New report investigates materiality of nutrition

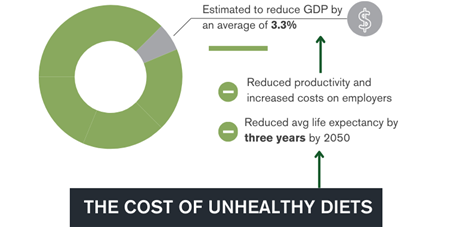

25 June 2024The foods routinely eaten across the world continue to fall short of the minimum standards for healthy and sustainable diets. Today, unhealthy diet is the leading global cause of disease, disability and premature death, and one of the top two risk factors for non-communicable diseases (NCD’s). Further, unhealthy diets cost employers, through reduced productivity and increased costs, and place a significant burden on society (estimated to reduce GDP by an average of 3.3%, and average life expectancy by three years by 2050). As such, investors are increasingly incorporating nutrition considerations into their investment processes.

In this report, ATNi and Planet Tracker put forward further evidence for building the business case for investing in nutrition. It analyses 20 global food manufacturers, and compares the healthiness of their food product portfolios with their profits and market valuations. It finds an association between companies with healthier food product portfolios and higher profitability and valuation in comparison to their unhealthy peers, creating opportunities for investors. The poor disclosures and a general lack of information observed constitutes a risk for investors and makes definitive conclusions difficult. The report therefore calls for additional study and further analysis to build on its conclusions.

-

Food companies are failing to disclose sufficient information to enable investors to properly price in the impacts of nutrition. This is a missed opportunity for companies with a positive story to tell. The threat of regulation is growing and companies producing unhealthy food products are likely to be most impacted. This also creates a risk for investors attempting to assess those companies. Any reduction in long-term growth forecasts as a result could materially affect valuations.

-

There is an opportunity for investors and society to mitigate risk and realise gains by encouraging companies to regard nutrition as material and switch to healthier food product portfolios. This research examines a scenario where companies with broader, unhealthy, food product portfolios switch to healthier alternatives. Not only would the costs to society related to the consumption of unhealthy food products decrease, but if one assumes these companies generated higher margins as a result (in line with their healthier peers), then the companies could generate nearly USD 350 million of extra profits if EV/EBIT multiples are considered.

-

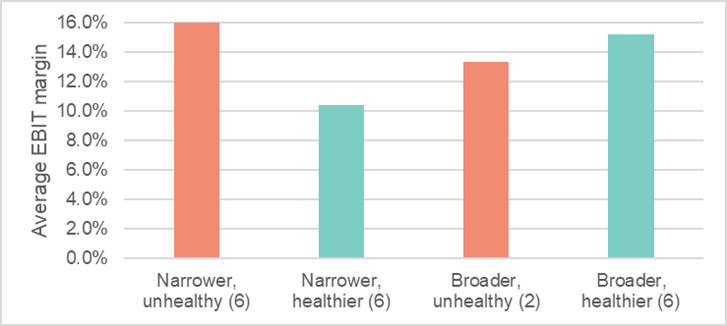

On average, companies with broader, healthier food portfolios have higher EBIT margins (15.2%) than their peers (13.4%), but the opposite is true for companies with narrower food portfolios (16.7% for companies with less healthy portfolios and 10.4% for those with healthy portfolios). However, this result is influenced by two companies (Coca Cola and Keurig Dr Pepper) that have very strong brands and generate significant revenues (and profits) from selling soft drinks while controlling costs by outsourcing a portion of their bottling operations.

- Thirteen out of 20 companies see nutrition as a strategic opportunity, but only seven regard nutrition as a sufficiently material issue to warrant raising in the context of their earnings calls discussions with analysts.

- Of the 20 companies, only two (Coca Cola and Grupo Bimbo) disclose targets relating to nutrition in their annual reports and only two (Danone and Grupo Bimbo) acknowledge their Health Star Rating.

- Nutrition is rarely mentioned as a risk in companies’ annual reports despite increasing regulation but frequently mentioned (albeit often briefly) as a strategic opportunity responding to consumer demand.

Consumer, policymaker, civil society and private sector efforts are being channelled towards creating healthier, more sustainable food systems outcomes. Companies that grasp opportunities and mitigate risks related to this will perform better in the long term. In addition, policymakers, motivated by the societal costs of obesity and by consumer concerns, are increasingly introducing regulation to improve the food environment. These include health taxes, restrictions on marketing, especially to children, limits on salt content and mandatory front of package labelling. This report aims to build on the existing business case for nutrition by demonstrating that investors can benefit from favouring food & beverage companies with healthier portfolios in their investments.

To address nutrition-related risks and opportunities when investing in food & beverage manufacturers, investors can:

-

Encourage companies to improve the healthiness of their food product portfolios before regulation forces changes on them.

-

Press companies for consistent, more detailed, nutrition-related disclosures; particularly an analysis of their food product portfolios (including profitability) using the Health Star Rating system or related government-endorsed product profiling system

-

Ask companies to set proportional nutrition-related targets and publish KPIs to allow progress to be monitored.

-

Incorporate an assessment of the healthiness of particular companies’ food product portfolios in their investment analysis.

-

Engage with food companies to encourage a greater focus on nutrition as an opportunity and to ensure companies are taking concrete steps to mitigate nutrition-related risks, in terms of lost employee productivity as well as increasing health related regulations.

-

Join with other investors to encourage regulators and policy makers to implement compulsory disclosure regimes relating to nutrition and to introduce rules and incentives to encourage companies.

-

Engage with ESG data providers to ensure they include nutrition as a metric in their frameworks and scoring.

Former Head of Danone and chair of the International Sustainability Standards Board (ISSB)

The key messages that resonated most with me were: one, regulation will be key to drive the required changes. Two, consumers will not be the main driver of this change. And three, investors need to play a role, but to date they have been hampered by a lack of disclosure on nutrition….. At ISSB, we are establishing a new global accounting language for sustainability to create clear accountability in disclosures to capital providers, and a link with the financial statements.

Food systems that are unsustainable from a human (and soil) health standpoint will face both physical and transition risks. With already about two billion people overweight in the world, and about 700 million with diabetes, the cost of malnutrition is obvious in the long term. These are both macro and micro economic risks for insurance, health systems, governments, and some are taking action.

One way or the other, companies will be led to share the cost to society of poor nutrition. The ISSB Standards require companies to look at their whole value chain, including consumers on the one side and agriculture on the other. They also need to look at short term impact and long term – this is a requirement, and have to report if this may affect their prospects.

Mechanisms like ATNI exist because of the ongoing market failures and lack of uniform disclosures. Financial institutions, from insurers to pension funds, central banks, sovereign issuers, will have no other choice than factoring the long-term risks they face on nutrition challenges.