Spotlight on Lobbying 2022

Benchmarking the nutrition-related lobbying commitments, management systems, and disclosure of food and beverage manufacturers.

Lobbying: “Any direct or indirect communication with public officials, political decision makers or representatives for the purposes of influencing public decision making and carried out by or on behalf of any organized group.

– Transparency International

The practice of lobbying can be an important part of the policy-making process. Allowing stakeholders to present their perspectives, data, and expertise, can contribute to better legislation, regulations, and standards by providing policymakers with a richer understanding of the (potential) impact of (proposed) policies on the ground. Meanwhile, when aligned with the public interest, this approach has the potential to drive stronger and more effective policy action on key sustainability and societal issues, achieving sector-wide impact and levelling the playing field for all.

However, lobbying does not always work this way in practice. Well-resourced interests can obtain access more easily, frequently, and effectively than other stakeholders, meaning their views have a disproportionate impact on public policy development. The result can be that policy outcomes reflect narrower interests at the expense of the wider public good. In this way, lobbying by the F&B industry has been cited as an obstacle in passing much-needed public policy changes to address the growing burden of obesity and other diet-related non-communicable diseases (NCDs) at the national level around the world.

This report is ATNi’s first in-depth benchmark of the world’s 25 largest F&B companies’ lobbying Policy commitments, Management systems, and Disclosures against the Responsible Lobbying Framework (RLF), with a focus on nutrition-related public health measures.

The RLF was developed to help organizations adopt corporate practices that ensure their lobbying activities are legitimate, transparent, consistent, and accountable, while providing the opportunity for other, more resource-constrained groups, to lobby in the public interest.

The methodology of this report, which consists of 35 indicators, was adapted from ATNi’s Spotlight on Lobbying 2021: BMS Manufacturers, which in turn was based on the RLF. The focus of this research is not to monitor actual lobbying activities or expenditures, but the company’s standards, positions, procedures, and transparency in doing so.

The aim of this report is to encourage F&B manufacturers to improve their corporate practices relevant to lobbying: setting high-level lobbying commitments; translating these into action through effective management systems; being open and transparent through comprehensive disclosure; and thereby lobbying more responsibly and in the public health interest.

Overall Ranking

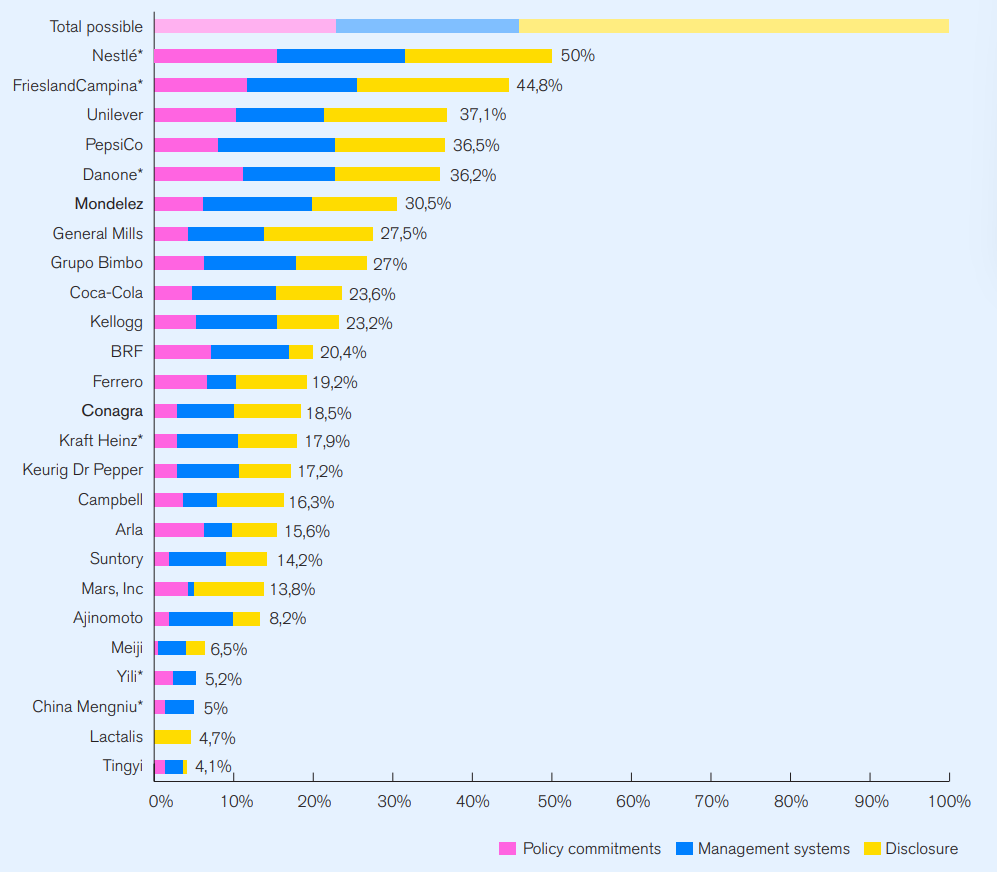

Companies are assessed on their commitments, management systems and disclosure for nutrition-related lobbying.

Key Findings

These results represent a baseline from which companies are expected to progress.

- When assessed against the RLF, the average score

achieved was 21% across all 25 companies, with individual scores ranging from 3% to 50% (as shown in Figure 1 below). While there is wide variation in company maturity on the subject, current practice is far from the standard set in the RLF. This is especially the case for Disclosure, with only two companies scoring over 30%, while Management systems and Disclosure relating to trade associations was also a significant shortcoming.

-

Encouragingly, best practices were identified for most indicators – meaning that, were companies to emulate their peers’ current practices (as a pre-competitive issue), near-full compliance with the RLF is already within reach.

-

No companies’ lobbying disclosures were global in coverage and complete. Many disclosures appear to be compliance-led – meaning they are made through lobbying transparency registers as a prerequisite for accessing policymakers (although this information is sometimes also disclosed voluntarily on companies’ own domains). However, few disclosures were found for markets that do not require such disclosures, especially in low- and middle-income countries (LMICs).

-

No companies disclose comprehensive and global lists of trade association memberships, nor provide information beyond such lists – such as lobbying dues paid, Board seats held, the purpose of these memberships, engagement examples, and lobbying activities undertaken. Stakeholders, therefore, have limited understanding of what kinds of lobbying is being undertaken on behalf of the company, and that the company is tacitly endorsing.

-

Very few companies state that they review their relationships with trade associations systematically and at Board-level, or outline specific measures taken in cases of disagreement. This indicates that they do not consider the prospect that these may lobby in ways or with positions contrary to the companies’ to be a significant risk.

- Exposure to the RLF can lead to improvements. While the results are not directly comparable, three out of five of the leading companies had been previously benchmarked against the RLF as part of the Spotlight on Lobbying 2021: BMS Companies – indicating that these companies had already made progress on aligning their practices with the RLF.

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Go to company scorecard

Going Forward

Companies are strongly encouraged to review and adopt the practical recommendations set out in the report. These include ‘easy wins’ in addition to more fundamental changes in practice applicable to all companies assessed, alongside customized recommendations detailed in the individual company scorecards.

Investors and other stakeholders are encouraged to use these findings to engage with companies to act on these recommendations and apply consistent pressure on them to increase transparency and change their practices in accordance with the RLF.

ATNI hopes to repeat the benchmark in the coming years in order to measure progress and drive further action on this topic. In addition, it will use these findings to engage with companies to facilitate peer-to-peer learning, understand their challenges, and identify barriers to progress.

ATNI also seeks to engage with the wider stakeholder community on exploring new ways to foster accountability on this topic. Key to this is consolidating the evidence-base on lobbying by the F&B industry, connecting the various initiatives active on this topic, and moving towards tracking it systematically: a strong evidence-base is crucial to bridging the gap in perspectives and understanding between industry, public health advocates, investors, policymakers, and wider civil society.

While nothing is stopping companies from increasing their disclosure voluntarily, the findings demonstrate that mandatory lobbying disclosure requirements remain the key driver of transparency on this topic. Therefore, all actors – industry, investors, and the wider stakeholder community – are encouraged to join calls for policymakers to develop or improve legislation around lobbying disclosure at country-level.