Materiality of Nutrition

Are financial markets missing the value of healthy foods?

Project Overview

An unhealthy diet is the leading global cause of disease, disability, and premature death, and one of the top two risk factors for non-communicable diseases (NCDs). In addition to the health-related consequences of malnutrition, it increases risks and costs to employers across all sections of the economy.

On average, across the 52 OECD countries, 8.4% of the health budget is expected to be spent to treat the consequences of overweight between 2020 and 2050, with the associated average reduction in GDP due to lower employment and reduced productivity predicted to be 3.3%, accompanied by a reduction in average life expectancy of three years. The expected economic costs of undernutrition, in terms of lost national productivity and economic growth, range from 2% to 3% of GDP in some countries, up to 11% of GDP in Africa and Asia each year.

Given the health and economic impact of unhealthy diets, the Access to Nutrition initiative (ATNi) in collaboration with Planet Tracker undertook research on the materiality of nutrition, which aimed to identify if investors were missing economic opportunities by not investing intentionally in companies with healthier food portfolios.

This research compared the healthiness of 20 global food manufacturers’ food product portfolios with their profits and market valuations. The total revenue for the included companies was worth USD 6.6 trillion in 2022 (10% of the total food and beverage market). An additional analysis was conducted on a subset of the company’s annual reports and earnings call transcripts to identify the extent to which companies and/or investors were discussing the healthiness of food product portfolios.

Read the executive summaryMethodology

The challenge of a small sample: grouping to compare like-with-like

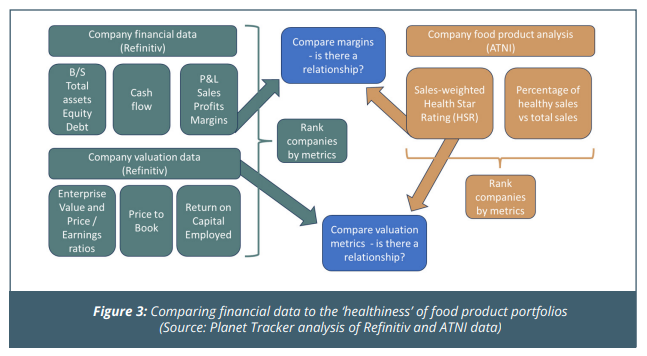

For this research on the materiality of nutrition, information for the healthiness of global food portfolios was based on health star rating data provided by ATNi’s Global Access to Nutrition Index, while company-reported financial and valuation data were taken from Refinitiv.

Given the relatively small and diverse sample of 20 F&B manufacturing companies covered by the 2021 ATNi Global Index, the extent of statistical analysis was limited. To address this challenge, the companies were categorised into four distinct groups based on market capitalisation and the breadth of their food portfolios: smaller vs. larger companies, and narrower vs. broader portfolios. Each group was further analysed based on their Health Star Ratings (HSR), distinguishing between ‘healthier’ (HSR ≥ 2.5) and ‘unhealthier’ (HSR ≤ 2.3) portfolios. This grouping aimed to facilitate more accurate like-for-like comparisons, although it did not yield equally sized categories across the divisions.

The categorisation process revealed trends within the sample, including the distribution of companies based on market cap and food category count. However, the small sample size posed challenges, as some sub-groups contained only one company, raising the risk of distorted results due to the influence of outliers. Overall, while the methodology aimed to provide a structured analysis, the findings should be interpreted with caution due to the limitations associated with the sample size and the diversity of the companies involved.

Read the full report hereKey Findings

With the right approach, health-wealth wins can be achieved that benefit society, companies and investors.

- Food companies are failing to disclose sufficient information to enable investors to properly price in the impacts of nutrition. This is a missed opportunity for companies with a positive story to tell. The threat of regulation is growing and companies producing unhealthy food products are likely to be most impacted. This also creates a risk for investors attempting to assess those companies. Any reduction in long-term growth forecasts as a result could materially affect valuations.

- There is an opportunity for investors and society to mitigate risk and realize gains by encouraging companies to regard the materiality of nutrition and switch to healthier food product portfolios. This research examines a scenario where companies with broader, unhealthy, food product portfolios switch to healthier alternatives. Not only would the costs to society related to the consumption of unhealthy food products decrease, but if one assumes these companies generated higher margins as a result (in line with their healthier peers), then the companies could generate nearly USD 350 million of extra profits if EV/EBIT multiples are considered.

- On average, companies with broader, healthier food portfolios have higher EBIT margins (15.2%) than their peers (13.4%), but the opposite is true for companies with narrower food portfolios (16.7% for companies with less healthy portfolios and 10.4% for those with healthy portfolios). However, this result is influenced by two companies (Coca Cola and Keurig Dr Pepper) that have very strong brands and generate significant revenues (and profits) from selling soft drinks while controlling costs by outsourcing a portion of their bottling operations.

- Thirteen companies see nutrition as a strategic opportunity, and many are keen to ensure the issue of nutrition is flagged to analysts during earnings calls. However, only seven companies regard nutrition as a sufficiently material issue to warrant raising in the context of their earnings calls discussion with analysts.

- Six companies with broader healthier food portfolios have a higher average profit (EBIT) margin (15.2%) than the average for their peers with broader unhealthy food product portfolios (13.4%).

- However, five companies with narrower, unhealthy, food product portfolios have a higher average margin (16.7%) compared to their peers with a narrower, healthier food product portfolios (10.8%). The higher average profit margin of this group is particularly influenced by two companies (Coca Cola and Keurig Dr Pepper) that have very strong brands and generate significant revenues (and profits) from selling soft drinks while controlling costs by outsourcing a portion of their bottling operations. However, there is significant overlap between the two groups in terms of their individual EBIT margins and the range of EBIT margins is wide.

- The six companies with broader, healthier food portfolios have a higher average EV/EBIT valuation ratio than their unhealthy peers.

- Analysis of a sample of the Annual Reports of the 20 companies showed that only two (Coca Cola and Grupo Bimbo) disclose targets relating to nutrition and only three (Danone, Nestlé and Grupo Bimbo)* acknowledge their Health Star Rating.

- Analysis of transcripts and Annual Reports of a sample of the 20 companies showed that nutrition is rarely mentioned as a risk despite the growing threat of regulation but frequently mentioned (albeit often briefly) as a strategic opportunity responding to consumer demand.

Investor Call to Action

Actions to address nutrition-related risks and opportunities when investing in food & beverage manufacturers:

- Encourage companies to improve the healthiness of their food product portfolios before regulation forces changes on them.

- Press companies for consistent, more detailed, nutrition-related disclosures; particularly an analysis of their food product portfolios (including profitability) using the Health Star Rating system or related government-endorsed product profiling system.

- Ask companies to set proportional nutrition-related targets and publish KPIs to allow progress to be monitored.

- Incorporate an assessment of the healthiness of particular companies’ food product portfolios in their investment analysis.

- Engage with food companies to encourage a greater focus on nutrition as an opportunity and to ensure companies are taking concrete steps to mitigate nutrition-related risks, in terms of lost employee productivity as well as the risks of increasing health-related regulations.

- Join with other investors to encourage regulators and policy makers to implement compulsory disclosure regimes relating to nutrition and to introduce rules and incentives to encourage companies.

- Engage with ESG data providers to ensure they include nutrition as a metric in their frameworks and scoring.