ATNi widens scope of work and publishes first report on the UK food retail sector

24 March 2020By Nikolaus Kelnreiter, Program Intern

Last week, we published our second report focusing on the UK market, entitled “UK Supermarket Spotlight: A review of the 10 largest UK food retailers’ disclosure on nutrition, diets and health.” The report sheds light on the commitments and contributions of the ten largest UK food and drink retailers in regards to promoting healthy food and helping consumers to move away from high fat, salt, sugar products. Judging from the publicly available information, these companies have a long way to go to improve their practices.

Obesity and diet-related diseases in the UK

What’s the problem? Isn’t it everyone’s individual choice to buy the products they like, and eat healthily, or not? Research has shown that supermarkets have substantial influence on our choices, which go far beyond how they place products on shelves. Too often, this influence has been used to persuade us to buy unhealthy products rather than healthier options.

In the UK, this has contributed to high levels of obesity and diet-related diseases. By 2016, 61% of adults were overweight or obese in England, with slightly higher numbers in Scotland and Northern Ireland. The issue isn’t confined to adults, however. In 2017/18, 22.4% of children starting school (usually age 5) were overweight or obese. For children in their sixth year, this share was up to more than 34%.

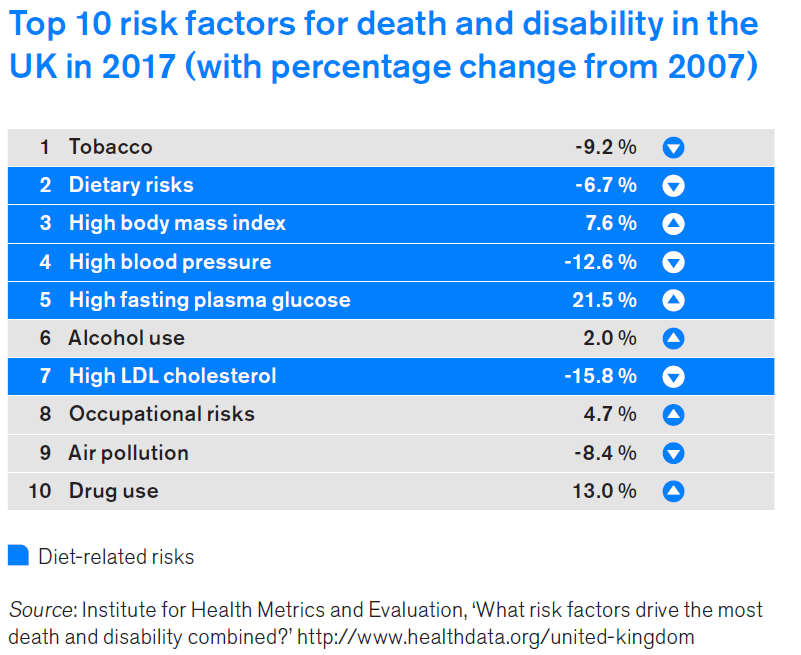

Unhealthy diets are linked to several health issues. 17% of all deaths in 2017 in the UK can be attributed to poor diets. Moreover, five of the top seven risk factors for death and disability are diet-related (see Table 1).

Companies’ disclosure is currently too limited

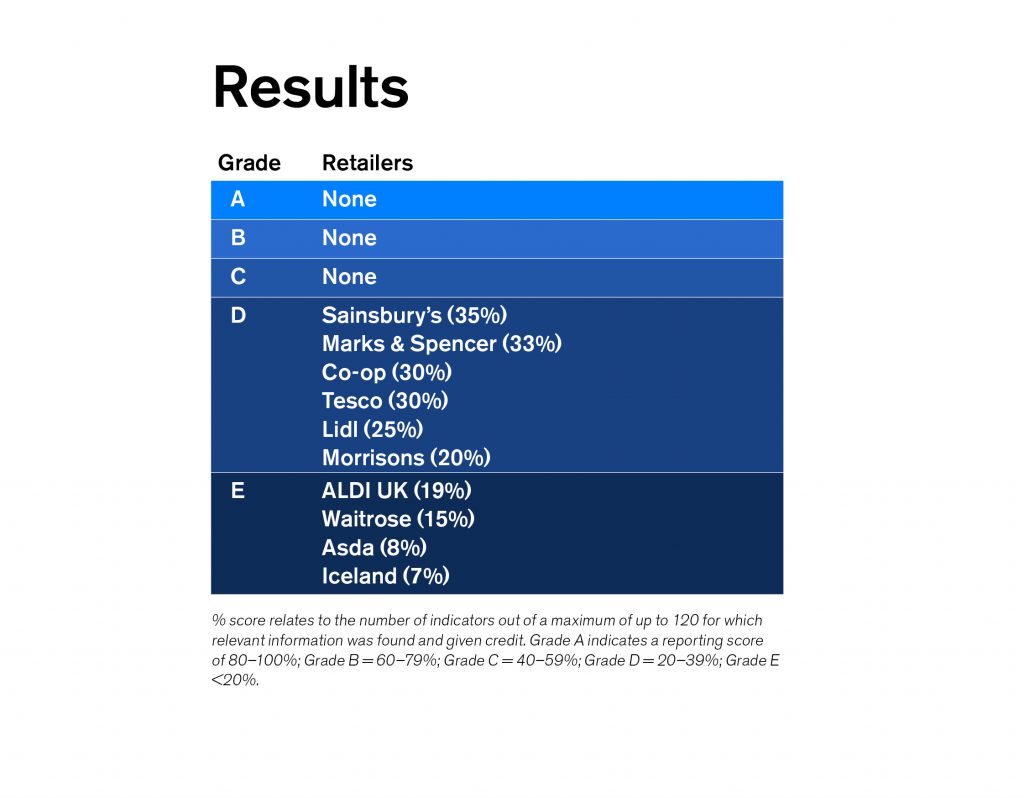

Looking at these numbers, it’s clear that companies have the responsibility – and an opportunity – to address the UK’s poor diets. The problem, as our report states, is that they aren’t doing enough. Or at least, they don’t seem to be, based on their own disclosure: of the 10 companies we looked at, Sainsbury’s reported most extensively – but merely on 35% of the 118 indicators used. These indicators covered eight topics, ranging from governance, nutrient profiling, product formulation, in-store promotion, responsible marketing, labelling, and engagement to infant and young child nutrition. The other companies assessed reported on somewhere between 7% (Iceland) and 33% (Marks & Spencer) of the indicators (see Table 2).

Overall, companies’ reporting is fragmented and does not provide a structured and transparent picture of their strategies on nutrition and health, nor their progress in delivering any such strategy. It therefore does not show whether and how these companies are evolving their businesses to support healthier diets across the country.

What should retailers do next?

Action is needed, urgently. Of course, companies cannot solve these challenges alone. Media, government, investors, opinion leaders, and academics all have to play their part. This is not to say that the private sector isn’t doing anything. But much more concerted action is needed. Concretely, all 10 supermarket chains should develop and publish comprehensive, well-informed strategies on diet, nutrition and health, and report annually their progress in delivering them. We also encourage the retailers to publish as soon as possible any internal nutrition plans, policies and data available on the topics assessed to quickly improve their disclosure. Let’s hope they will.

ShareAction has published an Investor Briefing that sets out the results mentioned above and makes a case for healthy retail environments as an investment theme and a topic that is ‘ripe for investor engagement. Read the full brief here.