Marico Limited

Product categories assessed

Breakfast Cereal|Edible Oils|Processed Meat, Seafood and Alternatives to MeatPercentage of company India sales covered by Product Profile assessment

90-100%Headquarters

IndiaType of ownership

PublicEuromonitor International Limited [2021]

© All rights reserved

Important

The findings of this Index regarding companies’ performance rely to a large extent on information shared by companies, in addition to information that is available in the public domain. Several factors beyond the companies’ control may impact the availability of information. Therefore, in the case of limited or no engagement by such companies, this Index may not represent the full extent of their efforts.

Scoring Overview

(%) Figure in brackets is the weighting of the category. All category and criteria scores are out of 10.

Product Profile

The Product Profile is an independent assessment of the nutritional quality of companies’ product portfolios. For this purpose, ATNI uses the Health Star Rating (HSR) model, which rates foods from 0.5 to 5.0 based on their nutritional quality. The underlying nutrient profile model assesses nutrients of concern (sodium, total sugar, saturated fat, and overall energy) and positive food components/ nutrients (fruit and vegetable content, protein, fiber, and, in some cases, calcium) to score products on the basis of nutritional composition per 100g or 100mL.

ATNI uses the threshold of 3.5 stars or more to classify products as generally healthier. Product Profile results account for 30% of the total Index score.

Portfolio-level Results

| Total no. products assessed |

Range of total 2021 company sales in India |

Sales-weighted Mean HSR (out of 5 stars) |

Products meeting the ‘healthy’ threshold (HSR of 3.5 stars or more) |

|

|---|---|---|---|---|

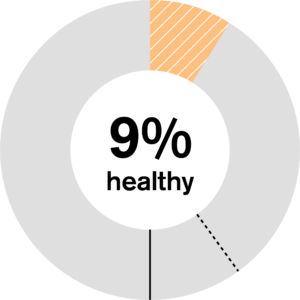

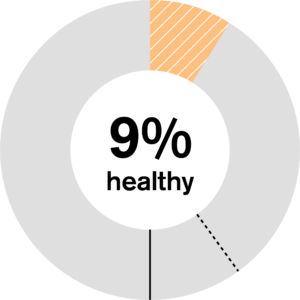

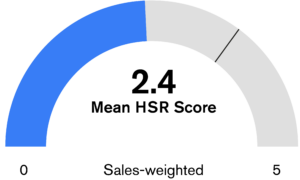

| 15 | 90-100% | 2.4 | % of distinct healthier products |

% sales from healthier products |

| 33 | 9 | |||

• Marico’s average sales-weighted Health Star Rating (HSR) is 2.4 (stars) out of 5 (3.0 unweighted mean HSR).

• A total of 15 products across the company’s three best-selling product categories were assessed using the HSR model.

• 33% of distinct products analyzed for Marico met the ‘healthy’ threshold (3.5 stars or more in the HSR).

• When taking category sales values into account, the company was estimated to derive approximately 9% of its India 2021 sales from healthier products (mostly from Meat alternatives).

Mean Health Star Rating by category for Marico Limited

companies assessed

in the category

Lowest mean HSR of

companies assessed

in the category Healthy threshold

• Among categories assessed, Marico’s products in Meat alternatives (4 products) had the highest mean HSR (4.4 out of 5.0), of which 75% reached the ‘healthy’ threshold.

• The company’s lowest scoring category is Edible Oils with a mean HSR of 2.3 out of 5, for which 0% of products reached the ‘healthy’ threshold.

• In total, 40% of distinct products and 78% when sales-weighted, was found to be eligible to be marketed to children using the WHO South-East Asia Region (SEAR) criteria.

• Marico (77%) ranked second in terms of sales-weighted proportion of products eligible to be marketed to children, using the WHO SEAR criteria.

• From the change analysis this and the last India Index, before sales-weighting was applied, Marico had the highest raw mean HSR in 2020 and 2023.

Categories

The Index is divided into seven categories which assess food & beverage companies' policies, practices and transparency related to nutrition in the Indian market.

Governance 10% of overall score

Products 45% of overall score

Accessibility 15% of overall score

Marketing 15% of overall score

Workforce 5% of overall score

Labeling 5% of overall score

Engagement 5% of overall score

Nutrition

• Since 2020, the company has developed the ‘Marico Nutrition Policy’ and published it in full on its website. The Policy outlines the company’s approach to “offering healthier and affordable food products to its consumers” primarily through (re)formulation (both minimizing nutrients of concern and increasing positive ingredients), guided by a newly developed nutrient profiling system and R&D into healthy innovations. It also outlines its approach to responsible marketing and labelling here. However, it does not explain how it aims to ensure that it offers ‘affordable’ healthier foods.

• The company reports on its progress in its Sustainability Report, in which it provides specific examples of recent ‘Food Innovations’ – products that have been introduced or reformulated in the last year with an improved nutritional profile – as well as progress on its labelling commitments.

• In its reporting on Enterprise Risk Management, the company identified “Changing consumer preferences” as a key risk, recognizing that its needs to respond by offering nutritious products and creating awareness around these.

• The company indicated to ATNI that it consults experts, including medical doctors, cardiologists, endocrinologists, and nutritionists, at different stages of the product life cycle, seeking guidance on the role its products can play in address under- and overnutrition in India.

Aspects to improve

• In addition to improving the healthiness of its portfolio, Marico is encouraged to also integrate in its nutrition strategy how its ‘healthier’ products reach consumers relative to its less healthy products, for example through via relative pricing strategies and/or increasing investments in marketing for the former. This is especially important to underpin the company’s aim of “offering healthier and affordable food products”. Ideally, this should also include specific attention to addressing the unmet needs of priority populations (based on government priorities).

• To drive progress internally on implementing its nutrition strategy, the company is recommended to develop specific, measurable, and timebound targets encompassing various elements of its approach, and an overall target to increase sales of the products it defines as ‘healthier’.

• In terms of reporting on the implementation of its nutrition strategy, the company is encouraged to go beyond reporting specific examples only and report on progress more systematically through the use of quantitative metrics, related to sales or other quantifiable outcomes (rather than only outputs), showing what has been achieved year-on-year across its portfolio or key product categories. This helps to assure stakeholders that the company is making meaningful progress on its nutritional journey.

• The company is encouraged to clarify on the public domain its accountability arrangements regarding the implementation of its nutrition strategy and/or reformulation targets, ensuring that these are assigned to the highest levels of seniority within the company and are subject to regular review at Board-level.

• Marico is encouraged to publish specific examples of its engagement with stakeholders to inform its nutrition strategy, including explanations of how this impacted the company’s approach.

Category B2: Portfolio Development

• In its Marico Nutrition Policy, the company states that it “makes concerted efforts to minimise ingredients of concern and focus on healthy ingredients and nutrients with inherent goodness in its product portfolio to contribute positively to an individual’s daily nutritional requirements.” However, no specific targets were found.

• Marico had made a Pledge in 2018 to reduce sodium in new products, reporting that by 2020 the company had reduced sodium by 20% in all new variants since 2018. The company has not set a new target for further reductions in sodium levels since.

• Marico's Nutrition Policy states that the company fortifies its edible oils (for example, under the Saffola brand) with vitamins A, D, and E, in line with Food Safety and Standards Authority of India (FSSAI) Fortification Regulation.

Category B3: Nutrient Profiling

• According to the ‘Marico Nutrition Policy’, the company has “developed science-based nutrition guidelines that explain our choices with respect to our existing product portfolio as well as future product innovations”. The company has indicated to ATNI that these apply to its entire portfolio.

• This system is stated to take into account “levels of sugar, saturated fat, trans fat, sodium, along with positives like vitamins, dietary fiber, protein, whole grains, and micronutrients”. However, no specific information can be found regarding the criteria for product categories, nutrient threshold values, reference units, and the algorithm to define what is considered 'healthier'.

• The company states that its nutrition guidelines are “science-based”; however, no references to studies or international guidelines are provided to support this.

Aspects to improve

Category B2: Portfolio Development

• In order to drive progress on improving the healthiness of its portfolio and build further on its 2018 Eat Right Pledge, the company is encouraged to set specific, measurable, and timebound targets to reduce nutrients of concern (sodium, sugar, and saturated fat) and increase positive ingredients (including whole grains and fruit, vegetable, nut and legume (FVNL)) across its relevant portfolio. These targets should ideally be aligned with the ICMR/National Institute of Nutrition (NIN) Dietary Guidelines and Recommended Dietary Allowances (RDAs) for Indians, and/or WHO guidelines, and are recommended to be published on the public domain.

• The company is recommended to report progress against all reformulation targets on an annual basis, in a consistent and easily accessible manner, in order to increase transparency and accountability.

• The company is strongly encouraged to develop an internal policy to prevent the fortification or enrichment of unhealthy products (i.e. with high levels of fat, sugar, and/or sodium), for example, according to nutrition criteria defined by an (internationally recognized) NPM. Thereafter, it is encouraged to produce more fortified products to address specific micronutrient deficiencies in India according to government priorities, while ensuring that these are ‘healthier’.

Category B3: Nutrient Profiling

• The company is recommended to disclose all details of the NPM it uses in full, including the nutrient thresholds it uses, reference values, and how ‘healthier’ is defined, on the company’s website and, ideally, in a scientific journal that is peer-reviewed and indexed.

• Marico is additionally encouraged to publish its system in a peer-reviewed journal, so that stakeholders can better understand and assess it.

• The company is also recommended to benchmark the proportion of products defined as ‘healthier’ according to this model against internationally recognized (and/or government-endorsed, when applicable) NPMs, strictly adhering to the guidelines of these models, and annually disclose the percentage of its India portfolio ‘healthier’ sales in the public domain.

• While one of the objectives stated in the Marico Nutrition Policy is to “Deliver consumer delight through food products that are healthier and affordable”, the company provides limited details on its approach to doing so, such as how affordable products are defined as ‘healthy’ or ‘affordable’, and how it ensures that its healthier products, particularly those addressing micronutrient deficiencies, reach lower-income consumers.

• While the company provided information to ATNI about how it approaches pricing of its products, it did not provide evidence that it did so specifically for healthier products, and with affordability for lower-income consumers in mind.

Aspects to improve

• To ensure that products that are considered by the company to be ‘healthier’ are being priced affordably for lower-income consumers, the company is recommended to:

- ensure that such products are defined as ‘healthy’ through the use of an NPM (or other clear nutrition criteria) - such that products high in fat, salt or sugar (HFSS) are specifically excluded;

- have a clear approach to determining whether a product is ‘affordably priced’; and

- use a formal classification of ‘lower-income consumers’ that it is trying to reach.

• With these definitions and processes in place, the company is encouraged to develop and implement a strategy or approach for ensuring that at least part of its ‘healthier’ (and, ideally, fortified or micronutrient-rich) product portfolio is priced affordably for lower-income consumers, and continually explore new opportunities for delivering ‘affordable nutrition’. Examples of approaches can be found in the methodology and chapter for Category C.

• The company is recommended to publicly disclose information about its affordable nutrition strategies/approaches, including specific definitions, the approaches taken to ensure affordability, and the progress made on implementation.

• Through its membership to the Advertising Standards Council of India (ASCI), Marico commits to the Code for Self-Regulations of Advertising Content in India, including the Self-Regulation Guidelines on Advertising of Foods and Beverages. The Guidelines outline commitments related to the representation of products in advertisements directed at a general audience in India, and do not include specific commitments on the marketing of foods and beverages to children.

Aspects to improve

• The company is encouraged to increase transparency and accountability for its responsible marketing commitments through its membership of the ASCI by integrating these into a responsible marketing policy that covers all media channels and audiences, published on the company’s website.

• The company is encouraged to develop and publish a comprehensive responsible marketing policy that covers all media channels and audiences, including children under the age of 18 (in line with Central Consumer Protection Authority (CCPA) guidelines).

• The company is encouraged to ensure more responsible marketing to children by adopting:

- aligning its nutrition criteria for products considered appropriate to be marketed to children with the WHO SEAR nutrient profiling model ;

- audience threshold of 25% for limiting children’s exposure to advertisements on all media;

- specific commitments not to use certain materials and techniques to market their products to children, including celebrities, licensed characters, promotional toys and games, and depicting children on packaging.

• The company is encouraged to commission regular third-party audits of compliance to its responsible marketing policy in India, and to disclose the results of this audit, as well as the response mechanism it has in place to address instances of non-compliance.

• Marico showed evidence that all canteens are certified by FSSAI as 'Eat Right Campuses'. In order to receive the certification, four different parameters are tested: safe food, healthy food, sustainable food, and building awareness.

• The company offers several initiatives on nutrition education for employees, such as nutrition sessions from the in-house nutrition team and expert guest speakers on healthy diets. It is not clear if there is a program in place with targets and whether this applies to all/ some office workers.

• Marico offers annual health check-ups for all employees, including nutrition focused checks.

• The company offers 15 days of paid paternity leave, in line with what is offered to government employees.

• Marico offers a creche facility for mothers with children 6 years old and below.

Aspects to improve

• The company is recommended to define quantifiable and meaningful expected outcomes for its workforce nutrition program and evaluate it accordingly – for example related to health-related behaviors, health-related outcomes, outcomes related to employee participation, or benefits to the company. Becoming a signatory of the Workforce Nutrition Alliance (WNA) and utilizing its self-assessment scorecards could be a good first step in this regard.

• The company is encouraged to develop a clear policy on support extended to breastfeeding mothers at work in order to aid their maternal health; and this should apply equally to all office and production site employees. Support should, at a minimum, include i) Private, hygienic, safe rooms for expressing breastmilk; ii) Refrigerators in place to store milk; and iii) Other flexible working arrangements to support breastfeeding mothers, such as flexible working hours. Furthermore, it is important to foster a workplace culture that is supportive of breastfeeding, for example through awareness campaigns.

• The company is also encouraged to develop a workforce nutrition program for its supply chain workers, starting with a needs assessment to identify those groups at highest risk of experiencing malnutrition. It can then engage with its supply chain partners and relevant civil society organizations to help reach these groups, further study the underlying causes of malnutrition in that specific context, and develop a tailored program to address their nutritional needs in a targeted manner. For more guidance, see the ATNI 2021 Action Research report and/or engage with the WNA.

• The company’s Saffola brand website shows clear images of front-of-pack and back-of-pack for each of its products, in addition to nutritional information tables showing per 100g and per serve and %RDA.

Aspects to improve • Once it is formally enacted by FSSAI, if the Indian Nutrition Rating (INR) FOP labeling system is on a voluntary basis, the company is strongly encouraged to adopt it across their entire portfolios in India.

• In its Annual (Consolidated) Report 2020-21, the company states that it engages in "Policy advocacy based engagements in industry forums, trade associations, interest groups, sectoral associations and scientific/R&D based thought leadership initiatives."

• In its 2022 Annual Report, it further states it “contributes in development of industry and government bodies in regulatory, operational and other areas by working along with these institutions” and that “Food safety, nutritional intake, healthier heart awareness” are among the priorities it has worked on. However, it does not report specific examples of working on policy measures in relation to these topics.

• The company publishes a list of 19 trade associations it is a member of, and two consumer associations that it is associated with. The company confirms that it holds leadership positions on several of these, but does not report this publicly or specify which.

Aspects to improve

• The company is encouraged adopt a responsible advocacy policy, which also applies to third-parties advocating on behalf of the company, in which it commits that personnel will conduct themselves responsibly; to be transparent about their identity and intentions; to require that the evidence presented shall be as independent and representative as possible; and to always consider the wider public health interest in its efforts. It should also clearly define what it defines as advocacy and what kinds of activities this includes.

• The company is recommended to publish details about the governance of its policy engagement and advocacy in India, including roles and responsibilities within the organization, approval procedures, and tracking mechanisms. If these are not already in place, they should be developed.

• The company should also publicly disclose specific examples of how it has engaged with government bodies’ regulatory development processes, especially relating to “nutritional intake” and “healthier heart awareness”. In doing so, it should clearly and unambiguously disclose its position on policy topics relevant to the company, whether it has engaged directly on these or not.

• While the company is comprehensive in its disclosure of trade association memberships and consumer association affiliations, it could also further demonstrate best practice by listing its the specific interest groups and scientific/R&D based thought leadership initiatives it is associated with that carry out political advocacy, particularly for nutrition-related policy measures.

• It should also publicly specify which trade associations and other organizations it holds leadership positions on.

Sustainability

• The company discloses categories of its Scope 3 emissions, reporting on emissions for each.

• The company provides qualitative evidence of reducing plastic use and transitioning to more sustainable forms of packaging.

• The company has a target to achieve 100% recyclable packaging by 2023, and reports that it is at 94% as of 2023. The company also states that it has saved 206 metric tons of material in FY22 due to product stewardship initiatives, however it is unclear whether this is solely focused on plastic material. The company also provides some qualitative evidence of transitioning product sleeves from PVC to PET, recycling of PPET for smaller SKUs, and removing Polybags from 1 Litre Saffola Oil.

Aspects to Improve

• The company is encouraged to work with its value chain partners to reduce both FLW Food Loss and Waste (FLW) and plastic use. This should go beyond requirements set out in mandatory waste management regulations.

• The company is encouraged to ensure that its efforts to transition to sustainable forms of packaging in India are evidence-based, and correspond with clear quantitative sustainability outcomes.