient deficiencies in priority populations: Arla, Danone, FrieslandCampina, Grupo Bimbo, Kellogg’s, Nestlé, and PepsiCo.

In the U.S., Kellogg’s commits to provide nutritious cereal products meeting the company’s healthy standards in ‘value-stores’, which the ambition to focus on the needs of children belonging to low-income households that shop in stores like Dollar General and Family Dollar. FrieslandCampina’s commitment is embedded in its approach of targeting local distribution channels. With this, the company aims to promote and distribute its affordable nutrition products in remote, rural areas. Danone embeds its commitment in an approach utilizing micro-distribution business models, by which it works with local partners to co-create micro-distribution projects in nine countries.

Seven companies have concrete strategies for improving the physical accessibility of healthy products, as shown in Table 2. PepsiCo has developed a toolkit to provide access through local distribution of products in some low- and middle-income countries. Meiji publicly describes its approach involving ‘Home Delivery Service’ of its milk products. With this, the company aims to contribute to the health of its consumers daily. Meanwhile, Nestlé aims “to work with governments, non-governmental organizations (NGOs), the professional nutritional community and retailers to increase micronutrient accessibility through partnerships, new routes to market and affordability strategies”.

Eight companies have tailored strategies to reach priority populations with products aimed at addressing micronutrient deficiencies. Unilever has developed a network of small-scale retailers to help them improve access to nutritious, affordable products. Grupo Bimbo retains its strategic 2020 goal since the 2018 Index, by which it aims “to distribute and market fortified/enriched products developed specifically for vulnerable populations with a wide distribution range (more than a trading channel with over 50% range) and a cost per piece at least 5% under the average per category”, but it has not set new objectives going beyond 2020 and does not explicitly refer to the healthiness of these fortified products.

Distribution analysis entails research conducted to determine how best, and through which distribution channels, to reach consumers that lack regular, geographical access to healthy foods.

In this Index ATNI found fewer companies sharing evidence of this type of analysis. Arla, Ajinomoto, Danone, FrieslandCampina, Mars, Nestlé, and PepsiCo provide evidence of this type of distribution-related analysis, with specific attention to populations with limited access to nutritious food. Through its analysis, Danone has implemented micro-distribution projects in nine countries to empower vulnerable populations, mainly women from underprivileged areas, and drive local development, while expanding access to healthy foods and beverages.

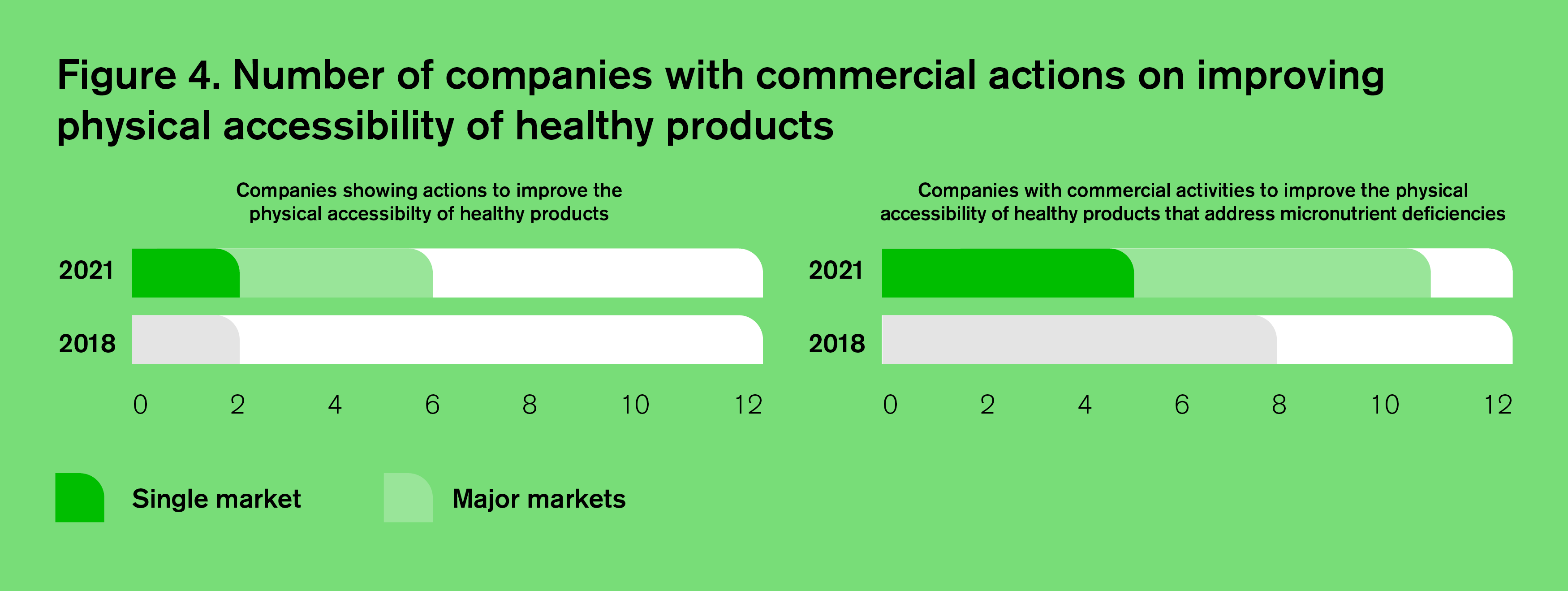

Four more companies provide examples of improving the accessibility of their healthy products, as shown in Figure 4. However, data demonstrating that companies’ have considered specific arrangements/incentives with retailers and distributors are scarce – and none of the companies provided sufficient examples that would indicate they are addressing issues related to accessibility of healthy products in all their markets. FrieslandCampina, Kellogg’s, Meiji, Nestlé, PepsiCo, and Unilever demonstrate relevant actions in this area. Kellogg’s focuses on low-income neighborhoods that incorporate arrangements with “value-stores” to provide low-income shoppers with affordable, healthy products.

Three more companies have provided examples of actions to improve accessibility of specific healthy products addressing micronutrient deficiencies in priority populations. Arla, Unilever, Danone, Meiji, Nestlé, and FrieslandCampina share evidence of arrangements with rural distributors in more than one market in which they operate. After a successful experience with the ‘Shakti distribution’ model (highlighted in the India Spotlight Index 2020), for door-to-door reach in remote, rural areas, Unilever has launched related programs in 10 more countries, including Ethiopia, Sri Lanka, Pakistan, Colombia, and Egypt. Meiji has a free Home Delivery Service in Japan offering a range of milks, probiotic yogurts, vitamin-rich fruit and vegetable juices, and other products; an offering that has expanded considerably since the 2018 Global Index. The service is used by 2.5 million households in Japan via 3,000 local distributors and is now also offered by its subsidiary in Thailand. Some of the products are fortified with micronutrients, such as ‘Meiji Milk Genki’ and Meiji TANPACT Lococare’ milk, the latter developed specifically for the elderly.

Although this Index has a heavier focus on the way companies improve distribution of healthy products commercially, it does take note of actions companies take non-commercially (although these efforts weigh in less in the end score). Twelve companies provided examples of non-commercial initiatives, such as providing products to be distributed to undernourished groups, supporting programs designed to address undernutrition to reach target groups with appropriate products, providing products to school feeding programs, and food banks, etc.

ATNI recommends that companies:

- Develop and publish formal commitments, in a policy or similar document, to improve the physical accessibility of healthy products and make specific reference to products designed to address micronutrient deficiencies in priority populations, and refer to groups with limited physical access to nutritious foods.

- Formulate a clear strategy with objective, SMART targets, taking into account how healthy products reach consumers with limited access such as those living in poor urban areas, food deserts, rural areas, etc. in all markets where the company operates.

- Design tailored accessibility strategies and objectives for healthy products aimed at addressing micronutrient deficiencies in priority populations. For example, seeking new retail partners to achieve set goals, further developing their local distribution networks, etc., and disclose examples of actions taken commercially.

- Conduct regular distribution analysis to assess and address the unmet needs of consumers with limited access to nutritious foods and use this insight to take specific actions for them.

- Provide examples of actions that have improved accessibility of healthy products – for instance, data to demonstrate that retailers in poor urban or rural areas are supplied with healthier options.