Category C: Accessibility

Delivering affordable, accessible products (15% of overall score)

Category C consists of two equally weighted criteria:

-

C1

Product Pricing

-

C2

Product Distribution

To perform well in this category, companies should generally:

- Make clear commitments, which will extend into an action plan, to promote accessibility and affordability of healthier products over less healthy products;

- Include practical actions as part of its commercial nutrition strategy, including category-level access and affordability commitments with incentives for wholesale and distribution partners, engagement of local sales teams, etc.

- Disclose these commitments and action.

And specifically, companies should:

- Adopt and publish a formal policy to improve the affordability of healthy products, and products aimed at addressing micronutrient deficiencies, with specific attention to low-income consumers across all Indian states where the company operates; and show evidence of actions taken.

- Provide evidence of pricing analysis and examples of discounts offered, price promotions or coupons on healthy products at the same or greater rate as products not meeting healthy standards.

- Take guidance from relevant national development initiatives, such as the Transformation of Aspirational Districts program, to develop company initiatives for improving affordability and accessibility.

- Adopt and publish a formal policy to improve the physical accessibility of healthy products and products aimed at addressing micronutrient deficiencies across all Indian states where the company operates, with specific attention to consumers living in urban slums, remote rural areas, etc., and show evidence of actions taken.

- Provide evidence of initiatives that have delivered healthy products to all consumers, including groups that lack access due to geographical factors, e.g. isolated rural areas, poor urban areas, etc.

Context

Consuming a healthy and nutritious diet can be expensive, which requires healthy foods to be both made available and affordable, and adequately distributed, especially considering the needs of groups with lower socioeconomic status. In India, it is estimated that 22.5% of the population lives with less than US$1.90 (World Bank 2011, PPP) per day while the Indian Planning commission estimates that 21.9% of the population are poor and living below the national poverty line. At the same time, as of 2019, approximately one third of the Indian population lives in urban cities with some affluent groups having improved standards of living. This type of socioeconomic heterogeneity is visible in the variety of nutrition issues Indians face, where prevalence of overweight, obesity and diet-related diseases coexist with a high burden of undernutrition and micronutrient deficiencies, which further complicates the country’s nutrition challenges.

India has the sixth largest food and grocery market in the world, with retail contributing up to 70% of total sales. In 2019 around 90% of the Indian retail market was served by small corner stores (kirana) and other informal sellers such as street vendors, with only 8% by supermarkets and just 2% online. The food and beverage sector is the fifth largest manufacturing sector in India. The Ministry of Food Processing Industries expects the total value of the food and beverage segment in India to increase to US$1.142 trillion by 2025. As a result, a wide range of packaged foods and beverages are reaching Indian consumers from national and international companies, which offer them a range of convenience and staple foods. Lifestyle changes have also caused a shift in the habits of Indian consumers – from the consumption of traditional food to new food habits consisting of increased sugar, fat and salt. Worryingly, despite this increasing food availability, India ranks 94th among 107 countries on the Global Hunger Index 2020.

A study estimated that 63-76% of the rural poor could not afford the national recommended diet (based on the Food Based Dietary Guidelines for Indians) when compared against India’s wage data. Furthermore, in December 2019, India saw the worst consumer inflation since July 2014 at 7.35%, primarily due to high food prices. These issues indicate that there is a gap in affordability and access to healthy and nutritious foods and the food and beverage manufacturers, among other stakeholders, play a key role in closing the gap.

The Indian government has taken several actions to improve the country’s nutrition status, such as the flagship Poshan Abhiyaan program to improve nutritional outcomes for children, pregnant women and lactating mothers. The Food Safety and Standards Authority of India (FSSAI), with its existing and new regulations and guidance, the Eat Right India movement, etc., promotes safe and nutritious foods and raises awareness among consumers about healthy and fortified foods. Another government-led initiative is the Transformation of Aspirational Districts program, which ranks districts on several socioeconomic indicators, including health and nutrition, and aims to combat socioeconomic disparities between the most and least developed areas in India. The National Institution for Transforming India (NITI Aayog) has called for more participation from the private sector for the success of this program. Indian food and beverage companies, therefore, can look to these government-led initiatives for guidance in order to broaden the scope of their pricing and distribution efforts. Specifically, companies can incorporate the needs of aspirational districts in their overarching affordability and accessibility strategies. To support the Poshan Abhiyaan mission; the Eat Right India movement; and other government initiatives; as well as the nutritional needs of Indian consumers, more healthy, accessible and affordable products can and should be introduced to make a real difference.

Full India Index Context chapterHow are the pricing and distribution of healthy products affected by the COVID-19 crisis in India?

- In India, food and nutrition security for the poor deserves special attention amidst the COVID-19 pandemic.Supply chain disruptions can cause food-price rises, increase the overall cost of nutritious foods and make a healthy and diverse diet less affordable.

- Since the start of the pandemic, FSSAI had stepped up its efforts in encouraging the fortification of food by announcing that fortification of edible oil and milk with vitamins will be mandatory by the end of 2020. In order to ensure these products will also be available to populations experiencing or at high-risk of micronutrient deficiencies, it is essential that companies commit to providing such products at an affordable price.

- Companies in India play an important role to secure the accessibility and affordability of healthy products; for example, by not increasing the price of healthier products despite the economic shocks of COVID-19. As highlighted in ATNI’s report on the impact of COVID-19 in India, currently none of India-based companies have made commitments on their websites to keep prices low.

The India Spotlight Index 2020 research did not include indicators to score and rank companies’ responses to the COVID-19. But ATNI did talk to companies about their initial coping strategies and responses to the pandemic between March and June 2020 and ATNI has been tracking publicly available information on industry’s response globally to the COVID-19 crisis, including in India, and reported on trends, best practices and areas of concern in separate reports. Read more about how companies can positively contribute to addressing the global nutrition challenges in ATNI’s COVID-19 Project.

Main messages

- Hindustan Unilever achieves the highest score (5.5 out of 10) for its comprehensive pricing and distribution strategies that make its healthy products more accessible to all Indian consumers. The company captures consumers’ needs by having strategically analyzed price points and rural distribution techniques as demonstrated in the Shakti Project for its healthy products across all Indian states where the company operates. Nestlé India (4) and Coca-Cola India (2.7) follow Hindustan Unilever on the leaderboard. Worryingly, the average score achieved by all companies assessed is very low (1.4 out of 10), which makes this the lowest scoring thematic area of the India Spotlight Index 2020. This is similar to the average score in the 2016 Index, which confirms that limited progress has been made to improve accessibility and affordability of healthy products overall.

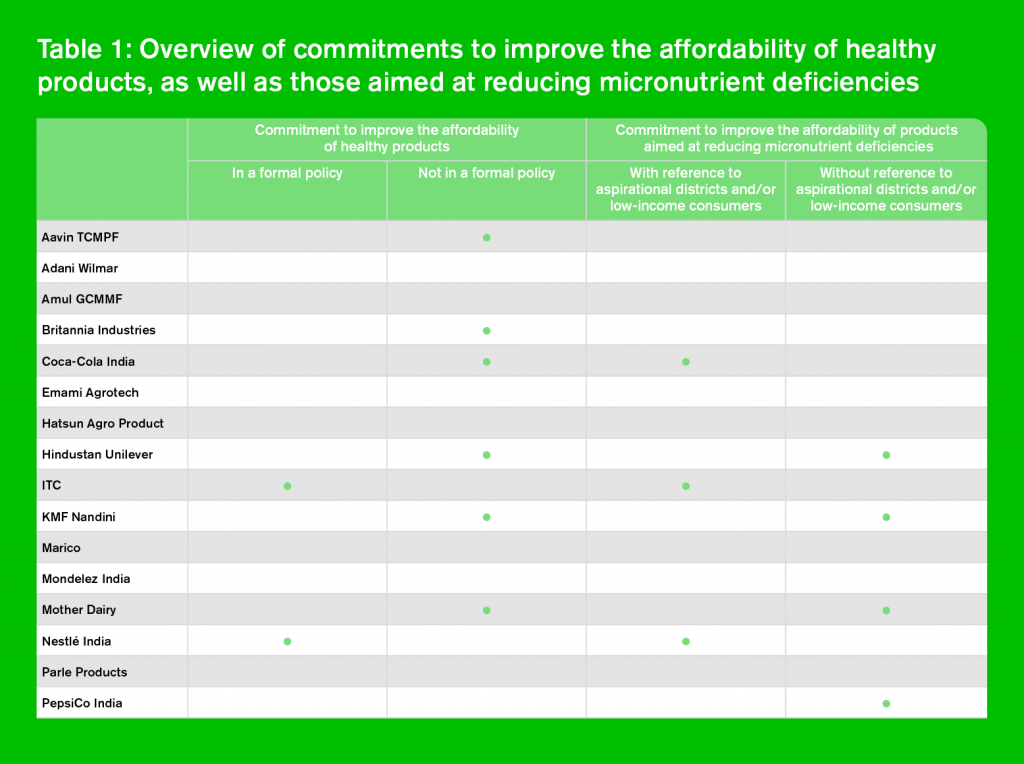

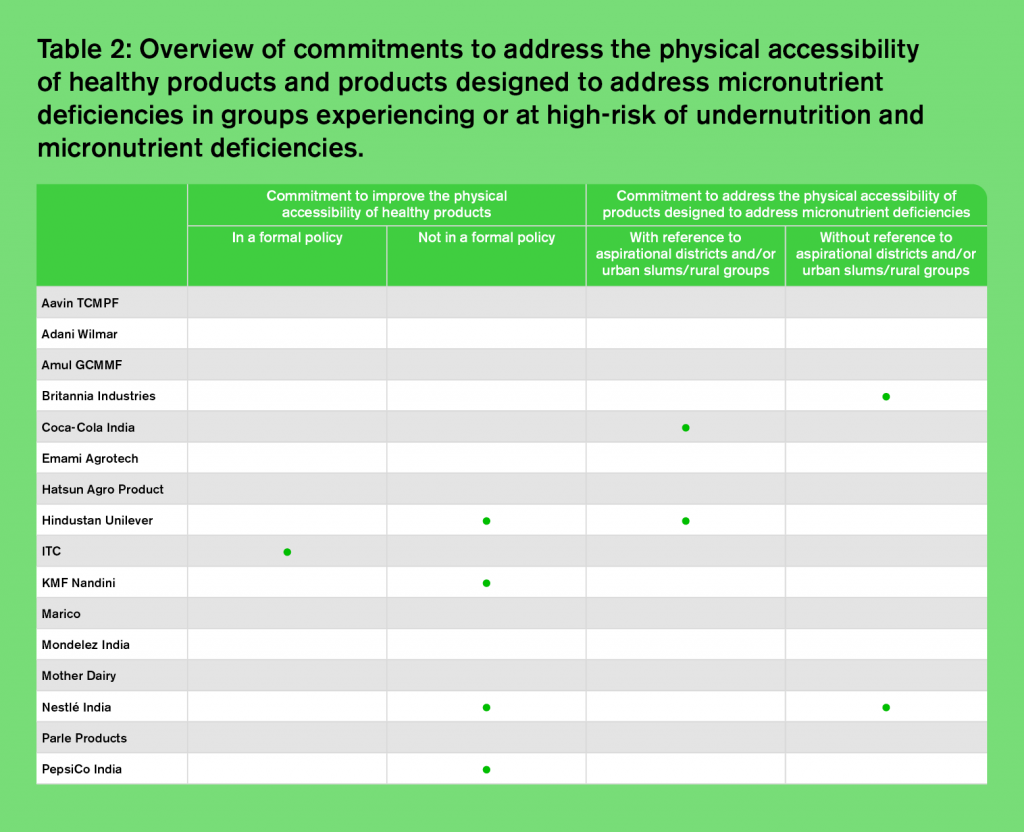

- Nestlé India and ITC are the only companies to have embedded their commitments to ensure the affordability and physical accessibility of healthy products in formal policies, although only ITC has evidence of having policies for both. Other companies show limited and/or specific commitments for either healthy products or products, which aim to address undernutrition and micronutrient deficiencies, such as fortified products. However, the research for this Index did not find evidence of any comprehensive approach to address accessibility and affordability of healthy food, nor did it show clear changes in the approach Indian food and beverage manufacturers have compared to 2016. Strikingly, some companies, such as Adani Wilmar, Amul GCMMF, Emami Agrotech, Hatsun Agro Product, Marico, Parle Products and Mondelēz India, do not appear to have developed any commitments or policies towards this key issue to help consumers eat nutritiously.

- Many companies assessed in this Index do not have a clear way of defining their healthy products. As a result, these companies are unable to formalize any specific accessibility strategy towards delivering healthy products and therefore score poorly in this category. Among the four companies found to have some approach for delivering affordable, healthy products , none of them have publicly disclosed any targets with regards to these strategies. There is therefore an urgent need for companies to define the products that meet healthy standards; formalize their approach to making these products accessible in a clear strategy; and set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) targets for achieving their strategic objectives.

- None of the companies have developed their commitments, policies, or strategies by specifically identifying or addressing the nutritional needs of groups in aspirational districts of India. The Indian government’s national development agenda has defined priority districts for development, with specific socioeconomic indicators measuring poverty, health and nutrition. While some companies have shared examples of initiatives aimed at low-income consumers and those that lack regular and proximate access to nutritious food (for example, rural areas/urban slums), the lack of alignment with the national development agenda is concerning.

- Companies show more emphasis – in terms of commitments, policies, and practices – on improving the physical accessibility and distribution of their healthy products than on making their healthy products affordable through appropriate pricing. This is indicated by the greater quantity of commercial and non-commercial initiatives addressing the physical accessibility of healthy products.

Novelties and best practices

Hindustan Unilever’s new approach to affordable pricing and focus on rural distribution

Hindustan Unilever has developed an approach to improve the affordability of its healthy products using specifically defined price points, which ensures that products meeting its Highest Nutrition Standards (an in-house standard for defining its healthy products) are affordable for middle- and low-income groups. The company’s Living Standards Measure research and marketing tool is used to segment the Indian population into 18 sections based on their standard of living and disposable income. As part of the company’s innovation process, further research is conducted to evaluate pricing and purchase intention among people on low incomes. The company has also launched a cost-managing platform that allows it to minimize currency fluctuations or material inflation, thereby preventing it from passing extra costs onto consumers.

Further, Hindustan Unilever demonstrates a continued commitment to improving the accessibility of its healthy products through its Shakti project, which is an initiative to financially empower rural women and create livelihood opportunities. According to the latest figures, 100,000 Shakti entrepreneurs distribute Hindustan Unilever brands in many thousands of villages across 18 Indian states. The company provides training on basic accounting, sales, health and hygiene, and relevant IT skills. Entrepreneurs are also equipped with smartphones containing a mini ‘Enterprise Resource Package’ to help them run their business efficiently. The project provides a regular income stream for the Shakti entrepreneurs and their families. It focuses on making accessible products that meet Unilever’s Highest Nutrition Standards, which can help address micronutrient deficiencies in villages and rural communities that experience or are at high-risk of undernutrition and micronutrient deficiencies.

KMF Nandini’s milk distribution approach

KMF Nandini is the best performing India-headquartered company in this category, which can largely be attributed to the company’s distribution approach. While the company mainly operates in rural areas, and is oriented to stimulating rural incomes, dairy productivity, and rural employment, it also aims to supply good quality milk at lower prices to urban consumers in all area where the company operates. The company states its objectives, which include: “Achieve economies of scale to ensure maximum returns to the milk producers, at the same time facilitate wholesome milk at reasonable price to urban consumers.”

The company also shared evidence of building a strong network to increase milk product sales by opening depots within and outside Karnataka State. It has 14 milk unions, covering all districts, which procure milk from Primary Dairy Cooperative Societies (DCS) to distribute milk to consumers across towns, cities and rural areas in Karnataka.

Mother Dairy’s distribution of healthy and fortified products at affordable prices

Mother Dairy has undertaken several initiatives to improve affordability of its healthy and fortified milk. For instance, since implementing its approach to fortify all milk products in the National Capital Region (NCR), Mother Dairy has maintained the low price of milk products, making it especially relevant considering the food consumption and expenditure among Indian consumers. The company sells bulk-vended milk fortified with Vitamin A and, since 2016, with Vitamin D in the NCR. Furthermore, Mother Dairy’s horticulture products, such as fruits and vegetables directly sourced from farmers, are sold all year long in the company’s own retail outlets at lower price points. Mother Dairy also sells fortified edible oil products under the brand name Dhara in smaller stock keeping units of 200 ml each at low prices.

Mother Dairy has also shown improvement in its strategies to increase physical accessibility of its healthy and fortified products. Mother Dairy operates around 3,000 bulk milk vending units installed at its consumer touchpoints which include milk booths, franchise shops, kiosks, mini shops, insulated containers, Kamdhenu mobile units, container-on-wheels (COW), etc. thereby offering convenience and plastic-packaging free milk to reach village areas and urban slum areas. Kamdhenu are eco-friendly milk vending machines set up by Mother Dairy to distribute milk across the NCR.

C1 Product pricing

- Eight out of 16 companies have made commitments to address the affordability of their healthy products, although Nestlé India and ITC are the only two companies to specify these commitments in a formal policy (See Table 1). Only, Hindustan Unilever, Nestlé India and ITC disclose their commitments publicly. In 2016, four out of the nine assessed companies made similar commitments. As a result, the findings of this Index show some improvement in the number of companies that acknowledge their role in addressing affordability issues in India. However, there is pressing need for Indian companies to adopt more formalized public policies.

- Seven out of 16 assessed companies have made a commitment to commercially address the affordability of products specifically designed to reduce micronutrient deficiencies in groups experiencing – or at high-risk of – undernutrition, micronutrient deficiencies and related diseases. However, Nestlé India, ITC and Coca-Cola India are the only companies that make specific references to low-income groups. Nestlé India shows its commitment through its Popularly Positioned Products (PPP) Strategy Fact Sheet, which highlights the company’s ambition to improve the price of products aimed at addressing micronutrient deficiencies in low-income consumers. ITC’s commitment is embedded in its Food Products Policy to offer fortified food products with affordable and appropriate nutrition.

- Hindustan Unilever is the only company that has set internal targets within its strategy to improve the affordability of its healthy products relative to products not meeting healthy standards. This is reflected in the company’s newly developed pricing strategy that allows the company to segment the income-demographic of Indian consumers and offer healthy products on a range of price points. The company links this pricing strategy to its global ambition of doubling the proportion of its product portfolio meeting its Highest Nutritional Standards.

- For improving the affordability of products aimed at addressing micronutrient deficiencies, Nestlé India and PepsiCo India have also shown strategic improvements. For instance, since the 2016 India Index, Nestlé India has continued to develop its PPP strategy with an ambition to reach consumers with nutritional products at an affordable price, including products designed to address micronutrient deficiencies. PepsiCo India’s approach has been to minimize the price differential between their healthy and less healthy products, which is also applied to their fortified products. The company shared examples of low-priced Quaker oats products and Tata Gluco Plus, an iron-fortified beverage that has been modified by adding 10% more juice content in seven flavors, whilst maintaining the price at ₹10 per pack.

- Most companies do not conduct a comprehensive pricing analysis of what appropriate pricing would be for products that meet healthy standards in order to ensure affordability of such products. Similar to 2016, Hindustan Unilever and Nestlé India have done this to some extent with Hindustan Unilever having the most comprehensive approach to identifying appropriate pricing for healthy products in a variety of package sizes at different price points across all the states where it operates. Coca-Cola India shared evidence of doing an India-wide pricing analysis too although it does not have a clear definition of healthy products or a Nutrient Profiling System (NPS).

- Mother Dairy showed evidence of promoting bulk vended milk at lower prices than other packaged milk. None of the other companies shared examples that indicate that they have offered discounts, price promotions or coupons on healthy products at the same or greater rate as products that do not meet their healthy standard.

- Seven companies have shown examples of improving the affordability of products that could help fight undernutrition and micronutrient deficiencies. Top performers among them are Nestlé India and Coca-Cola India. Nestlé India provided the example of fortified Chottu Maggi, a product that is part of its ‘popularly positioned products’ for low-income consumers. The company uses its hyperlocal model for marketing and distribution, which focuses on distributing affordable products to consumers across India. Coca-Cola India provided the example of Minute Maid Vitingo fortified with iron, Vitamin A, Vitamin C, Folic Acid, Vitamin B2 and B12, which is made available at low prices in selected states where the company operates.

- Mother Dairy shared the example of maintaining prices of its fortified bulk vended milk despite increasing procurement costs, which it sells at lower prices than other packaged milk in selected states.

C2 Product distribution

What commitments, policies and strategies have companies defined to improve the physical accessibility of their healthy products and products that intend to address undernutrition and micronutrient deficiencies?

- Five companies have made some form of commitment to address the physical accessibility of their healthy products (See Table 2), whereas in 2016, only two (Hindustan Unilever and Nestlé India) of the nine companies assessed showed any focus on this topic. ITC embeds its commitment in its Food Products Policy by disclosing that it will ensure the widest accessibility of its healthy food products. It will do so by ensuring a national geographic distribution across both urban and rural centers, using its fast-moving consumer goods distribution infrastructure and its e-choupal related rural distribution reach. Nestlé India, PepsiCo India and Aavin TCMPF describe some approach but not in a clear strategy and without the presence of any targets.

- Four companies commit to improving the physical accessibility of products designed to address micronutrient deficiencies in groups experiencing or at high-risk of undernutrition and micronutrient deficiencies. Hindustan Unilever (clear commitment) and Coca-Cola India (broad commitment) strengthen theirs by referring to the needs of groups that live in rural, village areas. For instance, Hindustan Unilever aims to offer fortified foods at an affordable price to bring them within the reach of as many people as possible. Britannia Industries (clear commitment) and Nestlé India (broad commitment) pledge without referring to specific needs of people with limited physical access.

Is there evidence that Indian companies have improved the physical accessibility of healthy products for all consumers including groups that lack access due to geographical factors, e.g. isolated rural areas or urban slums?

- Six companies provided evidence of improving the physical accessibility of their healthy products: Hindustan Unilever scores the highest with its Shakti project, which continues to play a significant role in improving the physical accessibility of healthy products in remote villages.

- While Mother Dairy does not share evidence of an explicit commitment or strategy, the company has shared examples of distribution techniques for its healthy products by having operational bulk vending units installed at its various consumer touchpoints.

- KMF Nandini and Aavin TCMPF do not define healthy products nor do they refer to specific groups that lack access due to geographical reasons. However, considering the inherently healthy nature of milk, their milk distribution efforts have been credited as examples of initiatives that improve distribution of healthy products. For instance, KMF Nandini is building a network of depots within and outside Karnataka to increase milk sales and distribution. The company has 14 Milk Unions covering all the districts of the State which procure milk from Primary Dairy Cooperative Societies, and distribute milk to the consumers in various towns, cities and rural areas in Karnataka.

- Six companies provided evidence of improving the physical accessibility of their products aimed at addressing undernutrition and micronutrient deficiencies through commercial channels. Hindustan Unilever highlights the work of Shakti project which helps them to distribute micronutrient rich Malt Based Food (MFD), such as Horlicks and Boost, to remote rural areas across India. Coca-Cola India shares the example of Minute Maid Vitingo, which it distributes through partnerships with pharmacies in rural areas.

- Nine companies provided examples of non-commercial initiatives to improve the physical accessibility of their products. KMF Nandini, Mother Dairy, Nestlé India, Hindustan Unilever, Britannia Industries and PepsiCo India distribute their healthy and/or fortified products through school feeding programs across the country. For instance, Mother Dairy’s ‘gift milk’ initiative helps the company donate milk to government school children in Delhi and Nagpur regions.

- Other companies, such as Adani Wilmar, show initiative by supporting programs designed to address undernutrition. For instance, Adani Wilmar, in association with the Adani Foundation (the Corporate Social Responsibility arm of the Adani Group), publicly discloses its work with the SuPoshan project by which it aims to combat malnutrition and anemia among children in the 0–5-year age group and adolescent girls, as well as women in the reproductive age group. The project also aims to create village level resource pools to support efforts aimed at reducing Infant Mortality Rate & Maternal Mortality Rate. In special Severe and Acute Malnutrition cases, the Adani Foundation supports with ready-to-use therapeutic food as well as nutrient supplements.

Recommendations

- Clearly define their healthy products based on objective nutrition criteria that align with national and international standards and make commitments to improve their affordability and accessibility.

- Adopt and publish a policy and strategy to improve the affordability and physical accessibility of their healthy products, which take into account how these products can reach low-income populations or groups that lack regular access to healthy, affordable food.

- Adopt and publish a policy and strategy to improve the affordability and physical accessibility of products designed to address undernutrition and micronutrient deficiencies.

- Set concrete pricing and distribution targets for reaching consumers across all the states where the company operates to encourage more purchases of healthier products over less healthy products.

- Conduct periodic/regular state-level pricing and distribution analysis to assess and address the unmet needs of consumers with low incomes and based in remote locations. Furthermore, consider taking guidance from national development initiatives, such as the Transformation of Aspirational Districts program, and take appropriate action.

- Include distribution partners, local sales teams and manufacturing departments in consideration of affordability and accessibility strategies.

- Disclose evidence of actions undertaken to improve the pricing and distribution of healthy products, as well as products designed to address undernutrition and micronutrient deficiencies, and report on progress made against their commitments to deliver healthy products across all regions of India.