ATNI launches the UK Retailer Index 2022

10 May 2022On May 11, 2022, the Access to Nutrition Initiative (ATNI) published the UK Retailer Index 2022.

ATNI’s UK Retailer Index 2022 is the first full nutrition- and health-specific Index to assess the largest 11 grocery retailers in the United Kingdom: Aldi UK, Asda, Co-op, Iceland, Lidl GB, Marks & Spencer, Morrisons, Ocado, Sainsbury’s, Tesco and Waitrose. This report is the latest in a suite of materials produced by ATNI in its partnership with ShareAction, which has included the publication of the UK Supermarket Spotlight 2020 and two UK Product Profiles (2019 and 2021).

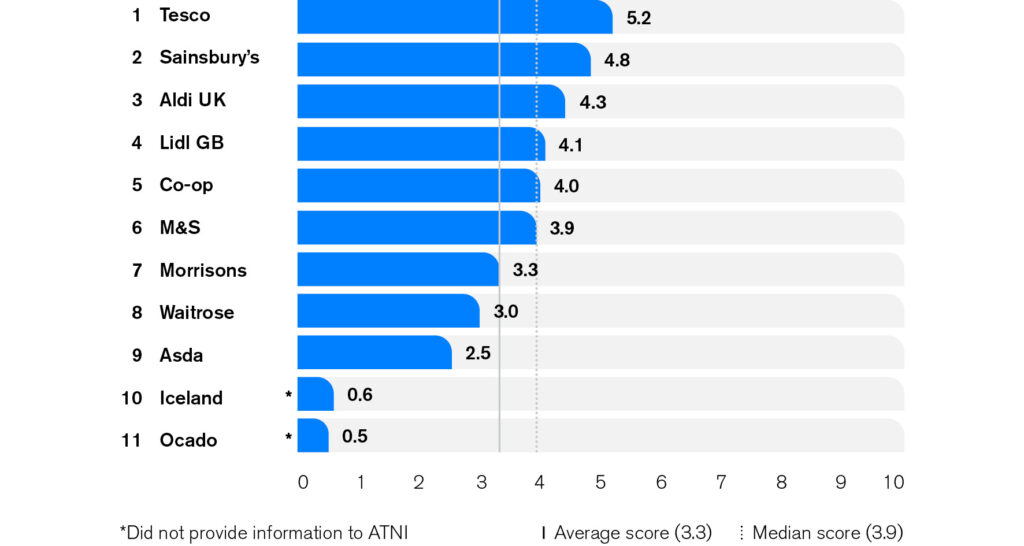

Findings from the report indicate that there is very considerable variation in the performance of the retailers, with no one company standing out as taking strong action across all 8 Topics assessed – see the Methodology for further details on the scope and depth of the assessment. The average across all retailers is 3.3 out of 10, illustrating that all companies need to enhance their efforts to encourage healthier diets in the UK. However, the fact that 9 of the 11 retailers submitted data during the research shows that nutrition and health are considered to be important issues for these UK supermarkets.

The figure below shows how the retailers perform in the overall ranking of the Index.

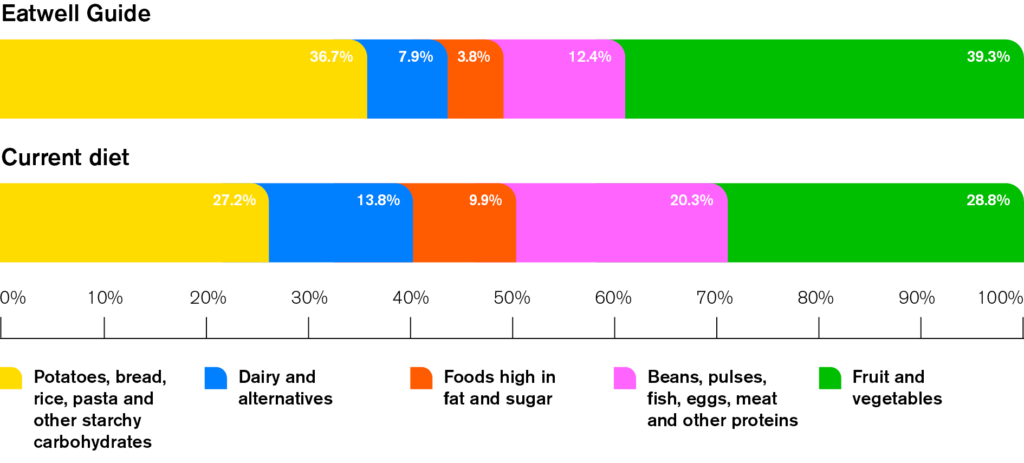

Good nutrition is at the heart of good health – and there is a diet-related health crisis in the United Kingdom. Poor diet is estimated to have account for one in seven of all deaths in the UK and significantly contributes to the disease burden as a risk factor for conditions including cardiovascular disease, many cancers and type 2 diabetes. There is no one action that will reduce overweight, obesity and diet-related diseases, but changing current food consumption patterns is a critical part of the patchwork of interventions required to deliver systemic change on obesity and good health in the UK.

Efforts by the UK government to tackle nutrition are outlined in depth in the Context and Annex of this report. Most recently, in 2019, the government commissioned an independent National Food Strategy. Among the 14 recommendations in the the second part of this strategy – known as the Plan – two are of particular relevance to the food retailers in their role as manufacturers of own-brand products. These are 1) a sugar and salt ‘reformulation tax’ and 2) mandatory reporting on nutrition-related metrics for large food manufacturers (including the retailers, as manufacturers of own-brand products).

Considering that the majority of food expenditure is on food to be consumed at home (in 2019, 55% of all food and beverage expenditure (including alcoholic beverages) was for at-home consumption) and that over 80% of grocery purchases are from the 11 retailers in this report, retailers have a huge opportunity – and arguably a responsibility – to play a pivotal role in addressing the UK’s poor eating habits.

The mounting economic and societal costs of diet-related poor health generate business risks for those retailers that do not act. Conversely, retailers have an opportunity to play a pivotal role if they develop comprehensive, well-informed strategies. Such strategies should aim to protect and enhance financial returns by addressing the business risks such as greater likelihood of regulation and taxes, potential loss of market share and reputational damage by creating the food environments that will lead to healthier communities.

Governance points the way: Retailers who score relatively highly for Governance also tend to rank higher in the UK Retailer Index 2022 as a whole. This is indicative of the association between robust nutrition governance, more comprehensive commitments and better performance across other areas such as responsible marketing, labelling, product formulation and engagement with stakeholders.

Performance is patchy: There are significant differences in the level of commitment/action being taken by the retailers, whether this is in product reformulation, in-store and on-pack marketing/promotion, or positive engagement with stakeholders. No one company led the way across all Topics, which suggests that there is significant scope for even the higher-scoring retailers to learn from each other and improve their performance across all areas of the Index.

There are different definitions of ‘healthy’: Many of the retailers use a nutrient profiling model, which can be used for product reformulation, product ranges and stocking, and marketing/promotions. However, not all the retailers use the government-endorsed Food Standards Agency 2004/5 model. This inconsistency between retailers potentially leads to confusion among customers as to the healthiness of products. Many are also not on track to reach on UK government targets on reformulating to remove unhealthy food components (salt, sugar and calories).

There is a lack of transparency in provision of information: Retailers often do not provide clear, accessible information on their nutrition commitments, their NPMs, and the performance and impact of their actions on nutrition across all aspects of this Index. Steps also still need to be taken in improving product nutrition information on-pack and online for customers.

To find out more about the detailed findings of this research, access the full report.

In order to be comprehensive and effective in their efforts to promote healthy diets for all in the UK, ATNI urges all retailers to adopt comprehensive strategies on nutrition, diet and health following the recommendations set out in this report and in the company-specific scorecards. Implemented consistently, across the country and across all store formats and retail channels, such changes could make an important contribution to a healthier future.

Our findings show that there is still much to do before the food environment in the UK is one in which healthy eating is the norm – and the food retailers can play an essential part, not only following government guidance and legislation, but learning from each other, and taking a lead in ensuring the right to healthy food for all.

To find out more about each retailer’s performance, visit our Companies page and read the individual company scorecards.