Patanjali Foods Limited

Product categories assessed

Dairy|Edible Oils|Flour|Processed Meat, Seafood and Alternatives to Meat|Sweet SpreadsPercentage of company India sales covered by Product Profile assessment

90-100%Headquarters

IndiaType of ownership

PublicEuromonitor International Limited [2021]

© All rights reserved

Important

The findings of this Index regarding companies’ performance rely to a large extent on information shared by companies, in addition to information that is available in the public domain. Several factors beyond the companies’ control may impact the availability of information. Therefore, in the case of limited or no engagement by such companies, this Index may not represent the full extent of their efforts.

Scoring Overview

(%) Figure in brackets is the weighting of the category. All category and criteria scores are out of 10.

Product Profile

The Product Profile is an independent assessment of the nutritional quality of companies’ product portfolios. For this purpose, ATNI uses the Health Star Rating (HSR) model, which rates foods from 0.5 to 5.0 based on their nutritional quality. The underlying nutrient profile model assesses nutrients of concern (sodium, total sugar, saturated fat, and overall energy) and positive food components/ nutrients (fruit and vegetable content, protein, fiber, and, in some cases, calcium) to score products on the basis of nutritional composition per 100g or 100mL.

ATNI uses the threshold of 3.5 stars or more to classify products as generally healthier. Product Profile results account for 30% of the total Index score.

Portfolio-level Results

| Total no. products assessed |

Range of total 2021 company sales in India |

Sales-weighted Mean HSR (out of 5 stars) |

Products meeting the ‘healthy’ threshold (HSR of 3.5 stars or more) |

|

|---|---|---|---|---|

| 25 | 90-100% | 2.4 | % of distinct healthier products |

% sales from healthier products |

| 25 | 32 | |||

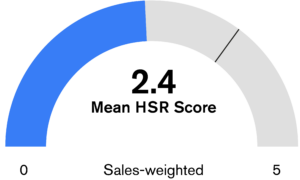

• Patanjali’s average sales-weighted Health Star Rating (HSR) is 2.4 (stars) out of 5 (2.5 unweighted mean HSR).

• A total of 25 products across the company’s three best-selling product categories were assessed using the HSR model.

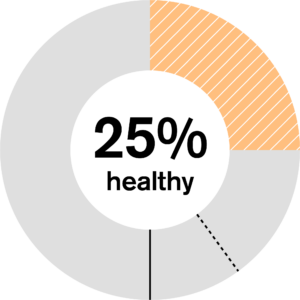

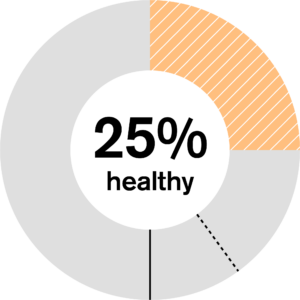

• 32% of distinct products analyzed for Patanjali’ met the ‘healthy’ threshold (3.5 stars or more in the HSR).

• When taking category sales values into account, the company was estimated to derive approximately 25% of its India 2021 sales from healthier products (mostly from Flour and Meat Alternatives).

Mean Health Star Rating by category for Patanjali Foods Limited

companies assessed

in the category

Lowest mean HSR of

companies assessed

in the category Healthy threshold

• Among categories assessed, Patanjali’s products in Flour (2 products) and Meat Alternatives (3 products) had the highest mean HSR (5.0 out of 5.0), of which 100% reached the healthy threshold.

• The company’s lowest scoring category is Dairy with a mean HSR of 0.7 out of 5, for which 0% of products reached the healthy threshold.

• In total, 36% of distinct products and 64% when sales-weighted, was found to be eligible to be marketed to children using the WHO SEAR criteria.

Categories

The Index is divided into seven categories which assess food & beverage companies' policies, practices and transparency related to nutrition in the Indian market.

Governance 10% of overall score

Products 45% of overall score

Accessibility 15% of overall score

Marketing 15% of overall score

Workforce 5% of overall score

Labeling 5% of overall score

Engagement 5% of overall score

Nutrition

• No evidence could be found of the company explicitly seeking to address nutrition through its commercial operations.

Aspects to improve

• Patanjali is encouraged to develop and publish a clear plan or strategy on how it intends to deliver on contributing to healthy and nutritional diets in India through its commercial operations. For example, it could develop specific plans to improve the nutritional profile of its portfolio by, for example, decreasing average levels of nutrients of concern (sodium, saturated fats, and sugar), increasing levels of positive ingredients (such as whole grains or fruits and vegetables), or fortification of key products.

• To drive progress internally on implementing its nutrition strategy, the company is recommended to develop specific, measurable, and timebound targets encompassing various elements of its approach, and an overall target to increase sales of the products it defines as ‘healthier’.

• Patanjali is recommended to report more comprehensively on all elements of its approach, showing what has been achieved year-on-year across its portfolio or key product categories. Reporting should ideally take the form of quantitative metrics, rather than specific examples only, and progress documented systematically.

• To ensure that the strategy receives strategic direction from the top, the company is recommended to ensure that its nutrition strategy is subject to regular review at the highest levels of the company, and is encouraged to assign formal responsibility for the success of its nutrition strategy to its most senior officials.

• In developing its nutrition strategy and approach, and to ensure that it is maximizing its positive impact on public health, the company is strongly recommended to engage with independent experts/stakeholders, such as independent (i.e. not directly affiliated with industry) public health-oriented civil society organizations, academic institutions, (inter-)national organizations.

Category B2: Portfolio Development

• No evidence could be found of the company setting reformulation targets in India or reporting on these efforts.

• The company did not share information with ATNI regarding its fortification approach in India.

Category B3: Nutrient Profiling

• The company did not provide evidence that it uses a nutrient profile model (NPM) or other objective nutrition criteria to evaluate the nutritional quality of its products to inform new product development or product reformulation.

Aspects to improve

Category B2: Portfolio Development

• In order to drive progress on improving the healthiness of its portfolio, the company is encouraged to adopt specific, measurable, and timebound targets to reduce nutrients of concern (sodium, sugar, and saturated fat) across its relevant portfolio. These targets should ideally be aligned with the ICMR/NIN Dietary Guidelines and RDAs for Indians, and/or WHO guidelines, and are recommended to be published on the public domain.

• The company is recommended to report progress against all reformulation targets on an annual basis, in a consistent and easily accessible manner, in order to increase transparency and accountability.

• The company is encouraged to produce more fortified products to help address specific micronutrient deficiencies in India (according to government priorities), while ensuring that there are strict internal policies and procedures in place to prevent the fortification or enrichment of unhealthy products (i.e. with high levels of fat, sugar, and/or sodium).

Category B3: Nutrient Profiling

The company is strongly encouraged to adopt a nutrient profiling model (NPM) to determine the relative healthiness of all products in its portfolio.

• Ideally, this should be (or align closely with) an internationally recognized (or, when applicable, government-endorsed) NPM; if developing its own, the company is encouraged to apply stringent thresholds for nutrients of concern that align with (inter)national standards, and use per 100g/ml as the reference unit (to ensure greater objectivity and comparability).

• The company is recommended to disclose all details of the NPM it uses in full, including the algorithm used to define ‘healthy’, on the company’s India website and, ideally, in a scientific journal that is peer-reviewed and indexed.

• No evidence of a strategy or approach to address the affordability specifically of its ‘healthier’ products was found on the company’s public domain or shared by the company.

Aspects to improve

• To ensure that products that are considered by the company to be ‘healthier’ are being priced affordably for lower-income consumers, the company is recommended to:

— ensure that such products are defined as ‘healthy’ through the use of a nutrient profiling model (NPM) (or other clear nutrition criteria) - such that unhealthy products (HFSS) are specifically excluded;

— have a clear approach to determining whether a product is ‘affordably priced’; and

— use a formal classification of ‘lower-income consumers’ that it is trying to reach.

• With these definitions and processes in place, the company is encouraged to develop and implement a strategy or approach for ensuring that at least part of its ‘healthier’ (and, ideally, fortified or micronutrient-rich) product portfolio is priced affordably for lower-income consumers, and continually explore new opportunities for delivering ‘affordable nutrition’. Examples of approaches can be found in the methodology and chapter for Category C.

• The company is recommended to publicly disclose information about its affordable nutrition strategies/approaches, including specific definitions, the approaches taken to ensure affordability, and the progress made on implementation.

• No evidence of a specific policy to address the responsible marketing of products to children or general audiences beyond legal requirements could be found on the company’s website.

Aspects to improve

• The company is encouraged to develop and publish a comprehensive responsible marketing policy that covers all media channels and audiences, including children under the age of 18 (in line with CCPA guidelines).

• The company is encouraged to ensure more responsible marketing to children by adopting:

— an audience threshold of 25% for limiting children’s exposure to advertisements on all media;

— specific commitments not to use certain materials and techniques to market their products to children, including celebrities, licensed characters, promotional toys and games, and depicting children on packaging.

• The company is encouraged to commission regular third-party audits of compliance to its responsible marketing policy in India, and to disclose the results of this audit, as well as the response mechanism it has in place to address instances of non-compliance.

• No specific mention of workforce nutrition could be found on the company’s public domain.

• No policy to support breastfeeding mothers in the workplace could be found, nor is it clear whether the company offers paid paternity leave.

Aspects to improve

• The company is recommended to develop a workforce nutrition program that includes providing access to healthy food at work, nutrition education, nutrition-related health checks, and breastfeeding support. This program should ideally be available to all employees, including those at manufacturing sites.

• The company is encouraged to develop a clear policy on support extended to breastfeeding mothers at work in order to aid their maternal health; and this should apply equally to all office and production site employees. Support should, at a minimum, include i) Private, hygienic, safe rooms for expressing breastmilk; ii) Refrigerators in place to store milk; and iii) Other flexible working arrangements to support breastfeeding mothers, such as flexible working hours or on-site creche facilities. Furthermore, it is important to foster a workplace culture that is supportive of breastfeeding, for example through awareness campaigns.

• The company is recommended to offer maternity and paternity or second caregiver leave, extending parental leave policies to go beyond current national regulations, and remove limitations based on the number of children born.

• No evidence of a standardized policy or approach to front-of-pack (FOP) product labelling beyond legal requirements could be found on the company’s public domain.

• Limited nutritional information is provided for the company’s products on its website.

Aspects to improve

• Once it is formally enacted by Food Safety and Standards Authority of India (FSSAI), if the INR FOP labeling system is on a voluntary basis, the company is strongly encouraged to adopt it across their entire portfolios in India.

• The company is encouraged to ensure that nutritional information is available for all products on its website both as high-definition images of the front and back of products, and as accompanying tables showing comprehensive product-specific nutritional information.

• No relevant information was found for the company regarding its advocacy policies, processes, positions, or activities in India.

Aspects to improve

• The company is encouraged to adopt a responsible advocacy policy, which also applies to third-parties advocating on behalf of the company, in which it clearly defines ‘advocacy’ and commits that personnel will conduct themselves responsibly; to be transparent about their identity and intentions; to require that the evidence presented shall be as independent and representative as possible; and to always consider the wider public health interest in its efforts.

• To improve its control over and accountability for its advocacy activities (which includes participation in policy-related multistakeholder meetings, responding to public consultations, and other interactions with policymakers), the company is recommended to ensure that only approved personnel engage with policymakers on nutrition-related policy matters, and ensure that these interactions are tracked and disclosed on the public domain.

• Even if the company is not engaging in a policy debate or development process directly, its trade associations are likely to be, and potentially other third-parties acting on the company’s behalf. Therefore, the company’s policy positions are still important, since it should be engaging with these third-parties to ensure that its positions are taken into account. The company is encouraged to disclose its policy positions on key nutrition-related policy measures under debate or development in India that would likely affect the company (for example, FSSAI’s new FOP labelling system). These positions should be as specific and unambiguous as possible, be Board-approved, and should consider the wider public health interest and long-term material implications of rising levels of malnutrition in India.

• The company is encouraged to disclose comprehensive lists of its trade association memberships in India and clearly indicate which it holds leadership positions on, such as on their Boards, management committees, or thematic working groups or sub-committees, in order to signify to stakeholders which ones the company has greater stakes in. If no such positions are held, this can be publicly stated.

Sustainability

• No information regarding the company’s sustainability efforts in India could be found on the public domain.

Aspects to Improve

• The company is strongly encouraged to track its GHG emissions in India, beginning with those in Scopes 1 and 2.

• The company is also recommended to set clear targets to reduce GHG emissions across each of these Scopes that are aligned with the Paris Agreement’s 1.5’C trajectory, and report quantitatively on progress. These targets (and reporting) should be for absolute reductions against a baseline, rather than relative emissions (i.e. ‘emissions intensity’).

• The company is encouraged to work with its value chain partners to reduce both FLW and plastic use. This should go beyond requirements set out in mandatory waste management regulations.

• The company is encouraged to ensure that its efforts to transition to sustainable forms of packaging in India are evidence-based, and correspond with clear quantitative sustainability outcomes.